The Keynesians seem to be dominant today. They are dominant because they have been brought into the hierarchy of political power. They serve as court prophets to the equivalent of the Babylonians, just before the Medo-Persians took the nation.They are in charge of the major academic institutions. They are the main advisers in the federal government. They are the overwhelmingly dominant faction within the Federal Reserve System. Their only major institutional opponents are the monetarists, and the monetarists are as committed to fiat money as the Keynesians are. They hate the idea of a gold-coin standard. They hate the idea of market-produced money….The welfare-warfare state, Keynesian economics, and the Council on Foreign Relations are going to suffer major defeats when the economic system finally goes down. The system will go down. It is not clear what will pull the trigger, but it is obvious that the banking system is fragile, and the only thing capable of bailing it out is fiat money. The system is sapping the productivity of the nation, because the Federal Reserve's purchases of debt are siphoning productivity and capital out of the private sector and into those sectors subsidized by the federal government…I offer this optimistic assessment: the bad guys are going to lose. Their statist policies will bring destruction that they will not be able to explain away. Their plea will be rejected. "Give us more time. We just need a little more time. We can fix this if you let us get deeper into your wallets."In the very long run, the good guys are going to win, but in the interim, there is going to be a lot of competition to see which group gets to dance on the grave of the Keynesian system.Get out your dancing shoes. Keep them polished. Our day is coming.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, October 02, 2012

Quote of the Day: Dancing on the Grave of Keynesianism

Monday, August 27, 2012

Gary North: The Keynesian Era is Coming to a Close

Author and Professor Gary North talks about how the Keynesian political economic system via the welfare-warfare state, like Marxism, is bound for doom.

I say this to give you hope. The Keynesians seem to be dominant today. They are dominant because they have been brought into the hierarchy of political power. They serve as court prophets to the equivalent of the Babylonians, just before the Medo-Persians took the nation.

They are in charge of the major academic institutions. They are the main advisors in the federal government. They are the overwhelmingly dominant faction within the Federal Reserve System. Their only major institutional opponents are the monetarists, and the monetarists are as committed to fiat money as the Keynesians are. They hate the idea of a gold coin standard. They hate the idea of market-produced money.

There was no overwhelming outrage among staff economists at the Federal Reserve when Ben Bernanke and the Federal Open Market Committee cranked up the monetary base from $900,000,000,000 to $1.7 trillion in late 2008, and then cranked it up to $2.7 trillion by the middle of 2011. This expansion of the money supply had no foundation whatsoever in anybody's theory of economics. It was totally an ad hoc decision. It was a desperate FOMC trying to keep the system from collapsing, or least they thought it was about to collapse. The evidence for that is questionable. But, in any case, they cranked up the monetary base, and nobody in the academic community except a handful of Austrians complained that this was a complete betrayal of the monetary system and out of alignment with any theory of economics.

The Keynesians are eventually going to face what the Marxists have faced since 1991. Literally within months of the collapse of the Soviet Union, when members of the Communist Party simply folded up shop and stole the money that was inside the Communist Party coffers, any respect for Marxism disappeared within academia. Marxism became a laughingstock. Nobody except English professors, a handful of old tenured political scientists, and a tiny handful of economists in the Union of Radical Political Economists (URPE), were still willing to admit in late 1992 that they were advocates of Marxism, and that they had been in favor of Soviet economic planning. They became pariahs overnight. That was because academia, then as now, is committed to power. If you appear to have power, you will get praised by academia, but when you lose power, you will be tossed into what Trotsky called the ashcan of history.

This is going to happen to the Keynesians as surely as it happened to the Marxists. The Keynesians basically got a free ride, and have for over 60 years. Their system is illogical. It is incoherent. Students taking undergraduate courses in economics never really remember the categories. That is because they are illogical categories. They all rest on the idea that government spending can goose the economy, but they cannot explain how it is that the government gets its hands on the money to do the stimulative spending without at the same time reducing spending in the private sector. The government has to steal money to boost the economy, but this means that the money that is stolen from the private sector is removed as a source of economic growth.

The Keynesian economic system makes no sense. But, decade after decade, the Keynesians get away with utter nonsense. None of their peers will ever call them to account. They go merrily down the mixed economy road, as if that road were not leading to a day of economic destruction. They are just like Marxist economists and academics in 1960, 1970, and 1980. They are oblivious to the fact that they are going over the cliff with the debt-ridden, over-leveraged Western economy, because they are committed in the name of Keynesian theory to the fractional reserve banking system, which cannot be sustained either theoretically or practically.

The problem we are going to face at some point as a nation and in fact as a civilization is this: there is no well-developed economic theory inside the corridors of power that will explain to the administrators of a failed system what they should do after the system collapses. This was true in the Eastern bloc in 1991. There was no plan of action, no program of institutional reform. This is true in banking. This is true in politics. This is true in every aspect of the welfare-warfare state. The people at the top are going to be presiding over a complete disaster, and they will not be able to admit to themselves or anybody else that their system is what produced the disaster. So, they will not make fundamental changes. They will not restructure the system, by decentralizing power, and by drastically reducing government spending. They will be forced to decentralize by the collapsed capital markets.

When the Soviet Union collapsed, academics in the West could not explain why. They could not explain what inherently forced the complete collapse of the Soviet economy, nor could they explain why nobody in their camp had seen it coming. Judy Shelton did, but very late: in 1989. Nobody else had seen it coming, because the non-Austrian academic world rejected Mises's theory of socialist economic calculation. Everything in their system was against acknowledging the truth of Mises's criticisms, because he was equally critical about central banking, Keynesian economics, and the welfare state. They could not accept his criticism of Communism precisely because he used the same arguments against them.

The West could not take advantage of the collapse of the Soviet Union, precisely because it had gone Keynesian rather than Austrian. The West was as compromised with Keynesian mixed economic planning, both in theory and in practice, as the Soviets had been compromised with Marx. So, there was great praise of the West's welfare state and democracy as the victorious system, when there should have been praise of Austrian economics. There was no realization that the West's fiat money economy is heading down the same bumpy road that led to the collapse of the Soviet Union.

It was not a victory for the West, except insofar as Reagan had expanded spending on the military, and the Soviets stupidly attempted to match this expenditure. That finally "broke the bank" in the Soviet Union. The country was so poverty-stricken that it did not have the capital reserves efficient to match the United States. When its surrogate client state, Iraq, was completely defeated in the 1991 Iraq war, the self-confidence inside the Soviet military simply collapsed. This had followed the devastating psychological defeat of the retreat of the Soviet Union out of Afghanistan in 1989. Those two defeats, coupled with the domestic economic bankruptcy of the country, led to the breakup of the Soviet Union.

The present value of the unfunded liabilities of the American welfare state, totaling over $200 trillion today, shows where this nation's Keynesian government is headed: to default. It is also trapped in the quagmire of Afghanistan. The government will pull out at some point in this decade. This will not have the same psychological effect that it did on the Soviet Union, because we are not a total military state. But it will still be a defeat, and the stupidity of the whole operation would be visible to everybody. The only politician who will get any benefit out of this is Ron Paul. He was wise enough to oppose the entire operation in 2001, and he was the only national figure who did. There were others who voted against it, but nobody got the publicity that he did. Nobody else had a system of foreign-policy which justified staying out. His opposition was not a pragmatic issue; it was philosophical.

The welfare-warfare state, Keynesian economics, and the Council on Foreign Relations are going to suffer major defeats when the economic system finally goes down. The system will go down. It is not clear what will pull the trigger, but it is obvious that the banking system is fragile, and the only thing capable of bailing it out is fiat money. The system is sapping the productivity of the nation, because the Federal Reserve's purchases of debt are siphoning productivity and capital out of the private sector and into those sectors subsidized by the federal government.

Read the rest here.

Quote of the Day: Keynesian Policies as Root of Inflationism

What is happening instead is that workers are getting higher money wages, which are lower real wages because the value of the monetary unit is constantly being diluted. We are going into progressive inflation. Savers are being liquidated. Their property is being confiscated. New savers are scared away. Politicians are constantly afraid, and rightly so, of doing things that are unpopular. They endorse popular spending measures but they shun the resulting costs, and to stay popular they have resorted to inflation. This is the so-called Keynesian policy. It is set forth in Keynes' book, The General Theory of Employment, Interest and Money. The key sentence is: "A movement by employers to revise money-wage bargains downward will be more strongly resisted than a gradual and automatic lowering of real wages as a result of rising prices."

This was the policy endorsed by Keynes. It is the policy of most governments in the Western world today. Keynes knew, as every economist does, that the only way that you can employ more people is to lower the wage rate. But ever since World War I this had become politically more difficult in Great Britain. Powerful British labor unions, with the help of the Fabian Socialists, had built up public pressures which opposed any lowering of any money wages. British politicians of all parties were afraid to resist this popular union policy. So in 1931, when the number of unemployed became unbearable, the politicians in office preferred to lower wages by devaluing the British pound. The workers kept their puffed-up pound wages, but their pounds bought less.

In 1936, Keynes gave this political policy academic sanction in the book and sentence just quoted. Since then, most Western nations have adopted this "full employment" policy. In essence, when unemployment is considered too high, wages are lowered by lowering the value of the monetary unit. This is done by increasing the quantity of the monetary units. This will be the subject of the next lectures. We will then discuss money and the government handling of this monetary problem. We have gotten into a situation of ever-rising wages and prices, with more and more workers paid less than they would earn in a free market. It is very difficult to get out of such a situation. The real answer, of course, is economic education.

Neither union leaders nor union workers are stupid people. Keynes and the British politicians were able to fool the employees in England when they first tried this scheme in 1931. They changed all the index numbers, making it difficult to document the price rises reflecting the lower purchasing power of the pound. But now every union has a statistician. They may call him an economist, but he can see from the official cost of living indices that prices are going up. And when they go up, the unions demand still higher wages. This system of Keynes' has just about reached the end of the road. You can no longer fool the workers by lowering the value of the monetary unit. They are on to what is happening and they are not going to take it much longer. The only final answer to this problem is more economic education, showing that the only way to keep raising wages permanently is to increase production, and the way to do this is to encourage savings. For it is only increased savings that can provide workers with more and better education and more and better tools, with which they can produce and buy more and better products that they want most.

(bold emphasis added)

This is from the must read transcribed lecture by economist Percy L. Greaves, Jr. (1906–1984) at the Mises.org.

Sunday, April 22, 2012

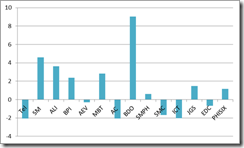

Bullish Signal Confirmed as Phisix Sets New Record High

As I said last week, rising stock prices on a slew of internal and external bad news usually signifies as bullish indicators.

Here is what I wrote,

Foreign trades have also been sluggish with paltry changes over the last two weeks. Yet, despite the marginal actions by foreign investors, the Philippine Peso posted modest advances.

So essentially, last week’s action suggest of a rotation away from second and third tier issues back into the blue chips.

Yet I expect to see normalization of trading activities in terms of Peso volume which should undergird either the current consolidation phase or a fresh attempt to break away into new highs.

When the markets to defy the spate of bad news that signifies as a bullish signal.

Speaking of luck that’s exactly how it turned out the week!

First of all, the Phisix broke into fresh nominal record high even as the Scarborough issue has not been resolved.

As an aside, I would reiterate that for whatever innuendos about resources alluded by media, the Spratlys-Scarborough issue has not been about oil or commodities but more about unspecified political agenda which could be related to promoting arm exports or ploys to divert the public from festering real political issues or as justifications for inflationism.

I might add that the heated kerfuffle over territorial claims has expanded to cover the disputed Senkaku Islands, where Japanese authorities has jumped into the fray to announce of their acquisition of the island from the “owners”. This has resulted to a political backlash from Chinese authorities.

Given that politics in Japan seems to have been entangled with monetary policies, Japan’s recent provocative foreign policy posture could be portentous of Bank of Japan’s (BoJ) moves to expand its stimulus (via asset purchases), perhaps under the pretext of increasing military spending.

Going back to the Philippine stock market, given the record performance, we can’t discount the prospects of interim ‘profit taking’. But again I think momentum still favors the bulls.

Second, net foreign trade has turned significantly positive mostly bolstered by the GT Capital’s listing last Friday

Third market breadth also turned positive…

…as advancing issues took the driver’s seat anew.

If the positive momentum, which is likely to be reflected on the actions of the benchmark Phisix should persist, then we would see a broadening of gains over the broader market.

Most of the gains had been concentrated on the sectoral leaders since the start of the year, particularly, property, finance and holding companies or mother units of the former two.

I think that rotation will occur among the heavyweights as the current leaders may take a short reprieve.

Importantly the Peso volume DID normalize…

Daily traded Peso volume (averaged weekly) surged amidst as last week’s record breakout.

I see a continuity of the bullish or upside momentum of the financial markets which may last until the first semester of the year, where central bank steroids are due for expiration. While this may lead to an interim volatile phase perhaps backed by deteriorating economic or financial conditions in Europe or in China, we should expect downside volatility to be met by aggressive responses from central bankers. This feedback mechanism between markets and central bank interventions has not only been made to condition the markets, but has become the central bankers’ guiding policy of crisis management.

BSP’s Euthanasia of the Rentier

This dogmatic approach has been assimilated even by the local central bank, the Bangko Sentral ng Pilipinas (BSP).

Just last week, domestic interest rate policies have been kept at “historics” lows whose levels were justified as “sufficient to help boost economic activity and avoid potential spike in inflation amid volatile global oil prices”.

The BSP blames external factors as secondary variables of domestic inflation through a “likely rise in foreign portfolio investments and higher prices of electricity amid petitions for further power-rate increases.”

In reality, interest rates policies that has driven been to superficially “historic” lows that are financed by “money from thin” are the real cause of inflation

Austrian economist Dr. Frank Shostak explains,

The exchange of nothing for something that the expansion of money out of "thin air" sets in motion cannot be undone by an increase in the production of goods. The increase in money supply — i.e., the increase in inflation — is going to set in motion all the negative side effects that money printing does, including the menace of the boom-bust cycle, regardless of the increase in the production of goods.

And symptoms from BSP’s actions have been manifesting on the domestic credit markets. Notes the Inquirer.net

True enough, credit growth so far this year has been robust. As of February, data from the central bank showed that outstanding loans by universal and commercial banks grew by 18 percent year on year to P2.74 trillion. The BSP said the increase in bank lending benefited both individual and corporate borrowers.

A boost in bank lending is not “a one-size-fits-all” thing.

A boost in bank lending that has NOT been prompted by consumer preferences but from the skewing price signals due to political “money printing” policies designed to achieve quasi permanent booms leads to bubble cycles.

And what is deemed as “robust growth” by media are, in reality, signs of malinvestments and speculative diversion of productive capital. Some of these borrowed money will find their way to the local stock exchange, real estate properties, bond markets and much of which will be diverted into consumption spending or misallocated capital that leads to capital consumption.

And adding to the policies of the promotion of “aggregate demand” or “the euthanasia of the rentier” through “historic” low interest rates has been the announcement by the local version of the welfare state, the Social Security System (SSS), to lower interest rates and to increase loanable amount to members for housing loans.

Apparently, little has been learned by local political authorities of the lessons from the latest US centric political homeownership crisis that has diffused across the world and whose phantom continues to haunt the political economies of the developed world.

Noble intentions eventually get burned by politically instituted economically unfeasible projects.

Sell In May?

Fund manager David Kotok of Cumberland Advisors rightly points out the differences in the current environment from yesteryears, such that seasonal statistical patterns like Sell in May and Go Away may not be relevant to current conditions.

History shows that ‘Sell in May and go away’ has applied when the Federal Reserve was in a tightening mode during the six-month span from May to November. If the Fed was actively raising interest rates, withdrawing or constricting credit, imposing additional reserve requirements, or taking an action that was of a tightening mode, stock markets were usually punished in that six-month period.

When we did the study we examined what the Fed did, not what it said. We used actual changes in the Federal Funds rate to determine whether the Fed was tightening, easing, or neutral. Once the Fed took the interest rate to zero at the end of 2008, the historical data series lost its power for forecast purposes, since the Fed cannot take the rate below zero. However, we believe the concept is valid even if the present measurement problem exists.

It is human action and NOT charts (for example the failed death cross pattern of the S&P 500 of 2011) or seasonal patterns, based on either statistics or historical outcomes, that determines future outcomes.

The substantial impact of central bank policies on the markets has been through the manipulation of money. Since money is a medium of exchange which represents half of every transactions people make, tinkering with money has greater tendency to alter or reshape the incentives of people.

Manipulation of money through inflationism tend to narrow people’s time orientation or increases time preferences which has been and will be ventilated through several attendant actions, as higher inclination to take debt, misdirection of investments via distorted price signals, consumption based lifestyles or pejoratively known as “consumerism”, greater risk appetite or higher inclinations towards speculation.

So when major central banks combine to tamper with money, which among themselves account for about 85% of the capital markets of the world, we can expect participants of the marketplace to adjust accordingly to these newly implemented policies. Current policies have been engendering asset inflation, which in reality has been designed to keep the flagging banking system and the unsustainable welfare states afloat.

Even emerging market central banks, as the Philippines have employed the same policies which are often justified from “growth risk”. Yet despite the standardization of monetary policies, the differences in market outcomes have been resultant to variances of people’s actions relative to the idiosyncratic structural compositions of each political economy.

In addition, while monetary policies have significant effects on people’s incentives other policies also matters such as fiscal policies and tax regimes, rule of law and protection of property rights, trade and economic freedom, and regulatory policies.

The bottom line is all these policies would have a greater impact to people’s action than simply reading numbers and history as basis for predictions.

As the great Ludwig von Mises wrote in Theory and History

Historicism was right in stressing the fact that in order to know something in the field of human affairs one has to familiarize oneself with the way in which it developed. The historicists' fateful error consisted in the belief that this analysis of the past in itself conveys information about the course future action has to take. What the historical account provides is the description of the situation; the reaction depends on the meaning the actor gives it, on the ends he wants to attain, and on the means he chooses for their attainment...

The historical analysis gives a diagnosis. The reaction is determined, so far as the choice of ends is concerned, by judgments of value and, so far as the choice of means is concerned, by the whole body of teachings placed at man's disposal by praxeology and technology.

Along the lines of the Professor von Mises, my former idol the exemplary stock market guru but who now has been converted to a crony, Warren Buffett, once lashed out at the tendency of people to anchor or rely heavily on past performance. The ailing 81 year old billionaire Mr. Buffett said

If past history was all there was to the game, the richest people would be librarians.

Friday, April 13, 2012

China’s Tiger by the Tail

Apparently China’s policymakers remain staunch devotees of Keynesian economics and promoters and practitioners of boom bust cycles.

The Bloomberg reports,

Policy makers have cut the amount banks must keep in reserves twice since November to free up cash for lending, in a bid to insulate the world’s second-largest economy from the effects of a global slowdown. Interest rates haven’t been reduced since 2008.

New local-currency lending was 1.01 trillion yuan ($160.1 billion) in March, the People’s Bank of China said on its website after the market closed. That compared with the median 797.5 billion yuan estimate in a Bloomberg News survey of 28 economists and 710.7 billion yuan the previous month. M2 money supply climbed 13.4 last month, accelerating from a 13 percent growth in February, the central bank said.

Instead of allowing the markets clear on the outstanding imbalances brought about by previous policies, China’s policymakers have decided to keep riding the tiger's tail.

According Mises Institutes Vice President Joseph Salerno,

It has now become clear that the Chinese government has made its choice to avoid a “hard landing” by attempting to ride the unloosed inflationary tiger for as long as it can. But its strategy of massviely expanding fictitious bank credit unbacked by real savings will cause added distortions and exacerbate unsustainable imbalances in China’s real economy. As the Austrian theory of the business cycle teaches, this will only postpone the needed recession-adjustment process and will precipitate a “crash landing” that may well shatter China’s burgeoning market economy. This would be a tragedy of the first order for the entire global economy.

As pointed out many times here, the recourse towards inflationism by China’s political authorities has been seen as necessity for the survival of the incumbent command-and-control structure of China’s political institutions. A financial and economic bust will only magnify the growing forces of malcontents which Chinese authorities have fervently been trying to contain.

And given the enormous scale of malinvestments, like her Western contemporaries, China’s authorities will likely push for more inflationism until economic realities prevail or until real savings get depleted.

Reports the Wall Street Journal,

China’s real-estate sector is enormous—accounting directly for 12% of gross domestic product, according to estimates by the International Monetary Fund—and changing fast. To capture developments in the sector, data are collected from more than 80,000 real-estate developers and reported up through the county, city, and province statistical system….

A key concern for investors is China’s overhang of unsold property. A trip around virtually any Chinese city reveals hosts of half-finished tower blocks waiting to be completed and sold. Analysts fear that excess supply could put a dent in prices, and reduce the real-estate investment that is a key contributor to China’s domestic demand.

Official data show 2.98 billion square meters of residential property under construction at the end of February. Wall Street Journal calculations show that is more than two square meters for every person in China and enough to satisfy demand for almost the next three years without a single extra apartment being built.

So unproductive grand projects already highlighted by ghost cities and malls as seen in the video below (hat tip Bob Wenzel) will mount, as scarce resources will continue to get funnelled into projects that consumes capital.

Bottom line: A Tiger by the Tail by the great Friedrich von Hayek represents an allegory of the allures of inflationism

An excerpt from the synopsis of Hayek’s work by Professor Salerno,

In brief, Hayek argues that all depressions involve a pattern of resource allocation, including and especially labor, that does not correspond to the pattern of demand, particularly among higher-order industries (roughly, capital goods) and lower-order industries (roughly, consumer goods). This mismatch of labor and demand occurs during the prior inflationary boom and is the result of entrepreneurial errors induced by a distortion of the interest rate caused by monetary and bank credit expansion. More importantly, any attempt to cure the depression via deficit spending and cheap money, while it may work temporarily, intensifies the misallocation of resources relative to the demands for them and only postpones and prolongs the inevitable adjustment.

The policies of permanent quasi booms or ‘extend and pretend’ policies will eventually get exposed for the fiction they sell—through a colossal bust or “a tragedy of the first order for the entire global economy”.

For now, profit from political folly.

Nonetheless it would be best keep vigilant over developments in China.

Friday, November 04, 2011

ECB’s Mario Draghi’s Baptism of Fire: Surprise Interest Rate Cut

You’ve just got to love how predictable welfare state politics operate.

Yesterday I pointed out that the global Banking cartel has intensified lobbying for the European Central Bank (ECB) to conduct more asset purchases or Quantitative Easing (QE)

Goldman Sachs alumni now ECB President Mario Draghi in his first meeting gave them an indirect platter—interest rate cuts using the Greece political drama as well as a potential Greece exit as an excuse!

From Bloomberg, (bold emphasis added)

The European Central Bank unexpectedly cut interest rates at President Mario Draghi’s first meeting in charge after the prospect of a Greek exit from the euro region sent bond yields soaring in Italy and Spain.

ECB officials lowered the benchmark interest rate by 25 basis points to 1.25 percent, confounding 51 of 55 economists in a Bloomberg News survey. Four predicted a quarter-point move and two expected a half-point reduction. The euro fell almost a cent to $1.3729 and the yield on Italian 10-year bonds retreated to 6.14 percent after surging to a euro-era high this week.

“The ongoing tensions in financial markets are likely to dampen the pace of economic growth in the euro area in the second half of the year and beyond,” Draghi said at a press conference in Frankfurt today.

European leaders last night raised the prospect of the 17- member area splintering, with France and Germany saying they would treat Greece’s surprise referendum on a second bailout as a vote on its euro membership. With the region’s economic slowdown deepening and investors growing increasingly concerned, the ECB was under pressure to reverse this year’s two rate increases.

Global financial markets just love it when they are being pampered…

Artificially manipulated low interest rates (premised on the “euthanasia of the rentier”) and quantitative easing (premised on “parting with liquidity”) translates to inflationism as opium to the political and banking-financial elites. Of course there is a third one: socialization of investment (bailouts).

How these elites love Keynesian policies of redistributing or diverting resources from the poor to the rich. (Wall Street Occupy people, where are you?)

US and European equity markets immensely applaud on ECB Draghi’s surprise cut.

Well I may be getting quite ahead of myself, ECB’s Draghi’s baptism of fire looks like a precursor to what the global banking elite has been asking for. Take it one step at a time.

Friday, October 28, 2011

The Morality of the Keynesian Monetary Dogma: The Euthanasia of the Savers

The US Federal Reserve and central bankers around the world have conjointly been applying artificially low interest policies (Zero Bound Interest Rates-ZIRP) pretty much in adherence to John Maynard Keynes’ dogma of the “euthanasia of the rentiers”—the idea where capital can be made plentiful by merely tinkering with interest rates.

Since every political decision entails a moral dimension, Professor Robert Higgs eloquently explains how the Keynesian prescription, which in reality signifies a nostrum that resembles the Philosopher’s stone—the alchemy of turning lead into gold—hurts the average citizens. (bold emphasis mine)

In short, the highest yield available to ordinary investors who seek a simple, low-risk investment of their funds is, at best, roughly equal to the rate of inflation—and then, with a 30-year term to maturity, only with substantial risk of capital loss if interest rates should rise. To put the matter another way, all ordinary investors are now being progressively impoverished because the nominal return on their investments falls short of the loss of purchasing power of the dollar during the term of the investment. Getting a positive real rate of return is effectively impossible for the proverbial widows and orphans. Only investors with the knowledge of how to invest in gold, crude commodities, and other such esoteric assets stand any chance of earning positive real returns, and then only with great risk of substantial capital losses.

Given that the Fed’s official policy is to drive all interest rates to near zero, one may conclude that the Fed seeks to impoverish the widows, orphans, retired people, and all other financially untutored people who rely on interest earnings to support themselves in their old age or adversity. Can a crueller official policy be imagined, short of grinding up these unfortunate souls to make pet food or fertilizer?

The politicians constantly bark about their solicitude for those who are helpless and in difficulty through no fault of their own. Yet, the scores of millions of people who saved money to support themselves in old age now find themselves progressively robbed by the very officials who purport to be their protectors. There are many reasons to oppose the Fed’s policy. The reason brought to mind by the official enthanasia of the nation’s small savers deserves far more attention than it has received to date.

Bottom line:

Keynesian policies have been designed at propping up the privileges of the INSIDERS (the central banking-banking-political elites) all at the expense of the outsiders or the ordinary people of the world (this includes me).

Although such policies are camouflaged by rationalizations from academic gibberish as ‘aggregate demand’ and ‘liquidity trap’, the mantra “privatize profits and socialize losses” represents as its implicit ethical framework.

Despite coordinated actions to attain such an environment, which instead has led to higher consumer prices, and that has been explicitly expressive of the policymakers’ intents that deserves the public’s reprobation, ironically there has hardly been a popular uproar.

Instead protestations today have been misdirected at the effects—financial sector deliberately being sustained by the political class.

No wonder politicians and their bureaucrats can afford to keep bamboozling us. Nevertheless, eventually or at the fullness of time, there is no escaping the laws of scarcity.

Wednesday, September 28, 2011

Quote of the Day: Keynesian Cultism

Keynesianism is one big fallacy, and a cult fallacy at that. It violates the Law of Cause and Effect by declaring that effect really is cause. And it wants us to assume that work is nothing more than a transmission mechanism for money, and it does not matter what government pays people to do, just as long as it provides money so that they can spend it and make us prosperous.

This isn't economics. It is nonsense.

This is from Professor William L. Anderson.

I’d add intellectual fraud to Professor Anderson’s description, as Keynesianism is used by zealots to promote the religion of government or socialism.

Tuesday, August 09, 2011

Monday, May 16, 2011

Ron Paul Slams IMF on Strauss Kahn

From the Right Perspective, (bold highlights mine)

US Presidential candidate Ron Paul says the arrest of IMF boss Dominique Strauss-Kahn shows why economic sovereignty and control of the money supply should not be handed over to an international body.

“These are the kind of people that are running the IMF and we want to turn the world finances and the control of the money supply to them?,” Paul rhetorically asked on FOX News Sunday. “That should awaken everybody to the fact that they ought to look into the IMF and find out why we shouldn’t be sacrificing more sovereignty to an organization like that and an individual like he was.”

US Rep. Ron Paul has referred to proposals for a global currency that would serve as substitute to the US dollar which according to the proponents would be represented by the IMF’s SDR (special drawing rights).

The fact is that the IMF’s SDR, as a global currency, has long been a fantasy for Keynesians.

As Murray Rothbard pointed out,

At best, the Keynesian Dream is a long shot. It is always possible that, not only British opposition, but also the ordinary and numerous frictions between sovereign nations will insure that the Dream will never be achieved. It would be heartening, however, if principled opposition to the Dream could also be mounted. For what the Keynesians want is no less than an internationally coordinated and controlled world-wide, paper-money inflation, a fine-tuned inflation that would proceed unchecked upon its merry way until, whoops!, it landed the entire world smack into the middle of the untold horrors of global runaway hyperinflation

Perish the thought of an IMF SDR as global currency!

Tuesday, May 03, 2011

Canada’s Politics: It’s Hayek Over Keynes As Harper Conservatives Win Majority

As I earlier noted, Keynesians have been on a losing streak.

Now we seem to be seeing this phenomenon percolate even in the realm of politics, a traditional Keynesian bastion.

This from Bloomberg, (bold highlights mine)

Canadian Prime Minister Stephen Harper won a majority of seats in Parliament for the first time, giving him a mandate to fund corporate and personal income tax cuts with curbs on spending.

Harper’s Conservatives were ahead or leading in 166 districts, according to preliminary results from Elections Canada. Jack Layton’s New Democratic Party was leading in 103 seats and will form the official opposition for the first time, followed by 34 for the Liberal Party led by Michael Ignatieff. The separatist Bloc Quebecois led in four seats with the Green Party ahead in one. The Conservatives held 143 seats in the 308- seat legislature before the vote was called in March.

The victory in the national election yesterday ends seven years of minority governments that have fueled government spending, and may make it easier for Harper to open up industries to foreign investment. Throughout the campaign, Harper said he needed a majority to secure the country’s economic recovery.

Stephan Harper grew up on Hayekian ideals, as this report from Canadianbusiness.com shows...

The government’s sudden embrace of Keynesian economics — the theory that you can spend your way out of a recession — is pretty much the mirror image of everything Harper has fought for over the past two decades. He complained bitterly about big government, high taxes and profligate spending during his time at the Reform Party (1987–1997), NCC (1997–2001), as leader of the Opposition (2002–2006), and even as prime minister, since he was first elected on Feb. 6, 2006. During the latest election campaign, Harper routinely criticized the tax-and-spend policies of his opponents, and as recently as October, he declared matter-of-factly: “I know economists will say we could run a small deficit, but the problem is that once you cross that line, as we see in the United States, nothing stops deficits from getting larger and larger and spiralling out of control.”

Few of Harper’s friends or supporters believe he honestly thinks the massive stimulus spending outlined in his latest budget will rescue Canada’s slowing economy. The measures, they say, are merely an attempt to stave off a non-confidence vote, like the one that loomed after Finance Minister Jim Flaherty threatened to remove the multimillion-dollar subsidy opposition parties have come to depend on in his economic statement in November. “Stephen Harper didn’t suddenly wake up and become a Keynesian,” says Frank Atkins, an economics professor at the University of Calgary who once taught the prime minister. “This is nothing more than a political budget.”...

Returning to the University of Calgary to work on his master’s degree, Harper began reading the works of Austria’s Friedrich Hayek, the influential conservative economist. Hayek vehemently disagreed with the Keynesian notion that government spending could limit economic downturns, and instead warned that intervention in the marketplace would merely prolong suffering and create unintended, and harmful, consequences.

(hat tip Greg Ransom)

Thursday, April 28, 2011

Video: Fight of the Century: Keynes vs. Hayek Round Two

The 'Fight of the Century: Keynes vs. Hayek Round Two' is themed on Keynes-Hayek debate over government spending (source: Cafe Hayek)

Monday, October 25, 2010

An Overextended Phisix, Keynesians On Retreat And Interest Rate Sensitive Bubbles

``The belief that a sound monetary system can once again be attained without making substantial changes in economic policy is a serious error. What is needed first and foremost is to renounce all inflationist fallacies. This renunciation cannot last, however, if it is not firmly grounded on a full and complete divorce of ideology from all imperialist, militarist, protectionist, statist, and socialist ideas.-Ludwig von Mises

The Philippine benchmark, the Phisix, remains overextended. (see figure 4) However, deep into major trends, periods of overextension happens, thus this shouldn’t be a surprise.

Figure 4 stockcharts.com: Phisix, Gold and Asian Markets On The Uptrend

And it appears that we could be, perhaps, in one of these unique periods.

I have been expecting the overheated ASEAN markets and the Philippine Phisix (see Relative Strength Index in top window) to take a breather. Apparently this hasn’t been so. My suspicion is that expectations of more monetary accommodation in developed economies may have prevented this from taking place.

Yet for some, this would seem as unsustainable, from which I agree, except that unsustainable can last several years before suffering from a major implosion or a regression to the mean.

The reason for such is that I understand global inflationism as giving rise to serial bubbles. And I don’t share the view that the world is hounded by lack of aggregate demand or liquidity traps or deflation in a world of central banking unless the later would see global monetary authorities submit to the market forces, a political dynamic of which has yielded no indications whatsoever.

And as the conditions of the Phisix (PSEC main window) and of the ASEAN bellwethers have shown, a financial asset boom signifies one of the symptoms of diffusing inflationism taking hold.

And it is also why chart reading cannot be consistently relied upon because they incorporate past data and performances which do not account for the next or prospective actions by the public and the officialdom, as well as their feedback mechanism, given the ever fluid conditions.

And as one would note, the outperformance of the Phisix shadows an equally vibrant Asian ex-Japan markets (P2DOW) and the gold market (GOLD), which means that NONE of the above has manifested the strains of what mainstream permabears calls as the “deflation menace” which is no more than a mainstream Keynesian bugbear that gives justification for authorities to engage in “inflationism”.

The Last Straw For Keynesians: Serial Bubbles

Of course, the prevailing dominance of the Keynesianism seems to be receiving a well deserved smackdown and a comeuppance in Europe as leaders there have opted to observe fiscal discipline[1] than wantonly engage in wasting taxpayer resources on non-market unproductive ‘pet’ projects of politicians in order spruce up the strawman of “aggregate demand” which for them translates to “employment”.

Contra Keynesians, needless consumption of resources on non-productive politically designated activities translates to a loss of capital, a reduction of productivity and subsequently lowered standards of living.

This may be just one of the evolving paradigm shifts that perhaps could serve as an epiphany over the limitations and the hazards of excessive government interventions.

And in contrast to permabears, the adaption of fiscal discipline is surely a path towards sound recovery and a vital source of optimism.

And as the US heads towards elections in the first week of the coming month, we may also see the same results.

Hence, the last straw for Keynesianism following the political retreat will likely be channeled towards the unelected bureaucrats, the central banks.

And for us, central banks are the clear maestros or engineers when fostering bubbles.

And bubble cycles are steeply sensitive to interest rates movements.

Emerging Markets And Fed Policy Rates

BCA Research has an interesting perspective on how emerging markets have reacted to Fed policies (figure 5).

Figure 5 US Global Funds[2]/BCA Research: Emerging Market Correlations

They posit that correlations with the US interest rates had been negative during the mid 90s and positive during the last crisis, where the BCA infers that a dismal global economic growth won’t likely buoy emerging market equities in spite of a Fed liquidity booster.

My comment is that the supposed divergences may not be all that persuasive.

One, the negative correlation in the 90s (left window) may be a function of lagged effects.

Half-way through the rising Fed rates has shown an equally strong emerging market performance which eventually peaked as the Fed rates continued to rise. Hence, the negative correlation may be skewed more towards the interpretation by the analyst more than evidence of strong correlation.

The second but most important factor is that in the 90s, bubbles were centered outside of the US particularly in Emerging Markets—the Tequila (Mexican) Crisis of 1994 and the Asian Financial Crisis of 1997. This implies that the transmission mechanism from Fed policies may have been eclipsed by unsustainable internal imbalances, seen in the said emerging markets, which imploded even as the US economy and her financial markets were left unscathed and continued to perform robustly.

It’s an entirely different story during the period of supposed positive correlation (right window), where the US had been the epicenter of the crisis which essentially rippled throughout the globe and thus the positive correlation.

In short, the major difference between the performances of the emerging markets and the US Fed policy rates, over the two time zones, has been source of the bubbles. Hence the economic growth story relative to Fed rates, for me, seems largely irrelevant.

Overall, interest rates will likely be the most critical factor in ascertaining the sustainability of financial asset inflation in emerging markets, ASEAN, the Philippines and elsewhere, as previously discussed[3].

For as long as the artificially suppressed rates stay low in real and nominal terms and remain unaffected by rising demand for credit or a surge in inflation or that the credit quality or credit ratings of crisis stricken highly levered developed nations remain beyond doubt, then these would be signs of the sweetspot of inflationism.

Interest rates will only start to impact the financial system and the markets once rising rates would render many highly levered unsound projects or speculative endeavors as unprofitable. We are nowhere near this point.

And even if there could be some interim reprieve in the markets, this means for now, party on!

[1] New York Times, Europe Seen Avoiding Keynes’s Cure for Recession, October 20, 2010, Wall Street Journal, Britain's 'Austerity' Lessons, October 22, 2010

[2] US Global Funds, Investor Alert October 22, 2010

[3] See Interest Rates As Key To Stock Market Trends, October 2010

Saturday, May 15, 2010

Is Greece Suffering From Deflation?

``Making Greece’s exporters competitive will be a very difficult task while the country remains in the euro zone. If it does, the likelihood is that there will be a prolonged period of deflation, with wages being reduced in an effort to cut costs." (bold highlights mine)

The mainstream impression is that because Greece is stuck with the rigidities of having a monetary system anchored on the Euro, where devaluation isn't an option, the attendant adjustments to the current debt problems intuitively leads to deflation.

But how true is this perception?

Greece has indeed been suffering from recession throughout most of 2009 until the present as shown in the above annual and quarterly charts from tradingeconomics.com.

Greece has indeed been suffering from recession throughout most of 2009 until the present as shown in the above annual and quarterly charts from tradingeconomics.com. Yet the inflation index registers a hefty jump (annual basis)!

Yet the inflation index registers a hefty jump (annual basis)!In addition, during the depth of the global crisis, Greece's inflation index shows that consumer prices had NOT fallen below zero or to the negative levels! So even if we stick by the mainstream's definition of deflation- of falling consumer prices and not shrinking money supply- deflation has been non-existent in Greece!

And the index has even yet to account for the recent massive bailout.

Bottom line: the mainstream perception, premised on the dominant economic ideology, of how the world operates seems far far far away from reality.

Before I forget, let me add that Greece seems to be suffering from 'stagflation' or a period of slow economic growth, high unemployment and rising prices, a scenario which mainstream has blatantly overlooked in the past (1970s) and seemingly appears to be the same source of vulnerability today.

Tuesday, January 26, 2010

Fear The Boom And Bust- Keynes versus Hayek Rap Video

Update here's the lyrics:

We’ve been going back and forth for a century

[Keynes] I want to steer markets,

[Hayek] I want them set free

There’s a boom and bust cycle and good reason to fear it

[Hayek] Blame low interest rates.

[Keynes] No… it’s the animal spirits

[Keynes Sings:]

John Maynard Keynes, wrote the book on modern macro

The man you need when the economy’s off track, [whoa]

Depression, recession now your question’s in session

Have a seat and I’ll school you in one simple lesson

BOOM, 1929 the big crash

We didn’t bounce back—economy’s in the trash

Persistent unemployment, the result of sticky wages

Waiting for recovery? Seriously? That’s outrageous!

I had a real plan any fool can understand

The advice, real simple—boost aggregate demand!

C, I, G, all together gets to Y

Make sure the total’s growing, watch the economy fly

We’ve been going back and forth for a century

[Keynes] I want to steer markets,

[Hayek] I want them set free

There’s a boom and bust cycle and good reason to fear it

[Hayek] Blame low interest rates.

[Keynes] No… it’s the animal spirits

You see it’s all about spending, hear the register cha-ching

Circular flow, the dough is everything

So if that flow is getting low, doesn’t matter the reason

We need more government spending, now it’s stimulus season

So forget about saving, get it straight out of your head

Like I said, in the long run—we’re all dead

Savings is destruction, that’s the paradox of thrift

Don’t keep money in your pocket, or that growth will never lift…

because…

Business is driven by the animal spirits

The bull and the bear, and there’s reason to fear its

Effects on capital investment, income and growth

That’s why the state should fill the gap with stimulus both…

The monetary and the fiscal, they’re equally correct

Public works, digging ditches, war has the same effect

Even a broken window helps the glass man have some wealth

The multiplier driving higher the economy’s health

And if the Central Bank’s interest rate policy tanks

A liquidity trap, that new money’s stuck in the banks!

Deficits could be the cure, you been looking for

Let the spending soar, now that you know the score

My General Theory’s made quite an impression

[a revolution] I transformed the econ profession

You know me, modesty, still I’m taking a bow

Say it loud, say it proud, we’re all Keynesians now

We’ve been goin’ back n forth for a century

[Keynes] I want to steer markets,

[Hayek] I want them set free

There’s a boom and bust cycle and good reason to fear it

[Keynes] I made my case, Freddie H

Listen up , Can you hear it?

Hayek sings:

I’ll begin in broad strokes, just like my friend Keynes

His theory conceals the mechanics of change,

That simple equation, too much aggregation

Ignores human action and motivation

And yet it continues as a justification

For bailouts and payoffs by pols with machinations

You provide them with cover to sell us a free lunch

Then all that we’re left with is debt, and a bunch

If you’re living high on that cheap credit hog

Don’t look for cure from the hair of the dog

Real savings come first if you want to invest

The market coordinates time with interest

Your focus on spending is pushing on thread

In the long run, my friend, it’s your theory that’s dead

So sorry there, buddy, if that sounds like invective

Prepared to get schooled in my Austrian perspective

We’ve been going back and forth for a century

[Keynes] I want to steer markets,

[Hayek] I want them set free

There’s a boom and bust cycle and good reason to fear it

[Hayek] Blame low interest rates.

[Keynes] No… it’s the animal spirits

The place you should study isn’t the bust

It’s the boom that should make you feel leery, that’s the thrust

Of my theory, the capital structure is key.

Malinvestments wreck the economy

The boom gets started with an expansion of credit

The Fed sets rates low, are you starting to get it?

That new money is confused for real loanable funds

But it’s just inflation that’s driving the ones

Who invest in new projects like housing construction

The boom plants the seeds for its future destruction

The savings aren’t real, consumption’s up too

And the grasping for resources reveals there’s too few

So the boom turns to bust as the interest rates rise

With the costs of production, price signals were lies

The boom was a binge that’s a matter of fact

Now its devalued capital that makes up the slack.

Whether it’s the late twenties or two thousand and five

Booming bad investments, seems like they’d thrive

You must save to invest, don’t use the printing press

Or a bust will surely follow, an economy depressed

Your so-called “stimulus” will make things even worse

It’s just more of the same, more incentives perversed

And that credit crunch ain’t a liquidity trap

Just a broke banking system, I’m done, that’s a wrap.

We’ve been goin’ back n forth for a century

[Keynes] I want to steer markets,

[Hayek] I want them set free

There’s a boom and bust cycle and good reason to fear it

[Hayek] Blame low interest rates.

[Keynes] No it’s the animal spirits

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.”

John Maynard Keynes

The General Theory of Employment, Interest and Money

“The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.”

F A Hayek

The Fatal Conceit

Tuesday, January 05, 2010

Dueling Keynesians Translates To Protectionism?

Not content with assigning blame on the marketplace for last year's crisis, a further step is to engage and rebuke foreign central planners on their elected policies.

For instance, the mainstream tends to focus on global imbalances as a source of the present tensions, where savers mainly from China have been blamed for the troubles in the US, primarily by manipulating the former's currency.

Hence, the prescription from the mercantilist camp is simplistically to demand China to conform to the interests of Americans by revaluing its currency, in order to rebalance the world by regenerating the lost "aggregate demand".

And on the other end, for the Americans to devalue their currency.

In short, a waving of the magical wand in view of currency adjustments will automatically resolve today's problems in the eyes of the politically correct mainstream.

Mainstream seem to see the problem like a shower faucet that can simply be turned hot or cold. It's that simple.

Never mind, if a "manipulated" Chinese currency translates to overall cheaper goods for US and global consumers.

Yet, if we go by the words of Adam Smith consumers and not producers should be the chief concern, ``Consumption is the sole end and purpose of all production; and the interest of the producer ought to be attended to only so far as it may be necessary for promoting that of the consumer. The maxim is so perfectly self-evident that it would be absurd to attempt to prove it. But in the mercantile system the interest of the consumer is almost constantly sacrificed to that of the producer; and it seems to consider production, and not consumption, as the ultimate end and object of all industry and commerce."

The mercantilist policy of forcing currencies to adjust benefits a politically privileged select "producers" more than the consumers or society in general.

Never mind too, that even when some currencies had been repriced, evidence doesn't automatically extrapolate to support expected benefits.

For instance the Japanese yen, which firmed from 350 (in the 70s) to about 100 (today) remains as one of the world's major exporters, and is ranked 8th among the world's most competitive nations in 2009 according to the World Economic Forum is said to be still deficient in domestic demand after all these years of currency strength.

On the other hand, following the recent hyperinflation episode, Zimbabwe has yet to transform into a major exporting powerhouse, while the Philippines, following over 4 decade of devaluation from Php 2 to Php 55 to a US dollar, remains an underdog in terms of goods and services exports.

And if one were to argue in the context of low net wages then the Philippines, India and Indonesia should be powering ahead based on a study by UBS.

As previously argued, currencies aren't everything. Capital and economic structures, political framework and its underlying institutions aside from cultural influences essentially varies from country to country.

Besides mainstream's dogmatism on the currency panacea presumes that all products have similar price sensitivity and is sold to one class of consumers, which isn't anywhere true.

Never mind too that when the mainstream argue about oversimplified nostrums, which is for China to revalue and for the US to devalue, exports as % of the GDP for the US translates to only 11%.

Never mind too that when the mainstream argue about oversimplified nostrums, which is for China to revalue and for the US to devalue, exports as % of the GDP for the US translates to only 11%.This means that devaluation isn't truly directed at boosting exports at the expense of the society, but instead tacitly aimed at reducing outstanding liabilities (about 350% of the GDP) to the benefit of select industries as the banking system and Wall Street.

Never mind too that the world operates on the US dollar standard system where according to the Triffin Dilemma, expanding global trade requires US dollar financing via expanded deficits. It would appear that the mainstream sees no distinction in the economic and trade categorization of China and the US.

Never mind too that the Chinese didn't force Americans to engage in a euphoric mania to buy houses, or for US institutions to engage in excessive risk taking or for the lapses of American regulators who had been caught asleep at the wheel.

Never mind too that Americans had responded to an ad hoc cocktail mix of domestic policies that promoted a bubble:

An extended ultra low interest rate regime, administrative housing policies that encouraged speculation and subsidized mortgage indebtedness, tax policies that tilted the public's incentives towards assuming debt than equity and capital regulations that prompted for regulatory arbitrage via financial innovation.

Yet the mainstreamism parses their perception of 'macro' problems on their perceived one dimensional framework than considering the mutual or bilateral aspects.

NYU's Professior Mario Rizzo asserts that the conflicting interests of international policymakers operating on the Keynesian framework leads to a negation of their system.

From Professor Rizzo,(emphasis added)

``But, as some economists freely admit, the problem is that this pits one country’s interest against another. Either China could gain or the US could gain by manipulating exchange rates.

``Yet I cannot help imagining that a Beneficent World Planner with Keynesian views might think it equitable to permit unemployment to stay high in the US but not in China. Not only is the US safety net better, many of our poor or lower middle class are better off than Chinese workers.

``However, the ideal Keynesian solution, we are told, is to have an internationally coordinated policy of low interest rates. Of course, China has been following a low interest-rate monetary policy; credit is abundantly available. But Chinese bankers and economists have become increasingly worried about bubbles. Should they not be?

``The Keynesian world-view is skeptical of the classical liberal idea of the international harmony of interests under free trade, when the economy is operating at less than full-employment. In this world, there are definite conflicts of interest among nations. A Chinese Keynesian would not have the same views as Krugman. This is not because they differ about theory but because the theory sets up conflict. Such conflict is naturally settled by the partiality of their perspectives.

``If the Keynesians are right, this is another example of traditional microeconomic theories being annulled in their system. I suggest that the formal limitation to conditions of less than full employment is not as stringent as it sounds. Much, perhaps most, of the time the economy will arguably be in either a state of less than full employment or be threatened with some change in the news that will knock it out of full-employment equilibrium."

I would add to Prof Rizzo's position that not only would the result be a nullification but 'settled by the partiality of their perspective' via a non-zero sum game theory called the Prisoner's dilemma or a game theory which "demonstrates why two people might not cooperate even if it is in both their best interests to do so".(wikipedia.org)

This involves policymakers to either cooperate or adversely outdo or undertake policies that clashes with each other, even to the extent that they could be mutually destructive, possibly in the form of protectionism.

And indications of the partiality of political policies in the direction of an internecine trade war between two camps of opposing Keynesian practitioners seems to have emerged.

As observed by John Stossel,

``The administration continues their relentless march towards a Trade War with China:

``Trade disputes between Beijing and Washington over exports of tires, chickens, steel, nylon, autos, paper and salt are multiplying and further damaging the already tense relationship between the two economic powers.

``The Obama administration says it only aims to protect the country's rights, but the Chinese counter that the United States started the whole thing by launching an unprovoked attack".

Again John Stossel, (bold highlights mine)

``This is madness. Even if China is subsidizing their exports, the US consumer benefits at China's expense. A Trade War will simply make everyone worse off (except maybe unions), leaving consumers with fewer choices and higher prices. The Administration needs to swallow its pride and drop the tarriffs, because if the US doesn't lead on free trade, no one will. A recent study by Global Trade Alert, a trade policy think tank based in Europe, shows that global protectionism is on the rise, with the wealthiest nations imposing more than 180 protectionist measures in the last year. Congress, meanwhile, won't even bring the Colombia Free Trade Agreement to a vote".

In the past free market devotees had been deceptively labeled as ruthless 'liquidationists'. We turn the tables and ask, what should we call policymakers and their adherents who espouse on belligerent or hostile short term oriented policies predicated on ideological zealotry that places society at extreme risks?