The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, May 06, 2014

Video: Milton Friedman on the Robin Hood Myth

Friday, November 01, 2013

Video: Milton Friedman on Why Inflation is a disease for a society

Inflation is a tax which is imposed without representation and which nobody has to vote for. And of course, it is a marvelous tax from the point of view of a congressman trying to meet the demands of his constituent for more spending

Thursday, October 17, 2013

Video: Milton Friedman on Inequality and Minimum Wage

The video video on inequality and minimum wage is a good example. (hat tip Cafe Hayek)

Tuesday, August 06, 2013

Video: F.A. Hayek, on Milton Friedman, Monetarism and Monetary Policy

Statistics offer you a no substitute for the detailed knowledge of every single price relations to each other which really guide economic activities. That's a mistaken attempt to overcome our limited knowledge. (2:08)No government is capable of politically or intellectually providing the exact of amount of money which is needed for economic development (2:55)Abolishing the government monopoly to issue money would deprive government of the possibility of pursuing monetary policy. That's what I want (4:40)

Friday, May 10, 2013

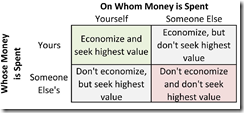

Election Promises are Mostly About Spending Other People’s Money

Elections have mostly been predicated on promises, particularly noble sounding promises backed by the spending of other people’s money.

If You Give Me A Trillion Dollars I'll Show You A Good Time

Thursday, February 14, 2013

Video: Milton Friedman on the Minimum Wage Law

The fact is, the programs labeled as being “for the poor,” or “for the needy,” almost always have effects exactly the opposite of those which their well-intentioned sponsors intend them to have.Let me give you a very simple example – take the minimum wage law. Its well-meaning sponsors there are always in these cases two groups of sponsors – there are the well-meaning sponsors and there are the special interests, who are using the well-meaning sponsors as front men. You almost always when you have bad programs have an unholy coalition of the do-gooders on the one hand, and the special interest on the other. The minimum wage law is as clear a case as you could want. The special interests are of course the trade unions – the monopolistic trade craft unions. The do-gooders believe that by passing a law saying that nobody shall get less than $9 per hour (adjusted for today) or whatever the minimum wage is, you are helping poor people who need the money. You are doing nothing of the kind. What you are doing is to assure, that people whose skills, are not sufficient to justify that kind of a wage will be unemployed.The minimum wage law is most properly described as a law saying that employers must discriminate against people who have low skills. That’s what the law says. The law says that here’s a man who has a skill that would justify a wage of $5 or $6 per hour (adjusted for today), but you may not employ him, it’s illegal, because if you employ him you must pay him $9 per hour. So what’s the result? To employ him at $9 per hour is to engage in charity. There’s nothing wrong with charity. But most employers are not in the position to engage in that kind of charity. Thus, the consequences of minimum wage laws have been almost wholly bad. We have increased unemployment and increased poverty.Moreover, the effects have been concentrated on the groups that the do-gooders would most like to help. The people who have been hurt most by the minimum wage laws are the blacks. I have often said that the most anti-black law on the books of this land is the minimum wage law.There is absolutely no positive objective achieved by the minimum wage law. Its real purpose is to reduce competition for the trade unions and make it easier for them to maintain the higher wages of their privileged members.

Wednesday, February 06, 2013

Video: Milton Friedman: Only Government Create Inflation

(1:37) Any other attribution to growth in inflation is wrong. Consumers don’t produce it. Producers don’t produce it. Trade unions don’t produce it. Foreign sheiks don’t produce it. Oil imports don’t produce it. What produces it is too much government spending and too much creation of money and nothing else.

Monday, January 28, 2013

Video: Milton Friedman on The Social Costs of Middle Class Welfare

Friday, December 28, 2012

Video: Miltion Friedman on the Difference Between Pro Free Enterprise from Pro Business

(3:38) we must separate diagnosis of problems from cure…

Friday, November 09, 2012

Video: Milton Friedman on the Path to Totalitarianism

Comments Professor Don Boudreaux at the Cafe Hayek

The fantasy that the democratic act of centralizing and concentrating decision-making authority and responsibility in the state ensures that decisions are made better and more wisely and more ‘scientifically’ and in ways likely to promote greater human flourishing is the most absurd and dangerous – yet widespread – fantasy that afflicts modern humanity. It is a fantasy to which academics, along with Hollywood celebrities, cling with special and remarkably steadfast faith.

Wednesday, August 01, 2012

Quote of the Day: Preservation of Political Freedom through the Free Markets

What the market does is to reduce greatly the range of issues that must be decided through political means, and thereby to minimize the extent to which government need participate directly in the game. The characteristic feature of action through political channels is that it tends to require or enforce substantial conformity. The great advantage of the market, on the other hand, is that it permits wide diversity. It is, in political terms, a system of proportional representation. Each man can vote, as it were, for the color of tie he wants and get it; he does not have to see what color-the majority wants and then, if he is in the minority, submit.

It is this feature of the market that we refer to when we say that the market provides economic freedom. But this characteristic also has implications that go far beyond the narrowly economic. Political freedom means the absence of coercion of a man by his fellow men. The fundamental threat to freedom is power to coerce, be it in the hands of a monarch, a dictator, an oligarchy, or a momentary majority. The preservation of freedom requires the elimination of such concentration of power to the fullest possible extent and the dispersal and distribution of whatever power cannot be eliminated – a system of checks and balances. By removing the organization of economic activity from the control of political authority, the market eliminates this source of coercive power. It enables economic strength to be a check to political power rather than a reinforcement.

(bold emphasis added)

This from Milton and Rose Friedman’s 1962 book (p.15), Capitalism and Freedom (as quoted by Professor Don Boudreaux at Café Hayek).

The illustrious economist and freedom fighter Milton Friedman celebrated his centennial birthday yesterday. And this stirred up the hornet’s nest about Dr. Friedman’s “love fest” with Keynes.

I’d say that this controversy just shows how people’s views evolve and this applies to Dr. Friedman. For instance, despite promoting activist monetarism, Dr. Friedman eventually declared that he favored the abolishment of the US Federal Reserve see here and here

Nevertheless, while I may not be agreeable to some of his earlier “statist comprises”, he surely has been one of the most eloquent and charismatic promoter and advocate of free markets, in general. That's why many of his videos have been posted here.

Belated Happy Birthday Dr. Friedman

Tuesday, June 19, 2012

Video: Milton Friedman: Minimum Wage Causes Unemployment and Poverty

Thursday, April 26, 2012

Video: Milton Friedman: Abolish the Fed! (2)

Unfortunately, as David Kramer points out at the Lew Rockwell Blog, while Mr. Friedman desired the elimination of the FED, he maintained a pro-central banking stance, which seemed a bizarre paradox.

Friday, February 24, 2012

Transparency Issues on the US Federal Reserve

Former IMF chief Economist Simon Johnson takes the US Federal Reserve to task for their lack of transparency,

The Wall Street Journal reported on Tuesday that during the 1980s the Fed’s board held 20 to 30 public meetings a year, but these dwindled during the Greenspan years to fewer than five a year in the 2000s and “only two public meetings since July 2010.” At the same time, “the Fed has taken on a much larger regulatory role than at any time in history” — including “47 separate votes on financial regulations” since July 2010, The Journal said.

This high level of secrecy is a concern. It is particularly alarming when combined with the disproportionate access afforded to industry participants in the arguments about what constitutes sensible financial reform.

Just on the Volcker Rule — the provision in Dodd-Frank to limit proprietary trading and other high-risk activities by megabanks — Fed board members and staff members apparently met with JPMorgan Chase 16 times, Bank of America 10 times, Goldman Sachs nine times, Barclays seven times and Morgan Stanley seven times (as depicted in a chart that accompanies the Wall Street Journal article).

How many meetings does a single company need on one specific issue? How many would you get?

For example, Americans for Financial Reform, an organization that describes itself as “fighting for a banking and financial system based on accountability, fairness and security,” met with senior Federal Reserve officials only three times on the Volcker Rule. (Disclosure: I have appeared at public events organized by Americans for Financial Reform, but they have never paid me any money. I agree with many of its policy positions, but I have not been involved in any of their meetings with regulators.)

Americans for Financial Reform works hard for its cause, and it produced a strong letter on the Volcker Rule — as did others, including Better Markets and Anat Admati’s group based at Stanford University.

Based on what is in the public domain on the Fed’s Web site, my assessment is that people opposed to sensible financial reform — including but not limited to the Volcker Rule — have had much more access to top Federal Reserve officials than people who support such reforms. More generally, it looks to me as though, even by the most generous (to the Fed) account, meetings with opponents of reform outnumber meetings with supporters of reform about 10 to 1.

According to those records, for example, the Admati group has not yet managed to obtain a single meeting with top Fed officials on any issue, despite the fact that the group’s members are top experts whose input is welcomed at other leading central banks. To my definite knowledge, they have tried hard to engage with people throughout the Federal Reserve System; some regional Feds are receptive, but the board has not been – either at the governor or staff level…

I do not understand the Fed’s attitude and policies — if it is serious about pushing for financial reform. No doubt they are all busy people, but how is it possible they have time to meet with JPMorgan Chase 16 times (just on the Volcker Rule) and no time to meet Anat Admati – not even for a single substantive exchange of views?

People’s actions are driven by incentives or purpose behavior. So are the actions of those running government bureaucracies. The fundamental difference is that the incentives of bureaucrats are prompted for by political exigencies against market participants who are guided by profits and losses.

Researcher Jane Shaw expounds on the public choice theory

Their incentives explain why many regulatory agencies appear to be "captured" by special interests. (The "capture" theory was introduced by the late George Stigler, a Nobel Laureate who did not work mainly in the public choice field.) Capture occurs because bureaucrats do not have a profit goal to guide their behavior. Instead, they usually are in government because they have a goal or mission. They rely on Congress for their budgets, and often the people who will benefit from their mission can influence Congress to provide more funds. Thus interest groups—who may be as diverse as lobbyists for regulated industries or leaders of environmental groups—become important to them. Such interrelationships can lead to bureaucrats being captured by interest groups.

The political relationship between the regulator and the regulated always impels for a feedback mechanism, such as lobbying, as the regulated will always find ways to circumvent or to relax on the rules which restricts or inhibits their actions. And the typical outgrowth to such relationship has always been the lack of transparency, revolving door relationships (Wikipedia: movement of personnel between roles as legislators and regulators and the industries affected by the legislation and regulation and on within lobbying companies), logrolling and corruption. Such "conflict of interests" relationships frequently make regulatory agencies “captured” by special interest groups.

And what is the ultimate cause for this?

To quote Milton Friedman in Capitalism and Freedom

Any system which gives so much power and so much discretion to a few men that mistakes – excusable or not – can have such far-reaching effects is a bad system. It is a bad system to believers in freedom just because it gives a few men such power without any effective check by the body politic – this is the key political argument against an "independent" central bank. But it is a bad system even to those who set security higher than freedom. Mistakes, excusable or not, cannot be avoided in a system which disperses responsibility yet gives a few men great power, and which thereby makes important policy actions highly dependent on accidents of personality. This is the key technical argument against an "independent" bank. To paraphrase Clemenceau, money is much too serious a matter to be left to the Central Bankers.

In short, the kernel of the transparency issues surrounding the US Federal Reserve has been about the negative ramifications from the centralization of power. Conflicts of interests and regulatory capture signifies as issues which won’t go away for as long political power (in relation to money, but applies elsewhere) remain concentrated to a few men. The more the power assumed by central bankers, the greater the risks of political indiscretions and secrecy.

Thus, the transparency issue can be resolved by the abolishment of central banks.

This means, yes, End the Fed.

Wednesday, November 30, 2011

Video: Milton Friedman: Abolish the Fed!

Thursday, October 20, 2011

Greed and the ONE Percent

Greed.

One way to win voters during an election period is to bash a minority group and appeal to the majority for the use of institutional or organized political force to achieve social goals as ‘equality’.

This Wall Street Journal article spares me precious time to parse on the newly released 2011 Wealth report from Credit Suisse, but nevertheless reflects on the du jour political theme: Greed is evil.

Wall Street the Wealth Report Blog’s Robert Frank writes,

Here’s another stat that the Occupy Wall Streeters can hoist on their placards: The world’s millionaires and billionaires now control 38.5% of the world’s wealth

According to the latest Global Wealth Report from Credit Suisse, the 29.7 million people in the world with household net worths of $1 million (representing less than 1% of the world’s population) control about $89 trillion of the world’s wealth. That’s up from a share of 35.6% in 2010, and their wealth increased by about $20 trillion, according Credit Suisse.

The wealth of the millionaires grew 29% — about twice as fast as the wealth in the world as a whole, which now has $231 trillion in wealth.

The U.S. has been the largest wealth generator over the past 18 months, according to the report, adding $4.6 trillion to global wealth. China ranked second with $4 trillion, followed by Japan ($3.8 trillion), Brazil ($1.87 trillion) and Australia ($1.85 trillion).

There are now 84,700 people in the world worth $50 million or more — with 35,400 of them living in the U.S.. There are 29,000 people world-wide worth $100 million or more and 2,700 worth $500 million or more.

The fastest growth in the coming years will be in China, India and Brazil. China now has a million millionaires. Wealth in China and Africa is expected to grow 90%, to $39 trillion and $5.8 trillion respectively, by 2016. Wealth in India and Brazil is expected to more than double to $8.9 trillion and $9.2 trillion respectively.

The article does not specify ‘greed’ or what form of greed constitutes evil. Nevertheless, the article already suggests that the statistics presented by the study could serve as an emotional fodder for the current movement of global protests.

Yet to broaden the perspective let me add more charts from the same study

Worldwide wealth in dollar terms has been expanding

The degree of growth varies from nation to nation

Or even seen from the perspective of region to region. The point is that wealth is relative.

Alternatively, this also means that wealth creation basically reflects on the idiosyncratic structure of a nation’s political economy.

Bottom line: Wealth is NOT created equally and will never be equal.

This runs contrary to socialist utopian abstractions which tries to project ‘equality’ where everyone should not only have same degree of income and wealth or access to public goods, but also perhaps the impossibility of us having to look alike, think alike, share the same value, share similar space for our presence and spouse, etc...

A Wall Street Journal editorial expounds on Asia’s newfound wealth (bold emphasis mine),

Rising net worth ought to be a sign that a growing number of individuals are spotting productive economic opportunities and profiting handsomely in return for the big entrepreneurial risks they've taken. That's certainly how the likes of Steve Jobs or Richard Branson made their billions in the West. There's also a fair share of that in Asia.

But it's also true—and troubling—that so much wealth-creation in the region is related to various forms of government patronage. There are the Hong Kong tycoons who benefit from favorable government land-sale rules, or the Korean chaebol executives who gain from lenient treatment "for the national economic interest" when corporate fraud allegations pop up. China is especially notable for being an environment where friendly connections with government officials can pave the way through a bureaucratic labyrinth, even easing access to capital that's scarce for purely private-sector enterprises.

In a modern free economy it's false to suggest that the wealth of one entrepreneur impoverishes others—the pie can grow for everyone even if it grows faster for some. But wealth amassed through collecting government favors often does impoverish others: those who don't enjoy similar benefits. This fact, and the cynicism it breeds, is a greater threat to social stability than unequal wealth distribution.

In short, wealth is achieved either by political means or by market (economic) means.

The other way to say this is that ‘greed’ as a human trait influences BOTH the market and politics. And the process undertaken to achieve an end (‘equality’) extrapolates to a TRADEOFF between these two means.

For example if society aims to attain ‘equality’ through the markets then the tradeoff equates to lesser political interventions. Yet if society opts to distribute resources ‘equally’ via the political means then market influences will diminish.

The $231 trillion question is which of these two means will function as the more efficient way to arrive at social prosperity.

Thus such tradeoffs suggests that there will either be market inequality or political inequality. The reality is that there will be no equality in whatever sense.

In the real world operating on scarce resources, then equality is no more than a utopian fantasy or mental self-abuse.

To give you an idea how some of the world’s wealth have been politically derived, the following excerpt is from the New Scientist (bold emphasis mine)

The Zurich team can. From Orbis 2007, a database listing 37 million companies and investors worldwide, they pulled out all 43,060 TNCs and the share ownerships linking them. Then they constructed a model of which companies controlled others through shareholding networks, coupled with each company's operating revenues, to map the structure of economic power.

The work, to be published in PloS One, revealed a core of 1318 companies with interlocking ownerships. Each of the 1318 had ties to two or more other companies, and on average they were connected to 20. What's more, although they represented 20 per cent of global operating revenues, the 1318 appeared to collectively own through their shares the majority of the world's large blue chip and manufacturing firms - the "real" economy - representing a further 60 per cent of global revenues.

When the team further untangled the web of ownership, it found much of it tracked back to a "super-entity" of 147 even more tightly knit companies - all of their ownership was held by other members of the super-entity - that controlled 40 per cent of the total wealth in the network. "In effect, less than 1 per cent of the companies were able to control 40 per cent of the entire network," says Glattfelder. Most were financial institutions. The top 20 included Barclays Bank, JPMorgan Chase & Co, and The Goldman Sachs Group.

The list of the biggest interlocking companies

Focusing on the financial behemoths, the above serves as example of crony capitalism or corporatism, where politically privileged private companies benefit from political concessions, regulations, monopolies, subsidies, private-public partnerships or other anti-market policies premised on “privatizing profits and socializing losses” that SHOULD BE differentiated from wealth derived from entrepreneurial or capitalist functions, whose gains are derived from pleasing consumers.

Political wealth (pelf) is mainly extracted from the looting of the taxpayer.

In fact the above only underscores the Austrian economic school’s thesis of a central-bank-cartel based [banking-and-financial sector cronyism] whom has lately been living off tremendous amounts of government subsides, bailouts, central bank QEs and massive interventions in the marketplace all of which has been designed to preserve the current cartel based welfare-warfare state.

Of course not all of the abovestated interlocking companies represent cronyism or politically generated wealth.

Cato’s Dr. Tom Palmer explains the differences of wealth in the video below

Cato’s Dan Mitchell also expounds on differences of entrepreneurship from political privileges in this Fox interview

Finally a good reminder comes from this classic video interview of the illustrious Milton Friedman on Greed, as I earlier posted

The magnificent Milton Friedman quote:

Well, first of all, tell me is there some society you know that doesn’t run on greed? You think Russia doesn’t run on greed? You think China doesn’t run on greed? What is greed? Of course none of us are greedy; its only the other fellow who’s greedy.

The world runs on individuals pursuing their separate interests. The great achievements of civilization have not come from government bureaus. Einstein didn’t construct his theory under order from a bureaucrat. Henry Ford didn’t revolutionize the automobile industry that way. In the only cases in which the masses have escaped from the kind of grinding poverty you’re talking about, the only cases in recorded history are where they have had capitalism and largely free trade. If you want to know where the masses are worst off, it’s exactly in the kinds of societies that depart from that. So that the record of history is absolutely crystal clear: that there is no alternative way so far discovered of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by a free enterprise system.

As said above, greed is a human trait that plagues politicians too.

Here is the list of the richest politicians of the world

Again to re-quote Milton Friedman above

none of us are greedy; its only the other fellow who’s greedy

Wednesday, August 24, 2011

The Coming Global Debt Default Binge: Moody’s Downgrades Japan

The global debt default binge is in process with credit rating downgrades signifying as the initial symptoms.

US credit rating agency Moody’s today downgraded Japan.

From Bloomberg, (bold emphasis mine)

Japan’s debt rating was lowered by Moody’s Investors Service, which cited “weak” prospects for economic growth that will make it difficult for the government to rein in the world’s largest public debt burden.

Moody’s cut the grade one step to Aa3, with a stable outlook, it said in a statement today. Rebuilding costs from the March 11 earthquake and tsunami, along with continuing efforts to contain the Fukushima nuclear crisis, may make it hard for officials to meet their borrowing target this year, it said.

The first Japan downgrade by Moody’s since 2002 reflects deteriorating credit quality across developed nations from Italy to the U.S., which lost its AAA status at Standard & Poor’s this month. While the move adds to the challenges of the next Japanese prime minister, scheduled to be picked next week, the impact on bond yields may be limited by what Moody’s described as domestic investors’ preference for government debt.

The rerating has also been felt in the CDS markets…

The cost of insuring corporate and sovereign bonds in Japan against default increased, according to traders of credit- default swaps. The Markit iTraxx Japan index rose 7 basis points to 153 basis points as of 12:09 p.m. in Tokyo, on course for its highest level since June 10, 2010, according to CMA, which is owned by CME Group Inc. and compiles prices quoted by dealers in the privately negotiated market…

Today’s rating move brings Japan to the same level as China, showing the diverging paths of Asia’s two biggest economies. China replaced Japan as the world’s No. 2 last year and Moody’s has a positive outlook on its ranking

But debt acquisition won’t be curtailed despite the downgrade…

Moody’s said today’s decision was “prompted by large budget deficits and the build-up in Japanese government debt since the 2009 global recession.”

Japan’s public debt is projected to reach 219 percent of gross domestic product next year even before accounting for borrowing to fund reconstruction after the March 11 earthquake, according to the Organization for Economic Cooperation and Development.

The government has amassed a debt of 943.8 trillion yen, according to the Finance Ministry, after two decades of fiscal spending to energize an economy hobbled by the collapse of an asset bubble in 1990 and lingering deflation that’s sapped private demand. The yen’s advance to a post World War II high this year also threatens exports, a main driver of the nation’s economic growth…

The government has pledged to raise the sales tax to 10 percent by the middle of the decade, a rate that would still be below the IMF’s recommendations. The additional revenue is intended to pay for social welfare for the aging population.

Japan’s government plans total spending of 19 trillion yen over five years to rebuild after the magnitude-9 temblor and tsunami that devastated the northeast coast of Japan and triggered the worst nuclear crisis since Chernobyl.

Politicians won’t learn until forced upon by economic realities.

So the initial preemptive response to the anticipated downgrade has been to inflate the system using the recent triple whammy calamity as pretext.

Finally, it certainly is not true that current developments recognized as “fiscal austerity” have been about getting off the welfare state-big government-deficit spending path.

What has been happening instead is the political process where massive amount of resources are being transferred from the welfare state to the banking sector.

Global political leaders are hopeful that by rescuing the politically privileged interconnected banks, they can bring 'normalcy' back to the 20th century designed politically entwined institutions of the welfare state-banking system-central banking system.

Proof?

Just look how the Japanese government (and other developed governments) addresses their dilemma—mostly by raising taxes!

As the illustrious Milton Friedman once said,

In the long run government will spend whatever the tax system will raise, plus as much more as it can get away with. That’s what history tells us. So my view has always been: cut taxes on any occasion, for any reason, in any way, that’s politically feasible. That’s the only way to keep down the size of government.

So tax increases equates to the preservation of the welfare state or big government.

Unfortunately, the system has already been foundering from under its own weight. And importantly, politicians apparently blase to these risks, continue to impose measures that would only increase the system's fragility. What is unsustainable won't last.

Thursday, June 16, 2011

The Myth of Good Government

One my favorite video clips is when Milton Friedman was interviewed by Phil Donahue in the 70s on the topics of greed and virtue.

In addressing Mr. Donahue’s suggestion that governments ought to “reward virtue” Mr. Friedman rebutted (bold emphasis added)

"And what does reward virtue? You think the communist commissar rewards virtue? ...Do you think American presidents reward virtue? Do they choose their appointees on the basis of the virtue of the people appointed or on the basis of their political clout? Is it really true that political self- interest is nobler somehow than economic self-interest? ...Just tell me where in the world you find these angels who are going to organize society for us?"

The illusion of “rewarding virtue” can be seen in the appointments of US President Obama,

From the Politico, (bold emphasis mine)

More than two years after Obama took office vowing to banish “special interests” from his administration, nearly 200 of his biggest donors have landed plum government jobs and advisory posts, won federal contracts worth millions of dollars for their business interests or attended numerous elite White House meetings and social events, an investigation by iWatch News has found.

These “bundlers” raised at least $50,000 — and sometimes more than $500,000 — in campaign donations for Obama’s campaign. Many of those in the “Class of 2008” are now being asked to bundle contributions for Obama’s reelection, an effort that could cost $1 billion...

More (from the same article; emphasis added)...

The iWatch News investigation found:

Overall, 184 of 556, or about one-third of Obama bundlers or their spouses joined the administration in some role. But the percentages are much higher for the big-dollar bundlers. Nearly 80 percent of those who collected more than $500,000 for Obama took “key administration posts,” as defined by the White House. More than half the 24 ambassador nominees who were bundlers raised $500,000.

The big bundlers had broad access to the White House for meetings with top administration officials and glitzy social events. In all, campaign bundlers and their family members account for more than 3,000 White House meetings and visits. Half of them raised $200,000 or more.

Some Obama bundlers have ties to companies that stand to gain financially from the president’s policy agenda, particularly in clean energy and telecommunications, and some already have done so. Level 3 Communications, for instance, snared $13.8 million in stimulus money.

And it’s not just President Obama, but also past President Bush (from the same article; emphasis added)

Public Citizen found in 2008 that President George W. Bush had appointed about 200 bundlers to administration posts over his eight years in office. That is roughly the same number Obama has appointed in a little more than two years, the iWatch News analysis showed.

Well, that’s in the US which supposedly is a country whose political institutions are far sounder than the most of the world.

Yet in the Philippines, it’s been no different.

From Sunstar.com.ph (emphasis added)

FRIENDS and allies of President Benigno Aquino III occupying government positions are not considered “untouchables” and will not be spared from corrections, the President’s spokesman said.

Presidential spokesperson Edwin Lacierda admitted that President Aquino prefers to appoint people whom he has level of comfort but it does not mean that they are not beyond criticism.

So there you have it.

Milton Friedman was correct to debunk the romanticized idea that governments’ reward the virtuous.

Instead, the main beneficiaries of the division of the spoils via political appointments (or political concessions) have been from political allies and political clients, vested ‘rent seeking’ interest groups, families and friends. And this dynamic applies to any form of government.

Realize that political leaders or bureaucrats are human beings or self-interested agents too, whom are subject to the same fragilities (biases, knowledge limitations, different interpretations based on diverse value preferences, cultural orientation, education and etc.) as everyone else.

The difference is in the incentives that governs them with those of economic agents.

Instead of profits and losses, these entities use institutional coercion or violence to redistribute resources based on political exigencies (e.g. populism) with the ultimate aim of annexation and preservation of power and of social image. Thus, the reliance on so-called ‘comfort zones’ as every society operates on diversified interests which continually competes for scarce resources.

Despite the popular notion, Government or the State will NEVER be about virtue or morality.

So for those who stubbornly insist of having “good governments”, be it known that dreams or illusions can last forever.

Thursday, April 07, 2011

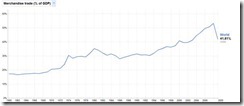

Global Poll: Free Trade Sentiment Gains In Emerging Markets, World

I am delighted to say that despite some short term setbacks, global sentiment on free trade appears to be gaining significant ground over the long term, and importantly, remains a dominant theme for the world.

This from the Economist, (bold emphasis mine)

FAITH in the free market is at a low in the world's biggest free-market economy. In 2010, 59% of Americans asked by GlobeScan, a polling firm, agreed "strongly" or "somewhat" that the free market was the best system for the world's future. This has fallen sharply from 80% when the question was first asked in 2002. And among poorer Americans under $20,000, faith in capitalism fell from 76% to 44% in just one year. Of the 25 countries polled, support for the free market is now greatest in Germany, just ahead of Brazil and communist China, both of which have seen strong growth in recent years. Indians are less enthusiastic despite recent gains in growth. Italy shows a surprising fondness for markets for a place that is uncompetitive in many sectors. In France under a third of people believe that the free market is the best option, down from 42% in 2002.

While free trade sentiment has skidded to low in the US, as a consequence of the crisis, the poll shows of an offsetting surge over most parts of the world.

A broader view of the poll shows this:

From Global Scan

Globescan.com writes, (bold highlights mine)

The results mean that a number of the world’s major emerging economies have now matched or overtaken the USA in their enthusiasm for the free market. The Chinese and Brazilians, 67 per cent of whom regard the free market system as the best on offer, are now more positive about capitalism than Americans, while enthusiasm in India now equals that in the USA, with 59 per cent rating the free market as the best system for the future.

Among the 20 countries polled in both 2009 and 2010, an average of 54 per cent today rate the free market economy as the best economic system, unchanged from 2009.

I am even more pleasantly surprised to see that the Philippines seems more “free market” oriented than some developed economies (e.g. Japan, Australia, France) or to some EM contemporaries (e.g. Indonesia).

Although operating from ground zero, I’d say that the free market sentiment may not be significantly accurate: many (even in the business community or in the elite academe or the media) don’t seem to understand or even resists the notion of free markets at all!

Some local 'free trade' experts see free markets more of a convenience or perhaps even a fad.

But there’s got to be some truth to this. that’s because probably the benefits of free trade (seen via globalization)—broader array of choices, cheaper and more affordable and quality and technologically enhanced products and services plus social mobility (tourism, migration) and more job or earning opportunities from external exposures (trade and remittances)—may have sublimely filtered to the sensibilities of the domestic populace.

Simply said, much of the world, including the Philippines, has been benefiting from increasing exposure to market economies and globalization.

And this has remarkably helped improved free market sentiments, mostly seen on the emerging markets which has been major beneficiaries of trade liberalization.

I am reminded of one of the champions of capitalism and free trade, the great Milton Friedman, in this historic interview about greed who said, (bold highlights mine)

Well first of all tell me, is there some society you know that doesn’t run on greed? You think Russia doesn’t run on greed? You think China doesn’t run on greed? What is greed? Of course none of us are greedy. It’s only the other fella that’s greedy. The world runs on individuals pursuing their separate interests. The greatest achievements of civilization have not come from government bureaus. Einstein didn’t construct his theory under order from a bureaucrat. Henry Ford didn’t revolutionize the automobile industry that way. In the only cases in which the masses have escaped from the kind of grinding poverty that you are talking about, the only cases in recorded history are where they have had capitalism and largely free trade. If you want to know where the masses are worst off, it’s exactly in the kind of societies that depart from that.

Tuesday, January 11, 2011

Video Interview Of Milton Friedman: In Defense of Free Trade

The premises are fundamentally the same today except that the economic actor at the receiving end of protectionism involves China instead of the Japan.

Some notes:

Import dollars eventually find their way back.

There are invisible and visible effects from policies (ala Bastiat). What makes the protectionist advocacy attractive to the public is the visibility of the effects (loss of jobs of steelworkers), while ignoring the invisible benefits (expansion of jobs in the other industries and importantly lower consumer prices).

As for Japanese mercantilism or a policy of unilateral free trade: “Why should we object to the Japanese giving us foreign aid?”