Move over shale gas, here comes methane hydrate. (Perhaps.) On Tuesday the Japanese government’s drilling ship Chikyu started flaring off gas from a hole drilled into a solid deposit of methane and ice, 300 metres beneath the seabed under 1000 metres of water, 30 miles off the Japanese coast.The real significance of this gas flare probably lies decades in the future, though the Japanese are talking about commercial production by 2018. The technology for getting fuel out of hydrated methane, also known as clathrate, is in its infancy. After many attempts to turn this “fire ice” into gas by heating it proved uneconomic, the technology used this week – depressurizing the stuff – was first tested five years ago in Northern Canada. It looks much more promising.Methane hydrate is found all around the world beneath the seabed near continental margins as well as in the Arctic under land. Any combination of low temperature and high pressure causes methane and water to crystallise together in a sort of molecular lattice. Nobody knows exactly how much there is, but probably more than all the coal and oil put together, let alone other gas.The proof that hydrate can be extracted should finally bury the stubborn myth that the world will run out of fossil fuels in any meaningful sense in the next few centuries, let alone decades. In 1866, William Stanley Jevons persuaded Gladstone that coal would soon run out. In 1922 a United States Presidential Commission said “Already the output of gas has begun to wane. Production of oil cannot long maintain its present rate.” In 1956, M. King Hubbert of Shell forecast that American gas production would peak in 1970. In 1977 Jimmy Carter said oil production would start to decline in “six or eight years”. Woops.The key will be cost. However, Japan currently pays more than five times as much for natural gas as America so even high-cost gas will be welcome there. The American economy, drunk on cheap shale gas, will not rush to develop hydrate. (Unlike oil, there is no world price of gas because of the expense of liquefying it for transport by ship.)

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, March 16, 2013

Welcoming the Gas Age

Saturday, January 26, 2013

Why the Neo-Malthusian Premise of “Peak Resources” are Misguided

Yet whether it is oil or copper or iron ore or whatever resource, people insist on relying on the same faulty reasoning that “the easy stuff is gone.” They continue to make the same tired case for chronic natural resource shortages and a decline in our standard of living.The great economist Joseph Schumpeter’s (1883-1950) criticism of the Malthusian position still holds. On Malthus and his ilk, he wrote: “The most interesting thing to observe is the complete lack of imagination which that vision reveals. Those writers lived at the threshold of the most spectacular economic developments ever witnessed.” Yet they missed it.So here is my prediction: I believe we are on the cusp of even greater levels of innovation and development — another industrial revolution is in progress right now. So ignore the gloom and doom on natural resources. Contra Grantham, the days of abundant resources and falling prices are far from over.

Deep-sea mining is poised as a major growth industry over the next decade, as large developing-world populations drive consumer demand for metal-containing products, climate change makes previously inaccessible regions like the Arctic Ocean seabed attainable, and improved extraction technologies turn previously uneconomical rock into paydirt.Cindy Van Dover is a Professor of Biological Oceanography at Duke University and a leading voice in the development of policy and management strategies for deep-sea extraction activities. Van Dover has studied the ecology of hydrothermal vents for years, and she takes a measured, pragmatic approach to the coming industrialization of her study sites. If mining is going to happen – a event that the more strident faction of the environmental movement will no doubt contest – “we need to work with industry to make sure we do it right,” says Van Dover.

A newly launched asteroid miner is looking to the history of deep sea mining as it attempts to navigate laws governing exploitation of space.Deep Space Industries, which rolled out its plan for space mining today at a news conference in the Santa Monica Museum of Flying in California, said the laws regarding resource mining beyond the earth are largely unformed, and the company will rely on co-operation between the main players. (Video embed of the press conference is below.)"If you look at parallels, like deep sea mining, that went forward without a global treaty. The companies that wanted to do deep sea mining shook hands: 'We won't interfere with you if you don't interfere with us', that was the general approach going forward," said David Gump, Deep Space's chief executive officer.Gump said the company will be relying on the 1967 space treaty, which he says will give the company the right to utilize space resources but will not grant the right to claim any sovereign territory.

“[N]atural resources are not finite in any meaningful economic sense, mind-boggling though this assertion may be. The stocks of them are not fixed but rather are expanding through human ingenuity.”

Saturday, March 24, 2012

Shale Oil Revolution: (Laissez Faire) Capitalism Deals Peak Oil a Fatal Blow

I used to believe in peak oil. That all changed when I got immersed in Austrian school of economics. I have come to realize that we are dynamic, and not static, beings whose actions are driven by time and value scale based incentives in response to the changes in the environment and to social developments. In other words, human action is what drives economic values of goods or services.

And given the opportunity or the right environment or a society tolerant for experimentation that rewards success and penalizes failure, people will find ways and means to employ resources in a more efficient manner in order to improve on our current unsatisfactory conditions.

“Peak oil” as a social phenomenon, and not in the engineering sense, is about to be vanquished [unless socialists cloaked as environmentalists succeeds to put a political kibosh on this sunshine industry].

The phenomenal pace of advances in engineering technology has been intensifying the Shale Oil Revolution

From the New York Times Green Blog, (bold emphasis mine) [hat tip Professor Mark Perry]

The revolution in production in Texas and across the country is partly tied to the rising price of oil over much of the last decade, which propelled aggressive technological experimentation and development. (Government encouragement over the last several administrations helped as well.)

Horizontal drilling and hydraulic fracturing have been around for years, but over the last five years, engineers have fine-tuned these and other techniques, even as many environmentalists worry about their impact on water and air.

Computer programs have been developed to simulate wells before they are even drilled. Advanced fiber optics permit senior engineers at company headquarters to keep track of drillers on the well pad, telling them when necessary where to direct the drill bit and what pressure to use in injecting fracking fluids. Seismic work has become far more sophisticated, with drillers dropping microphones down adjacent wells to measure seismic events resulting from a fracking job so they can more accurately determine the porosity and permeability of rocks when they drill nearby in the future.

Just a decade ago, complete wells were fracked at the same time with millions of gallons of water, sand and chemical gels. Now the wells are fracked in stages, with various kinds of plugs and balls used to isolate the bursting of rock one section at a time, allowing for longer-reaching, more productive horizontal wells. A well that once took two days to drill can now be drilled in seven hours.

For instance, when the Apache Corporation began drilling in the 100,000-acre Deadwood field in the West Texas Permian basin in 2010, there had only been a trickle of production there. The deep shale, limestone and other hard rocks had potential, but for years they had not been considered economically viable. The rocks were so hard, they would have likely sheared off the usual diamond cutters on the blade of any drill bit attempting to cut through.

But new adhesives and harder alloys have made diamond cutters and drill bits tougher in recent years. Meanwhile, Apache experimented with powerful underground motors to rotate drilling bits at a faster rate. Now, a well that might have taken 30 days to drill can be drilled in just 10, for a savings of $500,000 a well.

“By saving that money, you can spend more on fracking, which translates into more sand and more stages and better productivity,” said John J. Christmann, the Apache vice president in charge of Permian basin operations.

All these serves as empirical evidence of how the price signaling channel sets in motion entrepreneur’s incentives to fulfill market demands through the employment of savings or capital accumulation in shaping the fantastic advances in technology (in spite of the numerous government interventions) in a market economy.

As the great Professor Ludwig von Mises wrote,

What distinguishes modern industrial conditions in the capitalistic countries from those of the precapitalistic ages as well as from those prevailing today in the so‑called underdeveloped countries is the amount of the supply of capital. No technological improvement can be put to work if the capital required has not previously been accumulated by saving.

Saving—capital accumulation—is the agency that has transformed step by step the awkward search for food on the part of savage cave dwellers into the modern ways of industry. The pacemakers of this evolution were the ideas that created the institutional framework within which capital accumulation was rendered safe by the principle of private ownership of the means of production. Every step forward on the way toward prosperity is the effect of saving. The most ingenious technological inventions would be practically useless if the capital goods required for their utilization had not been accumulated by saving.

The entrepreneurs employ the capital goods made available by the savers for the most economical satisfaction of the most urgent among the not-yet-satisfied wants of the consumers. Together with the technologists, intent upon perfecting the methods of processing, they play, next to the savers themselves, an active part in the course of events that is called economic progress. The rest of mankind profit from the activities of these three classes of pioneers. But whatever their own doings may be, they are only beneficiaries of changes to the emergence of which they did not contribute anything.

The characteristic feature of the market economy is the fact that it allots the greater part of the improvements brought about by the endeavors of the three progressive classes—those saving, those investing the capital goods, and those elaborating new methods for the employment of capital goods—to the nonprogressive majority of people. Capital accumulation exceeding the increase in population raises, on the one hand, the marginal productivity of labor and, on the other hand, cheapens the products. The market process provides the common man with the opportunity to enjoy the fruits of other peoples’ achievements. It forces the three progressive classes to serve the nonprogressive majority in the best possible way.

As seen from the shale oil revolution, the illustrious economist Julian Simon has been right anew, human beings have indeed been the ultimate resource.

Tuesday, February 21, 2012

The Implications of Cuts in Saudi Arabia’s Oil Production and Exports

In the light of $100 oil, Saudi Arabia, the world’s largest oil producer and exporter has reportedly cut production.

The CNBC reports,

The world’s top oil exporter, Saudi Arabia, appears to have cut both its oil production and export in December, according to the latest update by the Joint Organizations Data Initiative (JODI), an official source of oil production, consumption and export data.

The OPEC heavyweight saw production decline by 237,000 barrels per day (bpd) from three-decade highs of 10.047 million bpd in November, the JODI data showed on Sunday.

The draw-down was sharper for the actual amount exported, declining by 440,000 bpd, or 5.6 percent, to come in at 7.364 million bpd, the data also showed. The level would still be similar to exports after a steep ramp-up last June.

In its monthly report on February 10, the IEA put Saudi Arabia’s production number for December slightly lower at 9.55 million bpd, a disparity of 260,000 bpd versus the JODI data.

The actions of the Saudi Arabian government have profound implications.

Could it be that Saudi Arabia has been responding to the threat of Shale oil revolution? Recently Saudi halted a planned $100 billion expansion of productive capacity.

And considering that Saudi’s fiscal budget breakeven level stands at an equivalent of $90 oil, with current prices only marginally above the critical threshold, Saudi’s political stewards seem to anxiously sense of the growing risks to political stability or a threat to their grip on power. Hence the move to reduce oil production aimed at the preservation of the status quo or the incumbent welfare state.

Chart from Energy Insights

It could also be that Saudi’s reserve and production may also have reached a “peak”.

Last year, Wikileaks reported that cable correspondence by key officials from Saudi Arabia suggested that the kingdom may have bloated their estimated reserves by nearly 40%. Thus cuts in exports and production have merely been exposing the chicanery of oil politics.

The bottom line is that Saudi Arabia seems desperate to see higher oil prices.

So aside from production cuts, the bias for inflationary policies, the other alternative would be to promote a war on Iran using the obsession “with the need to prevent Iran getting nuclear weapons” as cover. The same applies to other autocratic Middle East oil producing welfare states.

Thus political languages conveyed by political authorities can be deceiving as they may not reflect on the realities intended.

As George Orwell warned,

Political language is designed to make lies sound truthful and murder respectable, and to give an appearance of solidity to pure wind

Wednesday, December 07, 2011

Shale Oil Discoveries Goes International, Easing Peak Oil Concerns

Last week, Argentina and China reported major Shale oil discoveries

From Presstv.com

Argentina's YPF oil and gas company has announced a historic oil discovery in the country's southern province of Neuquen, Press TV reports.

Yacimientos Petroliferos Fiscales (YPF) new finding includes 927 million barrels of recoverable oil and natural gas, of which 741 million barrels is shale oil.

“They [YPF] have an important discovery, and they have to expand it. The major challenge is to develop the technology and raise the capital in order to produce at reasonable prices,” Daniel Gerold, an energy market analyst told Press TV.

From Independent.co.uk

The shale gas revolution spread to China yesterday as Royal Dutch Shell struck the rock-based fossil fuel while drilling, heralding the country's first commercial production.

In a joint venture with its local partner, PetroChina, Shell has drilled two wells and discovered a good flow of gas.

"It's good news for shale gas," said Professor Yuzhang Liu, vice president of Petrochina's Research Institute of Petroleum Exploration and Development. Shale gas is fraught with controversy because it is extracted from the rock with blasts of sand, water and chemicals through a process known as hydraulic fracturing, or fracking, that has been linked to earthquakes and water pollution.

However, the discovery of vast quantities of the gas in countries such as the US, Poland and the UK has the potential to provide a relatively cheap, secure source of energy.

In April, the US Energy Information Administration estimated that China may hold 1,275 trillion cubic feet of shale gas, 12 times its conventional gas reserves and almost 50 per cent greater than in the US.

With the spate of Shale oil discoveries which should be expected to increase, as I previously wrote,

Eventually the growth of the industry will likely reach a scale enough to incentivize a structural change or reconfiguration in the distribution of demand.

This implies an easing of relevance of peak oil.

From Platts.com,

The debate over whether the world's reserves of hydrocarbons have now peaked and are in decline has lost relevance over recent years as new technology allows oil companies to find and exploit new hydrocarbon sources, the CEO of Repsol Antonio Brufau said Tuesday.

Brufau said progress made in exploring and developing ultra-deepwater areas, unconventional oil and gas sources and the move into remote areas such as the Arctic, have been key to growing global reserves of oil and gas.

"The speed at which technology changes and its consequences have taken us largely by surprise. The peak oil debate, for example, has lost a great deal of its relevance in the past three years," Brufau told the World Petroleum Congress in Doha.

"The possibility that usable resources under commercially viable terms will run out is no longer a concern in the short or medium term," he said.

(Hat tip Professor Mark Perry)

Wednesday, November 16, 2011

The Explosive Growth of Shale Gas

The growth momentum of the ‘sunshine’ Shale gas industry has been revving up.

From Bloomberg

Surging crude output in the Bakken shale formation is set to make North Dakota a bigger oil producer than OPEC member Ecuador.

The CHART OF THE DAY tracks North Dakota’s production, which has almost doubled in the past two years, as Ecuadorean output has stagnated.

North Dakota and neighboring Montana are home to the Bakken Formation, identified by the U.S. Geological Survey in 2008 as having as much as 4.3 billion barrels of recoverable oil. Companies extract the oil with hydraulic fracturing, a technique that shoots water, sand and chemicals into shale.

“There’s been an amazing jump in North Dakota output,” said Rick Mueller, a principal with ESAI Energy LLC in Wakefield, Massachusetts. “We are looking for output to be anywhere from 700,000 barrels to 1 million barrels a day within five years.”

North Dakota pumped a record 464,129 barrels a day in September, the most recent month with available data, according to the state government, up from 86,072 barrels 10 years earlier. The state is now the fourth-biggest producer in the U.S. after Texas, Alaska and California, according to the Energy Department.

Ecuador produced 485,000 barrels a day in September, according to a monthly Bloomberg News survey of oil companies, producers and analysts, near the top of its range for the past four years. It was OPEC’s smallest producer until Libya’s production was disrupted this year by the insurrection that toppled Muammar Qaddafi.

The momentous growth by Shale gas industry has largely been ignored by the mainstream obsessed by politically ordained ‘renewable energy’ or by peak oil theorists fixated with Malthusian dynamics

A good example can be seen from the Economist

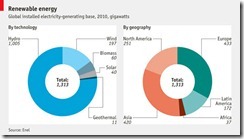

EFFORTS to tackle climate change include heavy investment in renewable sources of electricity around the world. Solar power saw the biggest leap in 2010, with the installed base jumping 70% compared with 2009 to 40 gigawatts. Wind power also grew strongly, adding 24% of generating capacity. Yet the biggest source of renewable electricity, hydropower, and the smallest, geothermal, both only added 3% to capacity. Finding usable sources of either is becoming increasingly hard or costly. The region that saw the biggest growth in renewable energy projects was power-hungry Asia. Investment in renewables also saw the biggest leap since 2007, with $243 billion spent, a 30% increase over 2009.

Eventually the growth of the industry will likely reach a scale enough to incentivize a structural change or reconfiguration in the distribution of demand.

Thursday, July 07, 2011

Huge Rare Earth Metals Discovery in the Pacific Seabed

For the many who believe in various “Peak” theories—seen as the shrinking of “finite” supplies of specific natural resources/commodities (e.g. oil, copper etc…)—their fundamental error has been to ignore the laws of economics and human ingenuity.

This also applies to entities who operate under such premises and think that they can monopolize or control supply of natural resources by restricting trade. This applies particularly to rare earth metals.

The BBC.co.uk reports,

Japanese researchers say they have discovered vast deposits of rare earth minerals, used in many hi-tech appliances, in the seabed.

The geologists estimate that there are about a 100bn tons of the rare elements in the mud of the Pacific Ocean floor.

At present, China produces 97% of the world's rare earth metals.

Analysts say the Pacific discovery could challenge China's dominance, if recovering the minerals from the seabed proves commercially viable.

The British journal Nature Geoscience reported that a team of scientists led by Yasuhiro Kato, an associate professor of earth science at the University of Tokyo, found the minerals in sea mud at 78 locations.

"The deposits have a heavy concentration of rare earths. Just one square kilometre (0.4 square mile) of deposits will be able to provide one-fifth of the current global annual consumption," said Yasuhiro Kato, an associate professor of earth science at the University of Tokyo.

The minerals were found at depths of 3,500 to 6,000 metres (11,500-20,000 ft) below the ocean surface.

My comments

One, China’s apparent monopoly on rare earth metals will be challenged by such findings.

Two, the laws of economics work: High prices translates to profitable opportunities for the market to discover alternative sources of supply

Three, innovative technology trends help underpin such supply sourcing. Yes, the above development points to seabed mining as the next major frontier in resource exploration.

Fourth, prices founded on current (‘peak’ and monopolists) premises will likely be affected.

So far, the REMX (Market Vectors Rare Earth ETF) have been on a downswing, along with a major US rare earth producer Molycorp [MCP] even before the news was released (maybe the market has anticipated this).

Yet aside from the above the dynamics of supply-demand balances, there is also monetary factor to always consider. So while prices of rare earth may be pressured by supply side discoveries, continuation of policies of inflationism may partly offset such declines.

Like any endeavor, there will always be naysayers or detractors (or perhaps defenders of the current monopolists)

From the same article,

The prospect of deep sea mining for precious metals - and the damage that could do to marine ecosystems - is worrying environmentalists.

Are these environmentalists really working to “save” the environment? Or are they there to promote vested interest groups or simply advancing the cause of etatism?

Wednesday, April 06, 2011

Energy Information Administration: Shale Gas Is A Global Phenomenon!

When people talk about Peak oil or peak anything, they only look at current prices and the available quantity of declared reserves, which they see as fixed and which they equate with neo-Malthusian insights of shortages.

They do this without comprehending the economic value of resources and without understanding the concept of human action—or that people don’t just standstill in the face problems, we react by working to resolve such unease via the price mechanism.

People, via the markets, respond to prices. This means when scarcities are projected via price signals, the market resorts to either conservation (rationing) or substitution.

This brings us to the announcement by the US EIA that shale gas production is a global phenomenon, with US having been the pioneer in its development.

The EIA writes, (bold highlights mine)

The use of horizontal drilling in conjunction with hydraulic fracturing has greatly expanded the ability of producers to profitably produce natural gas from low permeability geologic formations, particularly shale formations. Application of fracturing techniques to stimulate oil and gas production began to grow rapidly in the 1950s, although experimentation dates back to the 19th century...

The development of shale gas plays has become a “game changer” for the U.S. natural gas market. The proliferation of activity into new shale plays has increased shale gas production in the United States from 0.39 trillion cubic feet in 2000 to 4.87 trillion cubic feet in 2010, or 23 percent of U.S. dry gas production. Shale gas reserves have increased to about 60.6 trillion cubic feet by year-end 2009, when they comprised about 21 percent of overall U.S. natural gas reserves, now at the highest level since 1971

Shale gas production from the US has been exploding. (From the EIA) This accelerated progress has been buttressed by (free market induced) technological enhancements.

Shale reserves have likewise been expanding along with production. This proves the case of the growing economic value of Shale gas.

Shale Gas reveals of the substitution process in action.

Now for the global perspective, more from the EIA.... (bold highlights mine)

It appears evident from the significant investments in preliminary leasing activity in many parts of the world that there is significant international potential for shale gas that could play an increasingly important role in global natural gas markets... In total, the report assessed 48 shale gas basins in 32 countries, containing almost 70 shale gas formations...

The estimates of technically recoverable shale gas resources for the 32 countries outside of the United States represents a moderately conservative ‘risked’ resource for the basins reviewed. These estimates are uncertain given the relatively sparse data that currently exist and the approach the consultant has employed would likely result in a higher estimate once better information is available.

What does all this tell us?

The energy market is working quite well, despite numerous interventions applied by governments.

The diffusion of technological advancements combined with the attendant economies of scale enhances the commercial viability of these projects, which if the EIA is correct, would mean more nations utilizing their natural shale gas resources. This also means reserves will grow as usage grows, enabled by technology.

In short, shale gas is gradually being recognized as an economically valuable energy resource.

Shale gas is probably one of the possible candidates to compete, replace, if not compliment fossil fuel as a major energy source.

Only the markets will say.

Oh, I almost forgot: Please remember changes happen at the margins.

Thursday, February 10, 2011

Peak Oil Represents Government Failure

The beauty of the internet is that it has been leveling the playing field between the public and the governments in terms of information.

The web has placed much of government’s stealth activities in jeopardy.

A good example is the controversial Wikileaks which has recently revealed that Saudi Arabia could have been exaggerating the declaration of her oil reserves. Translation: Expect higher oil prices soon.

The Business Intelligence reports,

Saudi Arabia, the world's largest crude oil exporter, is unable to pump enough oil to keep prices from rising, the Guardian reported, citing confidential cables from the US embassy in Riyadh.

The cables from 2007 to 2009 made public by the website Wikileaks, urge Washington to take seriously a warning from a senior Saudi government oil executive that the kingdom's crude oil reserves may have been overstated by as much as 300 billion barrels, nearly 40%.

The report cites comments attributed to Saudi Aramco geologist and former exploration chief, Sadad al-Husseini, that Aramco couldn't reach the 12.5-million-barrel daily capacity needed to keep prices from rising.

According to the cables, which date between 2007-09, Husseini said "Saudi Arabia might reach an output of 12 million barrels a day in 10 years but before then – possibly as early as 2012 – global oil production would have hit its highest point." This crunch point is known as "peak oil".

Peak oil adherents may be quick to say “I told you so”.

However as we previously said,

While peak oil (via Hubbert Peak Theory) may be a valid engineering theory, it is a poor economic concept for the simple reason that engineering theories (like quant models) do not capture people’s behaviour.

The Wikileaks exposé only serve as a concrete example of how governments have steadfastly tried to manipulate every politically sensitive markets...and this includes the oil markets.

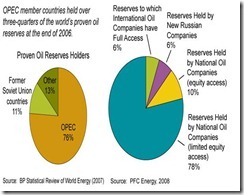

To consider, given the stranglehold control over oil supplies by different oil producing states, which accounts for more than 80% of the world’s proven reserves, if governments had the ascendancy to establish “equilibrium” then we won’t be bothered by prospective risks of shortages (via “Hubbert Peaks”) or suffer from elevated oil prices at all.

Graphs from the US EIA (includes BP Statistical Review and PRC Energy)

But obviously this hasn’t been the case.

Since governments are comprised by people—only that these elites have been politically mandated (which means they hold the barrel of the gun on us)—they suffer from the same frailties as anyone else.

Yet governments have been demonstrated:

-to lack access to the technology required to efficiently and productively utilize their oilfields,

-have had inadequate financing to invest to satisfy consumer demand,

-has revealed administrative incompetence in operating national firms or in the supervision of the 'choked’ industry, and

-most importantly, had been exposed for the paucity of knowledge to implement “equilibrium”.

It is worth emphasizing that with over 80% of proven oil reserves (supplies) controlled by global governments, this means there has hardly been a functioning free market in oil!

If Saudi officials are indeed guilty of withholding information then this reinforces the problems of the massive distortions in the oil markets which would likely implode on our faces-a negative externality as a result of government failure.

Otherwise, dynamic price signals in a free market would have reflected on the balance of demand and supply from which the marketplace would have adjusted accordingly.

What you have, instead, are vastly distorted oil markets that has been amassing intensive structural “supply-side” imbalances compounded by the manipulation of money supply by global central banks that has been contorting the “demand side”. A perfect storm in the making.

So what elevated oil prices suggest is not a validation of peak oil theory but one of the massive failure of government intervention or controls.

Monday, November 22, 2010

The Peak Oil Myth

Here are my thoughts on Peak oil

While peak oil (via Hubbert Peak Theory) may be a valid engineering theory, it is a poor economic concept for the simple reason that engineering theories (like quant models) do not capture people’s behaviour.

Let us learn from the history of oil as narrated by investment guru Steve Leuthold

500 Years Ago… England

First let’s go back about 500 years. During the Renaissance, wood was the critical energy component in England and other European economies, much as fossil fuel is today. Wood was the primary provider of heat, light, and food preparation. However, England, having chopped down most of its trees became a large wood importer, primarily from the Scandinavian countries.

Of course prices rose as wood became more scarce causing domestic brewers, bakers, and others to go out of business hit by lower priced imports from wood rich countries. The English citizenry rebelled, having to pay exorbitant rates for wood to heat their homes, light their nights, and cook their food. Thus in 1593 and again in 1615, Parliament enacted energy conservation legislation, including limiting the use of wood in construction and mandating the use of bricks (but it took more wood to bake the bricks than to build wood structures).

From 1600 to about 1650 the price of firewood soared 80%. Then in a single year the price of wood jumped another 300%. Some families were forced to burn furniture and even parts of their houses to survive the winters. Back then, there were no government wood subsidies for freezing families.

The Wood To Coal Transition

In the early 1600s, people were aware coal was an alternative energy source. But prior to the huge rise in wood, coal was far too dirty and expensive. Chopping down trees was easier and cheaper than hacking the coal out from underground. But, as the coal industry grew, mining sophistication and technology reduced the extraction costs and as coal supplies rose prices fell.

Coal was soon found to be a far superior industrial fuel and with vast improvements in coal mining productivity the price of coal kept falling. First iron production increased with quality improving. Then came steel and steam power. The Industrial Revolution was underway led by England, which was bigger, better and earlier than old Europe. England had become the world’s industrial revolution leader. The real catalyst was the Wood Crisis.

Over 150 Years Ago… United States

Now let’s go back about 200 years to the early 1800s. Once again it’s the beginning of another hugely important energy revolution. Since Colonial times, the primary source of illumination in the U.S. had been whale oil. But by 1850 the North Atlantic had almost been whaled out by New England’s whaling fleet. The shore price of whale oil doubled and then doubled again, even though new whaling technologies had maximized oil recovery from the whales that were taken.

The high whale oil prices were also making it profitable to harpoon smaller and smaller lesser yield whales.

The U.S. was growing fast while the North Atlantic with the whale oil field yielding less and less. At the time there were, on the East Coast, no known substitutes for whale oil. By 1848 prices had skyrocketed by 600%. Then in 1848 the shortage was temporarily alleviated by the discovery (and subsequent decimation) of the South Pacific whale herds. Whale oil prices temporarily moved lower. Yes, it was a long and expensive journey for the New England whalers exploiting the new whale oil find. A whaling expedition around the horn and back could take as much as two years.

By the advent of the Civil War even this new whale oil field was played out. Low grade whale oil was $1.45 a gallon by 1865, up from 23 cents in the 1840s. To put this in to perspective, in 1868 a complete dinner in a New York restaurant cost 19 cents. A customer could buy over seven dinners for the price of a single gallon of lighting oil. It cost restaurant owners more to light the place at night than they were paying for the food they served.

The Whale Oil To Kerosene Transition

An alternative energy source became essential as high prices, population growth and shrinking supplies of whale oil combined into a crisis for businesses in east coast cities such as New York, Boston and Philadelphia. Edwin Drake set out to find that alternative. In 1858 he first found it in Titusville, Pennsylvania.

The U.S. entered the Petroleum Age. By 1867, kerosene, refined from Pennsylvania crude broke the whale oil market. By 1900 whale oil prices had fallen 70% from their highs and whale oil lamps had become collector items. Kerosene prices, with production efficiencies, became cheaper and cheaper. More importantly, just as with the development of coal as an energy alternative 200 years earlier, a chain reaction of technological and economic development was triggered. Oil soon became the new foundation of the economy not merely the low cost provider of light at night.

Lessons gleaned from the history of oil

1. People (via supply and demand) adjust to prices, where high prices leads to conservation or substitution, e.g. the wood crisis that triggered a shift to coal, whale oil crisis that led to kerosene

2. commodities obtain values only when it becomes an economic good, e.g. oil was nothing or did not have value during the age of the wood and coal or whale oil.

3. technology enhances production.

We seem to be seeing a combination of the above dynamics playout today, where alternative energies such as the production of Shale oil has been vastly expanding

To quote University of Michigan’s Professor Mark Perry (chart from Professor Perry)

New, advanced techniques for drilling oil have revolutionized the domestic oil industry in North Dakota in ways that couldn't have even been predicted just a few years ago, and will likely also open up new oil production in other parts of the world in the near future (like the Alberta Bakken in Canada) that also would have been unimaginable before this year. That's one reason that "peak oil" is peak idiocy: it always underestimates the ultimate resource - human capital (i.e. human ingenuity and the resulting innovation, advances, new technology) - which is endless and boundless, and will never peak.

Let me add that the current high prices of energy and commodities are not only from the consumption model but also from the reservation demand model—where monetary inflation influences prices.

Of course, there are other factors involved, most of which have been government imposed: geographical access restrictions, trade restrictions, price controls, subsidies, cartels, tariffs and other forms of protectionism (aside from inflationism)

Thursday, March 18, 2010

Natural Gas: Alternative Energy Of The Future

The article goes to show that the world isn't running out of energy. It's just a matter of markets aided by technology, adapting to the current conditions.

Here's an excerpt, (all bold highlights mine)

``The source of America’s transformation lies in the Barnett Shale, an underground geological structure near Fort Worth, Texas. It was there that a small firm of wildcat drillers, Mitchell Energy, pioneered the application of two oilfield techniques, hydraulic fracturing (“fracing”, pronounced “fracking”) and horizontal drilling, to release natural gas trapped in hardy shale-rock formations. Fracing involves blasting a cocktail of chemicals and other materials into the rock to shatter it into thousands of pieces, creating cracks that allow the gas to seep to the well for extraction. A “proppant”, such as sand, stops the gas from escaping. Horizontal drilling allows the drill bit to penetrate the earth vertically before moving sideways for hundreds or thousands of metres.

``These techniques have unlocked vast tracts of gas-bearing shale in America. Geologists had always known of it, and Mitchell had been working on exploiting it since the early 1990s. But only as prices surged in recent years did such drilling become commercially viable. Since then, economies of scale and improvements in techniques have halved the production costs of shale gas, making it cheaper even than some conventional sources.

More from the Economist,

More from the Economist,``The Barnett Shale alone accounts for 7% of American gas supplies. Shale and other reservoirs once considered unexploitable (coal-bed methane and “tight gas”) now meet half the country’s demand. New shale prospects are sprinkled across North America, from Texas to British Columbia. One authority says supplies will last 100 years; many think that is conservative. In 2008 Russia was the world’s biggest gas producer; last year, with output of more than 600 billion cubic metres, America probably overhauled it. North American gas prices have slumped from more than $13 per million British thermal units in mid-2008 to less than $5. The “unconventional”—tricky and expensive, in the language of the oil industry—has become conventional.

``The availability of abundant reserves in North America contrasts with the narrowing of Western firms’ oil opportunities elsewhere in recent years. Politics was largely to blame, as surging commodity prices emboldened resource-rich countries such as Russia and Venezuela to restrict foreign access to their hydrocarbons. “Everyone would like to find more oil,” says Richard Herbert, an executive at Talisman Energy, a Canadian firm using a conventional North Sea oil business to finance heavy investment in North American shale. “The problem is, where do you go? It’s either in deep water or in countries that aren’t accessible.” This is forcing big oil companies to get gassier."

Read the rest here

My comments:

As we have repeatedly said, politics has been the fundamental reason for the elevated prices in oil, caused mainly by geological restrictions or limited access (mentioned by the article) combined with artificial demand from inflationism and or policies, such as subsidies (not mentioned in the article).

Nevertheless, because people adjust to the circumstances they are faced with, such as the pain of higher prices and political constrains, the perpetual desire to satisfy human needs makes possible for ingenuity to pave way for innovative technology which would allow for more access to supplies or substitution.

In the case of natural gas, since there is a recognition, out of the existing technologies, of the abundance of reserves, higher oil prices will likely compel producers to compete to convert erstwhile uneconomical resources into utilizable reserves, ergo "forcing big oil companies to get gassier" as the article mentioned.

And if successful, which I am optimistic of, this will have a spillover effect to the midstream (processing, storage, marketing and transportation) and the downstream (retail outlets, derivative products, etc...). In other words, part of the transformation would likely see global transportation evolve to natural gas as default fuel.

So in the future, we should expect natural gas to also play a big role in the transition to diversify energy sources.

The following chart caught my eye. If the technology to access shale oil becomes universally commercial, guess where the bulk of reserves are?

In Asia Pacific!

In Asia Pacific!Thursday, March 04, 2010

Peak Oil: Where Art Thou?

The chart found below is an example.

True, while oil prices are currently hovering at $80, technology is fast catching up on how unconventional oil is being found.

According to the Economist, (bold highlights mine)

According to the Economist, (bold highlights mine)``BP, A big British oil company, announced a round of efficiency measures and cost cuts on Tuesday March 2nd aimed at increasing annual profits by $3 billion over the next few of years. But BP and the world's other big oil companies face similar problems when it comes to boosting profits. Few big new oil fields that are easy to reach and cheap to exploit have been discovered in recent years. This has driven firms to seek oil ever deeper below the sea. In 1947, Kerr-McGee built the world’s first offshore oil well that was completely out of sight of land, drilling 4.6 metres into the seabed off the coast of Louisiana. This year Shell's 22,000-tonne Perdido rig is set to begin operation. Standing nearly as tall as the Eiffel Tower, it is chained to the seabed 2.4km metres below and is capable of extracting oil at a maximum depth of 2.9km."

I'd propose that the problem of high oil prices isn't due to the "perceived" scarcity of oil (or peak oil), but instead with over 90% of proven oil reserves held by governments, the problem is one of the access to these reserves as shown below.

In short, while government intervention adds to the inaccessibility factor in the supply side, government inflationism (too much printing money, subsidies, etc...) has been prompting for artificially increased demand, which compounds on the market distortions which results to high (and prospectively higher) oil prices.

To consider, technology has materially improved, in spite of the tremendous restrictions and contortions plaguing the oil marketplace.

Had free markets been allowed to function, we'd likely see the wonders of the price mechanism work by having more supplies sooner than later. In addition, markets are likely to discover feasible oil substitutes rather than government imposed options via subsidies.

As Professor Don Boudreaux explains, (bold highlights mine)

``Petroleum was no resource to our ancestors who had yet to grasp the fact that it can be refined and burned in ways that improve the quality of life. In fact, I suspect that whenever that gooey, noxious black stuff appeared in freshwater creeks in pre-Columbian Pennsylvania, natives of that region regarded it as a nuisance.

``So economically, the Earth's supply of nonrenewable energy resources was, back then, much smaller than it is today. Human creativity and effort turned a nuisance into a resource.

``Human creativity and effort also are at work finding not only substitutes for oil, but also new supplies of oil. Each success on this front increases the supply of oil. The reason is that oil deposits that remain unknown are economically nonexistent.

``The same is true of oil deposits that are known to exist but are currently too costly to tap. Oil in the Earth's crust that is out of reach with existing technology is no more of a resource today than is oil on Pluto. But if and when human creativity discovers cost-effective techniques for extracting that oil, it then -- and only then -- becomes a resource. In effect, more of the resource "oil" is created.

``Of course, as a matter of physics, there is indeed only a finite amount of oil in the Earth. But we have no idea how much. And our ignorance of this physical fact is economically relevant."