The chart below is an update of the current outperformance of the Philippine Phisix (and of ASEAN bourses) relative to global bourses.

Over the past two years, the Phisix (PSEC) remains on an uptrend while equity indices of developed economy bourses as represented by the US S&P 500 (SPX), the European Stoxx 50 (stox50) and the iShares MSCI All Country Asia ex Japan Index Fund (AAXJ) seems to have broken down.

The European Stoxx50 technically has segued into a bearmarket, down by 24% from the February 2011 peak, while the US S&P (-15%) and the MSCI Asia (-16%) seems at the verge of gradating into one. A bearmarket is defined as a downturn of 20% or more in multiple broad market indexes, according to investopedia.com[1]

Global equity markets have essentially been severely dampened by the reemergent and intensifying debt crisis in the Eurozone as contagion risks escalates.

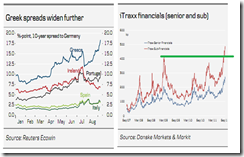

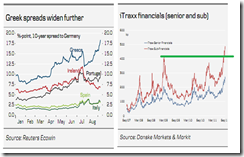

Chart from Danske Bank

The bond spreads of Greece relative to Germany has widened extensively (left window). Credit Default Swaps have now priced Greece bonds with a 92% probability of a default[2]. CDS prices of European financials have eclipsed the 2008 highs[3] (right window). This means that the financial market stress levels at the Eurozone has been far worse than the Lehman episode in 2008.

Adding to the current woes has been the conventional wisdom that sees heightened recession risks for the US.

So far, the market turbulence overseas has had modest impact on the ASEAN equity markets.

Over the short term or during past two months, the correlation of Phisix and ASEAN indices with that of distressed global equity markets have evinced formative signs of tightening or reconvergence.

As I have been saying, divergences in market performance may persist for as long as a global recession is not in the horizon.

One must remember that decoupling signifies as an unproven thesis that can only be validated during a full-blown crisis. It’s a theory that I have been sceptical of, considering the concurrent interconnectedness and interdependence of global economies.

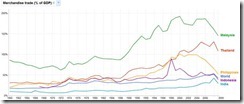

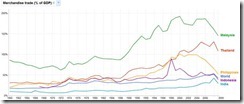

To prove this point, the degree of globalization or interconnectedness with the world, as measured by the merchandise trade as % to GDP[4], Malaysia and Thailand seems far more exposed to a global recession and or contagion risk compared to the Philippines and Indonesia.

One would note that the ordinal rankings of the year-to-date performances of ASEAN equity markets (as of Friday’s close) have partially reflected on such dynamic, where less globally exposed Indonesia and the Philippines has outclassed Thailand and Malaysia

But this variable alone does not convincingly or entirely explain the conspicuous aberration of the ASEAN’s performance relative to global equities or even among her Asian peers. For instance, India has the lowest merchandise trade compared to the ASEAN majors but her equity market is down 17.7% year-to-date.

Chart from US Global Investors/BCA Research

Of course there are other external links such as remittances and investment (capital account) flows to consider. These, as well as, many domestic variables as savings and investment responses to current fiscal and monetary policies, degree of economic freedom and etc… For instance, government expenditures as a ratio of GDP[5] remain low for the Philippines relative to her developed economy contemporaries and major Emerging Market peers. And where the financial markets have been attuned or fixated to debt levels and government spending, such relatively ‘better’ standings may have also been one of the many factors that has contributed to the asymmetric outcomes in global equity markets.

Although we have yet to see how the Phisix and ASEAN markets will respond to another major bout of developed market equity selloffs—the US Dow Jones Industrials -2.69%, S&P 500 -2.67% and European equity markets Stoxx 50 -4.15%, UK’s FTSE -2.35%—as seen last Friday.

The point is that there will be pockets of divergent market actions considering the nuances in the political responses by global authorities to the present chain of financial market imbroglios. This accentuates the point that today’s market conditions are manifestly dissimilar to that of 2008.

For instance, money supply growth in the US is at double digit rates or 15.6% annualized (three months through July) while the Eurozone is printing money at a significantly much slower pace at 2.1% annualized M2 over the same period[6].

So the present convulsions the Eurozone has been enduring can be traced to the ‘less’ aggressive ‘sheepish’ approach applied by the European Central Bank (ECB), the political divisions over monetary policies (as manifested by the resignation of ‘inflation hawk’ ECB Executive Board Member Juergen Stark[7] which might pave way for the ECB’s more aggressive stance towards inflationism) and capital adequacy regulations[8]

Nonetheless, given today’s vastly distorted marketplace, in times of heightened volatility, market correlations have the tendency to tighten or converge as the US equity markets[9] have been showing[10]. But again I wouldn’t bet on a 2008 scenario.

Resilient Phisix Equals a Sturdy Philippine Peso

One good way to assess general sentiment is to look at how market internals and the Philippine Peso have been playing out in the face of the current mercurial climate.

The resilience in the domestic equities has palpably been reflected on the Philippine Peso (left window) and Asian currencies as represented by the ADXY or the Bloomberg JP Morgan Asian Dollar Index (right window).

Even as there have been signs of mass liquidations abroad, so far, foreign investors have not been in a stampede mode out of Philippine assets.

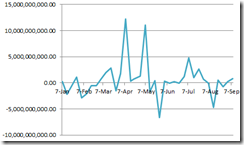

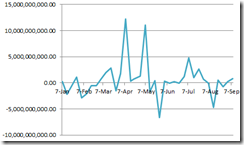

The weekly ‘averaged’ net foreign trade hardly reveals of signs of heightened distress. This has, so far, worked in favour of the Philippine Stock Exchange. Foreign trades have accounted for a little over 1/3 of the current traded peso based volume.

True, Friday saw big declines in Asian currencies as the US dollar fiercely rebounded over a broad number of major currencies. This US dollar rally may see an extension this Monday (unless there will be declarations for major actions by US and European policymakers over the weekend).

However, the Peso closed relatively little changed on Friday at 42.49 (against the US dollar) compared to Thursday’s close at 42.47. The Peso was only been slightly lower (.8%) from last week at 42.14.

So far, the Peso and the Phisix has managed to brush off major shocks from developed world economies.

Rotational Process Means Market Consolidation

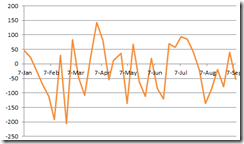

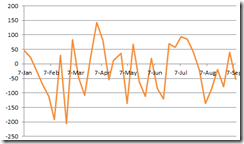

Market sentiment has also been manifesting signs of consolidation, through a rotational process instead of deteriorating market breadth.

Weekly ‘averaged’ Advance-Decline spread has been rangebound since the start of 2011. In seeming defiance of the Phisix which registered a 1.07% loss this week, market breadth appears to be improving from the troughs of the week of August 7th.

So far, the worst conditions of August had even been far better than the conditions during the Arab Spring-Japan Calamity last February until March.

Also last week’s market consolidation phase seems to bring about my long held prediction that there would be a rotation out of the severely overbought mining sector.

The property and industrial sectors posted slight gains over the week as the financials, mining and services weighed on the Phisix composite.

The variances in sectoral performances corroborate the signals emitted by the market internals as explained above. In short, the decline of the Phisix does not imply for broad market corrosion.

On a year to date basis, while the mining sector remains the dominant leader, the gains of the Phisix has been partly shaped by miniscule gains of the financials and the holdings sectors, whereas the industrials, property and the service sectors have been laggards.

Consolidation and rotation has been principal theme of the current market actions.

[1] Investopedia.com Bear Market

[2] See Greece’s Welfare State at Death Throes, Germany Prepares to Rescue Banks,

[3] Danske Bank Another week with the focus on Greece Weekly Focus, September 9, 2011

[4] World Bank World Development Indicators Merchandise Trade, Google Public Data Explorer

[5] Holmes, Frank Investor Alert - China Fears Much Ado About Nothing US Global Investors, September 9, 2011

[6] Wenzel Robert, The Just Released G7 Communique versus Reality Economic Policy Journal, September 9, 2011

[7] Reuters.com Top German quits ECB over bond-buying row, September 9, 2011

[8] See Why Capital Standard Regulations Will Fail, August 22, 2011

[9] See Applying Emotional Intelligence to the Boom Bust Cycle, August 21, 2011

[10] See More Evidence of Boom Bust Cycles Driving Equity Market Prices, September 10, 2011