Military Socialism is the Socialism of a state in which all institutions are designed for the prosecution of war. It is a State Socialism in which the scale of values for determining social status and the income of citizens is based exclusively or preferably on the position held in the fighting forces. The higher the military rank the greater the social value and the claim on the national dividend—Ludwig von Mises

In this issue

PSEi 30: Global Asset Liquidations Sparked the Largest Weekly Decline in 2024; The Silent Transition to a Global War Economy!

I. PSEi 30’s Year-to-Date Gains Evaporate in 9 Trading Days! An Autopsy of the PSEi 30’s 3.25% Weekly Plunge

II. The National Team Cushioned the PSEi 30s Plunge

III. Global Tightening Spurred Liquidations on Rising Risk Aversion and Deleveraging: Rising US Dollar, Higher Global Bond Yields

IV. Tightening Triggered Risk Aversion Through Global Stock Markets Sell-offs

V. The Silent Transition to a Global War Economy!

PSEi 30: Global Asset Liquidations Sparked the Largest Weekly Decline in 2024; The Silent Transition to a Global War Economy!

The hope for the revival of the bull market has encountered stiff resistance, as the PSEi 30 erased year-to-date gains last week. We explore why the transition to a war economy is hardly a positive sign for stocks.

I. PSEi 30’s Year-to-Date Gains Evaporate in 9 Trading Days! An Autopsy of the PSEi 30’s 3.25% Weekly Plunge

So, what happened to the establishment's wet dream for the supposed return or revival of the PSE's bull market?

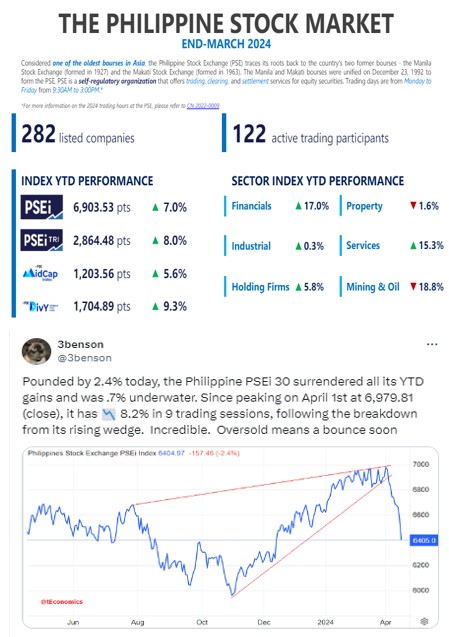

Figure 1

On April 16th, the PSEi 30 was monkey-hammered by 2.4% just a day before the Philippine Stock Exchange published its infographics to flaunt its 7% YTD returns last March. (Figure 1, upper diagram)

As posted in my tweet, it took only 9-trading sessions to eradicate or reverse the YTD returns. (Figure 1, lower image)

Or, three months of gains obliterated in just 9-trading sessions! Incredible.

As predicted, the PSEi 30 did bounce in the next two days, but by the week's close, it surrendered most of it anyway.

The PSEi 30 plunged 3.25% (WoW), the largest for the year and the most since September 2022.

The week of April 19th ended with the PSEi 30 slightly down by 0.11% year-to-date.

Figure 2

The property sector led the sectoral cascade with a 5.8% decline, supported by the broader member base. Holdings and industrials also dived by 4.01% and 3.83%, respectively. (Figure 2, topmost window)

26 of the 30 elite members registered a weekly decline, with an average of -3.97%. (Figure 2, middle chart) The difference between the headline and the broader index manifests the influence of the weightings of the free float market cap share.

The carnage was also visible in the PSE constellation, with 585 decliners against 367 advancers, resulting in a negative breadth of 218, the largest since the week of March 17th, 2023. (Figure 2, lowest graph)

The PSEi 30, which closed at 6,443 on April 19th, returned to mid-December 2023 levels.

II. The National Team Cushioned the PSEi 30s Plunge

There is little awareness that the index managers cushioned the PSEi 30's plunge.

Figure 3

Because BPI shares soared by 4.64%, and because the scale of decrease by the biggest market cap issues had been less than the average, the free-float market cap weights of the ICT (-0.48%) and three PSEi banks, along with the PSEi 30's top 5, climbed to their respective records! (Figure 3 upper and lower charts)

That's right. ICT + banks have a historic share of 22.6%, while the PSEi 30's top 5 issues control a record 51.6% of the headline index (as of April 18th).

This development suggests mounting concentration risks in the index, notwithstanding the skewing of other aspects such as valuations.

III. Global Tightening Spurred Liquidations on Rising Risk Aversion and Deleveraging: Rising US Dollar, Higher Global Bond Yields

Why April's meltdown?

In a word, tightening.

The current environment, both local and international, has shifted from easing to tightening—resulting in 'de-risking' and deleveraging.

Proof?

Figure 4

Though the USD index $DXY rose by only 0.1% this week, it pressured emerging markets and Asian currencies lower. (Figure 4, topmost pane)

The US dollar-Philippine peso $USDPHP exchange rate soared 1.94%, against the Indonesian rupiah $USDIDR 2.6%—based on Bloomberg data. (Figure 4, middle and lowest charts) These were the weakest currencies in the region.

To quote analyst Doug Noland of the CBB,

"For the week, the Mexican peso declined 2.6%, the Indonesia rupiah 2.5%, the Philippine peso 1.9%, the Brazilian real 1.6%, the South African rand 1.3%, and the Colombian peso 1.3%...Losses are mounting throughout Asian currency markets. The Japanese yen has declined 8.8% y-t-d, the Thai baht 7.4%, the South Korean won 6.8%, the Taiwanese dollar 5.6%, the Indonesian rupiah 5.3%, the Malaysian ringgit 4.0%, and the Philippine peso 3.9%. (Noland, 2024)

Figure 5

Further, the rising weekly yields of local currency-denominated Asian 10-year Treasuries have centered mostly on Indonesia, the Philippines, and Vietnam. (Figure 5, top and middle graphs)

Philippine rates have risen almost across the board, but the BVAL curve has steepened sharply—a presage of a potential upswing in inflation. (Figure 5, lowest chart)

Moreover, for USD-issued bonds, again Mr. Noland,

Fragile EM bond markets remained under pressure this week. In dollar-denominated EM bonds, Indonesia yields rose 13 bps to 5.28% (one-month rise 39bps), Philippines eight bps to 5.39% (35bps), Panama 23 bps to 5.41% (50bps), Colombia six bps to 7.69% (52bps), and Brazil three bps to 6.73% (25bps). Over the past month, local currency bond yields were up 116 bps in Turkey, 66 bps in Colombia, 61 bps in Brazil, 58 bps in Mexico, 52 bps in Hungary, 50 bps in Peru, and 50 bps in the Philippines. (bold added)

Simply put, the unwinding of speculative leveraged via carry trades and derivatives led to a series of asset liquidations globally.

III. Tightening Triggered Risk Aversion Through Global Stock Markets Sell-offs

Figure 6

This dynamic became evident in stocks, as Asian Pacific bourses experienced a rout as well. Out of the nineteen national indices, sixteen posted declines, with an average weekly drop of 2.4%.

The hardest-hit were Vietnam, plagued by a massive bank scandal and the $24 billion bailout by its central bank; Japan's Nikkei, pressured by the multi-year low in the yen; and Taiwan's bourse, affected by the meltdown in US big tech stocks. (Figure 6, upper image)

The "unstoppable" momentum in US AI, big-tech stocks, and crypto may have hit a wall, as evidenced by NVDA's plunge of 9.76% and the Nasdaq 100's fall of 3.9% last Friday. Week over week, NVDA dived by 13.6%, the Nasdaq 100 by 5.52%, and Bitcoin by 3.9%. (Figure 6, lower diagram)

While Pakistan’s Karachi 100 continued to hit back-to-back record highs this week, the all-time highs reached this year in four of the six national indices seem to be in peril (Japan, Taiwan, Australia, and Indonesia). Meanwhile, Pakistan’s government reportedly asked the IMF for another bailout.

At the PSE, foreign money liquidations played a significant role in the stampede out of Philippine equities. A series of daily outflows of foreign money started on March 22nd and has only crescendoed.

Foreign money reportedly sold off in the last four weeks, with last week's Php 3.3 billion signifying the largest outflow since the week ending October 13th, 2023. Foreign trade accounted for 51% of the gross turnover—the highest since March 15th, 2024.

Given the nation’s tenuous savings, the torrent of foreign money exodus exposed the vulnerability of the market's low volume turnover to heightened price volatility—as we have been emphasizing. (Prudent Investor, 2023)

Only a few issues—ICT, banks, and SM—received support from the Index managers or the local version of the "National Team."

IV. The Silent Transition to a Global War Economy!

Certainly, noxious geopolitical events influenced part of the selloff.

Iran’s much-telegraphed retaliation against Israel’s bombing of the former’s embassy in Syria and vice versa—whether a "mock war" (similar to the US-Spanish "Battle of Manila in 1898") or limited strikes (on orders from the higher powers)—demonstrates the various tripwires in the intensifying geopolitical competition and tension over global hegemony.

The US Deep State's "forever wars" appear to have reached a critical turning point.

As we keep emphasizing, the global economy has been transitioning to a war economy—marked by increasing "hot" or kinetic wars or the unveiling of World War 3 (with a diverse character from its predecessors), the escalating weaponization of money, trade, investments, information, social mobility, etc., and the rapid expansion of deficit spending, this time focused on the national defense industry justified on national security concerns. (Prudent Investor, 2024)

Defense spending is bound to be the next source of “stimulus,” coming at the expense of consumers.

Figure 7

An example would be the increasing use of industrial policy (Figure 7), which the recently IMF pointed out,

Many countries are ramping up industrial policy to boost innovation in specific sectors in the hope of reigniting productivity and long-term growth, amid security concerns. Major initiatives are springing up around the world, such as the United States’ CHIPS and Science Act, which will fund domestic research and semiconductor manufacturing, the European Union’s Green Deal Industrial Plan, which supports the bloc’s transition to climate neutrality, the New Direction on Economy and Industrial Policy in Japan, or the K-Chips Act in Korea, alongside longstanding policies in emerging market economies like China. (bold added) (IMF, 2024)

On this account, it is unsurprising to expect the inflation cycle to accelerate, accompanied by higher rates and slower economic growth (stagflation) as well as heightened credit risks—given the unprecedented systemic leverage globally.

The war economy also translates to the increasing embrace of socialism via a "big government," coming at the expense of civil liberties.

Certainly, because there are no trends that operate in a straight line, there will be rebounds or countercyclical forces (fierce bear market rallies). But the latest meltdown reinforced the (structural) bear market in action for the PSE.

Of course, there will always be some viable trade opportunities, but for most, this would amount to "catching a falling knife."

None of this is new to our readers.

Be careful out there.

___

references

Doug Noland, World-Wide De-Risking/Deleveraging, April 19, 2024, creditbubblebulletinblogspot.com

Prudent Investor Newsletters, The Philippine PSEi 30 Jumped 3.9% Courtesy of the "National Team," The "Powell Pivot:" A Christmas Gift to the Wall Street of the World? December 17, 2023, Substack.com

Prudent Investor Newsletters, What Surprise is in Store for the 2024 Year of the Wooden Dragon? February 11, 2024, Substack.com

Era Dabla-Norris, Daniel Garcia-Macia, Vitor Gaspar, Li Liu, Industrial Policy Is Not a Magic Cure for Slow Growth, April 10, 2024