From the Bloomberg, (bold emphasis added)

When a Chinese court sentenced 28- year-old Wu Ying, known as “Rich Sister,” to death for taking $55.7 million from investors without paying them back, it sparked an unexpected firestorm that has drawn in China’s top leadership.

Her crime involved a common, illegal practice in China: raising money from the public with promises to pay back high interest rates. Known as shadow banking, these underground lending and investing networks are estimated to total $1.3 trillion, according to Ren Xianfang, an economist with IHS Global Insight Ltd. (IHS) in Beijing. That’s the size of the 2011 U.S. government deficit.

Operating outside the banking system or government regulation, the informal networks provide an important source of economic growth, capital for private companies and return for investors seeking to beat inflation. Premier Wen Jiabao, in an unusual move, weighed in on the case at a March 14 news conference. His comments highlighted a public debate over the importance of shadow banking to the Chinese economy, government efforts to bring it under control -- and whether capital punishment is an effective means to do so.

“Chinese companies, especially small ones, need access to funds,” Wen said when asked about Wu’s case. “Banks have yet to be able to meet those companies’ needs, and there is a massive amount of idle private capital. We need to bring private finance out into the open.”

This is just an example of the abominable repercussions from arbitrary laws or how arbitrary laws are used as instruments for oppression.

Here, the private sector, clearly acting in response to government’s policies as evidenced by “seeking to beat inflation”, have been driven to become “criminals”. Yet China’s “criminal” shadow banks, which is no more than regulatory arbitrage practiced by grassroots entrepreneurs, has grown to an “estimated to total $ 1.3 trillion” or about 1/5 of the economy.

The conviction of the “Rich Sister” looks like another futile exercise at political symbolism to project the illusions of “virtuous” government or “government in action”. Nevertheless exposes on how arbitrary laws are used as instruments for oppression.

Of course, shysters and manipulators will always exist in every society and deserve punishment for the violation of the property rights of their victims.

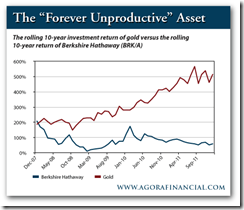

However, Ponzi schemes, which these scoundrels frequently employ, are magnified in an environment where money have been debauched as I earlier pointed out here.

That’s because the anti-savings policies by governments through central banks, encourages or incentivizes such behavior by narrowing the public’s time orientations or increasing the public’s time preferences.

So instead of savings, inflationism leads the public to chase for yields, speculate, gamble, increase debt loads and to consume at the expense of production. This policy induced shifts in people’s incentives make the public vulnerable to skullduggery and knavery.

And that’s why the biggest Ponzi schemers and ultimate insider traders are no more than central bankers and political authorities who use financial repression to plunder wealth from people.

In reality, the China’s informal economy has been emblematic of dynamic market forces at work, viz, filing the gap of the “need access to funds”, since state sanctioned or regulated private banks, as well as, state owned banks “have yet to be able to meet those companies’ needs”.

So Premier Wen’s statement and the actions of China’s government represents the proverbial “left hand doesn't know what the right hand is doing” or a patent self-contradiction.

The truth is that the Chinese government has virtually been exercising the same decorum as their Western counterparts—the promotion of the interests of politically privileged rent seekers or crony bankers who finances the activities of political authorities.

China’s war against informal economy serves as another indicator of the growing political fissures from a command and control political structure against the forces of decentralization or the “marginal revolutions”, as evidenced by the expanding political clout of entrepreneurs in and out of the ambit of China’s government.

China’s war against the informal economy or the shadow banks is bound for failure.