The US government’s grip on domestic and international politics seem to be slipping fast.

First, the US financial imperialist plan to isolate and drop Russia from the global financial system has backfired.

If Vladimir Putin is remotely capable of laughter (the jury is out on that one…) then he’s probably doing so right now.

Russia is once again Arch-Enemy of the United States. It’s like living through a really bad James Bond movie, complete with cartoonish villains.

And for the last several months, the US government has been doing everything it can to torpedo the Russian economy, as well as Vladimir Putin’s standing within his own country.

The economic nuclear option is to kick Russia out of the international banking system. And the US government has been vociferously pushing for this.

Specifically, the US government wants to kick Russia out of SWIFT, short for the Society of Worldwide Interbank Financial Telecommunications.

That’s a mouthful. But SWIFT is an important component in the global banking system because it lays the foundation for banks to communicate and transfer funds with one another.

It’s a network protocol of sorts. Whenever a bank in Pakistan does business with a bank in Portugal, the funds will clear through the SWIFT network.

According to the SWIFT itself, they link over 9,000 financial institutions worldwide in over 200 countries, which transact 15 million times per day.

Bottom line, being part of SWIFT is critical to conducting business with the rest of the world. And if Russia gets kicked out of SWIFT, it would be a disaster.

Now, SWIFT is technically organized as a ‘Cooperative Society’ and governed by a board of directors.

There are 25 available board seats, and each seat is allocated for a three-year term to a specific country.

The United States, Belgium, France, Germany, UK, and Switzerland each hold two seats. A handful of other countries hold just one seat. And of course, most countries don’t hold any seats at all.

Here’s what’s utterly hilarious—

On Monday afternoon, not only did SWIFT NOT kick Russia out… but they announced that they were actually giving a BOARD SEAT to Russia.

This is basically the exact opposite of what the US government was pushing for.

Awkward…

But this story is even bigger than that.

Because at the same time that the US government isn’t getting its way with SWIFT, the Chinese are busy putting together their own version of it called CIPS.

CIPS stands for the China International Payment System; it’s intended to be a direct competitor to SWIFT, and a brand new way for global banks to communicate and transact with one another in a way that does NOT depend on the United States.

We’ll talk about CIPS in more details in a future letter. But in brief, it addresses some serious weaknesses, inefficiencies, and technological challenges of SWIFT.

And it should be ready to go later this year.

Make no mistake, this is the beginning of the end of the US dollar’s global hegemony. It’s time to stop hoping that it won’t happen and time to start preparing for it.

Second, against US wishes, UK decides to join China’s Asian Infrastructure Investment Bank

The Obama administration accused the UK of a “constant accommodation” of China after Britain decided to join a new China-led financial institution that could rival the World Bank.

The rare rebuke of one of the US’s closest allies came as Britain prepared to announce that it will become a founding member of the $50bn Asian Infrastructure Investment Bank, making it the first country in the G7 group of leading economies to join an institution launched by China last October.

Thursday’s reprimand was a rare breach in the “special relationship” that has been a backbone of western policy for decades. It also underlined US concerns over China’s efforts to establish a new generation of international development banks that could challenge Washington-based global institutions. The US has been lobbying other allies not to join the AIIB.

Relations between Washington and David Cameron’s government have become strained, with senior US officials criticising Britain over falling defence spending, which could soon go below the Nato target of 2 per cent of gross domestic product.

Third, the first open spat over Ukraine between the US-NATO and Germany

German Foreign Minister Frank-Walter Steinmeier has told his US counterpart John Kerry that it is too early to take any pride in the western strategy towards the Ukraine crisis, just days after accusing the US of "dangerous propaganda" over Ukraine.

Steinmeier, speaking on a visit to the US, said to Kerry at a joint press conference in Washington: "It is far too early to pat our shoulders and take pride in what we've achieved."

His comments come days after an official in German Chancellor Angela Merkel's offices had complained of US Air Force General Philip Breedlove's "dangerous propaganda" over Ukraine, and that Steinmeier had talked to the NATO Secretary General Jens Stoltenberg about him.

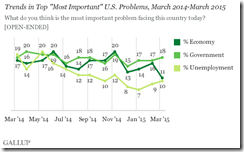

Fourth, the average Americans see the US government as the most important problem.

Americans continue to name the government (18%) as the most important U.S. problem, a distinction it has had for the past four months. Americans' mentions of the economy as the top problem (11%) dropped this month, leaving it tied with jobs (10%) for second place

Though issues such as terrorism, healthcare, race relations and immigration have emerged among the top problems in recent polls, government, the economy and unemployment have been the dominant problems listed by Americans for more than a year.

The latest results are from a March 5-8 Gallup poll of 1,025 American adults.

Finally, actions speak louder than words (demonstrated preference), record Americans have been ditching US passports.

According to the latest data from the Treasury Department, spotted by Andrew Mitchel at the International Tax Blog, a record 3,415 Americans renounced their citizenship in 2014. That was up from the 2,999 in 2013 and more than triple the number for 2012.

You can read the list of individuals who renounced here.

While some may see taxes as the main reason to flee, that's only part of the story. The big policy change that's causing people to give up their American citizenship is FATCA, the Foreign Account Tax Compliance Act.

It may sound wonky. But the act requires foreign banks to reveal any Americans with accounts over $50,000. Banks that don't comply could be frozen out of U.S. markets. And Americans overseas—even those who never lived in the U.S. or have a tangential connection here—are now under far more pressure to file detailed tax returns and pay U.S. taxes on their overseas income.

The program was designed to catch more wealthy overseas tax cheats. But one of its unintended consequences is that those Americans are simply giving up on being Americans.

And as part of this exodus, Americans in Asia have also been dumping their citizenship, from Asian Investor.net

A fast-rising number of Americans based in the region are disposing of their US citizenship, citing increasing difficulty of managing their financial affairs due to growing regulatory demands.

So underneath those record stocks have been a progressing US political entropy. Yet what happens if the US suffers a recession or another financial crisis?