Domestic headlines continue to banner on the verbal showdown and belligerent artifice between the US and North Korea.

DPRK’s Declaration of War and War Posturing

While I think that this seems more a vaudeville than of a real threat, geopolitical brinkmanship can always deteriorate into a real thing. Inflated egos of political leaders may impulsively react on events that could push posturing into a full scale war. All that is needed is an event that may serve as the Casus Belli[1].

North Korea or Democratic People's Republic of Korea (DPRK) has already declared a “state of war”[2] with its wealthier kin, South Korea or Republic of Korea (ROK) last March 30, 2013. But through the week, all that has occurred have been the mobilization or a show of force from contending parties.

Yesterday North Korea reported to have moved its two medium range missiles, the Musudan missiles, which has a range of 1,865 miles and has the capability to strike at South Korea, Japan and US bases in the Pacific, supposedly for a missile test[3].

Yet despite all the North Korean rhetoric and propaganda about launching a nuclear war with the US, her nuclear missiles hardly have the range and capability to reach the US[4].

On the other hand, the US has transferred anti-ballistic missile defence system to Guam[5] along with several B-1 ("Bone") Lancer strategic long-range bombers.

The US has also “secretly” deployed the E-6 Mercury “Doomsday plane” which has been reportedly “tasked with "providing command and control of U.S. nuclear forces should ground-based control become inoperable" and whose core functions include conveying instructions from the National Command Authority to fleet ballistic missile submarines and also to further command post capabilities and control of land-based missiles and nuclear-armed bombers”, according to the Zero Hedge[6].

In other words, should there be a full scale war, such may include the use of nuclear weapons. The outcome, hence, is likely to be devastating and cannot be compared to any previous conventional wars.

Thus any comparisons with modern wars as the 1982 Falklands War between the UK and Argentina[7], the 1991 US-Iraq Gulf War[8], the 1999 Kargil war between India and Pakistan over the Kashmir region[9], the 2003 US Invasion of Iraq[10], the Afghanistan War[11] or the 5 day South Ossetia war between Russia and Georgia[12] represents apples-to-oranges.

South Korea and the US will have to deal with North Korea’s 12-27 nuclear weapons with a TNT yield of 6-40 kilotons[13]. The atomic bombs that leveled Hiroshima “Little Boy” gravity bomb and Nagasaki “Fat Man” gravity bomb had TNT yields of 13-18 kilotons and 20-22 kilotons respectively[14].

Why is War Unlikely; North Korea’s Geopolitics of BlackMail

In 2010 I expressed doubts that a war in the Korean Peninsula will take place. I still maintain such skepticism.

Why?

North Korea is an impoverished state whose weapons are mostly dilapidated and obsolete, and whose vaunted millions of soldiers are likely to be starving, ill equipped and poorly trained[15].

And in spite of the North Korea’s vaunted war machinery, wherein much of the misallocation of the nation’s resources had been directed, the North Korean army is in a state of dilapidation and obsolescence: they seem ostensibly good for parades and for taunting, but not for real combat…Thus, based on socio- political-economic and military calculations, the North Koreans are unlikely to pursue a path of war, because the odds are greatly against them. And their political leadership is aware of this.

And as I previously pointed out, North Korea is the embodiment of the environmental politics of known as “Earth hour”[16]. Except for the North Korea’s capital, Pyongyang, satellite photos reveal that at night, the entire country has mostly been dark or without light, which is in stark contrast to South Korea (left window).

Moreover, North Korea has recently been plagued by hyperinflation[17].

Since July 2010, price inflation as measured by rice prices has pole-vaulted by 5x. So we can’t discount that such war histrionics may have been meant to divert public’s attention from internal economic woes, and instead, like typical politicians North Korean leaders have used foreigners as scapegoats for policy failures.

Except for nuclear weapons, North Korea isn’t likely to win a conventional war against South Korea, even without US support.

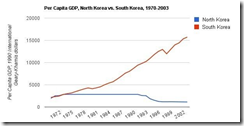

South Korea can afford to defend herself with a modern well equipped well trained army given the wide difference of her economic growth[18], capital surpluses and wealth disparities. But the problem is that she may have substantially relied or delegated to the US much of the home or national defense duties.

Given such reality, political leaders of North Korea have long used nuclear weapons as bargaining chips to indulge on the geopolitics of blackmail.

So unless North Korea’s Kim Jong-un has gone rogue and suicidal, the odds are that North Korea’s Kim will unlikely take on this war path.

Besides, Kim’s wife Ri-Sol-ju has reportedly given birth to their first baby in secret[19]. A war would mean sacrificing both their political privileges and their lives. And they know this.

Yet a conventional war may perhaps open the gateway for ordinary North Koreans to make a mad dash out of their highly repressive country.

And it isn’t also far fetch to think that a war may inspire many of North Korea’s military to immediately surrender or pledge allegiance to the South or mount a mutiny, given the horrors of the North Korean dictatorship. Just recently a North Korean official was executed by mortal shell for infringing on the rules covering the 100 day mourning period for the late King Jong il[20].

Of course such faceoff hasn’t been all about North Korea’s fault.

Aside from the sanctions imposed by the UN due to DPRK’s third missile tests, North Korean leaders may have been traumatized by recent US military air exercise involving heavy bombers[21].

Notes the historian Eric Margolis[22],

During the 1950-53 Korean War, US B-29 heavy bombers literally flattened North Korea. That’s why North Korea reacted so furiously when US B-52 heavy bombers and B-2 Stealth bombers skirted its borders late last month, triggering off this latest crisis. The B-2 can deliver the fearsome ‘MOAB’ 30,000 lb bomb called "the Mother of All Bombs" designed to destroy deep underground command HQ’s (read Kim Jong-un’s bunker) and underground nuclear facilities.

The real threat from a realization of a full scale war really hasn’t really been just about North Korea’s nuclear missiles but about the possible involvement of other nations as China, whom has long been North Korea’s key ally, and of Russia whom has had on and off relationship with the DPRK[23]. Although recently China’s leaders have expressed concern over the bellicose rhetoric of North Korea’s leaders[24], events may turn out differently once the shooting war begins.

Remember the Casus Belli of World War I had been the assassination of Archduke Franz Ferdinand of Austria[25], which invoked the assembly of opposing alliances that lead to the outbreak of war[26]. The opposing alliances then consisted of the Allies (based on the Triple Entente of the United Kingdom, France and Russia) on one side. And the Central Powers (originally the Triple Alliance of Germany, Austria-Hungary and Italy; but, as Austria–Hungary had taken the offensive against the agreement, Italy did not enter into the war), on the other side.

The US Military Industrial Complex and Stock Market Scenarios

Lastly the US seems to have been itching for a war either with Iran or with North Korea. Yet North Korea has long served as a useful public bogeyman which benefited of the US military industrial complex and the neoconservative politicians who support them.

The existence of a “bellicose” and “provocateur” DPRK has justified US military power build up in Asia. Jack A. Smith writing at Anti-War.com[27]

Washington wants to get rid of the communist regime before allowing peace to prevail on the peninsula. No “one state, two systems” for Uncle Sam, by jingo! He wants one state that pledges allegiance to — guess who? In the interim, the existence of a “bellicose” North Korea justifies Washington’s surrounding the north with a veritable ring of firepower. A “dangerous” DPRK is also useful in keeping Tokyo well within the U.S. orbit and in providing another excuse for once-pacifist Japan to boost its already formidable arsenal.

Not only “war is the health of the state”[28], war signifies as good business for the politically anointed since defense industry benefits from subsidies or wealth transfer from taxpayers to politicians and military industrial complex.

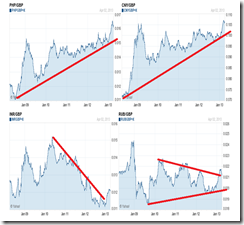

So how the Korean Peninsula standoffs affect the domestic and the regional stock markets?

I see four potential scenarios with different outcomes. 1. No war. 2. Limited conventional war. 3. Limited war but with use of nuclear weapons. 4. World War III.

The stock markets will hardly be affected given the first two situations: no war or a limited conventional war. I lean towards the first scenario.

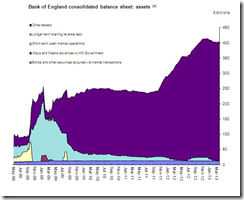

Nonetheless if the second condition occur, central banks are likely to inflate more. US monetary base surged during World War II, and also climbed during the Vietnam War.

If nuclear weapons will be used, the stock markets may be affected. But this will largely depend on the location and the extent of the damages.

Remember if DPRK’s Kim will go berserk and become suicidal then he may wish for retribution or make a statement against the West. Thus we should not dismiss the possibility that the DPRK may target nations with the least anti-ballistic defence or nations who are most vulnerable to their missiles. This puts Southeast Asia on such a list.

In this nuclear age, World War III means that we can kiss the stock markets goodbye and pray that we survive the nuclear holocaust.

Ignoring all these would signify as “denigration of history” or the false assumption that one is immune from misfortunes or disasters.

[1] Wikipedia.org Casus belli

[2] Bloomberg.com Mongolia Seeks to Play Peacemaker as North Korea Declares ‘War’ March 30, 2013

[3] Guardian.co.uk North Korea readies missile launch as fears of a covert cyberwar grow April 6, 2013

[4] Foreign Policy Blog Battle of the maps: North Korea's actual missile capability vs. North Korea's threatened missile capability March 29, 2013

[5] Reuters.com Extra line of defense – graphic of the day April 4, 2013

[6] Zero Hedge US Secretly Deploys B-1 Strategic Bombers, E-6 "Doomsday" Planes Near North Korea April 5, 2013

[7] Wikipedia.org Falklands War

[9] Wikipedia.org Kargil War

[10] Wikipedia.org 2003 Invasion of Iraq

[11] Wikipedia.org Afghanistan War

[12] Wikipedia.org Russia-Georgia War

[13] Wikipedia.org North Korea and weapons of mass destruction

[14] Wikipedia.org Nuclear Weapon Yield

[15] See Will A War Break Out In The Korean Peninsula? November 28, 2010

[16] See Earth Hour: North Korean Version March 31, 2010

[17] Steve H. Hanke, North Korea’s Hyperinflation Legacy, Part II Cato.org December 7, 2012

[18] Washington Post Kim Jong Il’s economic legacy, in one chart December 19, 2011

[19] CSMonitor Did Kim Jong-un and his wife have a baby? March 5, 2013

[20] Daily Mail North Korean official is executed by MORTAR SHELL for drinking during 100-day mourning period for late 'Dear Leader' Kim Jong-il October 24, 2012

[21] Bloomberg North Korea Vows Military Action Against More U.S. B-52 Flights March 20, 2013

[22] Eric Margolis War in Korea April 6, 2013

[23] Wikipedia.org North Korea–Russia relations

[24] Washington Post China expresses concern over North Korea’s rhetoric April 7, 2013

[25] Wikipedia.org Assassination of Archduke Franz Ferdinand of Austria

[26] Wikipedia.org World War I

[27] Jack A. Smith, Behind the US-North Korean Bluster Anti-war.com April 4, 2013

[28] Randolph Bourne War is the Health of the State Bureau of Public Secrets