The IMF is concerned about the potential shortage of supply of “safe assets”

Writes the Wall Street Journal Blog

Worries about nations’ fiscal health could cut the world’s supply of “safe” government debt by 16% in the next four years, the International Monetary Fund said Wednesday.

The diminishing supply comes even as demand rises for safe assets such as high-quality corporate bonds and sovereign debt, which many banks and investors need amid market uncertainty and regulatory changes.

The shrinking pool of safe assets could create more worries about financial stability, the IMF said.

“Safe asset scarcity will increase the price of safety and compel investors to move down the safety scale as they scramble to obtain scarce assets,” the fund said in its Global Financial Stability Report. “It could also lead to more short-term spikes in volatility, and shortages of liquid, stable collateral that acts as the ‘lubricant’ or substitute of trust in financial transactions.”

The notion of ‘safe assets’, which rest on the assumption of ‘intrinsic value’, is really an illusion. It has been a myth repeatedly peddled, inculcated and propagandized for the public to accept the falsehood of the necessity of the welfare-warfare state. The power to tax does not guarantee economic and financial feasibility and consequently ‘security’.

Safety does not emerge out of government decree, as the recent crisis or as history shown whether applied to government bonds or to money.

Instead, valuations are subjectively determined by acting man or by individuals.

The great Professor Ludwig von Mises explained

Value is the importance that acting man attaches to ultimate ends. Only to ultimate ends is primary and original value assigned. Means are valued derivatively according to their serviceableness in contributing to the attainment of ultimate ends. Their valuation is derived from the valuation of the respective ends. They are important for man only as far as they make it possible for him to attain some ends.

Value is not intrinsic, it is not in things. It is within us; it is the way in which man reacts to the conditions of his environment.

Neither is value in words and doctrines. It is reflected in human conduct. It is not what a man or groups of men say about value that counts, but how they act. The oratory of moralists and the pompousness of party programs are significant as such. But they influence the course of human events only as far as they really determine the actions of men.

Put differently, to paraphrase a popular axiom, safe assets are in the eyes of the beholder.

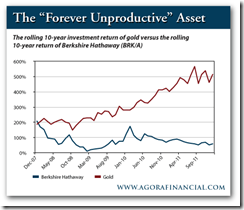

Take for instance gold.

Gold was essentially an ignored asset at the start of the new millennium, however following 11 consecutive years of price increases, the public’s perception has substantially changed. Now gold has been incorporated as part of the safe asset list of the IMF.

Through history, gold’s perceived safety arises from the money attributes it possesses compared with, or relative to, fiat currencies.

As I previously wrote,

paper currencies are basically IOUs issued and stamped by governments as “legal tender” and backed by nothing but FAITH in the issuer. Because paper money is an IOU, it bears counterparty risks.

Where money as a medium of exchange requires these characteristics: durability, divisibility, scarcity, portability, uniformity and acceptability, unlimited issuance of paper money essentially diminishes the moneyness quality of paper currencies. As we cited earlier given the massive and full scale deployment of the printing press globally, such the raises the risk of a potential of disintegration of the present financial architecture.

However gold may not permanently be a refuge asset either. A serendipitous discovery of a process that enables gold to be produced abundantly would lead to a loss of the current attributes and thereby the subsequent loss of gold’s moneyness. And in the world of rapid advances in technology this is something we cannot discount.

To quote Dr. Frank Shostak

If the increase in the supply of gold were to persist, people would likely abandon gold as the medium of exchange and adopt another commodity.

Bottom line: Safety is matter of subjective individual valuations and definitely not decreed by politicians and or the bureaucracy.

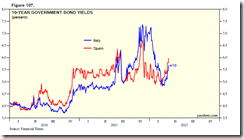

Chart from Dr. Ed Yardeni

To the contrary, what government declares as “safe” are likely to be the riskiest assets. A good example is the ongoing crisis in the Eurozone where toxicity has surfaced out of supposed “safe” debt instruments.

It has been the nature of the state to abuse on their powers, by plundering their citizenry through arbitrary laws, or policies of financial repression (includes inflationism), that ultimately undermines the quality of government issued papers.

In short, self-destructive actions cannot be reckoned as ‘risk free’ which serves as a paradoxical, or must I add absurd, proposition.