A

loose Fed monetary policy (i.e., a positive sloping curve), sets in

motion a false economic boom — it gives rise to various false

activities. A tighter monetary policy, which manifests through an

inversion of the yield curve, sets in motion the process of the

liquidation of false activities (i.e., an economic bust

ensues).—Austrian Economist, Frank Shostak

In

this issue:

Red

Alert: Philippine Bonds Warns of Rapid and Dramatic Deterioration of

Domestic Liquidity Conditions!

-Yields

of T-Bills Soars!

-Yield

Spreads: From Flattening to Inversion!

-Yield

Inversion: Symptoms of Balance Sheet Problems

-The

Implications of Negative Spreads

-Weak

Peso Compounds on Liquidity Squeeze, the 3Q Foreign Investments as

G-R-O-W-T-H Mirage

-Phisix

6,900: Desperation Calls For The Rampant Use of Marking the Close

Pumps!

Red

Alert: Philippine Bonds Warns of Rapid and Dramatic Deterioration of

Domestic Liquidity Conditions!

I

am supposed to be on a holiday break, but recent developments at the

Philippine bond markets have been too compelling to ignore because

they have been signaling significant turn of events.

A

week ago, I

wrote about the intensifying signs of the flattening/inverting of

the domestic yield curve as one of the factors that should not only

inhibit any meaningful return of risk appetite, but likewise amplify

the risk of an economic recession, as well as, risk of a credit

crunch.

Apparently,

this week’s market activities only reinforced my suspicions.

Yields

of T-Bills Soars!

The

above represents nominal BPS week on week changes

As

of last week, yields of 3 and 6 months bills have rocketed! 5 year

yield also jumped!

Perhaps

most of the bond yield manipulators went on a Christmas vacation too

soon for the surge in yields to have been unleashed.

Nevertheless,

to repeat this has NOT been a HOLIDAY dynamic.

The

following charts of the yields of 1, 3, and 6 month should tell us

why.

Whether

seen on a weekly (left) or monthly (right) basis yields of ALL three

short term bills (again 1,

3

and 6

months) have spiked to MILESTONE HIGHS!!!

To

put milestone in perspective, the weekly rates have been HIGHEST

since 2014, while the monthly rates have likewise been HIGHEST

since 2012!

However,

investing.com charts have been limited to these time frame

perspectives. And I suspect that the current yield have reached

levels MORE than the demonstrated years.

And

with the longer end little changed, the result has been a drastic and

a dramatic curve flattening!

What

you see depends on where you stand. So let us widen the angle to see

how bond yields performed on a year to date basis.

Again

the same dynamic holds: The yields of the short to mid end curve have

been ascending FASTER

than long term counterparts.

And

that’s the reason why we have seeing the flattening to inversion

process.

Now

such dynamic now applies to almost the entire domestic bond spectrum!

Yield

Spreads: From Flattening to Inversion!

Nevertheless,

considering that the 10 year bond yield has been used as the

mainstream’s benchmark, I will use them here to compare with the

bills and notes counterparts.

I

have

noted during the mid-week that the coupon yield of the 1 month

bill soared to a shocking 3.96%, but the yield has partly backed off

from its high last Friday.

Now

the above charts shows the spread between soaring yields of T-bills

and 10 year bond equivalent.

The

10yr-1 month spread has narrowed to just 66 bps! (upper window)

The

10yr 3 month spread has dived to just 140 bps! (middle window)

And

worst, the 10yr 6 month has collapsed to an astoundingly paltry 18

bps differentials! (lower window)

In

short, the front end of the curve appears to be fast approaching an

inversion!

Again

the above charts reveal that this has NOT been anomaly but an extant

dynamic for at least one year. It’s just that recent developments

have been accelerating or escalating!

Let

us move on to the spreads of the 10 yr relative to longer 1 and 2

year notes.

Apparently

both have been plagued by the same flattening conditions as with

T-Bill contemporaries.

It’s

true that the above spreads have somewhat or marginally widened from

previous levels last week, but they remain at landmark lows (as shown

by the red arrows)!

Moreover,

like the front face, the spreads above have been flattening from last

year, but has only intensified during the last quarter.

Understand

that the 10yr – 2yr benchmark has been a favorite bellwether by

mainstream institutions like ADB. So perhaps current improvement on

the 10yr-2yr maybe due to interventions to facelift the curve’s

conditions.

However

whatever cosmetic changes being applied by manipulators, it appears

that they haven’t been successful in the concealment of the

inversion process.

As

I have earlier pointed out, it’s not just flattening anymore,

negative spreads have already appeared.

For

the FOURTH STRAIGHT week, the 10 yr-3 yr yield spread remains

NEGATIVE!!!!!!!!!!!!

…and

apparently, negative spreads have not been confined to 10 yr and 3yr

anymore, they have now been joined by….

…the

10yr-5yr where the curve’s spread just crashed to negative last

week!

This

is totally stunning!

Yield

Inversion: Symptoms of Balance Sheet Problems

The

crux is: The abrupt narrowing of spreads has now spread to envelop

the entire Philippine treasury curve.

The

question is WHY has this been happening?

The

obvious main answer is that there is no such thing as a free lunch

forever.

Balance

sheet growth has inherent limits. The

continuing massive bank credit inflation has caused short term rates

to rise relative to the longer end.

Despite

headline profits, many

highly levered firms have HARDLY been generating sufficient cash

flows to pay for existing liabilities.

Many firms have been using NEW debt to pay for EXISTING debt. And

these have partly been ventilated through heightened

demand for short term loans. Importantly, these firms have been

competing

intensely

with each other for access to these scarce funds.

Meanwhile,

as part of exercise to meet current funding requirements, holders of

existing short to mid end papers have also been frantically selling

these securities to spur the upsurge in yields!

This

is simply a symptom of the unraveling of malinvestments.

Remember,

that only a few entities in the population have access to the formal

credit (banking/bonds) system. Hence, the zero

bound to negative spreads are symptomatic of increasing

concentration of credit risks!

And

such inversion dynamic appear to be signaling the intensification of

financial stress within the system.

Now

the mainstream would like to blame the US Federal Reserve for current

developments. Yet the above charts exhibit that the FED may only be

an aggravating factor and not its main cause.

The

Implications of Negative Spreads

And

think again of what the evolving spreads will do to bank lending

activities. Or what will happen to the banking system’s maturity

transformation (borrow short, lend long)?

As

of 3Q, for every Php 3 of loans

issued by the banking system (BSP current production loans) such

has only generated Php 1 of government’s inflated NGDP (GDP at

current price)!

Given

that I believe that NGDP has been INFLATED, then the credit/NGDP

ratio or credit intensity must be HIGHER!

And

any material reduction in credit activities will NOT only diminish

statistical GDP, it would raise credit risk

as well! Remember, credit money accounts for about 70% of domestic

liquidity (76%

M3 October 2015), hence a fall in credit activities will

translate to a drop liquidity (money in circulation) which should

distill into GDP (NGDP and Constant ‘real’ GDP)!

Think

of what happens to asset markets too. If the so-called ‘fundamentals’

of asset markets have been juiced up by credit, then the reduction of

credit activities will deduce to its deterioration.

And

if asset market pricing (boom) has similarly been pillared by credit,

then diminished credit activities would substantially lessen

demand for risk assets!

Said

differently, a

reduction of credit activities will lead to a substantial repricing

of the considerably overpriced and mispriced assets.

Hence,

overpriced and mispriced assets maybe vulnerable to violent

adjustments (a.k.a crashes)

Now

if half of the banking balance sheets have constituted loans and

other the half have been divided into financial (and property)

assets, and fees, then both will similarly be vulnerable to a

downturn in economic activities and from a hefty repricing of assets.

To

make a long story short, this

means there will be a transmission and feedback mechanism through the

sequence of slowing credit growth to NGDP to earnings to asset

pricing to credit risk and vice versa.

For

most of the mainstream, statistics or historical numbers only

matters. Crucial market signals, especially one that affects the core

of the present GDP G-R-O-W-T-H template, much like basic economics,

exists

in a vacuum or a black hole.

Furthermore,

if yield compression will force banks to substitute volume for

margins, then obviously this will come at the expense credit quality,

thereby amplifying credit risks.

As

I recently

wrote: So the

banking system must be so desperate as to seek margins by gambling

away depositor and equity holder’s resources through the

assimilation of more credit risks by lending to entities with poor or

subprime credit ratings.

Of

course, higher

yields don’t just imply credit risk, they also expose many sectors

to interest rate risk!

Weak

Peso Compounds on Liquidity Squeeze, the 3Q Foreign Investments as

G-R-O-W-T-H Mirage

And

to compound on the tightening liquidity noose has been the sustained

weakening of the peso.

Not

only will an infirm peso increase prices of imported items, it will

reduce demand for peso assets, and more significantly, it will

magnify the onus from foreign denominated liabilities. That’s

because a weak peso means more pesos to service every US dollar debt

owned.

The

flagging peso continues to draw foreign money away from domestic

financial markets. Foreign money exodus also contributes to a wobbly

peso. It’s a feedback loop. Foreign portfolio according

to the BSP posted net outflows last November.

Forgive

me, but I would question government’s relentless efforts to

exorcise the deterioration in real economic activities through the

repeated shouting of statistical talismans.

Instead,

I allude to a living and breathing, and not an artificially

constructed puffed up numerical economy.

Moreover,

foreign investments numbers tend to be extremely volatile. Having

said so, they don’t imply G-R-O-W-T-H!

History

shows us why. From 2010 through 2015, two out of six years posted

negative 3Q growth, specifically in 2012 -35.14% and in 2014 -44.32%.

(green circles). So from a statistical perspective 3Q 2015 data shows

of a base effect: current numbers reflect a reversal from the troughs

of 2014.

Also

this implies of little correlation or even causation with GDP.

Foreign investments cratered even when GDP

climaxed in 2012!

Additionally,

correlation between foreign investments and the peso (BSP’s

monthly average end of 3Q) have been loose so far. (top window)

This again suggests that the low USD-php volatility in the recent

past has had little influence on foreign investments. Such

relationship may be altered when currency volatility crescendos.

Worst,

historically, huge nominal

gains have coincided with collapses, as seen in 1997 and 2008!

(orange ovals)

And

the same phenomenon applies even on significant gains in terms of %

growth, as seen 1997, 2001 and 2005 (peaks in blue trend line).

Besides,

foreign investments are not like foreign portfolio flows, where the

latter tends to reflect on real

time

market activities.

Foreign

investments have to be “approved” by respective government

authorities or regulators. This means foreign investments have to

undergo the political bureaucratic screening process by specific

agencies based on technical legal guidelines as prescribed by the

national government. So it would be obvious that such statistical

numbers and or the release thereof would involve certain political

elements or contain some degree of political influence. And given the

embedded nature of politics on foreign investments, what stops the

government from either ‘timing’ its release or embellishing such

numbers? Given that government operates as monopoly, who will be

there to verify on the authenticity of those numbers? Yet we are

supposed trust those numbers.

Besides,

given the amplification of the risks of a global recession, this will

not only affect foreign investments but likewise magnify risks of

protectionism. Because inflationism represents an implied

protectionist policy, it is INCOMPATIBLE with liberalization. And the

consequence of inflationism will unfortunately (to my dismay as

libertarian) lead to protectionist

impulses or more politicization of the marketplace, the APEC

boondoggle notwithstanding. The domestic strongman

rule bubble already serves as manifestation of the rise of

populist protectionist politics.

At

the end of the day, with monetary conditions rapidly and severely

tightening, unless such juncture radically improves, then 2016 should

be a mainstream SHOCKER!

As

final thought, if

the shrinkage of domestic liquidity will lead to deflationary

pressures, particularly in parts of the economy where areas or

industries have been afflicted by excess supply and debt overhang, on

the other hand, the weak peso will lead to inflationary pressures on

areas dependent on imports. So the Philippines will likely see a

coming stagflationary environment—a simulacrum of the post 1997

era.

Phisix

6,900: Desperation Calls For The Rampant Use of Marking the Close

Pumps!

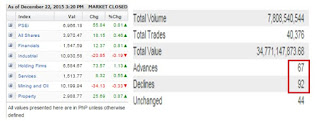

The

Phisix stormed to a 1.96% gain over the week on a very low volume

rip.

As

for the volume, at an average of Php 5.55 billion, daily volume

signified the FOURTH lowest for the year! So essentially sellers took

advantage of aggressive bids to unload on high prices.

But

what has really been striking has been the rampant “marking the

close” sessions used to attain the week’s gains.

On

Monday, the Phisix losses hit a peak of 1.8%, approached the runoff

period down .64% but shockingly closed up by .16% from a spectacular

two issue pump! Marking the close produced a whopping .81% swing to

turn negative into positive!

And

58.2% of SMPH’s eye-popping 8.25% jump to a new record high came

from a last minute pump. And so with GTCAP, where 82% of the day’s

6.02% gains came from marking the close.

Since

SMPH ended the week at Php 21.8/share or down Php 1.15 from the

record Php 2.95, it’s really sad to see how price fixing actions by

some entities have led to undue losses on resources used for such

desperation headline enhancing pumps.

The

same applies to GTCAP which closed at Php 1,262, though up 3.19% for

the week, had been down Php 37 or 2.8% from the Php 1,299 pump.

This

wasn’t limited to Monday.

Friday’s

session saw the Phisix down by 1.09% prior to the runoff (see upper

window). All of a sudden, the Phisix closed down by only .56%! This

shows how 49% of the day’s losses had been wiped out from Friday’s

price fixing session! A four issue pump had been used to bolster the

index.

Last

week’s rally was more than just about low volume, it was also about

divergence:

Among

the 30 composite issues constituting the PSEi index, 23 issues posted

advances, 6 posted losses while 1 was unchanged.

In

contrast, the broad market was tilted heavily in favor of sellers

(lower right window). Declining issues topped advancing issues by 99.

Declining issues led in 3 out of the 5 trading days of the week.

Such

divergence reveals of the cosmetic actions to festoon the headlines.

It’s

really a spectacle to see how price fixers have been frantically

attempting to prop the index up in the face of shrinking liquidity.

It’s an example of picking up coins (pennies) in front of

steamroller founded on hopium.

And

sad to say hopium has never been a good strategy.