Finally a much needed reprieve for the Philippine Phisix. Yet this week’s .34% loss can hardly be seen as the required “correction” or “profit-taking” phase following EIGHT successive weeks of advances that has brought about a magnificent 14.27% of returns in 2013.

Yet there has been much reluctance for profit taking to occur.

Last Thursday, we saw another major “marking the close” session where the listed heavyweights of the financial, property, industrial and holding sectors were pushed substantially higher at the close of the session[1]. Although much of the session had been modestly up, perhaps about 60% of the day’s 1.59% gains were attained through last minute buying binge which I suspect could have emanated from political money.

Early week profit taking combined with Friday’s 1.18% decline basically neutralized Thursday’s astonishing gains that have led to this week’s measly retrenchment.

Nonetheless, this week’s marginal profit-taking has barely changed the parabolic phase and near vertical picture which the local bellwether has transitioned to.

Indonesia’s Stock Market and Property Mania

And the manic phase of the stock market has not just been a Philippine phenomenon (candlestick).

Apparently, Indonesia’s bellwether, the Jakarta Composite Index (JCI; IDDOW-behind line chart) caught fire too. The JCI made a magnificent 3.45% move this week. Such record smashing move pole-vaulted her to overtake Thailand and narrow the gap with the Philippines.

For 2013, and as of Friday’s close, Indonesia’s JCI has returned 11.47% on a year to date basis compared to the Philippines’ 14.27% and Thailand’s SET at 10.61%.

The JCI’s fresh record highs[2] have been mostly powered by the same sectors that have driven the Phisix, specifically real estate/property (which includes infrastructure), finance and mining. (charts from Indonesia Stock Exchange Market Index[3])

The stock market-real economy boom in Indonesia comes from the same pedigree as with the Philippines or Thailand[4]: a credit boom.

Loans to the private sector[5] jumped by about 54% in 2 years (or 27% annual-averaged). Since May of 2002, the same measure posted a CAGR of 22.52%.

Indonesia’s bubble cycle plays into my account of the bubble process where a consumption credit fueled boom will eventually lead to the deterioration of the nation’s trade balance which will likewise be reflected on her current account.

As I earlier noted, external deficits “will need to be offset by capital accounts or increasing claims on local assets”[6].

Increasing dependence on foreign financing of domestic credit boom will make a nation such as Indonesia highly vulnerable to “sudden stops” or reversal of private foreign capital inflows[7].

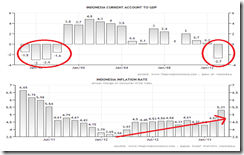

Indonesia’s economy recorded its first current account deficit[8] in 2012 since the pre-Asian crisis days (top window).

Recent deficits, according to the mainstream, have partly been traced to growth of imports having outpaced growth of exports where the latter has been attributed to “restrictive trade policies”[9] on the exports of unprocessed minerals, while the former has been imputed to outsized growth in fuel imports due to “fuel subsidies”[10].

A report further says that the risk of “overheating”[11] from central bank’s accommodative policies could weigh on Indonesia’s currency the rupiah.

At the start of the year, I predicted of the mainstream’s narrative of the current booms[12]

Eventually, the current boom will get out of hand, which will be manifested through rising interest rates, which the mainstream vernacular will call “economic overheating”…

The competition for resources from private sector activities funded by credit inflation and from the Indonesian government’s proposed $200 billion infrastructure spending through 2014[13] has begun to place pressure on consumer prices.

Indonesia’s statistical inflation rate has popped to 5.31% in February of 2013[14] (see bottom window). Indonesia’s consumer price inflation has been on the rise since January 2012 and may have commenced to accelerate further.

Eventually a sustained rise in price inflation will pressure interest rates higher. Higher interest rates will then strain all activities founded or established based on a low interest rate environment.

Rising price inflation also means that the expansions of activities which misallocates resources powered by credit far exceeds the productivity gains from the wealth generating real economic activities.

Like the Philippines, the Indonesian government’s desire to increase public sector infrastructure spending has prompted for plans to tighten collection of taxes by cracking down on supposed “tax evaders”[15]. Such measures would result to a meaningful shift in activities towards consumption—which will mostly be financed by debt and inflation than by taxes—at the expense of productivity, which thereby increases systemic risks.

Malaysia’s Property Bubbles

Property bubbles have not confined to the Philippines, Thailand or Indonesia.

Malaysia has likewise been revealing similar symptoms.

Even as Malaysia’s stock markets have underperformed, the KLCI has been at a loss—down 3.05% as of Friday on a year to date basis, housing prices has been skyrocketing.

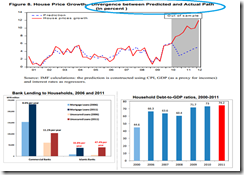

Household debt-to-GDP (lower right pane) continues to ascend partly from the jump in the growth of loans from Islamic banks (lower left pane). Yet the fastest growth segment of both commercial and Islamic banks has been from unsecured loans or loans based on borrowers creditworthiness rather than backed by collateral[16]

The housing boom has been defiant of the various measures imposed by the Malaysian authorities, such as revision of eligibility requirements for credit cards, tightening of lending conditions based on the loan-to-value (LTV), reintroduction of Real Property Gains Tax (RPGT) for houses sold within 5 years from purchase and the doubling of minimum price for home purchases made by foreigners[17].

So the failure of added regulations to stymie the housing bubble only means that zero bound rates remains to be a critical force in blowing Malaysia’s property bubbles.

The most striking aspect is how the IMF has patently miscalculated with its econometric models in predicting the rapid accumulation of current imbalances in the property-banking sector (top chart).

At least they have been candid to admit this.

As a final note, Malaysia reportedly plans to embark on a huge 10-year $444 billion infrastructure program[18] which in my view, will add to malinvestments and systemic fragility.

Blossoming Philippine Asset Mania

Going back to the Philippines, the manic phase of bubbles—which I described as last week as yield chasing phenomenon that are essentially underpinned by voguish themes unquestioningly embraced by the public and most importantly enabled, facilitated and financed by credit expansion[19]—seems to be well intact.

The Philippine central bank, the Bangko Sentral ng Pilipinas (BSP) reports that for January[20] systemic credit continues to be vigorous, albeit at a slightly lower pace on a month to month basis, 15.6% December and 16.6% for January.

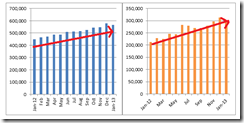

Nevertheless the key sectors which has been the object of faddish themes and whose growth has been funded by lavish credit inflation remains robust: real estate, renting, and business services ballooned by 25.9% (see left window, blue bars); financial intermediation swelled by 41.9% (see right window, orange bars) and wholesale and retail trade moderated but still at 12.9%.

It’s amazing how the fantastic growth in financial intermediation (41.9%) appears to coincide with the spectacular advances of the Phisix over the same time frame (33.33%)

How much of debt or margin trade have underpinned positions on the Phisix???

Meanwhile, the credit expansion in the domestic banking system has also been reflected on the money supply conditions:

Let us read it straight from the BSP[21]:

Domestic liquidity (M3) increased further by 10.8 percent year-on-year (y-o-y) in January to reach P5.0 trillion. This growth was broadly similar to the 10.6 percent expansion recorded in the previous month. On a monthly basis, seasonally-adjusted M3 expanded by about 1.3 percent, almost unchanged compared to the rate in December.Money supply grew by 23.3 percent y-o-y in January from 19.2 percent in the previous month, driven by the expansion in net domestic assets (NDA) following the sustained increase in credits to the private sector consistent with the robust lending activity of commercial banks.

The pace of credit expansion undergirding the supply side growth is almost three times the rate of economic growth. This is the tooth fairy from the populist “Aquinomics”: a credit bubble that will soon be unmasked along with the other central planning fantasies masqueraded as economic policies.

The Mania from the Perspective of Market Internals

Despite this week’s paltry correction, the PSE’s market breadth exhibits signs which shows how the bulls have become increasingly intransigent. They seem to refuse any idea of retrenchment, or have been in denial of the need for one, or simply thrives in a delusion that growth will be perpetual (justified as “structural”) or that convictions have become deeply embedded such that the economy and the stock market is a one way street: up up and away!

The inflationary boom continues to exhibit sectoral and intra-sector rotations.

For this week, the mining and the service sectors became the center of attraction anew as the current leaders, the sizzling hot property and financial sectors, took a breather. The mining sector recaptured the fourth spot while services remain in third position.

The mining’s comeback has partly been rationalized on the resumption of the operations[22] of heavyweight Philex Mining Corporation [PSE: PX] after the company’s recent settlement with the government by paying the Php 1 billion indemnity[23].

The reality is that market participants have been looking for any excuses to justify their feverishly bidding up of equity prices. Rotations, thus, are symptoms of such disorder.

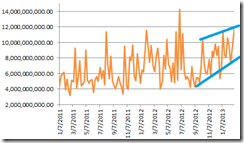

The number of daily trades (averaged weekly) has spiked to, I would presume, record highs. Again I have no comparison with 1993, which I believe, resembles today’s manic episode.

As I pointed out in the past, the number of daily trades serves as a key sentiment indicator which measures the state of the public’s confidence.

Record highs in the number of daily trade means the burgeoning of “new” participants, or of the increasing frequencies of trade churning by existing participants, or both.

A vertical ascent extrapolates to deepening overconfidence through relatively much aggressive actions on the equity markets than in the past.

The growth in the daily number of trades appears to be supported by the daily Peso volume (averaged weekly).

More people trading the stock market or increased churning of trades extrapolates to higher Peso volume.

This week’s supposed trivial correction comes with a spike in volume. This shows how bullish participants has gobbled up on profit takers—again a possible sign of refusal to correct or of the entrenched expectations of a sustained upside streak.

There are 344 publicly listed issues in the Philippine Stock Exchange as of 2012 according to Wikipedia.org[24].

The actions in the daily traded issues (averaged weekly) validates or chimes with both the activities in the number of daily trades and the daily Peso volume.

The increasing trend in the number of daily traded issues simply means that more listed firms are becoming tradeable or liquid. Bullish actions have been spreading into the domestic stock market at relatively different rates and time scales.

Current levels of daily issues traded represent 60% of available board issues. I cannot make any meaningful comparisons with past since I don’t have the data on the inclusion or exclusion of board issues or of its trend.

The bottom line is that from the perspective of market internals, belief of the sustainability of today’s rising market is being reinforced by the feedback loop of prices (outcome bias) and expectations that leads to actions (yield chasing). Such dynamic accentuates the flawed perception of reality as the public fails to comprehend that credit bubbles are unsustainable.

I am reminded by the wisdom of the value investor turned political entrepreneur, one of the richest and most successful stock market investor, Warren Buffett who once said that[25]

A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful

I am not saying that current events should translate to an inflection point or a reversal of the current market, as I believe that the manic phase will likely steepen or intensify.

I am saying that caution is required when signs of greed have apparently been mounting.

Since bubble cycles account for as policy induced market process and given the continued policies in place, we are, thus, approaching the time where such misallocation of resources will be revealed in the marketplace: the day of reckoning.

As the great Ludwig von Mises warned[26],

But the boom cannot continue indefinitely. There are two alternatives. Either the banks continue the credit expansion without restriction and thus cause constantly mounting price increases and an ever-growing orgy of speculation, which, as in all other cases of unlimited inflation, ends in a “crack-up boom” and in a collapse of the money and credit system. Or the banks stop before this point is reached, voluntarily renounce further credit expansion and thus bring about the crisis. The depression follows in both instances.

But perhaps not in 2013.

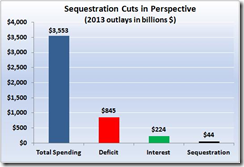

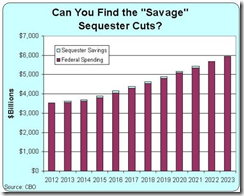

The Serial Blowing of US Bubbles

As the major US equity benchmark, the Dow Jones Industrial flirts with the all-time record highs, margin debt at the NYSE has also been soaring[27]

A bubble in the credit markets have also been ballooning which has been marked by broad based issuance and refinancing which are at record highs.

From the Bloomberg[28],

Corporate and sovereign borrowers issued $3.69 trillion in debt in 2012, generating $19.2 billion of fees for banks, both records, according to data compiled by Bloomberg. Investor demand for debt was so strong that banks were able to revive collateralized loan obligations, the bundles of securities that helped inflate the credit bubble that burst in 2008.

Credit standards have started to fall anew as riskiest companies have been accessing credit markets at a rate exceeding the height of 2007 bubble bust.

From Bloomberg/Between the Hedges[29]

The riskiest U.S. companies are tapping institutional investors for loans at the fastest pace ever, as some Federal Reserve governors warn of excesses developing in the market. Borrowers obtained more than $88 billion in loans last month from non-bank lenders, exceeding the pre-crisis peak of $55 billion in April 2007 and more than tripling the $26.7 billion received in January, according to JPMorgan Chase.

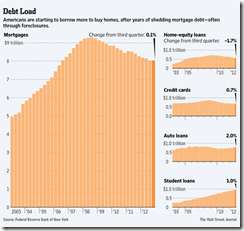

US households appears to have shed their inhibitions of accessing the credit markets[30] to buy houses and cars, following years of downsizing and deleveraging.

Central bank policies of financial repression via negative real rates[31] have sparked housing bubbles in the past, and could be in the process of blowing a new one today.

US Housing data continue to exhibit of a US Federal Reserve manipulated boom[32].

And given that housing represents a significant weight on the US statistical measurement of inflation, or through the consumer price index (CPI), then a sustained boom in housing will likely increase inflation pressures that will lead to higher interest rates as I earlier noted[33].

We have seen such an uptick in inflation rates[34] and interest rates during the 2002-2006 housing boom (red line).

This time will not be different.

Nonetheless despite all the pandemic of bubble blowing by global central banks, economic strains remain apparent.

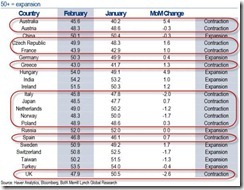

Major global economies as measured by manufacturing conditions have shown mixed performances in January with a downside tilt.

The global manufacturing PMI index reveals[35] that more than half or 12 countries of the 22 countries that have reported have been contracting while 10 countries have been expanding.

So all the cumulative money printing by global central bankers has done little to cushion or provide help to the real economy. On the contrary such policies have made them worse.

Yet I expect that more signs of economic weakness will likely translate to greater chances of more inflationism by central bankers. This means more systemic fragility ahead that leads to capital consumption and productivity losses.

The great dean of the Austrian school of economics, Murray Rothbard warned[36],

Superficially, it seems that credit expansion greatly increases capital, for the new money enters the market as equivalent to new savings for lending. Since the new “bank money” is apparently added to the supply of savings on the credit market, businesses can now borrow at a lower rate of interest; hence inflationary credit expansion seems to offer the ideal escape from time preference, as well as an inexhaustible fount of added capital. Actually, this effect is illusory. On the contrary, inflation reduces saving and investment, thus lowering society’s standard of living. It may even cause large-scale capital consumption.

Productivity losses from capital consumption simply translate to greater sensitivity to price inflation if central bankers persist on the current mode of policies.

And should the next crisis arise, there will hardly be any counterbalancing force as such crisis will likely mean a global domino effect of bursting bubbles.

The interesting part will be how policymakers will respond to such market conditions. Will they work to undermine the current currency system?

[1] See Phisix: Another Marking the Close Day? February 28, 2013

[2] Jakarta Post JCI breaks record as firms release 2012 reports, March 2, 2013

[3] Indonesia Stock Exchange Market Index

[4] See Thailand’s Credit Bubble January 26, 2013

[5] Tradingeconomics.com INDONESIA LOANS TO PRIVATE SECTOR

[6] See E-Vat 15%: Possible Consequence from Current Quasi Boom Policies December 10, 2012

[7] Wikipedia.org Sudden stop (economics)

[8] Tradingeconomics.com INDONESIA CURRENT ACCOUNT TO GDP

[9] CascadeAsia.com 2012 CURRENT ACCOUNT DEFICIT – SURPRISE, SURPRISE, February 15, 2013

[10] Jakarta Globe Indonesia's 2012 Current Account Deficit at $21.5b: Minister, January 8, 2013

[11] Euroinvestor.com Indonesia Current Account Deficit Widens to $7.8 Billion in 4Q, February 13, 2013

[12] See What to Expect in 2013 January 7, 2013

[13] Jakarta Post No hype: APEC economies on resilient growth path, February 27, 2013

[14] Tradingeconomics.com INDONESIA INFLATION RATE

[15] Bloomberg.com Indonesia Plans Crackdown on Tax Evaders to Boost Revenue February 28, 2013

[16] Investopedia.org Unsecured Loan

[17] IMF.org Malaysia: Financial Sector Stability Assessment February 2013

[18] Bloomberg.com Baht Leads Weekly Advance in Asian Currencies on Growth Optimism March 1, 2013

[19] See Has the Phisix has Gone Ballistic?! February 25, 2013

[20] Bangko Sentral ng Pilipinas Bank Lending Sustains Growth in January February 28, 2013

[21] Bangko Sentral ng Pilipinas Domestic Liquidity Continues to Expand in January February 28, 2013

[22] Rappler.com Govt allows Philex to resume mining operations February 27, 2013

[23] Rappler.com Philex settles P1-B mine leak fine February 19, 2013

[24] Wikipedia.org Philippine Stock Exchange

[25] Wikiquote Talk:Warren Buffett

[26] Ludwig von Mises Inflation III. INFLATION AND CREDIT EXPANSION Interventionism An Economic Analysis, Mises.org

[27] Zero Hedge Bubble On The Margin, March 1, 2013

[28] Bloomberg.com JPMorgan Grabs No. 1 Underwriter Spot Spurred by Debt Refinance, March 1, 2013

[29] Between the Hedges Today's Headlines Hedgefundmgr.blogspot, March 1, 2013

[31] Michael Cembalest, Fifty Trades of Grey: an illustrated story of investment, temptation, addiction and the cost of money J.P. Morgan Asset Management, ritholtz.com, March 2, 2013

[32] Ed Yardeni US Home Prices (Excerpt) Dr. Ed’s Blog, February 26, 2013

[33] See Will Higher Rents lead to Higher US Consumer Inflation?, January 9, 2013

[34] Tradingeconomics.com UNITED STATES INFLATION RATE

[35] Zero Hedge Global PMI Summary March 1, 2013