Any growth theory where government investment plays a crucial role in stimulating growth immediately runs afoul of the historical record, however. The first countries to industrialize did not require extensive government involvement to make these investments. In England, it was apparent that neither early capital accumulation nor social overhead investment depended heavily on the public sector, as Phyllis Deane (1979) notes when commenting on traditional explanations of growth that rely on government involvement to overcome lumpiness and externalities:“The consequence is that social overhead capital generally has to be provided collectively, by governments or international financial institutions rather than individuals, and the mobilization of the large chunks of capital required is most easily achieved through taxation or borrowing. The interesting thing about the British experience, however, is that it was almost entirely native private enterprise that found both the initiative and the capital to lay down the system of communications which was essential to the British industrial revolution.” [p. 73]Private returns were, apparently, sufficiently high in the late eighteenth and early nineteenth century to induce the private sector to make the necessary infrastructure investment required by the Industrial Revolution.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, October 21, 2012

Quote of the Day: Private Sector Infrastructure Investment and the Industrial Age

Monday, October 15, 2012

Quote of the Day: The Folly of Institutional Worship

The individual is king, and all these other things exist for the service of the king. It is a mere superstition to worship any institution, as an institution, and not to judge it by its effects upon the character and the interests of men. It is here that socialist and Catholic make the same grand mistake. They exalt the organization, which is in truth as mere dust under our feet; they debase the man, for whose sake the organization and all other earthly things exist. They posit a priori the claims of the external organization as supreme and transcending all profit and loss account, and they call upon men to sacrifice a large part of their higher nature for the sake of this organization. They both of them sacrifice man, the king, to the mere dead instrument that exists for man’s service.

Tuesday, October 09, 2012

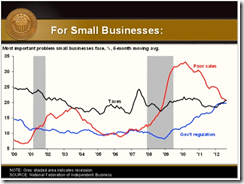

Regime Uncertainty and US Employment Woes

The employment gain was attributable to an increase of 838,000 in full-time employment, while part-time employment fell 26,000. What’s odd is that among those working part-time (which edged down slightly), there was a 582,000 increase in those working part-time for economic reasons. In other words, lots of people found full-time jobs, and lots of people who wanted to work full time could only find part-time jobs. Got that? Even odder is that the payroll survey showed that employment in the temporary help industry edged down by 2,000 in September.While I doubt that anyone at BLS tampered with the household data for political motives, I’m certain no one even thought to bother with the payroll employment numbers. September’s increase was a measly 114,000. I give much more weight to the revisions to the previous two months, which tend to be upwards when the economy is expanding. They totaled 86,000 during July and August, raising their monthly average gain to 161,500. The oddity here was that upward revisions occurred at the local-government level--mainly the hiring of school teachers (up 77,000)--which nearly matched the revision to overall payrolls…The debatable question is whether the Obama administration’s policies are creating jobs. The answer, of course, is they didn’t create them. Mitt Romney says he’ll create 12 million jobs if he is elected to be the next president. Presidents don’t create jobs. Profitable companies expand and create jobs, especially small ones that turn into big ones.

I have argued for years that this anemic investment recovery evinces, at least in part, the prevailing regime uncertainty brought about by the Fed’s and the Bush and Obama administrations’ massive, ill-advised, and counter-productive interventions in the economy during the past five years. These interventions are continuing, however, and continuing to prolong the recovery. The idea that these actions will ultimately succeed if only the authorities persist in them long enough and on a sufficiently great scale was a bad idea from the start, and its bankruptcy became fairly evident a long time ago even to many observers wedded to mainstream economics and conventional economic policy making.Policy makers have cost the U.S. economy a decade or more of normal economic growth. How long will people in their capacities as political and financial actors continue to tolerate this foolish, destructive policy making? I do not know, but I believe I know what the result of these misguided ongoing experiments will be—economic stagnation at best, relapse or another bust at worst.

Monday, October 01, 2012

Currency Manipulation and the Politics of Neo-Mercantilism

The dollar maintains its reserve currency status because it is the least worst of the major four currencies – the US dollar, the British pound, the Japanese yen, and the euro. All four of these currencies are now suffering the effects of a stimulative, expansive, and QE-oriented monetary policy.We must now add the Swiss franc as a major currency, since Switzerland and its central bank are embarked on a policy course of fixing the exchange rate between the franc and the euro at 1.2 to 1. Hence the Swiss National Bank becomes an extension of the European Central Bank, and therefore its monetary policy is necessarily linked to that of the eurozone…When you add up these currencies and the others that are linked to them, you conclude that about 80% of the world’s capital markets are tied to one of them. All of the major four are in QE of one sort or another. All four are maintaining a shorter-term interest rate near zero, which explains the reduction of volatility in the shorter-term rate structure. If all currencies yield about the same and are likely to continue doing so for a while, it becomes hard to distinguish a relative value among them; hence, volatility falls.The other currencies of the world may have value-adding characteristics. We see that in places like Canada, Sweden, and New Zealand. But the capital-market size of those currencies, or even of a basket of them, is not sufficient to replace the dollar as the major reserve currency. Thus the dollar wins as the least worst of the big guys.Fear of dollar debasement is, however, well-founded. The United States continues to run federal budget deficits at high percentages of GDP. The US central bank has a policy of QE and has committed itself to an extension of the period during which it will preserve this expansive policy. That timeframe is now estimated to be at least three years. The central bank has specifically said it wants more inflation. The real interest rates in US-dollar-denominated Treasury debt are negative. This is a recipe for a weaker dollar. The only reason that the dollar is not much weaker is that the other major central banks are engaged in similar policies.

First, they serve as lenders of last resort, which in practice means bailouts for the big financial firms. Second, they coordinate the inflation of the money supply by establishing a uniform rate at which the banks inflate, thereby making the fractional-reserve banking system less unstable and more consistently profitable than it would be without a central bank (which, by the way, is why the banks themselves always clamor for a central bank). Finally, they allow governments, via inflation, to finance their operations far more cheaply and surreptitiously than they otherwise could.

Protectionism, often refuted and seemingly abandoned, has returned, and with a vengeance. The Japanese, who bounced back from grievous losses in World War II to astound the world by producing innovative, high-quality products at low prices, are serving as the convenient butt of protectionist propaganda. Memories of wartime myths prove a heady brew, as protectionists warn about this new "Japanese imperialism," even "worse than Pearl Harbor." This "imperialism" turns out to consist of selling Americans wonderful TV sets, autos, microchips, etc., at prices more than competitive with American firms.Is this "flood" of Japanese products really a menace, to be combated by the U.S. government? Or is the new Japan a godsend to American consumers? In taking our stand on this issue, we should recognize that all government action means coercion, so that calling upon the U.S. government to intervene means urging it to use force and violence to restrain peaceful trade. One trusts that the protectionists are not willing to pursue their logic of force to the ultimate in the form of another Hiroshima and Nagasaki.

People favor discrimination and privileges because they do not realize that they themselves are consumers and as such must foot the bill. In the case of protectionism, for example, they believe that only the foreigners against whom the import duties discriminate are hurt. It is true the foreigners are hurt, but not they alone: the consumers who must pay higher prices suffer with them.

While the size of the credit expansion that private banks and bankers are able to engineer on an unhampered market is strictly limited, the governments aim at the greatest possible amount of credit expansion. Credit expansion is the governments' foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous.

Sunday, September 30, 2012

Lessons from Bernanke’s Thank You Notes

If you have the Federal Reserve’s back, there’s a good chance Ben Bernanke will notice.He may even send you a thank you note.In July, the Fed chairman sent letters of gratitude to five Democratic members of Congress after they delivered speeches on the House floor urging fellow lawmakers to reject the “Audit the Fed” bill authored by retiring Texas Republican Ron Paul, the central bank’s chief antagonist.Their efforts failed to defeat the bill, but they were not in vain, at least in Bernanke’s eyes.“While the outcome of the vote was not in doubt, your willingness to stand up for the independence of the Federal Reserve is greatly appreciated,” Bernanke wrote in the letters, which were obtained by POLITICO through a Freedom of Information Act request.He continued, “Independence in monetary policy operations is now the norm for central banks around the world — and it would be a grave mistake were Congress to reverse the protection it provided to the Federal Reserve more than 30 years ago.”The letters were sent to Reps. Barney Frank, Elijah Cummings, Melvin Watt, Carolyn Maloney and Steny Hoyer.“It's not unusual for the chairman to write thank you notes to members of Congress,” said Fed spokesman David Skidmore.Dated July 26, the notes were written the day after the House voted 327-98 to pass Paul’s bill, which would authorize the Government Accountability Office to audit how the central bank implements monetary policy.

Saturday, September 08, 2012

Public Work Failure: US Stadiums Burn $4 Billion

Devotees of public work (infrastructure) spending, who see such measures as necessity to lift statistical economic growth, should learn from the experience of US taxpayer funded stadium spending binges.

From Bloomberg,

New York Giants fans will cheer on their team against the Dallas Cowboys at tonight’s National Football League opener in New Jersey. At tax time, they’ll help pay for the opponents’ $1.2 billion home field in Texas.

That’s because the 80,000-seat Cowboys Stadium was built partly using tax-free borrowing by the City of Arlington. The resulting subsidy comes out of the pockets of every American taxpayer, including Giants fans. The money doesn’t go directly to the Cowboys’ billionaire owner Jerry Jones. Rather, it lowers the cost of financing, giving his team the highest revenue in the NFL and making it the league’s most-valuable franchise.

“It’s part of the corruption of the federal tax system,” said James Runzheimer, 67, an Arlington lawyer who led opponents of public borrowing for the structure known locally as “Jerry’s World.” “It’s use of government funds to subsidize activity that the private sector can finance on its own.”

Jones is one of dozens of wealthy owners whose big-league teams benefit from millions of dollars in taxpayer subsidies.Michael Jordan’s Charlotte, North Carolina, Bobcats basketball team plays in a municipal bond-financed stadium, the Time Warner Cable Arena, where the Democratic Party is meeting this week. The Republicans last week used Florida’s Tampa Bay Times Forum, also financed with tax-exempt debt. It is the home of hockey’s Lightning, owned by hedge-fund manager Jeffrey Vinik. None of the owners who responded would comment.

$4 Billion

Tax exemptions on interest paid by muni bonds that were issued for sports structures cost the U.S. Treasury $146 million a year, based on data compiled by Bloomberg on 2,700 securities. Over the life of the $17 billion of exempt debt issued to build stadiums since 1986, the last of which matures in 2047, taxpayer subsidies to bondholders will total $4 billion, the data show.

Those estimates are based on what the Treasury could have collected on interest from the same amount of taxable bonds sold at the same time to investors in the 25 percent income-tax bracket, the rate many government agencies assume. In fact, more than half the owners of tax-exempt bonds pay top rates of at least 30 percent, according to the Congressional Budget Office. So they save even more on their income taxes, a system that U.S. lawmakers of both parties and President Barack Obama have described as inefficient and unfair.

There hardly are major nuances when government undertake projects in the form of Public-Private Partnership, monopolies or public outsourcing to private contractors, or other forms of concessions to the politically favored private enterprises. The incentives guiding private enterprises will be directed towards attaining political objectives of the political masters rather than servicing the consumer.

Importantly, not only have these been a waste on taxpayers money, they become sources of rent seeking, corruption and other unethical relationships.

They have even become sources of public disasters.

And as I recently pointed out, the proposed 407 billion pesos spending by the Philippine government on infrastructure has been seen by media as signs of progress. They see this, under the impression that the incumbent government has been “clean” enough to undertake them.

All these signify a grand delusion. Populism ignores economic reality.

The public fails to understand that NO government have the requisite knowledge of the value scales and time preferences of individuals or of the the knowledge of the particular circumstances of time and place (Hayek) from which serves as the foundation of economic activities. Economic activities basically represent a bottom up phenomenon.

Second, government projects are likely designed under the influences of vested interest groups or cronies or if not by bureaucrats who will be designating them to the same groups for implementation.

Third, the private sector collaborators will benefit from the exposure of taxpayers money through guarantees or subsidies.

In many instances, both parties will find ways to game the system.

Moreover, money spent on public works focuses on short term political goals to promote media popular unproductive employment (to generate approval ratings and votes) at the expense of productive enterprises which provides real productive jobs.

As the great Henry Hazlitt wrote,

For then the usefulness of the project itself, as we have seen, inevitably becomes a subordinate consideration. Moreover, the more wasteful the work, the more costly in manpower, the better it becomes for the purpose of providing more employment. Under such circumstances it is highly improbable that the projects thought up by the bureaucrats will provide the same net addition to wealth and welfare, per dollar expended, as would have been provided by the taxpayers themselves, if they had been individually permitted to buy or have made what they themselves wanted, instead of being forced to surrender part of their earnings to the state.

Of course, all these leads to higher taxes and to price inflation (if these debts will be funded by politically directed credit expansion).

Finally, as shown by the US Stadium experience, politicization of resource allocation leads not only to inefficiency, wastage, but to immoral relationships between officials and their private sector lackeys.

The impression where government will be “virtuous” enough to undertake “honest” public work spending has been founded on utopian fantasies.

Tuesday, August 21, 2012

Why Not to Pay Heed to the Prophets of Ecological Apocalypse

Emotions based issues sell because people are emotional animals. Yet among all the emotions it is fear which is most powerful. That’s why horror movies sell, stock market crashes occur [where fear is a symptom and an accelerator of the market process], and that’s why many fall prey easily to "fear" based politics (e.g. climate change, peak resources and etc…).

Doomsayers sell or are popular also because of many people’s attachment to the Pessimism bias or the bias which exaggerates the likelihood of a negative outcome.

The profound Matthew Ridley writing at the Wired.com chronicles a list of prediction failures made by prophets of the apocalypse or Armageddon.

Ironically, despite the string of utter prediction failures; fear based issues remain in high demand. These have been evident in four fronts of social affairs, particularly in chemicals, diseases, people and resources. Mr. Ridley calls them the four horsemen of the apocalyptic promises

Here is an excerpt from the article.

Religious zealots hardly have a monopoly on apocalyptic thinking. Consider some of the environmental cataclysms that so many experts promised were inevitable. Best-selling economist Robert Heilbroner in 1974: “The outlook for man, I believe, is painful, difficult, perhaps desperate, and the hope that can be held out for his future prospects seem to be very slim indeed.” Or best-selling ecologist Paul Ehrlich in 1968: “The battle to feed all of humanity is over. In the 1970s ["and 1980s" was added in a later edition] the world will undergo famines—hundreds of millions of people are going to starve to death in spite of any crash programs embarked on now … nothing can prevent a substantial increase in the world death rate.” Or Jimmy Carter in a televised speech in 1977: “We could use up all of the proven reserves of oil in the entire world by the end of the next decade.”

Predictions of global famine and the end of oil in the 1970s proved just as wrong as end-of-the-world forecasts from millennialist priests. Yet there is no sign that experts are becoming more cautious about apocalyptic promises. If anything, the rhetoric has ramped up in recent years. Echoing the Mayan calendar folk, the Bulletin of the Atomic Scientists moved its Doomsday Clock one minute closer to midnight at the start of 2012, commenting: “The global community may be near a point of no return in efforts to prevent catastrophe from changes in Earth’s atmosphere.”

Over the five decades since the success of Rachel Carson’s Silent Spring in 1962 and the four decades since the success of the Club of Rome’s The Limits to Growth in 1972, prophecies of doom on a colossal scale have become routine. Indeed, we seem to crave ever-more-frightening predictions—we are now, in writer Gary Alexander’s word, apocaholic. The past half century has brought us warnings of population explosions, global famines, plagues, water wars, oil exhaustion, mineral shortages, falling sperm counts, thinning ozone, acidifying rain, nuclear winters, Y2K bugs, mad cow epidemics, killer bees, sex-change fish, cell-phone-induced brain-cancer epidemics, and climate catastrophes.

So far all of these specters have turned out to be exaggerated. True, we have encountered obstacles, public-health emergencies, and even mass tragedies. But the promised Armageddons—the thresholds that cannot be uncrossed, the tipping points that cannot be untipped, the existential threats to Life as We Know It—have consistently failed to materialize. To see the full depth of our apocaholism, and to understand why we keep getting it so wrong, we need to consult the past 50 years of history.

The classic apocalypse has four horsemen, and our modern version follows that pattern, with the four riders being chemicals (DDT, CFCs, acid rain), diseases (bird flu, swine flu, SARS, AIDS, Ebola, mad cow disease), people (population, famine), and resources (oil, metals). Let’s visit them each in turn.

Read the rest here

Monday, June 18, 2012

Surprise, Manny Pacquiao is Human

Veteran sport analyst and commentator Ronnie Nathanielsz finally awakens to reality and asked the right question “Is Pacquiao Slowing Down”

Mr. Nathanielsz at yahoo.com

As we cautioned some years ago, the late nights, the drinking and gambling would eventually take its toll on Pacquiao's physical condition and when the effects of abuse of a person's body and the effects of dissipation set in, it often happens abruptly.

A careful review of the fight tape shows Pacquiao has lost a split second in terms of speed, which both Arum and trainer Freddie Roach long pointed to as a key factor in Pacquiao's arsenal which effectively accentuated his power.

"Speed kills" was what Arum pointed to before Pacquiao pulverized De La Hoya that saw him quit on his stool at the end of the seventh round.

That speed has diminished as Pacquiao nears his 34th birthday on December 17, and as we assess his diminishing assets of speed and devastating power we need to accept the reality that the passing of the summers inevitably takes its toll on even the finest, relentlessly hardworking athlete who walked through the doors of Roach's Wild Card Gym in Los Angeles in the first week of June 2001, eleven long years ago. The innumerable fights, the punches he has taken, the burdens of training and the demands on his time as a congressman, a crossover superstar, a TV personality and a caring human being not to mention his former wild and wooly ways have surely taken their toll and its time we admit it, although such an admission doesn't mitigate the high crime committed in Las Vegas last June 9.

Let us put in a simple way: Contrary to popular expectations, Manny Pacquiao is just human. Yes read my lips, human. Mortal. Not superman. Yes, he susceptible to physiological ageing as anyone else.

Even if Mr. Pacquiao did away with gambling, drinking or late night escapades during his early years, unless technology will save the day, age will function as Manny’s neutralizing factor. This exempts no one, not even priests, monks or other vice free celibates.

You can go to the Boxing Hall of Fame and examine one by one and determine the median, if not the average age, when these former boxing legends had their career inflection point or when they retired.

That’s where the legendary Manny Pacquiao is today.

In the past, most of Pacquiao’s scintillating or brilliant victories came at the expense of OLDER boxers as noted I here. That cycle has turned.

Mr. Pacquiao will now wear the shoes of his former older opponents as most of his contemporaries have hanged up their gloves. So he will be faced with YOUNGER boxers even if he wins against Tim Bradley in a return bout.

The point is the more Pacquiao fights, the lesser the chances of his victory. Of course, this comes in the condition that he duels with younger foes with world class caliber.

And if he insist on staying on the ring, we should expect that after 3-4 more bouts (assuming 2 fights a year), the chances of losing badly (by KO or TKO) will become very significant. And that's when reality will sink in to him (that's if he remains stubborn to pursue more ring engagements)

So while relative age matter, a boxer’s career cycle has even more impact.

In economics, this is merely called the law of diminishing returns.

The law of diminishing returns based on the physiological ageing process has brought upon the twilight of Mr. Pacquiao’s boxing career.

Truth hurts. But that’s how nature works.

Deal with it.

Wednesday, March 21, 2012

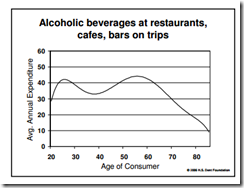

Social Drinkers Earn More than Non-Drinkers

Hear ye, Hear ye! Below should be good news for social drinkers.

In a 2006 research paper, Professors Bethany L. Peters and Edward Peter Stringham discusses the economic benefits of social drinking and how alcohol prohibition statutes negates these. [There are so many of aspects in life that goes against popular wisdom, which makes economics so interesting]

Here is the Abstract:

A number of theorists assume that drinking has harmful economic effects, but data show that drinking and earnings are positively correlated. We hypothesize that drinking leads to higher earnings by increasing social capital. If drinkers have larger social networks, their earnings should increase. Examining the General Social Survey, we find that self-reported drinkers earn 10-14 percent more than abstainers, which replicates results from other data sets. We then attempt to differentiate between social and nonsocial drinking by comparing the earnings of those who frequent bars at least once per month and those who do not. We find that males who frequent bars at least once per month earn an additional 7 percent on top of the 10 percent drinkers’ premium. These results suggest that social drinking leads to increased social capital.

Download the Paper here

I love beer, unfortunately I haven’t been to bars in years (only restaurants) and I don’t socialize much too.

Maybe I should…

From HS Dent

…before time catches up.

Sunday, January 15, 2012

Quote of the Day: Why Government is Not Private Business

From Professor Arnold Kling,

In business it is actually really hard to get people to do what you want. In fact, understanding that fact is exactly what sets CEOs apart from policy wonks. Policy wonks think that you write a law and that solves a problem. They think that you promulgate regulations and people do not figure out how to game those regulations.

Someone with business experience would never announce a mortgage loan modification program and expect it to be implemented in a matter of weeks (remember, a mortgage is a legal document that is somewhat antiquated with procedures that differ by state and local jurisdiction; remember that, prior to 2008, mortgage servicers had very few staff with any experience at all in loan modification; remember that when you introduce entirely new parameters into a highly computerized business process, somebody has to determine which systems are impacted, gather requirements, redesign databases, develop logic to protect against data input errors, develop a test plan,...). Someone with business experience would not enact a program that fines companies for failing to use a fuel that does not yet exist. Someone with business experience, I dare say, would understand that chaotic organization has consequences.

The fundamental difference between private business and government is the use of force.

To survive or to thrive, businesses must persuade consumers that their products or services offered are worth the use, the consumption or the ownership, in order for consumers to conduct voluntarily exchanges. Failing to do so means that these private sector providers would lose out to the competitors.

On the other hand government, operating as mandated or legislated monopoly, forces people to comply with their edicts or regulations under the threat of penalty (incarceration, fines and etc.) for non-compliance.

In other words, for businesses, the distribution of power to allocate resources is ultimately decided by the consumers, whom are guided by price signals and where the consumer represents as the proverbial 'king'. Whereas for government, it is the politicians and bureaucrats who decides, whom act based on political priorities rather than by price signals.

Social power, thus, is distinguished between market forces relative to political forces.

Yet there are many other significant differences.

So comparisons of “government run as business” is not only patently misguided but a popular fallacy which needs to be straightened out.

Saturday, July 23, 2011

Video: The Myth of Good Government

Friday, July 01, 2011

President Aquino’s First Term Speech: Everything to get Applause

President Aquino's speech on his first year in office, as excerpted by the Inquirer,

“Before, there was resignation, dejection and apathy,” the President told reporters.

“If you remember at the time, you were writing about the people’s apathy and numbness, as if they did not expect anything from their government. They were blasé to scandals that were being unearthed,” he said.

“Now, more people are expectant that their lives are changing for the better,” Mr. Aquino said.

He said growing demands for change from the people were a good thing.

And these are the cited accomplishments of the administration

Again from the same article,

These include the 21,800 families of policemen and soldiers who will have decent homes before the year ends, the 2 million poor families set to benefit from the conditional cash transfer program and the 240,000 farmers who will benefit from 2,000-kilometer farm-to-market roads finished in just one year, Mr. Aquino said.

“Isn’t it clear that there is change?” he said.

He said that because of reforms in the government financial system, the government was able to save funds more than the amounts allocated by the General Appropriations Act to implement programs, the President said.

These include providing P12 billion for the “Pantawid Pasada” for transport workers affected by high oil prices, he said.

“Housing, rice, security, salaries, roads, Pantawid Pasada and other lifeguards for the people drowning from poverty. These are the changes that we are reaping now,” he said.

It’s another vindication for me as economic reality has been unmasking all the illusions of deliverance from our over dependency on political distribution as a way to success.

Also, this justifies why I have not and will not exercise the so-called the rights to suffrage which only buttresses this perpetual charade.

People hardly realize that there are only TWO ways to attain people’s needs: this is by production (economic means) or by plunder (political means--forcibly taking other’s resources through political mandates) [Franz Oppenheimer].

The political route is a non-market process of distributing resources ‘legally’ expropriated from society. The choices made by political leaders are premised according to their biases, ambitions, interests, value preferences, ideology, networks, comfort zones, cultural, educational or religious orientation and other personal attributes.

Remember, political leaders are not gods but humans. So they suffer from the same frailties as anyone else. Most importantly they suffer from the knowledge problem.

The only difference is that they are backed by the power of organized violence through the state.

And since all economies are highly complex and dynamic, political distributions means taking or assuming choices for the benefit of a few groups from among the widely diversified and competing sectors.

Because various interests groups will jockey for such privilege, the societal interactions by these competing groups would translate to the employment of patronage, horse trading, shady deals, bribery and many other morally unscrupulous actions.

Politics is a zero sum game. Thus, the actions of these competing groups along with the respective political entities involved will be predicated on or revolve around attaining political goals by guiltism, covetism, envyism angerism and villainism (to borrow from libertarian Robert Ringer) which always leads to “resignation, dejection and apathy” and most importantly to perennial conflict.

So it never changes.

Yet it is naive, seemingly insensitive and supercilious to suggest that there has been "growing demands for change", as if Filipinos have been chronic dolts and have been blindly satisfied with the status quo despite their dire condtions.

The reason people act is to fulfill their uneasiness, thus, always strive for change.

The apparent passivity of the Philippine populace to political misconducts is NOT because of the lack of desire for change, but because most appear to have succumbed to the frustrations of the failed glamorized heroism of the state. Repeated government failures have jaded the Filipino’s vim.

And it is because of too much expectations founded from the grave misunderstanding on the role and limits of the state that has signified as the country’s main blight or the nation's Achilles Heels'.

Importantly, such delusions extends to the elitist academia (which serves as the recruitment pool for bureaucrats and private sector patrons of political actions) and well into the business sector, whom all look for patronage, anti-competition, and doleout as virtuous and a necessary condition for economic development.

If there have been any changes during the first year of President Aquino’s term these accounts for changes on the beneficiaries of redistribution.

Essentially, President Aquino has been no different from the actions of the predecessors, which is what I have been saying even prior to the last elections.

Yet most of the incumbent’s reported accomplishments have been designed as “feel good” noble intended redistribution programs (“Pantawid Pasada” or cash transfers to farmers) and to cosset groups that assures their hold on to power (policemen and soldiers).

This reminds me of the great H.L. Mencken’s description of former US President T.R. Roosevelt, whom Professor Don Boudreaux quotes from A Mencken Chrestomathy

What ailed him was the fact that his lust for glory, when it came to a struggle, was always vastly more powerful than his lust for the eternal verities. Tempted sufficiently, he would sacrifice anything and everything to get applause.

As a general rule, political self-interests signify as the most important priority for political actors. Apparently, President Aquino has not been an exception.

Thursday, June 23, 2011

Financial Success is a Function of Common Sense and Self Discipline

Some have this misbegotten notion/belief that attaining wealth and fame translates to a state of permanence.

Well it’s not.

This should be a noteworthy example, from yahoo.com (bold emphasis mine)

Patricia Kluge was once known as "the wealthiest divorcee in history." Those days are over. Kluge, who had formerly been married to the late billionaire Paul Kluge, recently filed for bankruptcy protection, citing debts somewhere between $10 million and $50 million and assets between $1 million and $10 million….

We doubt the couple will be out on the street selling pencils anytime soon. Still, Patricia Kluge's present straits represent a remarkable reversal for a woman who, at one time, was one of America's richest and most extravagant socialites. A buzzy article from the AP explains that the Kluges once hosted parties for "royalty, corporate chieftains, celebrities, and literary figures." She lived in a 23,500-square-foot mansion, owned a winery and, by all accounts, lived the good life.

A little too good, as it turned out. Her financial troubles began to pile up during the economic downturn and creditors started seizing her assets in earnest earlier this year. Kluge and her husband had attempted to renegotiate their loans with various banks, but failed. In April, Donald Trump bought most of Kluge's winery and vineyard from Farm Credit Bank for $6.21 million.

As I always tell my wonderful kids, financial success depends on a simple equation:

Income – Expense = deficit or surplus

If spending is greater than income where constant excess spending is financed by drawing from future income (debt), one ends up consuming wealth.

So has been the case of Patricia Kluge. And so will be the case for all the rest who fail to heed or realize on this simple lesson.

[Yes, local boxing legend Manny Pacquiao, despite his newfound riches, won’t be spared from this basic rule]

And so has this predicament befallen on governments, whom mistakenly believe that they can spend their way to prosperity.

Bottom line: It would need or take only common sense and self-discipline to observe this rule, which unfortunately many people especially those in the governments and their apologists don’t have (many live under the delusion that they are beyond or immune to the laws of economics. Also the idea that they are equipped with or backed by the printing presses can do them magical stuffs).

Thursday, June 16, 2011

Political Repression: Sacrificing Lives of Constituents and Mind Control

Here is another example of the myth of good government.

When political leaders are faced with the risks of losing their power, they will abandon or put to risk the lives of their constituents.

In fearing the ripple effect from the Arab Spring (wave of recent uprisings), the North Korean government has responded by refusing to repatriate her citizens stranded in the chaotic Libya.

The Foreign Policy reports, (bold emphasis mine) [pointer to Mark Perry]

In mid-February, as Libya shook to the incipient revolt against Muammar al-Qaddafi, around 200 North Korean migrant workers found themselves stranded. Like their compatriots in other parts of the Middle East, they had been brought in to work as cut-price doctors, nurses, and construction workers. But with a popular uprising unfolding, their government now refused to repatriate them.

According to reports, Pyongyang ordered the workers to remain in Libya out of fear that what they witnessed -- a full-blown popular rebellion against Qaddafi's dictatorship -- could lead to a copycat rebellion back home. "The fear was obviously that these 200 would have a kind of a viral effect, bringing news and information about what was happening in Libya," said Tim Peters, founder of Helping Hands Korea, which aids North Korean refugees.

Mass popular uprisings, so often a contagious affliction, pose problems for any dictatorship. For North Korea, the outbreak of revolts in Egypt and Libya -- two steadfast allies of the hermit regime -- has prompted swift moves to head off a similar outbreak of democracy on its own turf.

And it’s not just that, leaders will even turn to repress on their people when their political interests are at stake such as what has been happening in Libya, Yemen, Syria or elsewhere.

In the North Korean experience above, part of the crackdown against the prospect of a People Power revolt has been to seize possession of cellphones and to clamp down on access to foreign media, because...

(from the same article; bold emphasis added)

"What the authorities fear the most is in fact information," said Hyun In-ae, vice president of NKIS, which smuggles USB sticks containing entertainment and political materials into North Korea...

In recent interviews with North Korean refugees, Noland has detected what he calls a "market syndrome," suggesting a link between participation in illicit market activities, foreign news consumption, and negative views of the regime. Black markets, he said, have the potential to turn into a "semiautonomous zone of social communication" and a possible space for political organizing. "In short," Noland said, "information and markets are linked."

That’s why governments abhor free markets, because free markets are the epicenter of information that coordinates people’s actions. And such actions may include the power to neutralize the political interests of tyrannical leaders.

But one might be tempted to object:

“but that is North Korea and should not apply to the US or the Philippines.”

As the great Friedrich von Hayek reminds us, (The Road to Serfdom) [bold emphasis mine]

Collectivism means the end of truth. To make a totalitarian system function efficiently, it is not enough that everybody should be forced to work for the ends selected by those in control; it is essential that the people should come to regard these ends as their own. This is brought about by propaganda and by complete control of all sources of information.

In short, control of information, which leads to mind control or indoctrination for political subjugation, is the essence of totalitarianism. And this has universal application.

The Myth of Good Government

One my favorite video clips is when Milton Friedman was interviewed by Phil Donahue in the 70s on the topics of greed and virtue.

In addressing Mr. Donahue’s suggestion that governments ought to “reward virtue” Mr. Friedman rebutted (bold emphasis added)

"And what does reward virtue? You think the communist commissar rewards virtue? ...Do you think American presidents reward virtue? Do they choose their appointees on the basis of the virtue of the people appointed or on the basis of their political clout? Is it really true that political self- interest is nobler somehow than economic self-interest? ...Just tell me where in the world you find these angels who are going to organize society for us?"

The illusion of “rewarding virtue” can be seen in the appointments of US President Obama,

From the Politico, (bold emphasis mine)

More than two years after Obama took office vowing to banish “special interests” from his administration, nearly 200 of his biggest donors have landed plum government jobs and advisory posts, won federal contracts worth millions of dollars for their business interests or attended numerous elite White House meetings and social events, an investigation by iWatch News has found.

These “bundlers” raised at least $50,000 — and sometimes more than $500,000 — in campaign donations for Obama’s campaign. Many of those in the “Class of 2008” are now being asked to bundle contributions for Obama’s reelection, an effort that could cost $1 billion...

More (from the same article; emphasis added)...

The iWatch News investigation found:

Overall, 184 of 556, or about one-third of Obama bundlers or their spouses joined the administration in some role. But the percentages are much higher for the big-dollar bundlers. Nearly 80 percent of those who collected more than $500,000 for Obama took “key administration posts,” as defined by the White House. More than half the 24 ambassador nominees who were bundlers raised $500,000.

The big bundlers had broad access to the White House for meetings with top administration officials and glitzy social events. In all, campaign bundlers and their family members account for more than 3,000 White House meetings and visits. Half of them raised $200,000 or more.

Some Obama bundlers have ties to companies that stand to gain financially from the president’s policy agenda, particularly in clean energy and telecommunications, and some already have done so. Level 3 Communications, for instance, snared $13.8 million in stimulus money.

And it’s not just President Obama, but also past President Bush (from the same article; emphasis added)

Public Citizen found in 2008 that President George W. Bush had appointed about 200 bundlers to administration posts over his eight years in office. That is roughly the same number Obama has appointed in a little more than two years, the iWatch News analysis showed.

Well, that’s in the US which supposedly is a country whose political institutions are far sounder than the most of the world.

Yet in the Philippines, it’s been no different.

From Sunstar.com.ph (emphasis added)

FRIENDS and allies of President Benigno Aquino III occupying government positions are not considered “untouchables” and will not be spared from corrections, the President’s spokesman said.

Presidential spokesperson Edwin Lacierda admitted that President Aquino prefers to appoint people whom he has level of comfort but it does not mean that they are not beyond criticism.

So there you have it.

Milton Friedman was correct to debunk the romanticized idea that governments’ reward the virtuous.

Instead, the main beneficiaries of the division of the spoils via political appointments (or political concessions) have been from political allies and political clients, vested ‘rent seeking’ interest groups, families and friends. And this dynamic applies to any form of government.

Realize that political leaders or bureaucrats are human beings or self-interested agents too, whom are subject to the same fragilities (biases, knowledge limitations, different interpretations based on diverse value preferences, cultural orientation, education and etc.) as everyone else.

The difference is in the incentives that governs them with those of economic agents.

Instead of profits and losses, these entities use institutional coercion or violence to redistribute resources based on political exigencies (e.g. populism) with the ultimate aim of annexation and preservation of power and of social image. Thus, the reliance on so-called ‘comfort zones’ as every society operates on diversified interests which continually competes for scarce resources.

Despite the popular notion, Government or the State will NEVER be about virtue or morality.

So for those who stubbornly insist of having “good governments”, be it known that dreams or illusions can last forever.