Representative government cannot express the will of the mass of the people, because there is no mass of the people; The People is a fiction, like The State. You cannot get a Will of the Mass, even among a dozen persons who all want to go on a picnic. The only human mass with a common will is a mob, and that will is a temporary insanity. In actual fact, the population of a country is a multitude of diverse human beings with an infinite variety of purposes and desires and fluctuating wills.In a republic, a majority of the population from time to time decides what a candidate for public office shall have the use of The State’s police power. From time to time, an action of a majority can alter the methods by which men get power, the extent of that power, or the terms upon which they are allowed to keep it. But a majority does not govern; it cannot govern; it acts as a check on its governors. Any government of multitudes of men, anywhere, at any time, must be a man, or few men, in power. There is no way to escape from that fact.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, October 23, 2012

Quote of the Day: The Fiction of the Mass of the People

Monday, October 22, 2012

Graphic of the Day: EUSSR

Take a close look at this promotional poster. Notice anything? Alongside the symbols of Christianity, Judaism, Jainism and so on is one of the wickedest emblems humanity has conceived: the hammer and sickle.For three generations, the badge of the Soviet revolution meant poverty, slavery, torture and death. It adorned the caps of the chekas who came in the night. It opened and closed the propaganda films which hid the famines. It advertised the people's courts where victims of purges and show-trials were condemned. It fluttered over the re-education camps and the gulags. For hundreds of millions of Europeans, it was a symbol of foreign occupation. Hungary, Lithuania and Moldova have banned its use, and various former communist countries want it to be treated in the same way as Nazi insignia.

Monday, October 15, 2012

Quote of the Day: The Folly of Institutional Worship

The individual is king, and all these other things exist for the service of the king. It is a mere superstition to worship any institution, as an institution, and not to judge it by its effects upon the character and the interests of men. It is here that socialist and Catholic make the same grand mistake. They exalt the organization, which is in truth as mere dust under our feet; they debase the man, for whose sake the organization and all other earthly things exist. They posit a priori the claims of the external organization as supreme and transcending all profit and loss account, and they call upon men to sacrifice a large part of their higher nature for the sake of this organization. They both of them sacrifice man, the king, to the mere dead instrument that exists for man’s service.

Tuesday, October 09, 2012

Arts: How Socialism Sapped Creativity and Innovation

Capitalism has its weaknesses. But it is capitalism that ended the stranglehold of the hereditary aristocracies, raised the standard of living for most of the world and enabled the emancipation of women. The routine defamation of capitalism by armchair leftists in academe and the mainstream media has cut young artists and thinkers off from the authentic cultural energies of our time.Over the past century, industrial design has steadily gained on the fine arts and has now surpassed them in cultural impact. In the age of travel and speed that began just before World War I, machines became smaller and sleeker. Streamlining, developed for race cars, trains, airplanes and ocean liners, was extended in the 1920s to appliances like vacuum cleaners and washing machines. The smooth white towers of electric refrigerators (replacing clunky iceboxes) embodied the elegant new minimalism."Form ever follows function," said Louis Sullivan, the visionary Chicago architect who was a forefather of the Bauhaus. That maxim was a rubric for the boom in stylish interior décor, office machines and electronics following World War II: Olivetti typewriters, hi-fi amplifiers, portable transistor radios, space-age TVs, baby-blue Princess telephones. With the digital revolution came miniaturization. The Apple desktop computer bore no resemblance to the gigantic mainframes that once took up whole rooms. Hand-held cellphones became pocket-size.Young people today are avidly immersed in this hyper-technological environment, where their primary aesthetic experiences are derived from beautifully engineered industrial design. Personalized hand-held devices are their letters, diaries, telephones and newspapers, as well as their round-the-clock conduits for music, videos and movies. But there is no spiritual dimension to an iPhone, as there is to great works of art.Thus we live in a strange and contradictory culture, where the most talented college students are ideologically indoctrinated with contempt for the economic system that made their freedom, comforts and privileges possible. In the realm of arts and letters, religion is dismissed as reactionary and unhip. The spiritual language even of major abstract artists like Piet Mondrian, Jackson Pollock and Mark Rothko is ignored or suppressed.Thus young artists have been betrayed and stunted by their elders before their careers have even begun. Is it any wonder that our fine arts have become a wasteland?

Bastiat on the Political Religion of Mercantilism

The advocates of monopoly maintain that the facts are on their side, and that we have on our side only theory.They flatter themselves that this long series of public acts, this old experience of Europe, which they invoke, has presented itself as something very formidable to the mind of Mr. Say; and I grant that he has not refuted it with his characteristic sagacity. For my own part, I am not disposed to concede to the monopolists the domain of facts, for they have only in their favor facts that are forced and exceptional; and we oppose to these, facts that are universal, the free and voluntary acts of mankind at large.What do we say; and what do they say?We say, "You should buy from others what you cannot make for yourself but at a greater expense."And they say, "It is better to make things for yourself, although they cost you more than the price at which you could buy them from others."Now, gentlemen, throwing aside theory, argument, demonstration — all which seem to affect you with nausea — which of these two assertions has on its side the sanction of universal practice?Visit your fields, your workshops, your forges, your warehouses; look above, below, and around you; look at what takes place in your own houses; note your own everyday acts; and say what is the principle that guides these laborers, artisans, and merchants; say what is your own personal practice.Does the farmer make his own clothes? Does the tailor produce the corn he consumes? Does your housekeeper continue to have your bread made at home, after she finds she can buy it cheaper from the baker? Do you resign the pen for the brush to save your paying tribute to the shoeblack? Does the entire economy of society not rest upon the separation of employments, the division of labor — in a word, upon exchange? And what is exchange but a calculation which we make with a view to discontinuing direct production in every case in which we find that possible, and in which indirect acquisition enables us to effect a saving in time and in effort?It is not you, therefore, who are the men of practice, since you cannot point to a single human being who acts upon your principle.But you will say, we never intended to make our principle a rule for individual relations. We perfectly understand that this would be to break up the bond of society, and would force men to live like snails, each in his own shell. All that we contend is that our principle regulates de facto the relations that obtain between the different agglomerations of the human family.Well, I affirm that this principle is still erroneous. The family, the commune, the canton, the department, the province, are so many agglomerations, which all, without any exception, reject practically your principle, and have never dreamt of acting on it. All procure themselves, by means of exchange, those things that it would cost them dearer to procure by means of production. And nations would do the same, did you not hinder them by force.We, then, are the men of practice and of experience; for we oppose to the restriction you have placed exceptionally on certain international exchanges the practice and experience of all individuals and of all agglomerations of individuals, whose acts are voluntary and can consequently be adduced as evidence. But you begin by constraining, by hindering, and then you lay hold of acts that are forced or prohibited, as warranting you to exclaim, "We have practice and experience on our side!"You inveigh against our theory, and even against theories in general. But when you lay down a principle in opposition to ours you perhaps imagine you are not proceeding on theory. Clear your heads of that idea. You, in fact, form a theory as we do; but between your theory and ours there is this difference:Our theory consists merely in observing universal facts, universal opinions, calculations, and ways of proceeding that universally prevail; and in classifying these and rendering them coordinate, with a view to their being more easily understood.Our theory is so little opposed to practice that it is nothing else but practice explained. We observe men acting as they are moved by the instinct of self-preservation and a desire for progress, and what they thus do freely and voluntarily we denominate political or social economy. We can never help repeating that each individual man is practically an excellent economist, producing or exchanging according as he finds it more to his interest to produce or to exchange. Each, by experience, educates himself in this science; or, rather, the science itself is only this same experience accurately observed and methodically explained.But on your side you construct a theory in the worst sense of the word. You imagine, you invent, a course of proceeding that is not sanctioned by the practice of any living man under the canopy of heaven; and then you invoke the aid of constraint and prohibition. It is quite necessary that you should have recourse to force, for you desire that men should be made to produce those things that they find it more advantageous to buy; you desire that they should renounce this advantage, and act upon a doctrine that implies a contradiction in terms.I defy you to take the doctrine, which you acknowledge would be absurd in the relations of individuals, and extend it, even in speculation, to transactions between families, communities, or provinces. By your own admission it is only applicable to international relations.This is the reason why you are forced to keep repeating, "There are no absolute principles, no inflexible rules. What is good for an individual, a family, a province, is bad for a nation. What is good in detail — namely, to purchase rather than produce, when purchasing is more advantageous than producing — that same is bad in the gross. The political economy of individuals is not that of nations" — and other nonsense of the same kind.And to what does all this tend? Look at it a little closer. The intention is to prove that we, the consumers, are your property! — that we are yours body and soul! — that you have an exclusive right over our stomachs and our limbs! — that it belongs to you to feed and clothe us on your own terms, whatever be your ignorance, incapacity or rapacity!No, you are not men of practice; you are men of abstraction — and of extortion.

Thursday, October 04, 2012

In Fantasyland Price Inflation has been Imaginary

Higher energy prices forced annual inflation in advanced economies to rise to 2.0 percent in August from 1.9 percent in July, the OECD said Tuesday."Energy price inflation accelerated sharply to 3.5 percent in August, up from 0.7 percent in July, while food price inflation slowed to 2.1 percent in August, compared with 2.3 percent in July," said the Organisation for Economic Cooperation and Development in a statement.Excluding food and energy, the annual inflation rate slowed to 1.6 percent in August compared with 1.8 percent in July, according to the data for the 34-member OECD.By individual countries, inflation gained pace in Germany, reaching 2.1 percent in August from 1.7 percent in July, while in the United States it advanced to 1.7 percent from 1.4 percent.In Japan, however, consumer prices dipped 0.4 percent in August.Outside the OECD area, annual inflation accelerated in India to 10.3 percent in August from 9.8 percent in July.Inflation also rose in Russia to 5.9 percent from 5.6 percent and in China to 2.0 percent from 1.8 percent, the organisation said.Annual inflation was stable in Brazil from July to August at 5.2 percent and Indonesia at 4.6 percent.

Five years of low interest-rate policies “have not led to increased inflation,” and the public’s expectations for price gains “remain quite stable,” Bernanke told the Economic Club of Indiana.

The tools we have involve affecting financial asset prices. Those are the tools of monetary policy. There are a number of different channels. Mortgage rates, other rates, I mentioned corporate bond rates. Also the prices of various assets. For example, the prices of homes. To the extent that the prices of homes begin to rise, consumers will feel wealthier, they’ll begin to feel more disposed to spend. If home prices are rising they may feel more may be more willing to buy home because they think they’ll make a better return on that purchase. So house prices is one vehicle. Stock prices – many people own stocks directly or indirectly. The issue here is whether improving asset prices will make people more willing to spend. One of the main concerns that firms have is that there is not enough demand…if people feel their financial position is better they’ll be more likely to spend….

Updated to add:

Ironically, the New York Fed's economic model predicts of "explosive inflation"

From Zero Hedge:

Carlstrom et al. show that the Smets and Wouters model would predict an explosive inflation and output if the short-term interest rate were pegged at the ZLB (Zero Lower Bound) between eight and nine quarters. This is an unsettling fi nding given that the current horizon of forward guidance by the FOMC is of at least eight quarters

Monday, October 01, 2012

Currency Manipulation and the Politics of Neo-Mercantilism

The dollar maintains its reserve currency status because it is the least worst of the major four currencies – the US dollar, the British pound, the Japanese yen, and the euro. All four of these currencies are now suffering the effects of a stimulative, expansive, and QE-oriented monetary policy.We must now add the Swiss franc as a major currency, since Switzerland and its central bank are embarked on a policy course of fixing the exchange rate between the franc and the euro at 1.2 to 1. Hence the Swiss National Bank becomes an extension of the European Central Bank, and therefore its monetary policy is necessarily linked to that of the eurozone…When you add up these currencies and the others that are linked to them, you conclude that about 80% of the world’s capital markets are tied to one of them. All of the major four are in QE of one sort or another. All four are maintaining a shorter-term interest rate near zero, which explains the reduction of volatility in the shorter-term rate structure. If all currencies yield about the same and are likely to continue doing so for a while, it becomes hard to distinguish a relative value among them; hence, volatility falls.The other currencies of the world may have value-adding characteristics. We see that in places like Canada, Sweden, and New Zealand. But the capital-market size of those currencies, or even of a basket of them, is not sufficient to replace the dollar as the major reserve currency. Thus the dollar wins as the least worst of the big guys.Fear of dollar debasement is, however, well-founded. The United States continues to run federal budget deficits at high percentages of GDP. The US central bank has a policy of QE and has committed itself to an extension of the period during which it will preserve this expansive policy. That timeframe is now estimated to be at least three years. The central bank has specifically said it wants more inflation. The real interest rates in US-dollar-denominated Treasury debt are negative. This is a recipe for a weaker dollar. The only reason that the dollar is not much weaker is that the other major central banks are engaged in similar policies.

First, they serve as lenders of last resort, which in practice means bailouts for the big financial firms. Second, they coordinate the inflation of the money supply by establishing a uniform rate at which the banks inflate, thereby making the fractional-reserve banking system less unstable and more consistently profitable than it would be without a central bank (which, by the way, is why the banks themselves always clamor for a central bank). Finally, they allow governments, via inflation, to finance their operations far more cheaply and surreptitiously than they otherwise could.

Protectionism, often refuted and seemingly abandoned, has returned, and with a vengeance. The Japanese, who bounced back from grievous losses in World War II to astound the world by producing innovative, high-quality products at low prices, are serving as the convenient butt of protectionist propaganda. Memories of wartime myths prove a heady brew, as protectionists warn about this new "Japanese imperialism," even "worse than Pearl Harbor." This "imperialism" turns out to consist of selling Americans wonderful TV sets, autos, microchips, etc., at prices more than competitive with American firms.Is this "flood" of Japanese products really a menace, to be combated by the U.S. government? Or is the new Japan a godsend to American consumers? In taking our stand on this issue, we should recognize that all government action means coercion, so that calling upon the U.S. government to intervene means urging it to use force and violence to restrain peaceful trade. One trusts that the protectionists are not willing to pursue their logic of force to the ultimate in the form of another Hiroshima and Nagasaki.

People favor discrimination and privileges because they do not realize that they themselves are consumers and as such must foot the bill. In the case of protectionism, for example, they believe that only the foreigners against whom the import duties discriminate are hurt. It is true the foreigners are hurt, but not they alone: the consumers who must pay higher prices suffer with them.

While the size of the credit expansion that private banks and bankers are able to engineer on an unhampered market is strictly limited, the governments aim at the greatest possible amount of credit expansion. Credit expansion is the governments' foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous.

Thursday, September 27, 2012

Quote of the Day: The Mercantilist’s Pareto Strawman

The market economy has never been without its critics and enemies. Those who feel threatened by the market; those who, however unwisely, feel they could do better without it; economists with little imagination; those, like the devotees of Pareto optima, with only too much of it; those who find most entrepreneurs disgusting characters; those attracted by the romantic charm of a feudal order in which they never had to live; social thinkers offended by the raucous tone of modern advertising; and social thinkers who know only too well how to exploit envy and greed in the service of anticapitalistic movements – all these make a formidable array of opponents.

Saturday, September 22, 2012

Quote of the Day: The Fallacy of Redistribution

Those who talk glibly about redistribution often act as if people are just inert objects that can be placed here and there, like pieces on a chess board, to carry out some grand design. But if human beings have their own responses to government policies, then we cannot blithely assume that government policies will have the effect intended.The history of the 20th century is full of examples of countries that set out to redistribute wealth and ended up redistributing poverty. The communist nations were a classic example, but by no means the only example.In theory, confiscating the wealth of the more successful people ought to make the rest of the society more prosperous. But when the Soviet Union confiscated the wealth of successful farmers, food became scarce. As many people died of starvation under Stalin in the 1930s as died in Hitler's Holocaust in the 1940s.How can that be? It is not complicated. You can only confiscate the wealth that exists at a given moment. You cannot confiscate future wealth -- and that future wealth is less likely to be produced when people see that it is going to be confiscated. Farmers in the Soviet Union cut back on how much time and effort they invested in growing their crops, when they realized that the government was going to take a big part of the harvest. They slaughtered and ate young farm animals that they would normally keep tending and feeding while raising them to maturity.People in industry are not inert objects either. Moreover, unlike farmers, industrialists are not tied to the land in a particular country.Russian aviation pioneer Igor Sikorsky could take his expertise to America and produce his planes and helicopters thousands of miles away from his native land. Financiers are even less tied down, especially today, when vast sums of money can be dispatched electronically to any part of the world.If confiscatory policies can produce counterproductive repercussions in a dictatorship, they are even harder to carry out in a democracy. A dictatorship can suddenly swoop down and grab whatever it wants. But a democracy must first have public discussions and debates. Those who are targeted for confiscation can see the handwriting on the wall, and act accordingly.Among the most valuable assets in any nation are the knowledge, skills and productive experience that economists call "human capital." When successful people with much human capital leave the country, either voluntarily or because of hostile governments or hostile mobs whipped up by demagogues exploiting envy, lasting damage can be done to the economy they leave behind.

Thursday, September 20, 2012

Bastiat on Mercantalism: The Candle Maker's Petition

Xenophobia thus calls for the government to institute protectionist measures (mercantilism) to supposedly achieve their brand of utopia. Never mind if history keeps proving that closed economies leads to a path of poverty.

In reality, these xenophobes apply the fallacy of reductio ad absurdum when they oversimplify what truly is a complex world, and forget or deliberately ignore or discount the large influences of technology, globalization, inflationism (boom bust cycles) that reduces capital thereby jobs, as well as other forms of interventionism via regulations and taxes that all affect people’s incentives and time preferences on allocation of capital.

The great Frédéric Bastiat exposes on the absurdity and ridiculosity of the mercantilist argument through the classic The Candle Maker’s Petition (From Mises.org) [bold emphasis mine]

Petition of the Manufacturers of Candles, Waxlights, Lamps, Candlelights, Street Lamps, Snuffers, Extinguishers, and the Producers of Oil, Tallow, Resin, Alcohol, and, Generally, of Everything Connected with Lighting

To the Members of the Chamber of Deputies.

Gentlemen:

You are on the right road. You reject abstract theories, and have little consideration for cheapness and plenty. Your chief care is the interest of the producer. You desire to protect him from foreign competition and reserve the national market for national industry.

We are about to offer you an admirable opportunity of applying your — what shall we call it? — your theory? No; nothing is more deceptive than theory — your doctrine? your system? your principle? But you dislike doctrines, you abhor systems, and as for principles you deny that there are any in social economy. We shall say, then, your practice — your practice without theory and without principle.

We are suffering from the intolerable competition of a foreign rival, placed, it would seem, in a condition so far superior to ours for the production of light that he absolutely inundates our national market with it at a price fabulously reduced. The moment he shows himself, our trade leaves us — all consumers apply to him; and a branch of native industry, having countless ramifications, is all at once rendered completely stagnant. This rival, who is none other than the sun, wages war mercilessly against us, and we suspect that he has been raised up by perfidious Albion (good policy nowadays), inasmuch as he displays toward that haughty island a circumspection with which he dispenses in our case.

What we pray for is that it may please you to pass a law ordering the shutting up of all windows, skylights, dormer-windows, outside and inside shutters, curtains, blinds, bull's-eyes; in a word, of all openings, holes, chinks, clefts, and fissures, by or through which the light of the sun has been in use to enter houses, to the prejudice of the meritorious manufactures with which we flatter ourselves that we have accommodated our country — a country that, in gratitude, ought not to abandon us now to a strife so unequal.

We trust, gentlemen, that you will not regard this our request as a satire, or refuse it without at least first hearing the reasons which we have to urge in its support.

And, first, if you shut up as much as possible all access to natural light, and create a demand for artificial light, which of our French manufactures will not be encouraged by it?

If more tallow is consumed, then there must be more oxen and sheep; and, consequently, we shall behold the multiplication of meadows, meat, wool, hides, and above all, manure, which is the basis and foundation of all agricultural wealth.

If more oil is consumed, then we shall have an extended cultivation of the poppy, of the olive, and of rape. These rich and soil-exhausting plants will come at the right time to enable us to avail ourselves of the increased fertility that the rearing of additional cattle will impart to our lands.

Our heaths will be covered with resinous trees. Numerous swarms of bees will, on the mountains, gather perfumed treasures, now wasting their fragrance on the desert air, like the flowers from which they emanate. Thus, there is no branch of agriculture that shall not greatly develop.

The same remark applies to navigation. Thousands of vessels will proceed to the whale fishery; and in a short time, we shall possess a navy capable of maintaining the honor of France, and gratifying the patriotic aspirations of your petitioners, the undersigned candlemakers and others.

But what shall we say of the manufacture of articles de Paris? Henceforth, you will behold gildings, bronzes, crystals in candlesticks, in lamps, in lustres, in candelabra, shining forth in spacious showrooms, compared with which, those of the present day can be regarded but as mere shops.

No poor resinier from his heights on the seacoast, no coal miner from the depth of his sable gallery, but will rejoice in higher wages and increased prosperity.

Only have the goodness to reflect, gentlemen, and you will be convinced that there is perhaps no Frenchman, from the wealthy coalmaster to the humblest vendor of lucifer matches, whose lot will not be ameliorated by the success of this our petition.

We foresee your objections, gentlemen, but we know that you can oppose to us none but such as you have picked up from the effete works of the partisans of Free Trade. We defy you to utter a single word against us which will not instantly rebound against yourselves and your entire policy.

You will tell us that, if we gain by the protection we seek, the country will lose by it, because the consumer must bear the loss.

We answer:

You have ceased to have any right to invoke the interest of the consumer; for, whenever his interest is found opposed to that of the producer, you sacrifice the former. You have done so for the purpose of encouraging labor and increasing employment. For the same reason you should do so again.

You have yourselves obviated this objection. When you are told that the consumer is interested in the free importation of iron, coal, corn, textile fabrics — yes, you reply, but the producer is interested in their exclusion. Well, be it so; if consumers are interested in the free admission of natural light, the producers of artificial light are equally interested in its prohibition.

But, again, you may say that the producer and consumer are identical. If the manufacturer gains by protection, he will make the agriculturist also a gainer; and if agriculture prospers, it will open a vent to manufactures.

Very well! If you confer upon us the monopoly of furnishing light during the day, first of all we shall purchase quantities of tallow, coals, oils, resinous substances, wax, alcohol — besides silver, iron, bronze, crystal — to carry on our manufactures; and then we, and those who furnish us with such commodities, having become rich will consume a great deal and impart prosperity to all the other branches of our national industry.

If you urge that the light of the sun is a gratuitous gift of nature, and that to reject such gifts is to reject wealth itself under pretense of encouraging the means of acquiring it, we would caution you against giving a death-blow to your own policy.

Remember that hitherto you have always repelled foreign products, because they approximate more nearly than home products the character of gratuitous gifts. To comply with the exactions of other monopolists, you have only half a motive; and to repulse us simply because we stand on a stronger vantage-ground than others would be to adopt the equation + × + = − ; in other words, it would be to heap absurdity upon absurdity.

Nature and human labor cooperate in various proportions (depending on countries and climates) in the production of commodities. The part nature executes is always gratuitous; it is the part executed by human labor that constitutes value and is paid for.

If a Lisbon orange sells for half the price of a Paris orange, it is because natural, and consequently gratuitous, heat does for one what artificial, and therefore expensive, heat must do for the other.

When an orange comes to us from Portugal, we may conclude that it is furnished in part gratuitously, in part for an onerous consideration; in other words, it comes to us at half price as compared with those of Paris.

Now, it is precisely this semigratuity (pardon the word) that we contend should be excluded. You say, How can national labor sustain competition with foreign labor, when the former has all the work to do, and the latter only does one-half, the sun supplying the remainder?

But if this half, being gratuitous, determines you to exclude competition, how should the whole, being gratuitous, induce you to admit competition? If you were consistent, you would, while excluding as hurtful to native industry what is half gratuitous, exclude a fortiori and with double zeal that which is altogether gratuitous.

Once more, when products such as coal, iron, corn, or textile fabrics are sent us from abroad, and we can acquire them with less labor than if we made them ourselves, the difference is a free gift conferred upon us. The gift is more or less considerable in proportion as the difference is more or less great.

It amounts to a quarter, a half, or three-quarters of the value of the product, when the foreigner only asks us for three-fourths, a half, or a quarter of the price we should otherwise pay. It is as perfect and complete as it can be when the donor (like the sun in furnishing us with light) asks us for nothing.

The question, and we ask it formally, is this: Do you desire for our country the benefit of gratuitous consumption or the pretended advantages of onerous production? Make your choice, but be logical; for as long as you exclude, as you do, coal, iron, corn, foreign fabrics, in proportion as their price approximates to zero, what inconsistency it would be to admit the light of the sun, the price of which is already at zero during the entire day!

At the end of the day, in the world of politics, logic and the basic law of demand and supply gets swallowed by the black hole of preposterous political correctness.

As Julius Caesar once said,

Men in general are quick to believe that which they wish to be true

Monday, September 17, 2012

Quote of the Day: Economic Value of Politicians

By what insane calculation is a congressional candidate more representative of society than an entrepreneur, a corporate director, or a taxicab driver?

I am sharing Cafe Hayek's Professor Don Boudreaux quote of Steve Landsburg’s 1997 book, Fair Play (original emphasis) page 35

This quote reminds me of a popular and controversial media personality who recently said in a radio show that for a particular case, he only helps retired public officials because they have done “public service” to society and won’t do the same for civilians.

The announcer seem to have forgotten that that the food he eats comes from the private sector, the clothes he wears comes from the private sector, the car he drives comes from the private sector, the mobile phone he uses comes from the private sector, the microphone and sound system he uses to air his self-righteous junk comes from the private sector, the bed he sleeps on comes from the private sector…practically everything he does (directly and indirectly—even government roads may have been subcontracted to the private sector or at least sources their raw materials from the private sector) comes from the private sector which he so belittles.

And what of public officials? Public officials live off from the resources generated by the private sector to supposedly do some “public service” which in reality the private sector can provide. In short, public officials exists because of the private sector from whom the former forcibly extracts resources from the latter.

In the world of politics, what is self-evident can hardly be seen. Moreover, people are seduced to noble sounding economic naiveté themes, as well as, to morally bankrupt idea of collectivism (nationalism) or to the servitude to the state.

Monday, August 20, 2012

Phisix: Choosing The Ideology behind Profitable Actions

We have been trained to look for godliness, virtue, direction, and truth outside ourselves, in some agency external to ourselves. Such beliefs have been generated largely by those who have either a religion or a political system to fasten upon the necks of their fellow beings. It is through such thinking that some have been able to control the thoughts and actions of others by attacking their victims' sense of self-capacity and worthiness to function in the world.-Butler Shaffer

There will be only 3 trading sessions in the coming week because of the extended holidays (on Monday Eidul Fitar and Tuesday Ninoy Aquino Day).

This means that the public will likely be in a vacation mode. So unless some externally driven event will incite unusual volatility that may trigger a local response, I expect the market’s mood to be largely lackadaisical. So whatever direction the Phisix closes the week, the average trading volume will likely be weaker.

Since momentum in the global markets appear sprightly; the odds for a shock seem unlikely.

But given the fragility of current conditions, no one can really tell.

Update on Holiday Economics

As a side note, the string of political holidays only depletes productivity from the economy. The mainstream will argue that “holiday economics” promotes tourism and tourism related industries from which should support the economy. But again, costs are not benefits.

While holidays indeed promote tourism and allied industries, such thinking ignores the unseen costs borne by such political holiday statutes.

As I previously wrote[1],

local policies are counterproductive, privileges one sector (4% direct 10% indirect) over the entire economy, raises cost of doing business, reduces output, promotes idleness, hedonism and wrong virtues (spending instead of saving) and importantly the "elitist" tendencies of the powers that be.

For an update, according to World Travel & Tourism Council[2], the direct contribution of Travel & Tourism to GDP was PHP194.7bn (2.0% of total GDP) in 2011, the total contribution of Travel & Tourism (meaning tourism related industries) to GDP was PHP830.8bn (8.5% of GDP) in 2011. In terms of employment, direct employment from the industry accounted for 778,000 jobs or 2.1% of total employment and the total contribution of the industry to employment, including jobs indirectly was 9.6% of total employment (3,547,500 jobs).

Back of the napkin calculation tells us that ‘Holiday economics’ means supporting 8.5% (of GDP) against the 91.5% of the economy, and in terms of employment, 9.6% as against 90.4% of the labor force.

Holiday economics has been premised on promoting the interests of the elite at the expense of the underprivileged or the ‘poor’.

Market Internals Suggests of Healthy Correction Phase

In the Philippine equity markets, part of what I expected occurred last week.

The recent selloff in the mining sector seems to have percolated into the broader markets.

The Phisix languished, down 1.07% this week, weighed by all major sectoral indices except for the mining and oil which defied the broad market correction

As I wrote last week[3],

I lean on condition (B) or where the bear market of the mining sector will likely percolate into the general market, due to growing risks of contagion.

However everything really depends on how and what future policies will be conducted, especially in the US, as previously discussed.

So the correction phase appears to be another rotational process which essentially shifts the flow of sentiment from the mining sector to the general market and vice versa.

I seriously doubt that the domestic mining sector as having reached an inflection point or has “bottomed” out. I would like to be convinced based on evidences from internal and external forces. Instead I suspect that this week’s rally has been more of a dead cat’s bounce, from a vastly oversold position, than from a recovery.

The correction phase can be seen in the modest deterioration of the market breadth. The rotational process, as well as, the modest decline of the general market should be seen as a healthy profit taking process.

The continuity of the benign conditions, as I have repeatedly been pointing out, will depend on external developments.

Superstitious Beliefs versus Rigorous Analysis

Many have assigned the current weakness in the local equity market as having been influenced by the Chinese tradition of the “Ghost Month” (August 17 to September 15, 2012)[4]

The tradition suggests that many activities such as evening strolls, traveling, moving house, or starting a new business or even swimming can bring about bad luck, thus believers refrain from doing them.

People’s beliefs are acquired mostly through three ways[5], through tradition (handed down through generations), through persons of authority (whose opinions people take as truth and accept or assimilate them, e.g. parents, teachers, religious leaders, politicos, experts and etc…) and or from reason and evidence.

Based on reason, there has been little empirical evidence to support such claims.

While I don’t have the exact figures for the said periods, I used the annual % monthly returns of August (left window) and September (right window) of the Phisix since 1985 to see its validity.

As one would note that in the above chart, from both August and September windows, negative returns have not been a predominant feature. Instead we see sporadic fluctuations between positive and negative zones.

Examining further, one would note that the direction of returns have largely been driven by the dominant trend of the marketplace: Returns have either been negative or marginally positive during cyclical bear market periods, while in bull markets, returns have mostly been positive.

One interesting aspect is that sharp market volatilities has characterized September returns, where gains and losses have been magnified.

I think this seem to square with the seasonal activities in the US where September tends to be the worst month for stocks as exhibited by the Average Monthly gain by the Dow Jones Industrials since 1950[6].

And the sharp volatility compounded by negative returns could have been due to the simultaneous large liquidations of savings, which includes sales of stocks, to fund major consumption expenses by US households, particularly spending for new school clothes for children, winter clothes and other weather related consumption activities. Fueled by tight monetary conditions, the massive outlays for consumption may have served as catalyst for the notorious September-October window which has been seasonally prone to market crashes[7]

The lesson that can be gleaned from the above is that beliefs based on superstitions and or the tendency of many to employ the availability heuristics—mental shortcuts based on what we can remember rather than from complete data[8]—are hardly useful substitutes for thorough investigation and rigorous analysis of the marketplace from which to project the future or even explain markets on an ex-post basis.

On the contrary, I would say that the recent weakness of the Phisix can be traced to a single axiom: NO Trend Moves in a Straight Line.

Given that the Philippine Phisix, which has outperformed most of the world’s equity benchmarks on a year to date basis, has shown signs of being overbought and overextended, then a salutary reprieve should be a natural state.

In short, profit taking is an inherent process of the financial markets.

Year-to-date, Thailand seems to have successfully passed the Philippines (19.37 versus 19.1% respectively) to take the region’s leadership. Yet both managed to keep some distance from last year’s leader Indonesia, as well as, Malaysia who remains the laggard among the ASEAN majors.

Meanwhile Malaysia’s year-to-date returns largely understates the real action—Malaysia has been the only bourse in the region (if not the world) trading at record highs.

I think that in as much as rotations occur within the domestic market, the same dynamic will likely influence activities of the region’s equity bourses.

As I previously noted[9],

given the rotational dynamics, we might see some “catch up” play or the narrowing of the recent wide variance between the laggards and leaders overtime. But this doesn’t intuitively mean that such gaps will close.

So far, only the Phisix has backtracked while Thailand’s SET has still been in high Octane. On the other hand, Indonesia has slightly narrowed the gap with the Phisix.

Risk ON Stands on Perpetual Promises of Rescues

The reason why the world’s bourses have turned conspicuously positive has been due to the recent return of the RISK ON environment.

The following represents mainstream media’s attribution of the strong performance of global equity markets for the week.

European stocks, from Businessweek/Bloomberg[10]

European stocks rose to the highest level since July 2011, extending gains for an 11th week, as investors anticipated policy makers will stimulate the euro-area economy and German growth retreated less than forecast.

Asian stocks, from another Businessweek/Bloomberg[11]

Asian stocks rose this week, with the benchmark index posting its longest weekly winning streak since March, after China’s Premier Wen Jiabao said there’s more room to adjust monetary policy and U.S. economic reports signaled strength in the world’s largest economy.

In spite of indefatigable pledges by Chinese authorities, China’s bellwether, the Shanghai index remains in doldrums seemingly unaffected by the global RISK ON landscape.

In fact, China’s authorities have admitted to recent signs of outflows of hot money[12] as domestic banks became net sellers of foreign exchange or 3.8 billion yuan ($597 million), which for me could be worrying signs of a popping bubble.

Meanwhile US stock markets according to the Reuters[13]

The S&P 500 held near a four-year high on Friday, and the market's key gauge of anxiety sank to its lowest since 2007, suggesting a belief that the problems stressing investors might be closer to a resolution…

The S&P 500 made a solid move above the closely watched 1,400 level in the last session, posting its biggest gain in two weeks. But trading volume remained low…

The S&P 500 has risen 2.8 percent in August and about 11 percent since a year low in June as traders eye some encouraging U.S. jobs data and highly anticipated policy meetings at the European Central Bank and the Federal Reserve in September.

In essence, the gist of today’s rally in the global stock markets has been galvanized around intensifying expectations that global central banks and governments will effectively rescue the markets.

And tidbits of good news are seen as signs of selective confirmation of a recovery. On the other hand, bad news have been interpreted as having to add pressure on governments to intervene, the result of which is to supposedly deliver good news—a recovery.

In other words, today’s global equity markets investors seem to have been strongly conditioned to carry expectations that markets can only move in one direction: UP. It can be said that the circularity of this logic entails a “heads I win, tails you lose” market environment from political guarantees. Such is the confirmation bias which intensely embodies the mainstream view.

Such has also been the reason why markets everywhere have increasingly been politicized as participants have been oriented to see rising markets as a form of political entitlement.

Divergences Aplenty

It has been interesting to note that, yes corporate fundamentals may have posted some positive signs but again everything depends on the reference points.

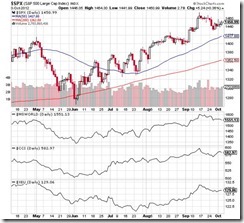

From the big picture, the positive signs emitted by the S&P 500 have not been convincing.

Aside from low volume, the divergences I previously mentioned, such as earnings, global economy, industrial and non-industrial activities[14], market internals, divergent signs on sub-sectors such as Transportation (Dow Theory)[15] or even the Russell 2000, have shown marginal and not substantial improvements, in spite of the near four year highs by the S&P 500.

A good example is the current divergence in the % of companies beating earnings and revenue estimates. While the above has shown positive results, it seems that US markets have been cheering what seems like diminishing returns or a decline in positive developments. (chart above from Bespoke Invest[16])

chart from Bespoke Invest

Again recent highs of the US markets have been accompanied by narrowing market breadth.

This means the drivers responsible for lifting the equity benchmarks have mainly been big cap issues. Yet the accounts of publicly listed companies at 52-week highs have also been diminishing. If such trend should continue then this entails limited upside for the S&P[17].

Finally the current rally in the US markets seems to have departed from the previous trend relative to gold.

In the past, rallying US markets (represented by the S&P 500) came at the heels of a more powerful run in gold (see lower window) and in other major commodities. So even as the S&P rose, gold climbed faster, thus the declining ratio between the S&P and gold.

The implication is that the RISK ON environment then had been broader which also meant that the rally had a firmer footing.

Today’s RISK ON environment seems to be concentrated on the equity markets and the junk bond markets where Gold and commodities has vastly underperformed, thus, the rising ratio between S&P and gold.

Junk bonds have been posting record issuance. Companies have been taking advantage of zero bound rates and strong demand which has brought down yields of speculative bonds to a few points away from the record lows reached during May of 2011[18]. Such yield chasing phenomenon exhibits the nature of today’s yield chasing rampant punting and speculations.

This means that gold’s modest rise has not been consistent with a strong RISK ON landscape.

The selective risk appetite and the apparent narrowing of asset selections mean that the markets could be highly susceptible to sudden changes of expectations or to mood swings: thus elevating the current risk profile of would be buyers.

Current Conditions Remain Highly Fragile

I have long been making this point: For as long as the US won’t fall into a recession or won’t suffer from a financial shock that could lead to a global recession, the recent decline in the Phisix extrapolates to a healthy profit taking process.

That said, a five to ten percent decline from the peak or the range at 4,825-5,080 could prove to be a spring board for the next record high. This is all conditional on the unfolding events abroad, and should not be read as one-size-fits all analysis.

Given the nature from which the recent global rally has been anchored, i.e. expectations from promises of rescues, I still remain highly apprehensive, or I will not write off the risks of possible sharp changes in expectations that may precipitate the current moderate RISK ON conditions to a swift and dramatic RISK OFF environment.

The contagion risks are real, which means current conditions remain highly fragile. Rising markets have not smoothened out all the underlying stresses.

Given the enormous distortions of the markets from repeated interventions, the best is to watch the interplay of stimulus-response between markets and policymakers.

To close, let us not forget our beliefs essentially drive our actions, rightly or wrongly. As the great Ludwig von Mises wrote[19],

In acting man is directed by ideologies. He chooses ends and means under the influence of ideologies. The might of an ideology is either direct or indirect. It is direct when the actor is convinced that the content of the ideology is correct and that he serves his own interests directly in complying with it. It is indirect when the actor rejects the content of the ideology as false, but is under the necessity of adjusting his actions to the fact that this ideology is endorsed by other people. The mores of their social environment are a power which people are forced to consider. Those recognizing the spuriousness of the generally accepted opinions and habits must in each instance choose between the advantages to be derived from resorting to a more efficient mode of acting and the disadvantages resulting from the contempt of popular prejudices, superstitions, and folkways.

[1] See The Economics of Holidays, October 22, 2009

[2] World Travel & Tourism Council Travel & Tourism Economic Impact 2012 Philippines

[3] See Philippine Mining Index: Will The Divergences Last?, August 13, 2012

[4] Mandarin Language Ghost Month and Ghost Festival About.com

[5] Green Alexander, The Noblest Expression of the Human Spirit, Early To Rise, October 6, 2010

[6] Chart of the Day Dow-Average Monthly Gains

[7] See Austrian Business Cycle and September Market Crashes, June 27, 2012

[8] Changingofminds.org Availability Heuristic

[9] See Phisix and ASEAN Equities in the Shadow of Contagion Risks July 22, 2012

[10] Businessweek/Bloomberg, European Stocks Rise for 11th Week on Stimulus Bets, GDP August 17, 2012

[11] Businessweek/Bloomberg, Asia Stocks Rise for a Third Week on Wen Comments, U.S. Economy August 17, 2012

[12] Wall Street Journal Investors Shift Money Out of China August 14, 2012

[13] Reuters.com US STOCKS-S&P 500 up for 6th week; fear index hits 5 yr low, August 18, 2012

[14] See Why Current Market Conditions Warrants a Defensive Stance, July 9, 2012

[15] See Phisix: Managing Through Volatile Times, August 6, 2012

[16] Bespoke Invest Final Earnings and Revenue Beat Rates August 17, 2012

[17] Bespoke Invest Wanted: More New Highs August 17, 2012

[18] Bloomberg.com Junk-Bond Sales Soar To Record In August: Credit Markets, August 17, 2012

[19] Mises, Ludwig von 2. The Role of Power XXIII. THE DATA OF THE MARKET Human Action, Mises.org