“The list of qualities [an investor should have] includes patience, self-reliance, common sense, a tolerance for pain, open-mindedness, detachment, persistence, humility, flexibility, a willingness to do independent research, an equal willingness to admit mistakes, and the ability to ignore general panic.” - Peter Lynch

Allow me for my “I TOLD YOU SO” moment!

It’s not easy writing about financial markets (or about political philosophies too). Some feedbacks occasionally do test one’s patience, especially if they are meant, not as a serious critique, but as one to nitpick. The latter is directed at testing one’s esteem rather than to test the validity or soundness of an idea.

Thus when my views are validated by the market, contra the quibblers, I think I deserve to vent...“I told you so!”

First “I Told You So!” Moment: Gold

There are two important milestones deserving of “I told you so!” this week.

First is gold.

Gold prices are now drifting at the near record nominal levels. Early this year, gold’s lackluster price performance has prompted some commentaries to call on an inflection point or a major reversal from which I argued against.

Here is what I wrote[1],

So I unlike those who see a surge in the “event risks” from the current string of upheavals in the Middle East as a reason to sell, I see gold rebounding from these uncertainties, fed by the inflationism in central banks and eventually a rally in most of the global equity markets, including the Phisix.

With a bounce in gold, a month after, I followed this up with[2],

Don’t look now, but gold is surging right back! (I have to wait for a successful test of 1,430 before I could blurt out ‘I told you so’)

If gold is surging right back, then it is likely that global equity markets will follow gold’s path.

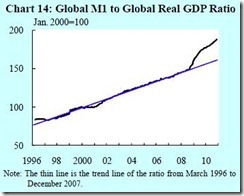

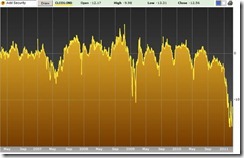

Figure 1: I Told You So Moment No. 1: Record Gold prices (stockcharts.com)

My self-made conditions have been met. Gold has recently passed 1,430 and was last traded 1,427.9. Importantly, global equity markets appear to be in consonance, most of which appear as moving higher, if so indicated by the indices as the Dow Jones World (DJW), Dow Jones Asia ex-Japan (P2DOW) and Emerging Markets (EEM) in Figure 1.

This would appear similar to the 2008 post Lehman event where gold reversed to the upside a few months ahead of the global equity markets.

However, the conditions for my “I told you so!” moment for the Phisix, ASEAN and emerging market stocks has not been sufficiently met, as technical barriers have yet to be breached, thus would remain pending or unsettled for now.

Diminishing Returns of Information

Before I proceed to my second “I told you so!” moment which is about the unmasking of the false causation of “MENA political crisis + high oil prices = falling stock markets”, I must admit that while the attributed events, like the MENA crisis and lofty oil prices, may not posit as the main variables for today’s major market movements, they do account for some degree of influence or relevance.

Because the emergence of such unforeseen events are considered as uncertainty (immeasurable risk, and not possible to calculate[3]), the markets work to reappraise of ‘uncertainty’s’ influence or impact, which gradually digests on them. So the influence of uncertainty depends mostly on the scale and the time value of influence.

You can go back to the chart in figure 1 and see how markets did somewhat react adversely to the outbreak of the Arab revolution highlighted by the culmination of the Tunisian Jasmine revolution (downside green arrows) which swiftly spread to Egypt (2nd to 3rd week of January). This, I think represented as the initial reaction to the uncertainty posed by the Arab ‘People Power’ revolts.

Once the markets learned of and adjusted to such uncertainty, or to the new information, and subsequently established its cost-benefit expectations around it, uncertainty gets to be transformed into risks (measurable potential losses) via discounting. Discounting, thus, signifies as the diminishing returns of information or the marginal value theorem[4] applied to information.

So when the temporal effects of the perceived event risks have been discounted, market dynamics eventually gives way or returns to the fold of the major influences or drivers.

Second “I Told You So!” Moment: Popular False Causations

So the du jour explanations on much of today’s market action, especially for the local media and so called experts, has been the due to the causation “MENA political crisis + high oil prices = falling stock markets”.

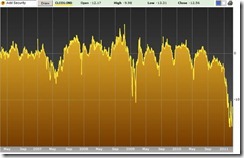

Figure 2: “I Told You So” Moment 2: Say What? Oil and MENA Crisis Equals Falling Phisix? (stockcharts.com)

The beauty of last week’s action or the invalidation of a flawed popular theory comes with the remarkable divergence in the price actions of the global equities relative to oil and the MENA equities.

WTIC or West Texas Intermediate Crude[5] or a major benchmark representing US sweet crude oil, which is traded at the New York Mercantile exchange, closed at $104.65 over the week. Friday’s closing price accounts for over $13 a barrel from the start of the year or about $7 up from last week! (red circle)

Meanwhile, Europe’s contemporary oil bellwether, the Brent Crude[6] has even been higher, Brent Crude was last traded at $114.79 per barrel on Friday or about $10 premium to the WTIC!

Figure 3: WTI-Brent Spread At Record Variance (Bloomberg)

Brent crude mostly comes from the North Sea and is used mostly by European and Asian consumers whereas WTI originates and is used mostly in the US.

The WTI-Brent spread (figure 3) has risen to a record premium. This record spread could perhaps be due to possible variance in the relative production levels (relative depletion rate) or reportedly concerns over the the tanker shipment routes via the Suez canal[7], where 1m barrels a day pass through. But others argue that this is likely based on arbitrages[8]. So there seems to be no unison or consensus opinion on this.

It is not clear how the Middle East crisis plays into this WTI-Bremt spread anomaly. I would have to dig deeper.

Anyway, the Middle East crisis has likewise been reflected on the region’s stock markets as represented by T. Rowe Price Africa & Middle East Fund (TRAMX).

The TRAMX has currently been undergoing a dramatic liquidation or a selloff, as exhibited by the recent collapse of major MENA benchmarks.

While news say that retail and foreign investors have been mainly responsible for this, I argued otherwise[9]—entrenched (political economic) interests could be scrambling for the exit gates.

Fearing political retribution by sequestration or by a freeze on their assets, these politically connected elites (along with the political leadership) could be scurrying to convert and safekeep their wealth outside the region and or through alternative assets, that could hide their identities.

So given the above accounts, where the MENA political crisis and oil prices appear to be amplifying the so-called event risks, we should, according to the mainstream, expect the Philippine Phisix and other Emerging Market bourses, as well as developed markets to likewise feel the heat or pressure.

Ironically, we seem to be witnessing the opposite price actions.

The Phisix (PSEC) and ASEAN Equities (FSEAX) seem to be making a signifcant inroads to the upside, as shown by this week’s substantial gains in both price actions (Figure 2).

True, one week does not a bullmarket make. Or that these rallies could constitute as ‘dead cat’s bounce’, since they are yet far from establishing technical metrics to suggest of a convincing comeback (but this would mean even bigger rallies!).

Nevertheless, the important thing is that markets appears to be consistently validating on my outlook despite pressures for me to turn “short term”.

Divergent Signals Between Currencies and Equities

I’d like to add that relative to the Philippine assets, I have been making a point that the actions of the Philippine Peso and the Phisix have been diverging[10].

Falling local stocks and a strong Peso represent an incompatible relationship. That’s because given the relatively underdeveloped capital markets here, where alternative avenues to generate returns via the financial markets are deeply constrained, the traditionally route for the elite has been to export capital (a.k.a. capital flight) when endogenous market or economic conditions are weak.

Though this correlationship may not be perfect, as there accounts for some intermittent time lags, the Peso-Phisix serves as a reliable barometer for the direction of the movement of the local stock market.

So when you have a strong Peso and a weak Phisix, you can be sure that one of them is about to give way.

And by looking at the bigger picture, we see a similar correlationship between Asian currencies and Asian equity markets (figure 4).

Figure 4: Strong correlations between Asian Stocks and Asian Currencies

The Bloomberg-JP Morgan currency basket [ADXY:IND AP Dollar Index] (green line) can be seen simultaneously weakening along with the MSCI AC Asia Pacific Index [MXAP:IND MSCI AC ASIA PACIFIC] (yellow line) during key downturns over the past 3 years. The four red ellipses have exhibited the strength of such correlationship. Of course, such correlationship also works on the upside.

The important point is that when the Philippine Peso has been firming along with Asian currencies, and where East Asian equity markets as Japan have been on the upside (Asia Pacific markets as Australia and New Zealand are likewise on the upside), even when most are either consolidating or on the downside, then it is likely that ASEAN markets, including the Phisix, are not in a bear market, but rather in a hiatus, and will likely be bouncing back as they seem to be happening.

Even the local bond markets appear to be suggesting the same.

There is also the role of retail participants, whom we have been closely monitoring[11]. As previously stated, retail participants are mostly emotionally driven participants whom Wall Street refers to as the proverbial pigs who always become a fodder for the bulls and the bears. Excessive actions (buy or sell) by retail participants usually highlight the end of the ongoing trend—in this case the downside.

For all its worth, I am simply reiterating my points which I already stated but with the providence of being complimented by current market actions that appears to validate on my theories.

[1] See Gold Fundamentals Remain Positive, January 31, 2011

[2] See Resurgent Gold Equals Resurgent Emerging Market Bourses? February 20, 2011

[3] Wikipedia.org Knightian uncertainty

[4] Wikipedia.org Marginal value theorem

[5] Wikipedia.org, West Texas Intermediate

[6] Wikipedia.org, Brent Crude

[7] AMEINFO.com Trading opportunity WTI versus Brent, February 10, 2010

[8] Commodity online, Will WTI-Brent price difference stay? March 4, 2011

[9] See Middle East Stock Market Meltdown: Likely Driven By (Political Economic) Insider Selling March 3, 2010

[10] See Phisix: Panicking Retail Investors Equals Buying Opportunity, January, 31, 2011

[11] See Phisix: What Market Internals Are Saying, February 20, 2011