Massive power outages in India has affected more than half of the population.

From the Bloomberg, (bold highlights mine)

India’s electricity grid collapsed for the second time in as many days, cutting off more than half the country’s 1.2 billion population in the nation’s worst power crisis on record.

Commuter trains in the capital stopped running, forcing the operator, Delhi Metro Rail Corp., to evacuate passengers, spokesman Anuj Dayal said. NTPC Ltd. (NTPC), the biggest generator, shut down 36 percent of its capacity as a precaution, Chairman Arup Roy Choudhury said by telephone. More than 100 inter-city trains were stranded, Northern Railway spokesman Neeraj Sharma said, as the blackout engulfed states in the north and east.

So what went wrong?

From the same article…

State-owned Power Grid Corp. of India Ltd., which operates the world’s largest transmission networks, manages power lines including in the northern and eastern regions. NTPC and billionaire Anil Ambani-controlled Reliance Power Ltd. (RPWR) operate power stations in north India that feed electricity into the national grid. The northern and eastern grids together account for about 40 percent of India’s total electricity generating capacity, according to the Central Electricity Authority.

The grids in the east, north, west and the northeast are interconnected, making them vulnerable, said Jayant Deo, managing director of the Indian Energy Exchange Ltd. The outage has also spread to seven additional states in the northeast, NDTV television channel reported.

“Without a definitive plan by the government to gradually bring the grids back online, this problem could absolutely get worse,” Deo said.

Singh is seeking to secure $400 billion of investment in the power industry in the next five years as he targets an additional 76,000 megawatts in generation by 2017. India has missed every annual target to add electricity production capacity since 1951.

Well in reality, the root of the problem hasn’t been about ‘definite plans’ by the Indian government, but rather largely due to India’s statist political economy.

Again from the same article…

Improving infrastructure, which the World Economic Forum says is a major obstacle to doing business in India, is among the toughest challenges facing Singh as he bids to revive expansion in Asia’s third-largest economy that slid to a nine- year low of 5.3 percent in the first quarter.

Tussles over policy making with allies in the ruling coalition, corruption allegations and defeats in regional elections have weakened Singh’s government since late 2010.

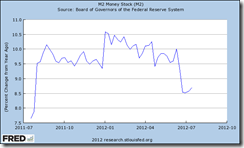

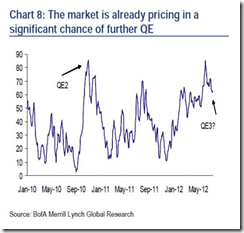

Must I forget, artificial electricity demand has partly been boosted by India’s central bank, the Reserve Bank of India (RBI), who passes the blame on others.

Again from the same article

The Reserve Bank of India, which has blamed infrastructure bottlenecks among others for contributing to the nation’s price pressures, today refrained from cutting interest rates even as growth in the $1.8 trillion economy cooled to a nine-year low in the first quarter.

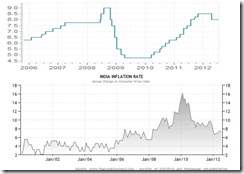

Indian consumer-price inflation was 10.02 percent in June, the fastest among the Group of 20 major economies, while the benchmark wholesale-price measure is more than 7 percent.

The last time the northern grid collapsed was in 2001, leaving homes and businesses without electricity for 12 hours. The Confederation of Indian Industry, the country’s largest association of companies, estimated that blackout cost companies $107.5 million.

Chart above from global-rates.com and tradingeconomics.com

India’s bubble ‘easy money’ (upper window) policies in 2009-2010 fueled a stock market recovery (below window) in 2010.

On the other hand, the then negative interest rate regime also stoked local inflation (pane below policy interest rates).

This has prompted the Reserve Bank of India to repeatedly raise policy rates or tightened monetary policy. The result has been to put a brake on India’s economy and the stock market rebound.

Part of the Indian government’s attack on her twin deficits, which has been blamed for inflation through the decline of the currency, the rupee, has been to turn the heat on gold imports and bank gold sales.

Aside from demand from the monetary policies, electricity subsidies has also been a culprit. Farmers have been provided with subsidized electricity. Such subsidy has not only increased demand for power but also put pressure on water supplies.

Environmentalists would likely cheer this development as ‘Earth Hour’ environment conservation.

Yet India’s widespread blackouts are evidences and symptoms of government failure.

Rampant rolling blackouts extrapolate to severe economic dislocations which not only to means inconveniences but importantly prolonged economic hardship.