Cowards play to the roaring crowd, and give the crowd what the crowd demands. Cowards buy their cheap glory and security by coddling what is seen and loved, and by attacking what is seen and despised, without regard to the consequences that such coddling and attacking will have in the future. In contrast, a true economic hero is someone who, even at great personal cost, appropriately deals with the unseen future – with the unnoticed and unappreciated potentials – no less than with the noticed and looming here and now.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, August 16, 2013

Quote of the Day: True Heroes

Thursday, April 11, 2013

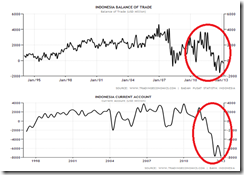

Indonesia’s Boom: Resource Based or Credit Bubble?

The world’s fourth most-populous nation is seeing its economy reshaped as cities on islands including Sumatera and Borneo grow faster than Java, home to the nation’s capital, Jakarta. A transmigration program championed by former President Suharto in the 1980s, combined with China’s demand for palm oil, coal and iron from Indonesia’s rural provinces, helped outlying cities expand as much as 4 percentage points faster than the national average over the past decade.As China’s expansion boosts incomes of miners and farmers in some of the sleepiest and most far-flung corners of Asia, companies from Unilever Plc (ULVR) to Toyota Motor Corp (7203). are flocking to Indonesia’s second-tier cities to tap their rising demand. At the same time, increasing urbanization raises pressure on President Susilo Bambang Yudhoyono to improve infrastructure and strains environmental resources…The boom in second-tier cities has helped swell the middle class. Seven million Indonesians joined their ranks each year for the past seven years, according to a 2011 World Bank report. Private spending grew 5.4 percent in the fourth quarter of 2012 from a year earlier, and consumer confidence in March was 116.8, the eighth straight month the indicator exceeded 115. Pekanbaru, Pontianak, Karawang, Makassar and Balikpapan regions will lead growth, McKinsey says…

As new shops and apartments spring up, the government is trying to keep up, spending more on roads and ports. President Yudhoyono plans to build 30 new industrial zones across the 17,000-island archipelago and to spend $125 billion on infrastructure by 2025, including $12 billion on 20,000 kilometers of roads, enough to go halfway round the world….

The main driver behind the increasing wealth and power of the nation’s regional capitals is a decade-long boom in the nation’s resources. In the past 12 years, palm oil prices have more than tripled, even after a 34 percent drop in the past year. China-led demand has lifted coal, copper and gold as much as fourfold in a decade.

Monday, October 22, 2012

Bastiat on the Twin Doctrines of Luddism and Mercantilism

What misleads the adversaries of machinery and foreign importations is that they judge of them by their immediate and transitory effects, instead of following them out to their general and definite consequences.The immediate effect of the invention and employment of an ingenious machine is to render superfluous, for the attainment of a given result, a certain amount of manual labor. But its action does not stop there. For the very reason that the desired result is obtained with fewer efforts, the product is handed over to the public at a lower price; and the aggregate of savings thus realized by all purchasers enables them to procure other satisfactions; that is to say, to encourage manual labor in general to exactly the extent of the manual labor which has been saved in the special branch of industry which has been recently improved. So that the level of labor has not fallen, while that of enjoyments has risen.Let us render this evident by an example.Suppose there are used annually in this country 10 million hats at 15 shillings each; this makes the sum which goes to the support of this branch of industry £7,500,000 sterling. A machine is invented that allows these hats to be manufactured and sold at 10 shillings. The sum now wanted for the support of this industry is reduced to £5,000,000, provided the demand is not augmented by the change. But the remaining sum of £2,500,000 is not by this change withdrawn from the support of human labor. That sum, economized by the purchasers of hats, will enable them to satisfy other wants, and consequently, to that extent will go to remunerate the aggregate industry of the country. With the five shillings saved, John will purchase a pair of shoes, James a book, Jerome a piece of furniture, etc. Human labor, taken in the aggregate, will continue, then, to be supported and encouraged to the extent of £7,500,000; but this sum will yield the same number of hats, plus all the satisfactions and enjoyments corresponding to £2,500,000 that the employment of the machine has enabled the consumers of hats to save. These additional enjoyments constitute the clear profit that the country will have derived from the invention. This is a free gift, a tribute that human genius will have derived from nature. We do not at all dispute that in the course of the transformation a certain amount of labor will have been displaced; but we cannot allow that it has been destroyed or diminished.The same thing holds of the importation of foreign commodities. Let us revert to our former hypothesis.The country manufactures 10 million hats, of which the cost price was 15 shillings. The foreigner sends similar hats to our market, and furnishes them at 10 shillings each. I maintain that the national labor will not be thereby diminished.For it must produce to the extent of £5,000,000 to enable it to pay for 10 million hats at 10 shillings.And then there remains to each purchaser five shillings saved on each hat, or in all, £2,500,000, which will be spent on other enjoyments — that is to say, which will go to support labor in other departments of industry.Then the aggregate labor of the country will remain what it was, and the additional enjoyments represented by £2,500,000 saved upon hats will form the clear profit accruing from imports under the system of free trade.It is of no use to try to frighten us by a picture of the sufferings that, on this hypothesis, the displacement of labor will entail.For, if the prohibition had never been imposed, the labor would have found its natural place under the ordinary law of exchange, and no displacement would have taken place.If, on the other hand, prohibition has led to an artificial and unproductive employment of labor, it is prohibition, and not liberty, that is to blame for a displacement that is inevitable in the transition from what is detrimental to what is beneficial.

Saturday, September 08, 2012

Public Work Failure: US Stadiums Burn $4 Billion

Devotees of public work (infrastructure) spending, who see such measures as necessity to lift statistical economic growth, should learn from the experience of US taxpayer funded stadium spending binges.

From Bloomberg,

New York Giants fans will cheer on their team against the Dallas Cowboys at tonight’s National Football League opener in New Jersey. At tax time, they’ll help pay for the opponents’ $1.2 billion home field in Texas.

That’s because the 80,000-seat Cowboys Stadium was built partly using tax-free borrowing by the City of Arlington. The resulting subsidy comes out of the pockets of every American taxpayer, including Giants fans. The money doesn’t go directly to the Cowboys’ billionaire owner Jerry Jones. Rather, it lowers the cost of financing, giving his team the highest revenue in the NFL and making it the league’s most-valuable franchise.

“It’s part of the corruption of the federal tax system,” said James Runzheimer, 67, an Arlington lawyer who led opponents of public borrowing for the structure known locally as “Jerry’s World.” “It’s use of government funds to subsidize activity that the private sector can finance on its own.”

Jones is one of dozens of wealthy owners whose big-league teams benefit from millions of dollars in taxpayer subsidies.Michael Jordan’s Charlotte, North Carolina, Bobcats basketball team plays in a municipal bond-financed stadium, the Time Warner Cable Arena, where the Democratic Party is meeting this week. The Republicans last week used Florida’s Tampa Bay Times Forum, also financed with tax-exempt debt. It is the home of hockey’s Lightning, owned by hedge-fund manager Jeffrey Vinik. None of the owners who responded would comment.

$4 Billion

Tax exemptions on interest paid by muni bonds that were issued for sports structures cost the U.S. Treasury $146 million a year, based on data compiled by Bloomberg on 2,700 securities. Over the life of the $17 billion of exempt debt issued to build stadiums since 1986, the last of which matures in 2047, taxpayer subsidies to bondholders will total $4 billion, the data show.

Those estimates are based on what the Treasury could have collected on interest from the same amount of taxable bonds sold at the same time to investors in the 25 percent income-tax bracket, the rate many government agencies assume. In fact, more than half the owners of tax-exempt bonds pay top rates of at least 30 percent, according to the Congressional Budget Office. So they save even more on their income taxes, a system that U.S. lawmakers of both parties and President Barack Obama have described as inefficient and unfair.

There hardly are major nuances when government undertake projects in the form of Public-Private Partnership, monopolies or public outsourcing to private contractors, or other forms of concessions to the politically favored private enterprises. The incentives guiding private enterprises will be directed towards attaining political objectives of the political masters rather than servicing the consumer.

Importantly, not only have these been a waste on taxpayers money, they become sources of rent seeking, corruption and other unethical relationships.

They have even become sources of public disasters.

And as I recently pointed out, the proposed 407 billion pesos spending by the Philippine government on infrastructure has been seen by media as signs of progress. They see this, under the impression that the incumbent government has been “clean” enough to undertake them.

All these signify a grand delusion. Populism ignores economic reality.

The public fails to understand that NO government have the requisite knowledge of the value scales and time preferences of individuals or of the the knowledge of the particular circumstances of time and place (Hayek) from which serves as the foundation of economic activities. Economic activities basically represent a bottom up phenomenon.

Second, government projects are likely designed under the influences of vested interest groups or cronies or if not by bureaucrats who will be designating them to the same groups for implementation.

Third, the private sector collaborators will benefit from the exposure of taxpayers money through guarantees or subsidies.

In many instances, both parties will find ways to game the system.

Moreover, money spent on public works focuses on short term political goals to promote media popular unproductive employment (to generate approval ratings and votes) at the expense of productive enterprises which provides real productive jobs.

As the great Henry Hazlitt wrote,

For then the usefulness of the project itself, as we have seen, inevitably becomes a subordinate consideration. Moreover, the more wasteful the work, the more costly in manpower, the better it becomes for the purpose of providing more employment. Under such circumstances it is highly improbable that the projects thought up by the bureaucrats will provide the same net addition to wealth and welfare, per dollar expended, as would have been provided by the taxpayers themselves, if they had been individually permitted to buy or have made what they themselves wanted, instead of being forced to surrender part of their earnings to the state.

Of course, all these leads to higher taxes and to price inflation (if these debts will be funded by politically directed credit expansion).

Finally, as shown by the US Stadium experience, politicization of resource allocation leads not only to inefficiency, wastage, but to immoral relationships between officials and their private sector lackeys.

The impression where government will be “virtuous” enough to undertake “honest” public work spending has been founded on utopian fantasies.

Friday, June 29, 2012

BSP's loan to the IMF: Costs are Not Benefits

The simmering debate over the proposed loan to the IMF by the Bangko Sentral ng Pilipinas (BSP) can be summarized as:

For the anti-camp, the issue is largely one of purse control or where to spend the government (or in particular the BSP’s money) seen from the moral dimensions.

For the pro-camp or the apologists for the BSP and the government, the argument has been made mostly over the opportunity cost of capital or (Wikipedia.org) or the expected rate of return forgone by bypassing of other potential investment activities, e.g. best “riskless” way to earn money, appeal to tradition, e.g. Philippines has been lending money to the IMF for decades, and with some quirk “foreign exchange assets …are not like money held by the treasury” which is meant to dissociate the argument of purse control with central bank policies.

I will be dealing with latter

This assertion “foreign exchange assets …are not like money held by the treasury” is technically true or valid in terms of FORM, but false in terms of SUBSTANCE.

Foreign exchange assets are in reality products of Central Banking monetary or foreign exchange policies of buying and selling of official international reserves (Wikipedia.org)

This means that foreign exchange assets and reserves are acquired and sold by the BSP with local currency units, or the Philippine Peso, prices of which are set by the marketplace

It is important to address the fact that the local currency the Peso has been mandated as legal tender by The New Central Bank Act or REPUBLIC ACT No. 7653 which says

Section 52. Legal Tender Power. -

All notes and coins issued by the Bangko Sentral shall be fully guaranteed by the Government of the Republic of the Philippines and shall be legal tender in the Philippines for all debts, both public and private

This means that ALL transactions made by the BSP based on the Peso are guaranteed by the Philippine government. This also further implies that foreign exchange assets held by the BSP, which were bought with the Peso, are underwritten by the local taxpayers. Therefore claims that taxpayer money as not being exposed to the proposed BSP $1 billion loan to the IMF are unfounded, if not downright silly. We don’t need to drill down on the content of the balance sheet and the definition of International Reserves for the BSP to further prove this point.

The more important point here: whether foreign exchange or treasury or private sector assets, we are dealing with money.

And money, as the great Austrian professor Ludwig von Mises pointed out, must necessarily be an economic good, the notion of a money that would not be scarce is absurd.

As a scarce good, money held by the National government or by the BSP is NOT money held by the private sector.

Therefore the government or the BSP’s “earnings” translates to lost “earnings” for the private sector.

Costs are not benefits. To paraphrase Professor Don Boudreaux, that the benefit the BSP gets from investing in the asset markets might make sacrificing some unseen private sector industries worthwhile does not mean such sacrifices are a benefit in and of itself.

The public sees what has only been made to be seen by politics. Yet the public does not see the opportunities lost from such actions. Therefore, the cost-benefit tradeoff cannot be fully established.

Besides, any idea that loans to the IMF is risk free is a myth. There is no such thing as risk free. The laws of economics cannot be made to disappear, or cannot become subservient, to mere government edicts as today’s crisis has shown. Remember the IMF depends on contributions from taxpayers of member nations. And for many reasons where taxpayers of these nations might resist to contribute further, and or where the loan exposures by the IMF does not get paid, then the IMF will be in a deep hole.

As I pointed previous out the risk to IMF’s loan to crisis nation are real. There hardly has been anything to enforce loan covenants or deals made with EU's crisis restricted nations.

Also, it is naïve to believe that just because the Philippines has had a track record of lending to the IMF, that such actions makes it automatically financially viable or moral. This heuristics (mental short cut) wishes away the nitty gritty realities of the distinctive risks-return tradeoffs, as well as the moral issues, attendant to every transaction. Here the Wall Street saw applies: Past performance does not guarantee future outcomes.

It is further misguided to believe that the government (in particular the BSP) behaves like any other private enterprises.

As a side note, I find it funny how apologists use logical verbal sleight of hand in attempting to distinguish central bank operations from treasury operations but ironically and spuriously attempts to synthesize the functionality of government and private enterprises.

Two reasons:

1. Central banks are political institutions with political goals.

As the great dean of Austrian School of economics, Murray N. Rothbard pointed out,

The Central Bank has always had two major roles: (1) to help finance the government's deficit; and (2) to cartelize the private commercial banks in the country, so as to help remove the two great market limits on their expansion of credit, on their propensity to counterfeit: a possible loss of confidence leading to bank runs; and the loss of reserves should any one bank expand its own credit. For cartels on the market, even if they are to each firm's advantage, are very difficult to sustain unless government enforces the cartel. In the area of fractional-reserve banking, the Central Bank can assist cartelization by removing or alleviating these two basic free-market limits on banks' inflationary expansion credit.

2. The guiding incentives and structure of operations for government agencies (not limited to the BSP) is totally different from profit-loss driven private enterprises.

Again Professor Rothbard,

Proponents of government enterprise may retort that the government could simply tell its bureau to act as if it were a profit-making enterprise and to establish itself in the same way as a private business. There are two flaws in this theory. First, it is impossible to play enterprise. Enterprise means risking one's own money in investment. Bureaucratic managers and politicians have no real incentive to develop entrepreneurial skill, to really adjust to consumer demands. They do not risk loss of their money in the enterprise. Secondly, aside from the question of incentives, even the most eager managers could not function as a business. Regardless of the treatment accorded the operation after it is established, the initial launching of the firm is made with government money, and therefore by coercive levy. An arbitrary element has been "built into" the very vitals of the enterprise. Further, any future expenditures may be made out of tax funds, and therefore the decisions of the managers will be subject to the same flaw. The ease of obtaining money will inherently distort the operations of the government enterprise. Moreover, suppose the government "invests" in an enterprise, E. Either the free market, left alone, would also have invested the same amount in the selfsame enterprise, or it would not. If it would have, then the economy suffers at least from the "take" going to the intermediary bureaucracy. If not, and this is almost certain, then it follows immediately that the expenditure on E is a distortion of private utility on the market — that some other expenditure would have greater monetary returns. It follows once again that a government enterprise cannot duplicate the conditions of private business.

In addition, the establishment of government enterprise creates an inherent competitive advantage over private firms, for at least part of its capital was gained by coercion rather than service. It is clear that government, with its subsidization, if it wishes can drive private business out of the field. Private investment in the same industry will be greatly restricted, since future investors will anticipate losses at the hands of the privileged governmental competitors. Moreover, since all services compete for the consumer's dollar, all private firms and all private investment will to some degree be affected and hampered. And when a government enterprise opens, it generates fears in other industries that they will be next, and that they will be either confiscated or forced to compete with government-subsidized enterprises. This fear tends to repress productive investment further and thus lower the general standard of living still more.

From here we derive the third view that distinguishes from the two mainstream camps:

Government is NOT supposed to “earn” money. Government should leave the private sector to earn from productive undertakings. Whatever “surpluses” or “earnings” should be given back to the taxpayers. How? By reducing taxes, by cutting down government spending and or by paying down public debt.

The “returns” from these actions will surely outweigh gains made from political speculations. Unfortunately this has been unseen.

As the great Frederic Bastiat once remarked

Between a good and a bad economist this constitutes the whole difference - the one takes account of the visible effect; the other takes account both of the effects which are seen, and also of those which it is necessary to foresee. Now this difference is enormous, for it almost always happens that when the immediate consequence is favourable, the ultimate consequences are fatal, and the converse. Hence it follows that the bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come, - at the risk of a small present evil.

Saturday, May 26, 2012

Agricultural Subsidies Keep Agricultural Commodity Prices High

Wonder why prices of agricultural commodities remain stubbornly lofty despite advances in technology?

Not all have been about "demand" growth from emerging markets.

The widely unseen forces come from central bank money printing, trade restrictions and agricultural subsidies. For instance the US government subsidizes farm owners not to farm (which contributes to a reduction in supplies).

From Wall Street Journal Blog (bold highlights original)

Bottom line: politics distorts demand and supply.More farmers than expected applied to put their land in a government program that pays the farmers not to plant crops and not all of the acres could be accommodated, the U.S. Department of Agriculture said Friday.

The USDA accepted 3.9 million new acres into the Conservation Reserve Program, or CRP, in the latest sign-up period and turned away 600,000 acres.

Interest in the program was so high, a USDA spokesman said, the agency extended the time period to allow farmers to get their applications filed.

A guaranteed return on land is appealing to farmers, especially if the land isn’t well suited for planting crops, said Todd Davis, a senior economist with the American Farm Bureau Federation.

The USDA is anxious to enroll new acres in the program that is aimed at protecting environmentally sensitive land because on Sept. 30 the contracts that keep about 6.5 million acres of potential farm land idle will expire. Contracts take land out of production, thus conserving soil, for either 10 or 15 years.

About 30 million acres are now idled under the program, but the 6.5-million-acre exodus will be the largest ever. The USDA spends about $1.8 billion a year on the program, paying “rent” to land owners.

Tuesday, April 17, 2012

Quote of the Day: Good Economists

It's difficult to be a good economist and simultaneously be perceived as compassionate. To be a good economist, one has to deal with reality. To appear compassionate, often one has to avoid unpleasant questions, use "caring" terminology and view reality as optional

Affordable housing and health care costs are terms with considerable emotional appeal that politicians exploit but have absolutely no useful meaning or analytical worth. For example, can anyone tell me in actual dollars and cents the price of an affordable car, house or myomectomy? It's probably more pleasant to pretend that there is universal agreement about what is or is not affordable.

If you think my criticism of affordability is unpleasant, you'll hate my vision of harm. A good economist recognizes that harm is not a one-way street; it's reciprocal. For example, if I own a lot and erect a house in front of your house and block your view of a beautiful scene, I've harmed you; however, if I am prevented from building my house in front of yours, I'm harmed. Whose harm is more important? You say, "Williams, you can't tell." You can stop me from harming you by persuading some government thugs to stop me from building. It's the same thing with smoking. If I smoke a cigarette, you're harmed – or at least bothered. If I'm prevented from smoking a cigarette, I'm harmed by reduced pleasure. Whose harm is more important? Again, you can't tell. But as in the building example, the person who is harmed can use government thugs to have things his way.

How many times have we heard that "if it will save just one human life, it's worth it" or that "human life is priceless"? Both are nonsense statements. If either statement were true, we'd see lower speed limits, bans on auto racing and fewer airplanes in the sky. We can always be safer than we are. For example, cars could be produced such that occupants could survive unscathed in a 50-mph head-on collision, but how many of us could buy such a car? Don't get me wrong; I might think my life is priceless, but I don't view yours in the same light. I admire Greta Garbo's objectivity about her life. She said, "I'm a completely worthless woman, and no man should risk his life for me."

That’s from Professor Walter E. Williams who channels Frédéric Bastiat’s "That which is seen and unseen" but includes the ethical dimensions.

Read the rest here

Wednesday, March 28, 2012

Quote of the Day: War Equals Presidential Greatness

Our data analysis suggests that wars in which a large percentage of the U.S. population is killed will, all other things equal, cause historians to judge as great a president on whose watch those wars occurred. Certainly, this was the perception of presidents Theodore Roosevelt and John F. Kennedy. It was probably also the perception of other presidents.

This conclusion is troubling. Most presidents, after all, probably want to be thought of as great. When they spend resources on war, they are spending almost entirely other peoples money and lives. They get little credit for avoiding war. Martin Van Buren, for example, effectively avoided a war on the northern border of the United States. How many people know that today?

Indeed, how many people have even heard of Martin Van Buren?Woodrow Wilson, by contrast, inserted the United States into World War I. That was a war that the United States could easily have avoided. Moreover, had the U.S. government avoided World War I, the treaty that ended the war would not likely have been so lopsided. The Versailles Treaty`s punitive terms on Germany, as Keynes predicted in 1919, helped set the stage for WorldWar II.

So it is reasonable to think that had the United States not entered World War I, there might not have been a World War II. Yet, despite his major blunder and more likely, because of his major blunder, which caused over 100,000 Americans to die in World War I, Wilson is often thought of as a great president.

The danger is that modern presidents understand these incentives. Those who want peace should take historians` ratings of presidents seriously. Beyond that, we should stop celebrating, and try to persuade historians to stop celebrating, presidents who made unnecessary wars. One way to do so is to remember the unseen: the war that didn`t happen, the war that was avoided, and the peace and prosperity that resulted. If we applied this standard, then presidents Martin van Buren, John Tyler, Warren G. Harding, and Calvin Coolidge, to name four, would get a substantially higher rating than they are usually given.

That’s from a paper by Professors David Henderson and Zachary Gochenour.

Seeing greatness in war or destruction is an example of the public’s misconceived glorification of the state, which has mostly been a product of indoctrination and political propaganda.

War, according to writer Randolph Bourne, is the health of the state.

Wars are the ramifications of societies that worship the state, where the gullible public are misled to exalt the illusions of the supposed virtues of nationalism by ignoring the destructive real effects of such political actions.

Wars will always be a recourse or an option of any society that depends on political redistribution of resources.

Saturday, March 17, 2012

Quote of the Day: Hidden Cost of Regulations

The truth is that there is no way to calculate the real cost of more regulations, more taxes, and more government control. It’s sort of like Obama insisting that his policies have “saved jobs.” How in the hell does anyone prove he saved jobs? He can’t. It’s a statement carefully crafted for idiots. No rational person with an IQ above 60 would take seriously such an absurd claim.

Likewise, you can’t prove what the cost of a government monstrosity like Obamacare will cost, because it’s impossible to know how many companies it will put out of business, how many jobs will be lost, how much it will destroy the economy, how high interest rates will go, and how bad the coming hyperinflation will be.

The truth is that the cost could be in the trillions of dollars, but no one can ever know for sure because most of the costs are hidden. And the biggest cost would likely be the loss of what is left of our freedom and of the country that was once known as the United States of America.

From libertarian author Robert Ringer

Friday, March 09, 2012

Quote of the Day: The Seen and Unseen

If one-sidedness is the other side of literature’s emphatic concreteness, emphatic awareness of strangers’ pains and pleasures is the unexpected other side of economists Gradgrindian detachment. Consider rent control. The beneficiaries are plain to see: they are the tenants when the rent-control law is adopted. The victims are invisible: they are the future would-be tenants, who will face a restricted supply of rental housing because landowners will have a diminished incentive to build rental housing and owners of existing apartment buildings will prefer to sell rather than rent the apartments in them. Economics brings these victims before the analyst’s eye…. A jurisprudence of empathy can foster short-sighted substantive justice because the power to enter imaginatively into another person’s outlook, emotions, and experiences diminishes with physical, social, and temporal distance.

That’s from Richard Posner’s 1995 Overcoming Law (as quoted by Professor Don Boudreaux).

Wednesday, January 06, 2010

The Lost Decade: US Edition Part 2

Well, America's blemished decade hasn't just been confined to the performance of its stock markets, but likewise reflected on major economic indicators as magnificently shown in the chart below from the Washington Post.

According to the Washington Post, (bold emphasis mine)

According to the Washington Post, (bold emphasis mine)``The U.S. economy has expanded at a healthy clip for most of the last 70 years, but by a wide range of measures, it stagnated in the first decade of the new millennium. Job growth was essentially zero, as modest job creation from 2003 to 2007 wasn't enough to make up for two recessions in the decade. Rises in the nation's economic output, as measured by gross domestic product, was weak. And household net worth, when adjusted for inflation, fell as stock prices stagnated, home prices declined in the second half of the decade and consumer debt skyrocketed."

The obvious lesson is that policies that promote short term prosperity through inflating asset bubbles negates the ephemeral yet unsustainable policy driven gains.

As Ludwig von Mises presciently warned in his magnum opus, ``The boom squanders through malinvestment scarce factors of production and reduces the stock available through overconsumption; its alleged blessings are paid for by impoverishment."

In short, bubble blowing policies simply don't work.

To add, the impact of the fast ballooning Federal regulations as seen in the Federal Register journal [as earlier discussed in Has Lack Of Regulation Caused This Crisis? Evidence Says No] should likewise be considered in the decomposition of the prevailing conditions of the US economy.

To add, the impact of the fast ballooning Federal regulations as seen in the Federal Register journal [as earlier discussed in Has Lack Of Regulation Caused This Crisis? Evidence Says No] should likewise be considered in the decomposition of the prevailing conditions of the US economy.As previously quoted,``According to the Washington, DC-based Competitive Enterprise Institute’s 2009 edition of “Ten Thousand Commandments” by Clyde Crews, the cost of abiding federal regulations is estimated at $1.172 trillion in 2008 – 8% of the year’s GDP. This “regulation without representation,” says Crews, enables the funding of new federal initiatives through the compliance costs of expanded regulations, rather than hiking taxes or expanding the deficit."

In other words, numerous opportunity costs from the costs of compliance, costs of an expanded bureaucracy and the attendant corruption, the cost of the crowding out of private investments, the misdirection and wastage from inefficient use of resources and other forms 'unseen' distortions from the said regulations should also be reckoned with in appraising the economy.

To argue that America's decade have been emblematic of the frailties free markets is to engage in Ipse Dixitism or plain falsehood.

That's because it's easy to use the strawman to blame others, yet the worst is to admit one's mistakes. And passing the buck won't solve anything but agitate for more restriction of individual liberties and possibly provoke unnecessary conflicts.

Monday, December 28, 2009

Philippine Environmental Issues: Government Interventionism And Private Property

While the majority of mainstream media, the church and the public have swallowed hook, line and sinker to the government and academic propaganda that environmental issues have mostly been caused by "market failure" due to "greed", the fact is that markets, composing of acting individuals, respond to incentives.

And unknown to many, government policies shape the incentives that govern the markets.

Here we are reminded of Frédéric Bastiat, who in his classic must read That Which Is Seen and That Which Is Unseen- the book that fundamentally altered my fundamental perception, cautioned us about interpreting on what may seem as the plausible and visible but are fundamentally short term effects as proximate causality.

Instead, we have been advised to dig deeper in order to fathom on the authentic and not the shallow causes; from which mostly have been the baneful long term consequences of populist political actions.

In other words, the politicians and the gullible public severely overestimate on the culpability of the markets while grossly underestimate on the role of government in influencing such behavior.

And it is no different in the populist agenda known as environmentalism.

Here is a splendid article (Kudos to Calixto V. Chikiamco-author of the article) on domestic environmental problems seen in context of how government interventionism, which constricts on private property, have prompted for the aftermath of environmental degredation. [Hat tip: Francis Bonganay]

The intro from the Chikiamco's article on the Businessworldonline, [bold emphasis original]

``When one thinks about being friendly to the environment, one usually counterposes it to private property rights. Along this line of thinking, the government is for the environment and the private sector with its "greed" is anti-environment.

Mr. Chikiamco does a Bastiat,(bold highlights mine)

``How can we then explain the massive denudation of the country? Well, government was and is the culprit.

``The macro-explanation is that the government’s protectionist import-dependent import-substitution economic policy in the fifties encouraged deforestration. This policy, buttressed by an overvalued exchange rate, ensured a persistent trade deficit. To finance the trade deficit, the government encouraged extractive industries -- logging and mining -- in the sixties and seventies to generate foreign exchange. In effect, our natural resources were used to pay for the inefficiency of our protected import-substituting industries.

``However, government exacerbated the situation by two wrong-headed policies.

``One is that it imposed a "reforestation fee" on logging companies, telling the logging companies that the government will assume the responsibility of replanting and sustaining the forests. Of course, the government never did replant and used the reforestation fee wisely. The fee got lost in graft, the government didn’t have the resources and interest to police the forest and keep out the kaingeros (slash-and-burn farmers), and because of population pressures, people started moving upland and cutting trees.

``The other is that the government did not give logging companies secure, long-term property rights. Logging permits were usually short-term (five years or less) and highly political because keeping them was dependent on one’s padrinos and political connections. Because of the long period it takes to plant and grow a tree and recoup one’s investment, the government should have given secure property rights of 25 years or more.

``Property rights analysis, therefore, should be at the core of any plan to preserve and sustain the environment."

In contrast to popular wisdom, in effect, the sordid state of our environment hasn't been due to the aftermath of greed, but rather, of the political failure to uphold its touted responsibility (reforestation fee) and importantly the use of environment to award or dispense political privileges known as economic rent to politically favored affiliates, interest groups or patrons via the curtailment of private property.

I would intuitively suggest that there is more to this, albeit I haven't made an indepth research on it.

In short, government failure have resulted to the present environmental decadence and the public being misled by looking at the wrong dimensions would see the aggravation and not the abatement of the present predicament.

The last words of wisdom from Frédéric Bastiat, ``Between a good and a bad economist this constitutes the whole difference - the one takes account of the visible effect; the other takes account both of the effects which are seen, and also of those which it is necessary to foresee. Now this difference is enormous, for it almost always happens that when the immediate consequence is favourable, the ultimate consequences are fatal, and the converse. Hence it follows that the bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come, - at the risk of a small present evil."

Wednesday, November 18, 2009

Why Free Lunch Policies Sells

In the case of the US, according to mint.com, 47% have ZERO income tax liability in 2009 while 27% will shoulder the burden for the redistribution.

While it is easy to see the numbers and think about noble goals, what is usually missed is that taxes have been punishing the most productive economic agents whom contributes to the gist of the nation's economic growth...to the benefit of the non-productive actors.

Such redistribution leaves a big segment of the population dependent on welfare and vulnerable to scheming political actors.

As Dr Richard Ebeling recently wrote,

``a number of economists, such as Nobel Laureate, James Buchanan, have taught us that the actual politics of government intervention and redistribution has little to do with high-minded notions concerning some hypothetical "public good" or "general interest." The reality of democratic politics is that politicians want campaign contributions and votes to be elected and reelected, and they offer in exchange other people's money. Those who supply those campaign contributions and votes want the money of those others, which they are not able to honestly earn through the free play of open competition in the market place.

``The bias in the democratic process toward political plunder is due to what is called a “concentration of benefits and a diffusion of burdens” that results from various government interventions.

Thursday, October 22, 2009

The Economics of Holidays

The Economist continues,

``STRIKING the right balance between life and work can be tricky. Employees in European countries tend to have a better deal than most, enjoying more days off work than their counterparts in Asia or America. Workers in Finland, France and Brazil have the most generous statutory allowance, getting 30 days of holiday every year. Americans work longer hours: theirs is the only rich country that does not give any statutory paid holiday. (In practice, most workers get around 15 days off.) This work ethic may in turn help to explain Americans' material wealth. Even adjusting for purchasing-power parity, America generates more wealth per person than all but a handful of mainly oil-rich economies such as Norway." (bold highlights mine)

In short, Americans have NO statutory mandates but earn more than their counterparts. The reason is obvious, capital accumulation through worker productivity gains offset losses from mandated "paid holidays".

This reminds me of the Philippine incumbent government's thrust to promote "holiday economics", where most of the holidays have been rescheduled to "extend the weekends" (even if they fall on Saturday or Sundays) allegedly to promote local tourism.

This we had earlier excoriated in Broken Window Fallacy: The Vicious Hidden Costs of "Holiday Economics".

The above commentary from the Economist exposes how local policies are counterproductive, privileges one sector (4% direct 10% indirect) over the entire economy, raises cost of doing business, reduces output, promotes idleness, hedonism and wrong virtues (spending instead of saving) and importantly the "elitist" tendencies of the powers that be.

While the adverse effects can't directly be seen, this contributes to why the Philippines has lagged its neighbors in terms of economic performances.