This

week’s outline

Even

at Only 7,800: PSEi Hits Historic Proportions in Terms of Valuations

Excesses!

-Déjà

vu 1996? Furious Pumping Sends PSEi Valuation Excesses to 1996

Levels!

-Broadening

Misperception: Historic PERs Not Just About Price Pumping, But

Lethargic Earnings Growth!

-BSP’s

Silent Stimulus Will Aggravate the Malinvestments and the Coming

Violent Market Clearing Process!

Even

at Only 7,800: PSEi Hits Historic Proportions in Terms of Valuations

Excesses!

Activities

at the Philippine Stock Exchange have reached historic

proportions.

The

headline index has yet to match the April 2015 milestone threshold of

8,127.48 but current developments have already signified epochal

scales in the context violent price pumping.

And

since actions have consequences, the ramifications of such frenetic

or manic episodes of price pumping (combined with rampant

manipulations) have led to the panoply of momentous vertical price

charts for the PSEi majors.

And

since price pumping equates to the disproportionate increase in

prices relative to fundamentals, or price multiple expansions, or

seen in economics as mounting imbalances between prices and

fundamentals, thus another consequence has now been manifested

through the acceleration of climatic valuations!

Déjà

vu 1996? Furious Pumping Sends PSEi Valuation Excesses to 1996

Levels!

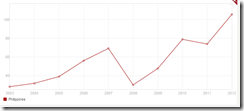

Early

last week, the Philippine Stock Exchange updated their PER data to

incorporate the overall performance of listed companies for the year

2015.

As

a side note, I validated this by looking at the SMPH’s 2015 annual

report where the firm’s earnings for the year 2015 was at Php .982

per share. At Friday’s closing price of Php 27.5 per share, PER was

at 28.004. This number matched the PSE’s data. In 2015, SMPH had a

huge jump in earnings due to one off extraordinary gains (Php 7.4

billion) from sale of marketable securities. The 2015 data bloated

the eps and artificially reduced the lather from the previous high

PER. But being an extraordinary item, in the 1Q 2016, the firm’s

earnings at .202 represented a 54% drop. So SMPH 1Q annualized (1Q

eps x4) would still entail a fantastic 34 PER!

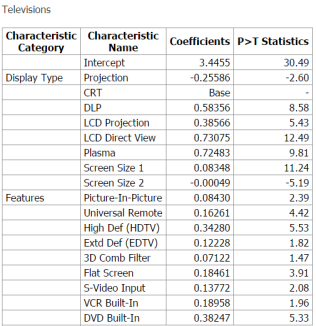

Based

on the PSE’s PER* as of Friday’s close, the average PER

catapulted to an earth-shattering 1996 level of 25.7!!!

It was even at 26.06 last Monday, the Fourth of July!

Meanwhile,

the market cap weighted PER now stands at a staggering 26.65!!!

The

PSEi was down by .75% this week but the average PER rocketed by 30.8%

to 25.7 from 19.65! This means that the average PER have now caught

up, or closed the gap with the market cap weighted PER!

Nota

Bene: The PSE includes the PER on their quote page which is updated

real time. The PSEi’s average PER represents the summation of

indicated PER of the headline 30 composite members divided by 30.

PSEi PER= Σ PER (of 30 issues)/30. The market cap weighted PER is

the summation of PERs of the headline composite members multiplied by

their respective % share in terms of market cap weight during the

period of reckoning. Market cap PSEi PER= Σ PER x market weight (of

30 PSEi issues). Market cap weights are also reflected real time on

the PSE’s index composition page. I routinely tabulate and input

the closing figures at the trading week’s end. Anyone can go to the

PSE website to generate their data.

Aside

from their reckless and disingenuous cheerleading, the PSE’s

apparent taciturn on the performance of listed firms has prompted me

to write disparagingly on them. It appears that the annual report

card for the PSE universe will be published in their coming monthly

report for May. But like the 2Q and 3Q reports, I suspect or doubt

that they will broadcast a summary as part of their “press room”

disclosure, if the results have been dismal.

The

PSE only brandishes their data only

when the numbers fit on their preferences. Or the PSE highlights the

numbers only if they resonate on G-R-O-W-T-H theme which palpably has

metastasized into a political slogan! That’s the stylized du

jour

version of financial professionalism. That was the case for the last

two quarters where the PSE universe underperformed. Total silence.

Yet

what the PSE reckons as the PER for a specified period is the PER of

the last trading day of the said timeframe. This applies to the

monthly or annual data.

This

means that in 1996, the PER of the last trading day of December 1996

reflected on the 1996 data, the PER of which was at 26.14 (left

window).

What

this illustrates has been that the contemporary PERs have already

matched the 1996-1997 levels!

Yet

the end December 1996 PER level had been extended further for the

next three months, in particular 28.21 in January 1997, 27.35

February and 27.57 in March (right window)! This happened even when

the PSEi grew by only 1.65% over the three month period.

(Just

a side note, the PSEi composition and methodology have been different

then and today. So it is unclear how accurate the headline numbers

are)

Nevertheless,

the 1996-1997 episode only demonstrated that ultra-high

valuations

only means negative

returns.

Said

differently, prices

and returns have an INVERSE relationship, ceteris paribus (given all

things constant).

The higher

the price paid for an expected stream of future cash flows would only

translate to lower

returns for a perceived investment over time.

Just

take a listed firm, ABC with say a fair

value of Php 10. If the ABC’s share price is at Php 8 then

expected return should be 25%. At Php 9, this would be 11%. At Php

10, returns should be ZERO. Anything in excess of Php 10, or its fair

value, would mean NEGATIVE returns.

So

prices can only go permanently

higher only if the laws of economics and finance (via valuations)

have been rendered obsolete or broken. Though the same price-return

valuation relationship do

not discount

that prices can go up momentarily.

The

1996-1997 aeon have only demonstrated that such fundamental laws

existed. It delivered a fatal blow to popular expectations—through

a 68% market crash. Though of course, price-valuation imbalances

remained elevated for a certain period of time before the day of

reckoning.

Such

market crash, thus, put into spotlight the statistical

law called the reversion/regression

to the mean. The market cleared valuation excesses via the

reversion or regression to the mean. The Asian crisis, which

belatedly appeared in July of 1997, only served as trigger to such

mean reverting process.

The

1996-97 lesson applied today.

Should

the 1996-1997 milepost rhyme, then this means that while the current

episode could further extrapolate to even higher prices, that should

magnify valuation dislocations, any further upside run will likely be

limited.

Moreover

any further runup will extrapolate to intensifying market risks in

the face of enhanced buildup of price-fundamental discrepancies.

And

should

history serve as blueprint of the present, then current developments

indicate that present price levels would represent a crucial turning

or inflection point!

Broadening

Misperception: Historic PERs Not Just About Price Pumping, But

Lethargic Earnings Growth!

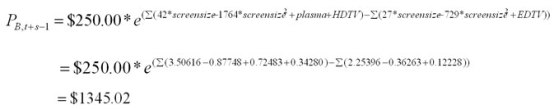

Since

PER represents a ratio between prices and reported earnings, it looks

most likely that not only has the spike in the headline index PER

been about rabid price inflation, but also about the denominator,

or an earnings growth issue.

For

a specific time period, the PSEi price index level can be divided by

the estimated PER to generate an estimated nominal based earnings to

represent the index.

Nevertheless

I’d rather wait for the official PSE disclosure to see the outcome.

The

past provides a clue. Through the 3Q of 2015, whether income or

revenues, the official numbers had only evinced inertia. Revenues and

income for listed companies, including PSEi composite members, were

mostly drifting in the negative.

And

this has been why these numbers have not made it through the PSE’s

“press room”. Any facts outside the G-R-O-W-T-H theme must be

considered as an anomaly thus excluded from official announcements or

censored!

And

I surmise that the based on a back of envelop calculations, fourth

quarter numbers could even be WORST!

Hence,

the current ferocious price pumping in the face of growing divergence

with real developments represents the worst dynamic in

motion—concrete signs of widening misperception!

And

current unfolding conditions have only reinforced my suspicions of

why the BSP launched a silent stimulus in 4Q 2015-1Q 2016!

The

chart above represents the distribution of PERs according to the

quintile market cap ranking based on Friday’s data.

Again

it shows of the concentration

of the HIGHEST PERs towards the top 15 or specifically, the top 5.

However,

the huge leap in the 16-20 quintile has been mainly due to the surge

in ICT’s PER to 124!

Yet

the end of the year for 2015 numbers could only likely mean an

extension of the stagnant 9 month performance.

Moreover,

to fill in the blanks, the 1Q 2016 30 PSEi eps numbers gives us clues

to the 2015 report.

The

present savagery in price pumping has come even as eps continues to

falter! Not just in 2015.

For

the PSEi, 1Q 2016 eps

growth slipped by 2.25% over the comparable period!

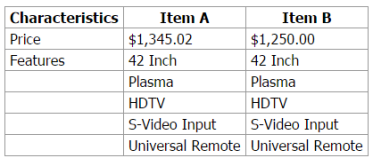

It’s

not just the headline numbers that has been bad. The

breadth and quality of earnings appear to be in decay.

Firms

with at least 10% in eps growth or the outperformers accounted for

only 16 or 53% of the PSEi universe.

Firms

with less than 5% growth (2015 NGDP was 5.2%) totaled 8 or 26.67% of

the Phisix.

5

firms or 16.67% of PSEi issues posted growth rates that were down

(negative) from last year. One posted negative or loss.

Overall,

14 or 47% of the Phisix had underperformed. And most of the

underpeformance comes exactly were the furious vertical pumping had

occurred—the top 15! 9

out of the top 15 or 60% had performed below par in 1Q 2016 relative

to last year!

1Q

2016’s underpeformance numbers have now been far greater than the

2Q 2015 numbers where only less than a third had lethargic eps

growth.

Moreover,

a vast majority of listed firms has shown of declining top line

numbers or revenues. This means that most

of the growth in eps had emerged from cost side reductions.

This only reveals that the 6.9% 1Q GDP was a puffery!

Again

this goes to show why the BSP had taken action in 4Q 2015-1Q 2016.

Also

this exhibits why the mainstream has been inundated by

misinformation, balderdashes or drivels, like the 4G telecom monopoly

that has served as fuel to a frenzied 5 month + pump!

That’s

because industry and economy wide eps has been hurtling downward!

BSP’s

Silent Stimulus Will Aggravate the Malinvestments and the Coming

Violent Market Clearing Process!

Of

course, I do not discount that the sudden spike in bank credit growth

from 4Q to the present could provide a TEMPORARY boost to NGDP and

eps.

Nonetheless,

the bank credit response to the BSP’s silent stimulus would

postulate to an enlargement or the amplification of an already

existing excess capacity in bubble sectors, the accretion of deeper

mispricing (as seen in the vertical pumping of stocks, but has yet to

be seen in property), significant degeneration of balance sheets of

credit recipients and credit providers, and most importantly, the

loss of purchasing power by Philippine resident consumers.

Proof?

June

CPI spiked by a stunning 18% to 1.9% from May’s 1.6%!

The

BSP

explained (bold mine): The

higher

June headline inflation was driven mainly by higher prices of most

food

commodities, particularly meat, fish, fruits, milk, cheese, and eggs,

as well as vegetables. At the same time, non-food inflation went up

as price increases of clothing, furnishings, and household equipment

as well as service-related CPI components

such as education, health, and catering services

more than offset the decline in electricity rates and in the prices

of domestic petroleum products.

Food

accounted for 36.29% in BSP’s CPI

basket.

Food related restaurant CPI which represented the second largest

non-food category has a 12.03% share. Education and health which

ranked fourth and sixth has 3.36% and 2.99% share. To wit, food, food

related services and basic spending on health and education has

accounted for 54.67% of the consumer’s income.

It’s

not just the CPI, there has similarly been a fantastic surge in

prices at the retail levels (+37.5% in May to 2.2% from April’s

1.6%).

From

the Philippine

Statistics Authority

(bold

mine):

The

annual growth of the General Retail Price Index (GRPI) in the

National Capital Region (NCR) moved up by 2.2 percent in May 2016. It

was registered at 1.6 percent in April 2016 and 1.5 percent during

the same month in 2015. Higher

annual increases were recorded in the indices of food

at 5.7 percent; beverages and tobacco, 1.9 percent; crude materials,

inedible except fuels, 1.4 percent; and manufactured goods classified

chiefly by materials, 0.7 percent.

Let

us assume that these statistics have not been understated. Or let us

give the benefit of doubt that these figures somewhat reflects on

actual developments. This tells us that overall,

the abrupt swelling of prices in basic items means LESSER disposable

spending power for consumers. That’s if the erosion of consumer

spending power through price level inflation have not been offset by

income growth.

Yet

with the PSE’s performance as a guidepost, then the 1Q 2016 data

hardly provides evidence

that income has grown enough to offset the ongoing corrosion of the

consumer’s purchasing power.

And

more signs that whatever stimulus implemented has hardly been felt in

the job markets.

Major

online job advertisers as Monster.com

and the largest online job website, Jobstreet.com, have shown bounces

off the recent lows. But such bounces may reflect on cyclical

responses rather than a structural recovery.

Not

even the BSP silent stimulus appears to have filtered into

Jobstreet’s nominal based job openings which appears to be turning

lower again [see lower window] (I tabulate this every Thursday).

So

just where are the jobs to provide spending power for consumers?

OFW

remittances? The BSP fidgeted with

the April remittance data

perhaps to hide another negative remittance growth rates last March.

Yet

OFWs growth rates are clearly headed downhill. OFW remittances are

unlikely sources of marginal demand and income growth.

And

here is a curiosity. The government says that since the Philippine

NGDP grew by 5.2% in 2015, disposable income grew by ONLY note 6%!

From

the Philippine

Statistics Authority:

“Net

National Disposable Income amounted to Php 15.0 trillion in

2015 or 6.0 percent higher as compared to Php 14.1

trillion in 2014. With the HFCE and GFCE amounting to PhP

9.8 trillion and PhP 1.5 trillion, respectively, total

Savings in 2015 amounted to PhP 3.7 trillion, up by 1.9

percent from 2014.”

The

plunge in CPI (thereby GFCE) most likely helped contribute to the

disposable income growth data. Of course, I would suspect that this

had

been tilted to the higher income levels (or the few beneficiaries of

the credit boom) to have lifted the aggregate numbers.

YET

go back to the 2015 NGDP figures. In the year 2015, the NGDP

performances of the bubble industries: Construction 10.4%, Real

Estate 10.3%, Retail 7.5%, Hotel and restaurants 9.7% and financial

intermediation 7.6%.

To

repeat, from the government’s perspective: Disposable income grew

by only 6%. Yet all these industries ballooned by MORE than the

growth rates of disposable income. Since every industry competes for

the consumer’s peso or disposable income, then

just what happens to the variance or the gap in the growth rates

between the industry and consumers? Would this not translate to

excess capacity??!!!

You

see, malinvestments reveal themselves even in government numbers!

And

because the numbers cited are from the government, disposable income

is likely to be overstated, while based on industry declarations,

previous declared expansion numbers suggest that some like real

estate and retail could be understated.

All

one has to do is to look at bank credit loans to the industry.

Yet

with disposable income under pressure from spiraling inflation rates,

just who will buy all such massive outgrowth in the supply of

shopping malls, office condos, horizontal and vertical housing and

hotels and casinos?

The

BSP hasn’t learned. They inflated domestic liquidity M3 by 30%+++

for 10 consecutive months in 2H 2013-1H 2014. And these caused

massive displacement in the economy from which side effects (as

reflected the erosion of eps, jobs and income and etc…) continues

to linger.

YET

with the silent stimulus, they apply more of the same treatment to

the very symptoms that emerged out of their 2009 “trickle down”

policies of borrowing growth from the future to pump GDP today.

The

BSP can never learn because this represents the prevailing central

bank dogma adapted by contemporaneous central bankers everywhere.

The

central bank catechism: Spend the economy to prosperity by through

credit expansion! Forget the balance sheets!

And

because balance sheets are not just imaginary and serve as real

function to every entity, the “spend to prosperity via debt”

paradigm has only been disintegrating.

So

worldwide, we now see central bank actions sending debt levels

skyrocketing even as the war on interest rates escalate. The war on

interest rates is now being conducted via negative interest rate

policies (NIRP) and bans on cash transactions!

And

worst, the central banking easy money doctrine transformed into

policy applied to the Philippines have only been intensifying

price-fundamental misalignment at the Philippine Stock Exchange.

Thus

the credit expansion fueled historic price pumping activities have

now been manifested through a landmark disparity in terms of price

valuations!

The

ramifications of which—if history where to rhyme would be an

earth-shattering nasty market clearing process via a reversion to the

mean!