Global stock markets continue to sizzle.

The US stock markets, which accounts for as the largest in the world based on market capitalization[1], and the de facto leader of global equity markets have broken into 5-years highs and is less than 3% in nominal terms and about 14% away in inflation adjusted terms from the ALL time highs reached in October of 1997[2].

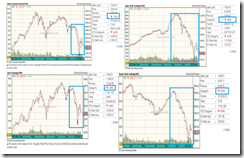

The chart above reveals of the blistering run by the US S&P (SPX).

More than that, the above shows how tightly correlated stock markets have been. Figures may differ on statistical correlation, but the trend undulations of the above benchmarks of the European Stox 50 (STOX 50) Asia-ex-Japan (P2DOW) and the Philippine Phisix (PSE), exhibits of essentially similar trends. Specifically, since the European Central Bank and the US Federal Reserve unveiled back-to-back the Long Term Refinancing Operation[3] (December 2011) and Operation Twist[4] (September 2011), these benchmarks traversed on a generally similar route with nearly the same movements.

The point is although there may be significant variances in the degree of returns, any interpretation of the local market as operating in an independent path (decoupling) would be patently misguided. The global inflationary boom, incited by policies of central banks of major economies has been entwined or tightly linked with domestic forces.

In other words, the speculative orgy on asset prices abroad, not limited to equities as discussed last week[5], has equally been influencing regional, as well as, the domestic version of a brewing mania. In the case of the Philippines, booming stocks, bonds and Peso and in the real economy, the inflating property-shopping mall bubble.

This is why I am inclined to think that in the current episode of the frenetic global yield chasing, the Phisix may be prone to a blow-off melt-up phase. This is strictly in the condition that the Risk ON-low interest environment prevails throughout the year.

A melt up phase means that the 10k Phisix may be reached sooner than later. The negative aspect is that such melt up phase would be accompanied by an acceleration of the systemic bubble in the real economy.

Furthermore, given the tight correlation of world markets, this implies that the Phisix is sensitive to contagion risks that may be transmitted via downside volatilities from anywhere around the world.

And given that bubbles are being nurtured almost everywhere we can’t discount that the source of the next crisis may arise from the region or from the country itself.

And like individuals every economy is distinct. Thus the elasticity or the tolerance level for economic imbalances will be dissimilar. No one can really say where the proverbial pin will be and when it will strike. Nonetheless for now we should simply take advantage of the boom while it lasts, but at the same time keeping vigil over the risks of a reversal.

And another thing, even the big guys appear to be jumping into the “great rotation” theme such as DoubleLine Capital LP, Loomis Sayles & Co and PIMCO[6] where investors now are seeing equities as providing returns than bonds thus the shift.

Will This Time Be Different?

Many, if not, the consensus here and abroad, have been seduced by the “outcome bias”. They see rising prices, popular media touting economic “upswing” supposedly based on sound economic growth and peer pressure as having reinforced their beliefs that “THIS TIME IS DIFFERENT”. They forget that these four words are loaded, and signify as the four dangerous words of investing[7] according to the late legendary investor Sir John Templeton

Yet how much of the domestic growth have emanated from natural market forces? How much have been influenced by monetary factors? No one can say. Everyone seems to assume that a debt-driven present oriented consumption economy can last forever.

I would add that on my radar screen list of 83 international bourses, only 10 are in the red. This suggests that a vast majority of equity benchmarks have been buoyed by a collective and collaborative policy of credit easing.

Yet the gains of 2013 have not been inconsequential. I would estimate that the average returns in 2013 for those in the upside, in the range 4-5% year-to-date.

If stock markets have been a depiction of economic growth, then why the need for collective and collaborative easing from central banks?

What is the relevance of economic performance with stock market growth?

I have used Venezuela’s 2012 mind boggling 300% stock market returns[8] as an example, now I refer to Greece

Since the advent of 2013, Greece has been one of the outstanding performers, where the Athens Index has been up 12.56% as of Friday’s close. Such fantastic returns add to the extraordinary gains at the close of 2012, where the Greece benchmark returned at almost the same level of the Phisix, up 32.47% and 32.95% respectively.

But look at the economy of Greece. Based on mainstream statistics, the stock market and the economy has been starkly moving in the opposite direction; a parallel universe.

And we are not talking here of a one-off event but 4-year intensifying slump versus a 7 month rally in the Greek Athens index.

If stock markets theoretically should represent future earnings stream, then the rally of the 7 month rally should highlight a meaningful of recovery. Yet even from a statistical viewpoint, there seems hardly any sign of this. Why?

So what also explains the need for the escalating central bank interventions, whom have cumulatively and synchronically been intensifying expansion of their balance sheet expansions, if indeed economies have been vigorously growing?

Yet how much real economic growth have such policies accomplished? The Zero Hedge[9] estimates that over the past 5 years where central bank assets grew by 17% annualized, an equivalent of only 1% of GDP growth had been attained over the same period.

Are we thus seeing diminishing returns which could be why central banks have become more aggressive?

The Bangko Sentral ng Pilipinas (BSP) has likewise been engaged in the same actions but at a much reduced scale[10] than her developed economy peers. In developed and emerging Asia, the BSP had been the most aggressive in cutting interest rates in 2012.

The general idea promoted by the consensus has been that all these actions would have immaterial impact or backlash to the economy. But what of the future?

Yet ironically, central banks have begun to signal a pushback from what seems as growing overdependence on them and from potentially becoming the scapegoat of politicians.

Proof?

From Bloomberg[11], (bold mine)

The central bankers who saved the world economy are now being told they risk hurting it.

Even as the International Monetary Fund cuts its global growth outlook, a flood of stimulus is running into criticism at the World Economic Forum’s annual meeting in Davos. Among the concerns: so-called quantitative easing is fanning complacency among governments and households, fueling the risk of a race to devalue currencies and leading to asset bubbles.

Central banks can buy time, but they cannot fix issues long-term,” former Bundesbank President Axel Weber, now chairman of UBS AG, said in the Swiss ski resort yesterday. “There’s a perception that they are the only game in town.”

Also, central bankers have been signaling anxiety from any potential repercussions from their current actions.

The central bank of central bankers, the Bank for International Settlements headed by Jaime Caruana recently said in a TV interview that “world was reaching the point where the damage from central banks' printing money could outweigh the benefits”[12]

He further beckoned that politicians should deal with the real economic reforms "There is always a risk of overburdening central banks. There is perhaps excessive pressure when we discuss about growth; probably the attention should be focusing on productivity, competitiveness, labour market participation. There is a bit too much focus on central banks”.

And echoing former Bundesbank Axel Weber in the above, the role of central banks has supposedly been to provide window for addressing real issues, "Central bank measures such as cutting interest rates could only buy time for governments to take action on structural economic reform”.

Instead, the current policies have been incentivizing moral hazard “sometimes low rates provide incentives that time is not used so wisely", which essentially means that politicians have used central bankers to kick the can down the road.

Does all of the above serve as evidence of sound economic growth? What happens if central bankers decide to put meat on their words?

Or have people become deeply addicted to the inflationism as predicted by the Austrian school of economics?

As the great Professor Ludwig von Mises warned[13],

Credit expansion cannot increase the supply of real goods. It merely brings about a rearrangement. It diverts capital investment away from the course prescribed by the state of economic wealth and market conditions. It causes production to pursue paths which it would not follow unless the economy were to acquire an increase in material goods. As a result, the upswing lacks a solid base. It is not real prosperity. It is illusory prosperity. It did not develop from an increase in economic wealth. Rather, it arose because the credit expansion created the illusion of such an increase. Sooner or later it must become apparent that this economic situation is built on sand.

While I have little doubts that central banks will continue to pursue current policies despite subtle agitations against politicians, which should push the markets higher in 2013, it may not be central banks at all who will take the proverbial punchbowl away, but economic imbalances brought about by today’s deepening speculative mania.

The Risks from Thailand’s Credit Bubble

I have posted yesterday on my blog[14] what I sense as a vulnerable spot in Thailand’s economy: credit growth has been expanding far beyond the economy’s capacity to pay.

Thai’s average credit growth from the private sector has been at 7.94% and from the government at 15% (based on external debt) compared to Thai’s statistical economic growth average at 3.6%. Loan growth from both sectors has recently been accelerating.

Importantly, while Thai’s external debt to GDP ratio remains far below the 1997 levels, their increasing reliance on short term debt now accounts for about 54% of total external debt which has virtually surpassed the 1997 levels at 45%!

And one of the symptoms from ‘economic overheating’ has been a surge in minimum wages—89% in 2012!

Now my question is with all the credit boom, where has the money been flowing into? One could be in the stock market, the Stock Exchange of Thailand beat the Phisix by a narrow margin 35.76% and 32.96% respectively. Next is could be a property bubble.

Thai’s financial assets and the economy has not only been bolstered by domestic credit but by portfolio flows into bonds and equities, as well as, burgeoning Foreign Direct Investments all of which has, so far, managed to offset their deficits in international trade balance data.

This only reveals that Thai’s economy seems highly susceptible to a sharp upside pendulum swing on interest rates that can be triggered by a “sudden stop”[15] in capital flows (most likely from regional or global contagion) or from an intrinsic implosion.

And it is important to note that measuring debt levels relative to statistical GDP can misinform analysts.

Most of the systemic debt accrued from both the private ‘formal’ sector and the government can be accurately measured from the outstanding issuance on the bond markets and from loans by the banking system.

On the other hand, GDP, which are accounting constructs based on estimates, can be bolstered by pumping up the system with money which raises relative price levels (thus economic growth), and from government expenditures.

In short a credit boom can mask a debt problem.

So when a bust arrives, the numerator which is fixed— as debts are based on contracts unless restructured or defaulted upon—will rapidly outweigh the shrinking denominator (GDP), which will initially adjust to reflect on the drop in the economic activities.

The result will be a higher level of debt to GDP ratio as the economy retrenches. This is likely to be further exacerbated by bailouts and other interventions to “save” the economy or when private debt will be transferred to the government.

Deceptive Economic Growth Statistics

Speaking of statistical duplicity, there are three ways to arrive at the GDP[16]: expenditure, income and production. The popularly used is the expenditure approach[17] popularly seen via the equation:

GDP (Y) = Consumption (C) + Investment (I) + Government Spending (G) and Net Exports (X-M)

As shown above, the equation has a bias for Government Spending which it sees as positive for the economy, regardless of how government spends the money, hence the plus operation (+) and the bias of exports over imports (X-M) which has been used by mercantilists as an excuse to support the “balance of trade” fallacy (the latter I won’t be dealing here)

So in dealing with the first premise, we find it common for mainstream experts to proffer that government helps the economy even if they just build pyramids or dig up holes and fill them.

Such has been embodied by the work of John Maynard Keynes, who prescribed[18],

If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coalmines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and, with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is. It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.

So if the government puts $1,000 for people to just dig and fill, from a macro accounting identity, the economy would be equally boosted by $1,000, or $1,000 (Y)= 0 (C) + 0 (I) + $1,000 (G) + 0 (X-M)

This is exactly why the GDP accounting tautology or as a statistical measure for economic growth misleads; statistical abstractions substitutes for economic reasoning, when the real economy is about purposeful human action as represented by the ever dynamic activities in pursuit of survival and progress, through production or provision of services channeled through voluntary exchange with the consumers.

Professor of economics and blogger at the Library of Economics and Liberty Garett Jones recently dealt with the inconsistencies of Government spending as a feature of economic growth[19],

Because GDP counts government salaries as "government expenditures" as soon as the government hires a person. But the "consumption" and "investment" parts of GDP only count genuine purchases by the private sector

So if a private sector product spends years in the incubator, burning through thousands of person-hours of work and millions of dollars of salary--but never sees the light of day--then the product never shows up in GDP. But if the government had hired those same workers who worked just as long on a similarly fruitless project, their labor would give a big boost to GDP.

Government hiring creates GDP by definition. Private hiring only creates GDP if the worker actually creates a product.

I’d further add that government spending, which represents coercive transfers from productive sectors of society, hardly accounts for value added or productivity growth to the real economy.

For instance, imposing regulations on commerce will stymie business activities, but such opportunity losses will not be accounted for in the said growth statistics. Instead, what will be added will be the spending done by the government in the hiring of people and other costs attendant to or associated with the implementation of such business restrictive regulations.

In short, the opportunity costs, as well as the negative feedback mechanism from interventions (e.g. future higher unemployment or taxes) will hardly be reflected on growth statistics.

Obsessing over growth statistics is a folly, even the principal architect of the GDP, Simon Kuznets, warned against its use to measure welfare[20], in 1934 he wrote[21]

The welfare of a nation can scarcely be inferred from a measurement of national income.

In 1962 Mr, Kuznets reiterated the same point but emphasized on the quality rather than the quantity of growth[22].

Distinctions must be kept in mind between quantity and quality of growth, between its costs and return, and between the short and the long term. Goals for more growth should specify more growth of what and for what.

In addition, official economic statistics are not only inaccurate they can be manipulated with to suit political ends[23]. They do in in both directions where statistics can be boosted for electoral purposes or undermined as means to supplicate for foreign aid.

In short, statistics can be made to lie. The case of Argentina in 2011 has been notorious. Officials persecuted private sector economists for not kowtowing to official numbers in measuring consumer price inflation. Some speculated that the design for such actions has been to finagle Argentina’s bondholders[24]. In other words, Argentina’s government not only manipulated economics, but censored and harassed the economics profession, aside from shaking down both the bond holders and their citizens.

The bottom line is that while statistics may assist in providing empirical evidence, they must be used with caution. Statistics should not be used to derive for causation and theory, instead economics which is an a priori science, should serve as groundwork for sound analysis.

Importantly we should realize what economics is truly about, as the late Professor Austrian economics Percy L. Greaves, Jr eloquently wrote[25],

Economics is not a dry subject. It is not a dismal subject. It is not about statistics. It is about human life. It is about the ideas that motivate human beings. It is about how men act from birth until death. It is about the most important and interesting drama of all — human action.