It had been a calculation error says the California preacher, thus doomsday will be reset on October 21. Booooo!

Reports the Yahoo, (bold highlights mine)

A California preacher who foretold of the world's end only to see the appointed day pass with no extraordinarily cataclysmic event has revised his apocalyptic prophecy, saying he was off by five months and the Earth actually will be obliterated on Oct. 21.

Harold Camping, who predicted that 200 million Christians would be taken to heaven Saturday before catastrophe struck the planet, apologized Monday evening for not having the dates "worked out as accurately as I could have."

He spoke to the media at the Oakland headquarters of his Family Radio International, which spent millions of dollars_ some of it from donations made by followers — on more than 5,000 billboards and 20 RVs plastered with the Judgment Day message.

It was not the first time Camping was forced to explain when his prediction didn't come to pass. The 89-year-old retired civil engineer also prophesied the Apocalypse would come in 1994, but said later that didn't happen then because of a mathematical error.

Not only has the events proven him wrong, but the preacher even admits to it: econometrics has failed him as I predicted. Yet he continues to apply the same methodology.

But I hear some people clamor that government has to “act” on Mr. Camping’s doom mongering.

Should the US government apply censorship on Mr. Camping?

Does it mean that we should rely on his poor track record to use force against what we may perceive as wrong predictions or ideas we don’t agree with?

But what if he will be correct and October will indeed account for as doomsday? Remember Aesop’s famed fable, The Boy who cried Wolf?

I am not saying that I agree with or believe in him. I think his overdependence on math camouflaged by religious creeds will continue to lead his predictions astray. But I could be wrong.

But there are two important points here:

-he is selling an idea of what he purportedly believes in and

-two we don’t know the future.

On the issue of selling ideas, marketing guru Seth Godin has a terrific commentary on the possible lessons gleaned from the recent apocalyptic prophesy.

Mr. Godin writes, (italics original)

Sell a story that some people want to believe. In fact, sell a story they already believe…

Not everyone wants to believe in the end of the world, but some people (fortunately, just a few) really do. To reach them, you don't need much of a hard sell at all.

In other words, many of those who listen to Mr. Camping’s prophesies could be people who already believed in them or that Mr. Camping merely personifies the belief of an extant segment of captive audiences. That's why he gets donations.

If Mr. Camping’s followers represent as zealots of doom, can we legislate away beliefs or faiths? Are we supposed to prevent the expression of ideas that doesn’t mesh with ours?

Besides, who should decide whose ideas are accurate anyway, the President? If governments have been shown as unable to sufficiently resolve social problems, then why should we expect them to know the substance of information which signifies relevance for us and what are not? Have you ever heard of propaganda or indoctrination-false information deliberately spread as truths for political ends?

This shows of the assumptions that government have superior knowledge accounts for as fatal conceit-the fallacious presumption of omniscience.

As US playwright and Nobel awardee Eugene Gladstone O'Neill said,

Censorship of anything, at any time, in any place, on whatever pretense, has always been and will always be the last resort of the boob and the bigot

Second is the issue of uncertainty.

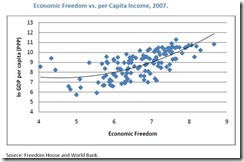

All of us speculate about the future, that’s because we don’t know exactly how things will turnout. That’s why markets are there. And that’s why money exists. And that’s why people use mathematics, such as statistics, in the perpetual attempt to “smooth out” risks and uncertainties.

True, some issues are more predictable than the others, but again that’s why markets exist—to allocate resources according to one’s perception of time variant needs (satisfying one’s unease, e.g. some people see the need of believing in doomsdays).

As Professor Art Carden writes

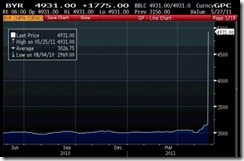

People with strong beliefs should be willing to put their money where their mouths are. The late Julian Simon was a master of this. Superior knowledge and insight can be turned into profitable opportunities. My personal property no longer has value to me after the Rapture, but it might have value to someone else. If I knew the precise date of the end of the world, I would sell everything in the months leading up to it and use the resources to spread the word, as some of Camping’s followers have apparently done.

If I were pretty sure the Rapture might happen sometime over the next 40 years, I should be able to make a deal with someone who disagrees but who would be willing to pay me now in exchange for title to my property after the Rapture. I could then use the resources to spread my message. I got no takers on my offer of $1000 for all of one apparently Camping-affiliated group’s earthly belongings I made after I first learned about the claim that Judgment Day would happen on 5/21/2011.

Harold Camping isn’t the only discredited doomsday prophet among us. As I’ve followed this, I’ve wondered what percentage of the people who laugh at Camping and his misled followers nonetheless nod sagely, furrow their brows, and reach for their checkbooks whenever professional doomsayers in the environmental movement like Lester Brown and Paul Ehrlich warn of overpopulation, the end of oil, and the end of prosperity in spite of track records littered with doomsday predictions that failed to come true.

Indeed, beliefs can be parlayed into profit opportunities. We can profit from someone else’s mistakes, so why apply censorship?

This is like investing the stock market where wrong analysis or flawed theories or inaccurate information can lead to losses. So given the logic of advocates of censorship should we effectively ban losers (applied not only to stockmarkets but to all markets)? Or should we also apply censorship on newsletters fund managers and analysts whose prediction of the markets have been inaccurate?

What people say and do are frequently detached. Did global economic activities stop prior to May 21st in anticipation of the rapture? Did you sell or give away your assets because of this?

If not, then the obviously you were not affected, because you didn’t believe, you were a skeptic. This is called demonstrated preference. Because the world didn’t fall into a stasis, most people around the world simply ignored such cataclysmic prophesy.

Only media likes to drum up on sensational issues because they profit from them. Fear draws attention. Yet shooting the messenger won’t eradicate the message. So censorship would signify as a fool’s errand.

At the end of the day, the issue of Judgment day will be one decided by your and my personal disposition and not by the government. Unless you honestly believe that governments can stop doomsday [har har har].

Finally, it would be an issue of legal fraudulence if modern day Cassandras engage in purposeful misrepresentation or deception to profit from prophesies of Armageddon.

But that would mean personal issues of those who felt affected or victimized, whose recourse should be channeled through the courts of law.

I close this anti-censorship ‘freedom of speech’ rant with this prominent quote which has been frequently (mis) attributed to Voltaire (but according to Wikipedia is from Evelyn Beatrice Hall who wrote “under the pseudonym of Stephen G Tallentyre in The Friends of Voltaire (1906), as a summation of Voltaire's beliefs on freedom of thought and expression)

I disapprove of what you say, but I will defend to the death your right to say it.