Interesting comparison between China's crashing stocks and Wall Street's 1929 crash

On Wall Street in 1929, it was the great banking houses of J.P. Morgan and Guaranty Trust Company.

In China today, it’s names like Citic Securities Co. and Guotai Junan Securities Co.

They’re separated by 86 years and 7,300 miles, but Chinese financiers are turning to the same playbook used by their American counterparts to fight a crash that’s wiping out stock-market fortunes on an unprecedented scale.

Investors in China are hoping it works out a lot better this time around.

When five of America’s most-powerful financiers met at the House of Morgan at 23 Wall Street on Oct. 24, 1929, the immediate impact of their plan to pool resources and prop up the market was encouraging: the panic of Black Thursday gave way to a recovery and the New York Times lauded the bankers for putting a floor under share prices.

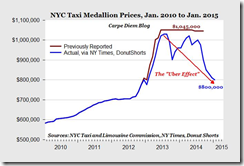

The boost to confidence didn’t last long. The rout resumed by the following Monday, with the Dow Jones Industrial Average losing 13 percent. The gauge would go on to drop another 34 percent over the next three weeks, as the attached chart shows.

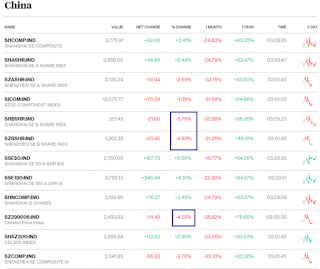

Oh here is an update on Chinese stocks

The Shanghai index closed up 2.41% on a volatile session.

The major benchmark opened 4+% (update:not 4% but 7.8%!!) but by afternoon lost all of the gains to even fall into negative. It’s only from the final tenth of the session where all of today’s gains emanated from.

Moreover, the final segment pump has reportedly been directed at a few companies.

More than two stocks dropped for each one that rose on the Shanghai Composite Index, which climbed 2.4 percent to 3,775.91 at the close. The benchmark gauge was supported by rallies in PetroChina Co. and Industrial & Commercial Bank of China Ltd., the two largest members on the index, amid speculation of buying by state-directed funds. The ChiNext measure of smaller companies sank 4.3 percent, while the Shenzhen Composite Index retreated 2.7 percent.

So perhaps the Chinese government took a page out of Philippine index managers’ afternoon delight pump.

But the result from the government's support has only been to push up the index while the rest of the market remained unconvinced, as shown above.

Divergences imply of weak foundations that has pillared today's market actions. So unless market breadth improves, the menace of a crash remains.

And fascinatingly, such mixed showing came just after the PBOC announced last night that they will backstop margin trades of brokerages via a government agency.

From Wall Street Journal: The People’s Bank of China will inject capital into China Securities Finance Corp., which is owned by the securities regulator, according to the statement by the China Securities Regulatory Commission. The company will then use the funds to expand brokerages’ business of financing investors’ stock purchases.

Will the harrowing Wall Street’s 1929 episode repeat in China?

.bmp)

.bmp)