There are secrets to our world that only practice can reveal.-Nassim Nicolas Taleb, Anti Fragility, Chapter 4 How (Not) To Be A Profit

We definitely live in interesting times.

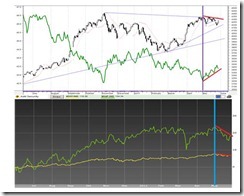

It has long been my position that gold and global equity markets including the Philippine Phisix have been strongly correlated where the price actions of the gold market frequently leads equity markets.

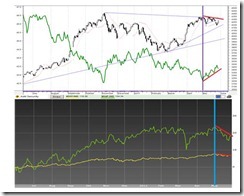

Look at the beauty of such correlationship.

The above 2- year chart represents the price actions of the Phisix (PSEC red-black candlesticks) and gold prices in US dollar (black line). The relationship even looks like a 5-wave Elliott Wave count.

One would note that the oscillations may not be in exactitude, but clearly a symmetric cadence has been in motion.

The implication is: for as long as the trend of gold prices remains to the upside, the Phisix will likely follow unless domestic factors become powerful enough to impel a disconnect.

Prices of gold have served as reliable barometer so far.

Alternatively, this also means that accrued corporate earnings or micro economics or mainstream’s macro views can hardly explain this phenomenon.

Consumption demand, which has been the popular perspective, can hardly explain the broad based increases in commodity prices along with equity prices.

Of course correlation does not imply causation or that there presents no causal relationship between gold and the Phisix.

The point is: both gold and the Phisix account for as symptoms of an underlying pathology, which has largely been an unseen factor.

The Phisix-gold phenomenon has not been isolated.

This can also be observed elsewhere.

This relationship appears evident also in the global equity markets: commodities (represented by the CCI) have strongly been correlated with the S&P 500 and the Dow Jones World (DJW).

Financial Repression and Inflationism

Anyone can say what they want but it can’t be denied that the price actions in the commodity markets have been tightly connected with actions in the global equity markets.

Meanwhile the divergences in bond markets can be explained. Bond markets have essentially been rigged, have been heavily distorted and used as main instruments by governments to conduct financial repression[1]. They hardly account for as signs of deflation as deflation exponents argue.

Government interventions have been rampant almost everywhere: in the commodity markets[2] by the precipitate doubling of credit margins over a very short time frame, on the bond markets by banning short sales[3] and even seizing of private pensions such as in Argentina, Hungary, Ireland and demanding partial control of private savings in Bulgaria and Poland[4].

Even the construction of Consumer Price statistics [CPI] in the US has been severely contorted[5] which has largely been skewed towards housing.

The general incentive appears to be to keep CPI low so as to continually justify the policy of inflationism, which benefits the banking sector and the bureaucracy most.

Furthermore, the ongoing problems in the Eurozone (fiscal reforms), in China (inflation), in Japan (aftermath of the triple whammy calamity) and in the US (fiscal reforms) will likely prompt US authorities to avoid the risk of a bond market auction failure and similarly the potential risk posed by a further downslide in the housing industry which could destabilize the balance sheets of the highly protected banking industry[6]. This suggests of the likelihood of more Quantitative Easing (QE) programs to come.

Yet clamor for more QE from the mainstream has grown louder[7] which I think is part of the mind conditioning of the public meant for its acceptance.

Incidentally, the US Federal Reserve has been the largest buyer of US treasury [8]. This implies that without the QE, and with lower purchases from foreign entities, interest rates in the US will rise.

Hence, the overall direction of policies by global governments has been to expropriate private sector savings via printing money, keeping interest rates artificially down and outright confiscation (taxation or nationalization of pensions).

The leakages from these activities have percolated into commodity and stock markets.

Yet stock markets have also served as a target[9] of government policies considering their predominant guiding policy of the “wealth effect” doctrine.

So the traditional metrics to evaluate stock markets investments has been eclipsed by the direction of government policies as I have been predicting since 2008[10].

The Currency-Equity Link

If you should doubt such transmission mechanism, there are more proofs that the Phisix has been driven mainly by external forces.

It has also been a position of mine that the Philippine Peso and the Phisix have long had a symbiotic relationship.

Such actions are apparently being reinforced anew.

On the upper window, the recent feebleness in the Phisix (black candle stick) seems also reflected on the USD-Peso (green line).

In the past, a rising Peso would mirror a buoyant Phisix and vice versa. Recently both the Phisix and Peso seems to have hit the wall simultaneously (red trend lines) at the start of May (violet vertical line)!

And this has NOT been confined to a Peso-Phisix relationship. The same equity-currency collegial relationship pervades in Asia (see lower window).

The rally in the JP Morgan-Bloomberg Asian Dollar basket (ADXY- yellow line) and the MSCI Asia Pacific (MXAP:IND) has also been foiled at the start of May! So the rallies in both Asian currencies and Asian equity markets have been thwarted also on the first week of May.

Globalization Decoupling and Political Tea Leaves

The above only exhibits the depth of the interdependence of the global financial markets.

Those who extrapolate ‘decoupling’ on this highly globalized environment, will get the analysing and predicting the directions of the markets all wrong.

Globalization should not be seen only as a function of trade, labor, investment and capital flows but also on the transmission effects of global monetary policies (financial globalization) where the US as the world’s de facto currency reserve has the most influence.

Also the above price weaknesses share a common denominator: the early days of May 2011.

It is during this period where administrative interventions against the markets transpired, such as the war on commodity markets.

So whether it is the commodity markets or Asian currencies and Asian equities the coordinated reaction from interventions has been quite evident.

The chart also suggests that a seeming reprieve in the interventions has palpably led to a bounce.

Whether this rally is a function of a dead cat’s bounce (a natural counter reaction to a previously extended action) or simply a reversion to the major trend has yet to be established. Of course governments may use such occasion to further intrude on the marketplace that may add to market’s instability.

It’s not in my crystal ball to go for short term trends. Although in the understanding that politics drives the markets today, governments could use market volatility to justify prospective money printing programs. So markets could go either way from here.

Of course, it is true that seasonal factors (such as “Sell on May and Go Away”[11]) can affect the market’s activities. These signify as statistical metrics that are subject to margins of error.

In other words, there would likely be more significant variables that may influence the markets than plain seasonality. And as said above, a major force will be politics.

Bottom line:

The actions in the Phisix reflect on its tight connection with the global financial markets. And these activities have likewise echoed the actions of commodity markets.

These conjoint motions represent as symptoms or signs of major forces operating beyond the superficial understanding of the consensus on what propel the actions in the marketplace. Such force is the policy induced boom bust cycles.

Because of this tight correlations, any extrapolations or predictions of decoupling will likely be falsified when the markets undergoes another episode of spasms. Decoupling under today’s US Dollar based system will prove to be a charade.

For now, the stalled rally in the Phisix has coincided with the weakness of global equity markets and commodity prices. Such infirmities appear to have been orchestrated, perhaps specifically designed to achieve unannounced political goals.

Yet a rally in the commodity sphere, which should manifest mostly a decline of the US dollar, will translate to a rally in the Phisix and the Peso.

This rally could happen anytime.

[1] See Financial Repression Drives The Bond Markets, May 23, 2011

[2] See War on Commodities: Intervention Phase Worsens and Spreads With More Credit Margin Hikes!, May 14, 2011

[3] See War on Speculators: Restricting Short Sales on Sovereign Debt and Equities, May 18, 2011

[4] nation.foxnews.com Watch Out! Feds Could Seize Your Private Retirement Savings, May 23, 2011

[5] See US CPI Inflation’s Smoke and Mirror Statistics, May 18, 2011

[6] See The US Dollar’s Dependence On Quantitative Easing, March 20, 2011

[7] See Mainstream Calls For More Quantitative Easing, May 24, 2011

[8] Wood, Christopher The new bond conundrum, Greed & Fear, CLSA May 6, 2011 scribd.com

[9] See The US Stock Markets As Target of US Federal Reserve Policies, May 12, 2011

[10] See Stock Market Investing: Will Reading Political Tea Leaves Be A Better Gauge?, November 30, 2008

[11] See Global Equity Markets: Sell in May and Go Away?, May 16, 2011