We have been trained to look for godliness, virtue, direction, and truth outside ourselves, in some agency external to ourselves. Such beliefs have been generated largely by those who have either a religion or a political system to fasten upon the necks of their fellow beings. It is through such thinking that some have been able to control the thoughts and actions of others by attacking their victims' sense of self-capacity and worthiness to function in the world.-Butler Shaffer

There will be only 3 trading sessions in the coming week because of the extended holidays (on Monday Eidul Fitar and Tuesday Ninoy Aquino Day).

This means that the public will likely be in a vacation mode. So unless some externally driven event will incite unusual volatility that may trigger a local response, I expect the market’s mood to be largely lackadaisical. So whatever direction the Phisix closes the week, the average trading volume will likely be weaker.

Since momentum in the global markets appear sprightly; the odds for a shock seem unlikely.

But given the fragility of current conditions, no one can really tell.

Update on Holiday Economics

As a side note, the string of political holidays only depletes productivity from the economy. The mainstream will argue that “holiday economics” promotes tourism and tourism related industries from which should support the economy. But again, costs are not benefits.

While holidays indeed promote tourism and allied industries, such thinking ignores the unseen costs borne by such political holiday statutes.

As I previously wrote[1],

local policies are counterproductive, privileges one sector (4% direct 10% indirect) over the entire economy, raises cost of doing business, reduces output, promotes idleness, hedonism and wrong virtues (spending instead of saving) and importantly the "elitist" tendencies of the powers that be.

For an update, according to World Travel & Tourism Council[2], the direct contribution of Travel & Tourism to GDP was PHP194.7bn (2.0% of total GDP) in 2011, the total contribution of Travel & Tourism (meaning tourism related industries) to GDP was PHP830.8bn (8.5% of GDP) in 2011. In terms of employment, direct employment from the industry accounted for 778,000 jobs or 2.1% of total employment and the total contribution of the industry to employment, including jobs indirectly was 9.6% of total employment (3,547,500 jobs).

Back of the napkin calculation tells us that ‘Holiday economics’ means supporting 8.5% (of GDP) against the 91.5% of the economy, and in terms of employment, 9.6% as against 90.4% of the labor force.

Holiday economics has been premised on promoting the interests of the elite at the expense of the underprivileged or the ‘poor’.

Market Internals Suggests of Healthy Correction Phase

In the Philippine equity markets, part of what I expected occurred last week.

The recent selloff in the mining sector seems to have percolated into the broader markets.

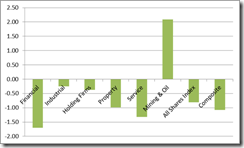

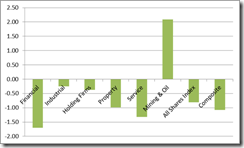

The Phisix languished, down 1.07% this week, weighed by all major sectoral indices except for the mining and oil which defied the broad market correction

As I wrote last week[3],

I lean on condition (B) or where the bear market of the mining sector will likely percolate into the general market, due to growing risks of contagion.

However everything really depends on how and what future policies will be conducted, especially in the US, as previously discussed.

So the correction phase appears to be another rotational process which essentially shifts the flow of sentiment from the mining sector to the general market and vice versa.

I seriously doubt that the domestic mining sector as having reached an inflection point or has “bottomed” out. I would like to be convinced based on evidences from internal and external forces. Instead I suspect that this week’s rally has been more of a dead cat’s bounce, from a vastly oversold position, than from a recovery.

The correction phase can be seen in the modest deterioration of the market breadth. The rotational process, as well as, the modest decline of the general market should be seen as a healthy profit taking process.

The continuity of the benign conditions, as I have repeatedly been pointing out, will depend on external developments.

Superstitious Beliefs versus Rigorous Analysis

Many have assigned the current weakness in the local equity market as having been influenced by the Chinese tradition of the “Ghost Month” (August 17 to September 15, 2012)[4]

The tradition suggests that many activities such as evening strolls, traveling, moving house, or starting a new business or even swimming can bring about bad luck, thus believers refrain from doing them.

People’s beliefs are acquired mostly through three ways[5], through tradition (handed down through generations), through persons of authority (whose opinions people take as truth and accept or assimilate them, e.g. parents, teachers, religious leaders, politicos, experts and etc…) and or from reason and evidence.

Based on reason, there has been little empirical evidence to support such claims.

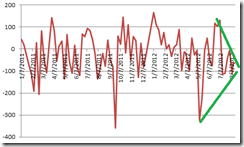

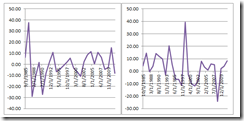

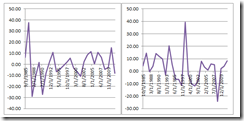

While I don’t have the exact figures for the said periods, I used the annual % monthly returns of August (left window) and September (right window) of the Phisix since 1985 to see its validity.

As one would note that in the above chart, from both August and September windows, negative returns have not been a predominant feature. Instead we see sporadic fluctuations between positive and negative zones.

Examining further, one would note that the direction of returns have largely been driven by the dominant trend of the marketplace: Returns have either been negative or marginally positive during cyclical bear market periods, while in bull markets, returns have mostly been positive.

One interesting aspect is that sharp market volatilities has characterized September returns, where gains and losses have been magnified.

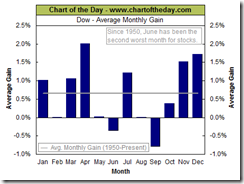

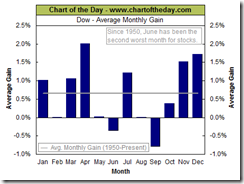

I think this seem to square with the seasonal activities in the US where September tends to be the worst month for stocks as exhibited by the Average Monthly gain by the Dow Jones Industrials since 1950[6].

And the sharp volatility compounded by negative returns could have been due to the simultaneous large liquidations of savings, which includes sales of stocks, to fund major consumption expenses by US households, particularly spending for new school clothes for children, winter clothes and other weather related consumption activities. Fueled by tight monetary conditions, the massive outlays for consumption may have served as catalyst for the notorious September-October window which has been seasonally prone to market crashes[7]

The lesson that can be gleaned from the above is that beliefs based on superstitions and or the tendency of many to employ the availability heuristics—mental shortcuts based on what we can remember rather than from complete data[8]—are hardly useful substitutes for thorough investigation and rigorous analysis of the marketplace from which to project the future or even explain markets on an ex-post basis.

On the contrary, I would say that the recent weakness of the Phisix can be traced to a single axiom: NO Trend Moves in a Straight Line.

Given that the Philippine Phisix, which has outperformed most of the world’s equity benchmarks on a year to date basis, has shown signs of being overbought and overextended, then a salutary reprieve should be a natural state.

In short, profit taking is an inherent process of the financial markets.

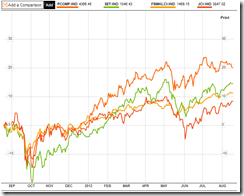

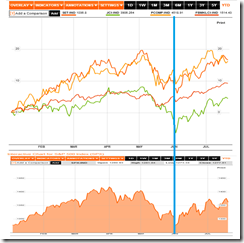

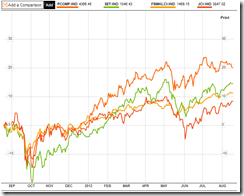

Year-to-date, Thailand seems to have successfully passed the Philippines (19.37 versus 19.1% respectively) to take the region’s leadership. Yet both managed to keep some distance from last year’s leader Indonesia, as well as, Malaysia who remains the laggard among the ASEAN majors.

Meanwhile Malaysia’s year-to-date returns largely understates the real action—Malaysia has been the only bourse in the region (if not the world) trading at record highs.

I think that in as much as rotations occur within the domestic market, the same dynamic will likely influence activities of the region’s equity bourses.

As I previously noted[9],

given the rotational dynamics, we might see some “catch up” play or the narrowing of the recent wide variance between the laggards and leaders overtime. But this doesn’t intuitively mean that such gaps will close.

So far, only the Phisix has backtracked while Thailand’s SET has still been in high Octane. On the other hand, Indonesia has slightly narrowed the gap with the Phisix.

Risk ON Stands on Perpetual Promises of Rescues

The reason why the world’s bourses have turned conspicuously positive has been due to the recent return of the RISK ON environment.

The following represents mainstream media’s attribution of the strong performance of global equity markets for the week.

European stocks, from Businessweek/Bloomberg[10]

European stocks rose to the highest level since July 2011, extending gains for an 11th week, as investors anticipated policy makers will stimulate the euro-area economy and German growth retreated less than forecast.

Asian stocks, from another Businessweek/Bloomberg[11]

Asian stocks rose this week, with the benchmark index posting its longest weekly winning streak since March, after China’s Premier Wen Jiabao said there’s more room to adjust monetary policy and U.S. economic reports signaled strength in the world’s largest economy.

In spite of indefatigable pledges by Chinese authorities, China’s bellwether, the Shanghai index remains in doldrums seemingly unaffected by the global RISK ON landscape.

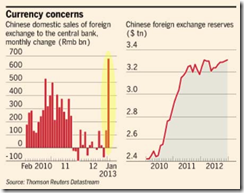

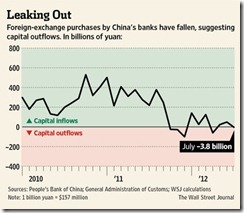

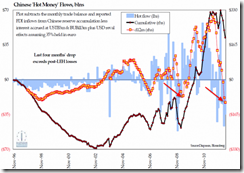

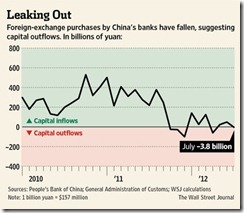

In fact, China’s authorities have admitted to recent signs of outflows of hot money[12] as domestic banks became net sellers of foreign exchange or 3.8 billion yuan ($597 million), which for me could be worrying signs of a popping bubble.

Meanwhile US stock markets according to the Reuters[13]

The S&P 500 held near a four-year high on Friday, and the market's key gauge of anxiety sank to its lowest since 2007, suggesting a belief that the problems stressing investors might be closer to a resolution…

The S&P 500 made a solid move above the closely watched 1,400 level in the last session, posting its biggest gain in two weeks. But trading volume remained low…

The S&P 500 has risen 2.8 percent in August and about 11 percent since a year low in June as traders eye some encouraging U.S. jobs data and highly anticipated policy meetings at the European Central Bank and the Federal Reserve in September.

In essence, the gist of today’s rally in the global stock markets has been galvanized around intensifying expectations that global central banks and governments will effectively rescue the markets.

And tidbits of good news are seen as signs of selective confirmation of a recovery. On the other hand, bad news have been interpreted as having to add pressure on governments to intervene, the result of which is to supposedly deliver good news—a recovery.

In other words, today’s global equity markets investors seem to have been strongly conditioned to carry expectations that markets can only move in one direction: UP. It can be said that the circularity of this logic entails a “heads I win, tails you lose” market environment from political guarantees. Such is the confirmation bias which intensely embodies the mainstream view.

Such has also been the reason why markets everywhere have increasingly been politicized as participants have been oriented to see rising markets as a form of political entitlement.

Divergences Aplenty

It has been interesting to note that, yes corporate fundamentals may have posted some positive signs but again everything depends on the reference points.

From the big picture, the positive signs emitted by the S&P 500 have not been convincing.

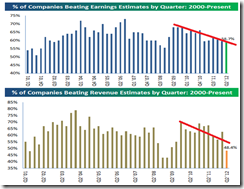

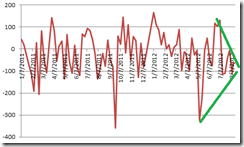

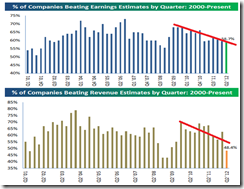

Aside from low volume, the divergences I previously mentioned, such as earnings, global economy, industrial and non-industrial activities[14], market internals, divergent signs on sub-sectors such as Transportation (Dow Theory)[15] or even the Russell 2000, have shown marginal and not substantial improvements, in spite of the near four year highs by the S&P 500.

A good example is the current divergence in the % of companies beating earnings and revenue estimates. While the above has shown positive results, it seems that US markets have been cheering what seems like diminishing returns or a decline in positive developments. (chart above from Bespoke Invest[16])

chart from Bespoke Invest

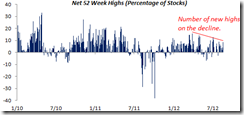

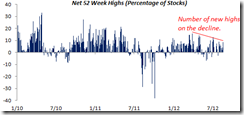

Again recent highs of the US markets have been accompanied by narrowing market breadth.

This means the drivers responsible for lifting the equity benchmarks have mainly been big cap issues. Yet the accounts of publicly listed companies at 52-week highs have also been diminishing. If such trend should continue then this entails limited upside for the S&P[17].

Finally the current rally in the US markets seems to have departed from the previous trend relative to gold.

In the past, rallying US markets (represented by the S&P 500) came at the heels of a more powerful run in gold (see lower window) and in other major commodities. So even as the S&P rose, gold climbed faster, thus the declining ratio between the S&P and gold.

The implication is that the RISK ON environment then had been broader which also meant that the rally had a firmer footing.

Today’s RISK ON environment seems to be concentrated on the equity markets and the junk bond markets where Gold and commodities has vastly underperformed, thus, the rising ratio between S&P and gold.

Junk bonds have been posting record issuance. Companies have been taking advantage of zero bound rates and strong demand which has brought down yields of speculative bonds to a few points away from the record lows reached during May of 2011[18]. Such yield chasing phenomenon exhibits the nature of today’s yield chasing rampant punting and speculations.

This means that gold’s modest rise has not been consistent with a strong RISK ON landscape.

The selective risk appetite and the apparent narrowing of asset selections mean that the markets could be highly susceptible to sudden changes of expectations or to mood swings: thus elevating the current risk profile of would be buyers.

Current Conditions Remain Highly Fragile

I have long been making this point: For as long as the US won’t fall into a recession or won’t suffer from a financial shock that could lead to a global recession, the recent decline in the Phisix extrapolates to a healthy profit taking process.

That said, a five to ten percent decline from the peak or the range at 4,825-5,080 could prove to be a spring board for the next record high. This is all conditional on the unfolding events abroad, and should not be read as one-size-fits all analysis.

Given the nature from which the recent global rally has been anchored, i.e. expectations from promises of rescues, I still remain highly apprehensive, or I will not write off the risks of possible sharp changes in expectations that may precipitate the current moderate RISK ON conditions to a swift and dramatic RISK OFF environment.

The contagion risks are real, which means current conditions remain highly fragile. Rising markets have not smoothened out all the underlying stresses.

Given the enormous distortions of the markets from repeated interventions, the best is to watch the interplay of stimulus-response between markets and policymakers.

To close, let us not forget our beliefs essentially drive our actions, rightly or wrongly. As the great Ludwig von Mises wrote[19],

In acting man is directed by ideologies. He chooses ends and means under the influence of ideologies. The might of an ideology is either direct or indirect. It is direct when the actor is convinced that the content of the ideology is correct and that he serves his own interests directly in complying with it. It is indirect when the actor rejects the content of the ideology as false, but is under the necessity of adjusting his actions to the fact that this ideology is endorsed by other people. The mores of their social environment are a power which people are forced to consider. Those recognizing the spuriousness of the generally accepted opinions and habits must in each instance choose between the advantages to be derived from resorting to a more efficient mode of acting and the disadvantages resulting from the contempt of popular prejudices, superstitions, and folkways.

[1] See The Economics of Holidays, October 22, 2009

[2] World Travel & Tourism Council Travel & Tourism Economic Impact 2012 Philippines

[3] See Philippine Mining Index: Will The Divergences Last?, August 13, 2012

[4] Mandarin Language Ghost Month and Ghost Festival About.com

[5] Green Alexander, The Noblest Expression of the Human Spirit, Early To Rise, October 6, 2010

[6] Chart of the Day Dow-Average Monthly Gains

[7] See Austrian Business Cycle and September Market Crashes, June 27, 2012

[8] Changingofminds.org Availability Heuristic

[9] See Phisix and ASEAN Equities in the Shadow of Contagion Risks July 22, 2012

[10] Businessweek/Bloomberg, European Stocks Rise for 11th Week on Stimulus Bets, GDP August 17, 2012

[11] Businessweek/Bloomberg, Asia Stocks Rise for a Third Week on Wen Comments, U.S. Economy August 17, 2012

[12] Wall Street Journal Investors Shift Money Out of China August 14, 2012

[13] Reuters.com US STOCKS-S&P 500 up for 6th week; fear index hits 5 yr low, August 18, 2012

[14] See Why Current Market Conditions Warrants a Defensive Stance, July 9, 2012

[15] See Phisix: Managing Through Volatile Times, August 6, 2012

[16] Bespoke Invest Final Earnings and Revenue Beat Rates August 17, 2012

[17] Bespoke Invest Wanted: More New Highs August 17, 2012

[18] Bloomberg.com Junk-Bond Sales Soar To Record In August: Credit Markets, August 17, 2012

[19] Mises, Ludwig von 2. The Role of Power XXIII. THE DATA OF THE MARKET Human Action, Mises.org