The ongoing financial tremors in China appears to be absent in the eyes of the mainstream

Instability in China’s Credit Markets

Yields of China’s 10 year local currency bond remains at 2008 levels.

As of Friday, China’s money market rates leapt to the highest level in a month as banks have reportedly been hoarding funds in order to meet withdrawals before the Spring Festival (New Year) holidays and concerns over “first trust-product default”.

The seven-day repurchase rate, reports the Bloomberg[1], surged 81 basis points, the most since Dec. 20, to 5.17 percent in Shanghai, according to a weighted average from the National Interbank Funding Center. That was the highest level since Dec. 31. It climbed 114 basis points this week.

The Chinese government attempted to ferret out her shadow banking system by withdrawing liquidity last June only to discover that the vehemence of market reactions[2].

For the Chinese government market instability would run the risk of upsetting political goals of generating statistical economic target which may have political repercussions. This forced the People’s Bank of China to inject funds and abort the mission.

But artificial treatments have led China’s debt disease to rear her ugly head. Not only has interest rates soared, but the credit pressures have become apparent anew as China’s annual probability of default based on 5 year credit default swaps have risen.

Ballooning Debt Levels

Runaway credit growth underpinning China’s property bubble plus growing complexity from deepening politicization of the banking sector via credit allocation has prompted for a dramatic evolution of credit activities in China over the past few years.

Local government debt has reportedly reached 17.89 trillion yuan or about US $ 3 trillion. Lending restrictions by the central government on the local government has forced the latter to migrate and tap shadow banks consisting of trust securities, insurance and leasing companies, and other non-bank financial institutions, which accounted for 27.8% of new debt. Aside from shadow banks the local government has resorted to other financial engineering instruments too, they have used IOUs and shifted the use of local government financing vehicles (LGFV) into using State Owned Enterprises (SOE) who acquired loans in their behalf (backed by illicit guarantees by the borrowing local government).[3]

Mainstream media wants to put the blame financial liberalization on the explosive growth of lending, but as one would note from the above, credit growth has largely been from the local governments camouflaged through the private sector, via LGFVs, or through the Shadow banks. All these avalanche of debt financed spending on mostly property projects has spurred a massive property bubble. Although these has mostly been contrived to produce statistical growth which has been meant to get the blessings of the higher ups in order to ensure the political tenure and to fulfil the political ambitions of the officials of local governments.

A lot of the supposed private sector entities appear to be either wards or crony arms of local and state governments. And all these collective attempts to generate statistical “growth” have led to China’s dire pollution problems where smog has reached dangerous levels[4].

Meanwhile Chinese credit expansion has also been in a product of the PBoC’s printing of yuan in exchange for foreign currency. Although much of the proceeds of foreign exchange transactions end up with the banking system and subsequently converted into loans. China’s money supply growth has soared past the US[5]

China’s foreign exchange reserves have now reached new records at $3.82 trillion at the end of December. Importantly, China’s vendor financing scheme with the US has led to record holdings of US treasuries. China now has $ 1.317 trillion worth of USTs[6]. This record holding of US contradicts the PBoC’s earlier claim where they will not increase acquiring of USTs last November[7]. This also shows how China continues to implicitly finance the US military via UST purchases, which for me, represents a Dr. Jekyll and Mr. Hyde or an inconsistency in terms of the brinkmanship geopolitics of territorial disputes.

Emergent Signs of Credit Stress

Yet despite the huge reserves, the Chinese government appears to be a bind. They would like to put a curb on the shadow banks, but they fret that doing so might impair the credit channels via the banks, which may harm credit conditions, undermine the economy and imperil the already fragile political conditions.

An example can be seen in a reported infighting between banking regulators: the People’s Bank of China (PBoC), whom has been finding ways to “move loans off their books” and China’s banking regulator, the China Banking Regulatory Commission (CBRC), whom has supposedly “watered down” regulations to accommodate the requests of the banking system[8].

A proposed new rule by the CBRC known as Regulation 9 has been designed to restrict off banking sheet lending activities that would limit backdoor activities, but lobbying from the banking industry allegedly pushed the CBRC to dilute the essence of the regulation.

Nonetheless a record 2.6 trillion yuan ($427 billion) of interest and principal on securities issued by non-financial companies have reportedly been due this year[9]. This has brought about growing concerns over credit risks.

There have already been signs of emerging credit stress. 74 of about 800 Peer-to-peer online lending companies which came online in 2013[10] with outstanding loans of 26.8 billion yuan ($4.4 billion) have either shut down or have been unable to facilitate cash withdrawals to its users.

Importantly at the start of the article I noted that rising money market rates have reportedly been due to banks hoarding funds in anticipation of the “first trust-product default”.

The world’s largest bank (in terms of assets[11]), the Industrial & Commercial Bank of China Ltd., which is state owned bank, has reportedly rejected calls to bailout a 3 billion-yuan ($495 million) shadow banking trust product which it had distributed[12]. The company reportedly invested in a coal mine venture, Shanxi Zhenfu Energy Group, which recently collapsed.

A default on the investment product, according to a report from Bloomberg, which comes due Jan. 31, may shake investors’ faith in the implicit guarantees offered by trust companies to lure funds from wealthy people. Assets managed by China’s 67 trusts soared 60 percent to $1.67 trillion in the 12 months ended September even as policy makers sought to curb money flow outside the formal banking system.

A China Triggered Global Black Swan Event?

This is interesting because the Chinese government embarked on a massive stimulus program in 2008 to the tune of 4 Trillion RMB US$ 586 billion[13] to shield her from the global crisis. Apparently the Chinese government got hooked on such political measures from which stimulus spending have now become a standard and stealthily implemented via state and local governments.

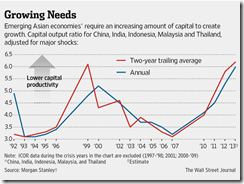

And yet the government may have already drained the people’s savings and has thus used debt to attain statistical growth. And as noted above, most of today’s economic growth model comes with heavy reliance on leveraging which results to the loss of productivity making them vulnerable to bursting bubbles.

Applied to China, billionaire, market guru and crony capitalist George Soros appears to share the same insight. In a recent article, Mr Soros writes[14] that China’s “model depended on financial repression of the household sector, in order to drive the growth of exports and investments. As a result, the household sector has now shrunk to 35% of GDP, and its forced savings are no longer sufficient to finance the current growth model. This has led to an exponential rise in the use of various forms of debt financing.”

Mr. Soros continues “There are some eerie resemblances with the financial conditions that prevailed in the US in the years preceding the crash of 2008. But there is a significant difference, too. In the US, financial markets tend to dominate politics; in China, the state owns the banks and the bulk of the economy, and the Communist Party controls the state-owned enterprises.”

And while many including Mr. Soros points to China’s Third Plenum as being an optimistic factor, as I recently noted[15],

implementation will mark the difference from rhetoricYet the Chinese political economy and her financial markets will have to face vast immediate or short term challenges first. And the ultimate challenge is how to deal with her overleveraged economy.

I recall that in late November, as companies borrowing costs spiked, China’s state newspapers warned about a “limited debt crisis”[16].

China’s Shanghai Index seems to share the same worries and has been down 5.25% year to date as of Friday’s close

2014 will probably answer the following questions:

Will the year of the horse usher in a series of defaults for the China’s overleveraged system? Will such defaults be contained (perhaps by her record reserves)? Will the Chinese government resort to bailouts? Or will it cause a domino effect that may spread through the financial system? Will there be a global contagion?

Has the proverbial chicken come home to roost for China’s credit and property bubbles?

Will economic and financial troubles prompt China into a military showdown with her neighbors over territorial disputes?

Will China trigger the Black Swan Event in 2014?

[1] Bloomberg.com China Money Rate Surges on Cash Demand Amid Trust-Product Risks January 17, 2014

[2] See China’s PBOC: From Tapering to Easing? June 21, 2013

[3] Wall Street Journal Real Times Economics Blog A Micro Reading of China’s Local Government Audit January 9, 2013

[4] Australia New Network Dangerous pollution hits the Chinese capital as index hits top of the scale January 17, 2014

[5] New York Times With China Awash in Money, Leaders Start to Weigh Raising the Floodgates, January 15, 2014

[6] Bloomberg.com China’s Treasury Holdings Climb to Record in Government Data January 16, 2014

[7] Bloomberg.com PBOC Says No Longer in China’s Interest to Increase Reserves November 21, 2013

[8] Wall Street Journal Regulators at Odds on Reining In China's Shadow Lending January 14, 2014

[9] Bloomberg.com First China Default Seen as Record $427 Billion Debt Due December 9, 2014

[10] Bloomberg.com China Peer-to-Peer Loan Sites Fail as Fraud Climbs, Xinhua Says January 13, 2014

[11] Global Finance Magazine World’s Biggest Banks 2013 October 2013

[12] Bloomberg.com ICBC Won’t Repay Troubled China Trust Product, Official Says January 17, 2014

[13] Wikipedia.org Chinese economic stimulus program

[14] George Soros The World Economy’s Shifting Challenges Project Syndicate January 2, 2014

[15] See China’s Stock Market Soars on ‘Leaked’ Reform Documents as Bond Markets Seize Up November 16, 2013

[16] Bloomberg.com Record Spread Blowout Sparks Mini-Crisis Warning: China Credit November 27, 2014