Fear is the foundation of most governments; but it is so sordid and brutal a passion, and renders men in whose breasts it predominates so stupid and miserable, that Americans will not be likely to approve of any political institution which is founded on it.- John Adams

It’s nice to see global equity markets bounce off newly established lows.

The ASEAN-4, represented by the Philippines (PCOMP-yellow), Thailand (SET-green), Indonesia (JCI-orange) and Malaysia (FBMKLSE-red), once again demonstrating tight correlations of price actions even on a near term or 3 months basis.

Bottom or Dead Cat’s Bounce?

But has the recent lows been indicative of a bottom or has last week’s actions signified a dead cat’s bounce?

First of all, last week’s highly volatile actions in the global equity markets exhibited lucid conditions of boom bust cycles as the market’s principal drivers

This has been especially evident last Tuesday.

As US equity markets encroached on the bear market threshold of 20%, the announcement of the bailout of Belgium’s biggest bank Dexia SA by French and Belgian governments seemed to have spurred a dramatic 4% upside swing on the final hour of trading session where US major equity benchmarks closed significantly higher[1].

This signifies as the second bailout of Dexia SA.

At the height of the maelstrom in 2008, Dexia was the first among the many European banks to fall and subsequently became one of the major borrowers from the US Federal Reserve[2].

The possible implication of this is that the US central bank could be part of the consortium that determines how the bailout will be conducted.

Although current reports say that Drexia would be split into two banks, where one of the banks will hold troubled assets or serve as a ‘bad bank’[3]; there has been no mention of any participation of the US Federal Reserve yet. So this would signify as speculation on my part.

Like Greece, this serves as another example which reveals how bailout policies:

-usually don’t work,

-signify as inefficient approach in rectifying an imbalance,

-account as short term patches that only defers the problem,

-and function like a black hole where scarce economic resources are not only diverted, but drains on the productive sectors which ultimately enfeebles the overall system

Additionally, while credit margins for commodity markets have been serially squeezed, the CME Group, the biggest futures exchange, recently went to the opposite direction for financial securities, where the CME eased credit margins a whopping 33%[4].

This serves as another evidence where indirect market manipulation by policymakers has been biased towards bolstering the financial sector at the expense of the commodity markets.

The S&P 500 closed the week up by 2.12% while the Dow Jones Industrials and the Nasdaq were higher 1.74% and 2.65% respectively.

Technically speaking, the S&P remains below the 50-day and 200-day moving averages which points to the likelihood of a temporary bounce, until proven otherwise.

Yet the rest of the week has been distinguished by an environment directed towards more bailouts.

The Bank of England (BoE) reactivated her version of Quantitave Easing (QE) 2.0[5], whom will be expanding bond purchases to 275 billion pounds ($421 billion) from 200 billion over the next four months.

The BoE, through governor Mervyn King, has preempted European governments. Mr King claimed that this action has been made because they have lost faith in European governments’ ability to resolve the region’s debt crisis[6].

However, in doing so, Mr. King utilized fear anew to justify such interventions.

To quote BoE governor Mervyn King[7]

This is the most serious financial crisis we’ve seen, at least since the 1930s, if not ever. We’re having to deal with very unusual circumstances, but to act calmly to this and to do the right thing

This essentially validates my theory that markets today are increasingly being massaged, not only through direct policies, but through communications management, or technically known as signaling channel[8], in order for the public to politically accommodate on such interventions.

Fear has served as an ever convenient tool to impose political controls over society.

And just hours after the BoE’s move, the European Central Bank (ECB) announced that they will be expanding her coverage of QE or asset purchasing program, by including ‘covered bonds’ or pooled securities backed by mortgages and public sector loans.[9] The ECB will buy 40 billion euros or $53 billion next month.

In addition, the ECB will give banks unlimited access to cash through January 2013 or loans in the duration of 12 and 13-months[10].

Also, speculations had been rife that ‘policy makers are working on plans to boost bank capital’.

European stocks have rallied off from a 2 week low as represented the STOX 50[11] or a blue chip index which covers 50 stocks from 12 Eurozone countries.

All these developments reveal of how global equities has been artificially buttressed by serial bailouts and policies of inflationism.

Also, interventionism, meant to prevent markets from reflecting the real values of financial securities, has massively skewed the pricing process that has led to severe volatility or sharp fluctuations.

Moreover, as further manifestation of distorted markets, price actions of so called risk assets have become tightly correlated when strains to the financial system emerges.

Finally price trends or the fate of asset prices are most likely to be determined by the prospective actions of policymakers. This makes governments the ultimate practitioners of insider trading—where governments manipulate markets to benefit certain segments of society.

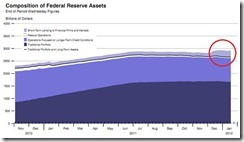

With almost every major central banks expanding on their balance sheets today, most notably the very aggressive Swiss National Bank (SNB), see green line from Danske Bank chart[12], I would presume the US Federal Reserve’s participation will be a matter of political timing.

Blanc De L'oeil (White of the Eye)

It is important to note that announcement and implementation of QEs does NOT imply that markets would automatically or mechanically respond favorably. QE policies will likely be size-dependent and or highly sensitive to market expectations based on the timing, scale and duration of the program.

The efficacy on the marketplace from the current programs initiated by the BoE and the ECB which seem to be less in size than the previous measures, has yet to be established. Thus, the sustainability of the recent QE-led rebound can only be arrived at when chatters of bailouts diminishes—which implies that the market has began to discount the momentary adverse impacts of the underlying crisis.

Also, I am in the camp that sees that the US as unlikely to succumb to an economic recession. For example the chart above shows that the US Purchasing Managers Index PMI of New Orders and Employment remain in positive non-recession territories in spite of the recent slowdown[13]. And as I have been pointing out money supply growth in the US has been growing at a substantial pace[14] which poses as unlikely indicators of a looming recession.

But my stance would be conditional based on factors that may turn out to be shocks, such as further deterioration in the Eurozone or a China bubble meltdown.

In addition, I harbor a deep suspicion that markets are presently being used as fulcrum by politicians to secure their preferred political actions. This can be exemplified by BoE’s Mervyn King recent scare tactics, where such jawboning risks becoming a self-fulfilling prophesy.

And I would think that the US Federal Reserve chief Ben Bernanke may probably be discreetly wishing for more of market stress that would clear the way for him to impose his signature creed contribution to modern central banking—the modified helicopter option or the QE version 3.0.

It is important to note that US Banking and finance stocks appear to be highly dependent on Bernanke’s QE where the latter’s absence has led to declining share prices[15]. So aside from lethargic property markets, falling equity prices may affect the banking sector’s capital adequacy ratios that would prompt for further asset liquidations.

In addition, the interconnectedness of global banking system and the considerable exposure of US banks to crisis affected Eurozone banks leaves US banks highly vulnerable to a contagion[16].

These reasons would have been enough impetus for Mr. Bernanke to resort to QE 3.0. However, Mr. Bernanke appears to be have been inhibited by the recent political impasse with other political agents where his failure to incorporate QE 3.0 during the last FOMC meeting triggered a convulsion in the global financial markets[17]

This turns out to be one instance where supposed transparency of government policies meant to stabilize the markets morphed into an expectations failure because of politics. In short, like typical politicians, promises are meant to be broken.

Furthermore, resonant calls of greater odds of recession by his private sector allies could be part of this campaign to inculcate ‘fear’ in order to warrant political intervention through inflationism.

And I would add that the price action of gold has been indicative of the current state of limbo.

Despite the newly announced QEs, gold prices continues to fumble along which appears to deviate from the actions of the equity markets. Such variance puts emphasis on the aura of heightened uncertainty.

As for my position in the local equity markets, as stated last week

I would need to see the blanc de l'oeil or the French idiom for seeing ‘the white of their eyes’ before taking my shots.

[1] See Reported Bailout of Belgium’s Dexia Spurs a fantastic US Equity Market Comeback, October 5, 2011

[2] Telegraph.co.uk Belgian bank Dexia was biggest borrower from Federal Reserve discount window, March 31, 2011

[3] Bloomberg.com Dexia Board Meets as France, Belgium Tussle, October 8, 2011

[4] Zerohedge.com Soaring Financial Vol Leads CME To Announce A 33% Margin...Cut, October 4, 2011

[5] See Bank of England Activates QE 2.0, October 6 2011

[6] Bloomberg.com BOE Loses Faith in Europe, Announces Stimulus, October 7, 2011

[7] Telegraph.co.uk World facing worst financial crisis in history, Bank of England Governor says, October 9, 2011

[8] See War on Precious Metals: The Rationalization Process For QE 3.0, May 7, 2011

[9] See European Central Bank expands QE to include Covered Bonds October 6, 2011

[10] Bloomberg.com ECB Keeps Banks Afloat as Governments Act on Greek Risk, October 7, 2011

[11] Stoxx.com EURO STOXX 50

[12] Danske Bank Japan: BoJ can afford to be on hold for now October 7, 2011

[13] Dr. Ed’s Blog US Purchasing Managers Indexes, October 6, 2011

[14] See US in a Deflationary Environment, NOT! (In Charts) September 16, 2011

[15] See The US Banking Sector’s Dependence on Bernanke’s QEs, October 5, 2011

[16] See US Banks are Exposed to the Euro Debt Crisis, October 8, 2011

[17] See Bernanke Jilts Markets on Steroids, Suffers Violent Withdrawal Symptoms, September 22, 2011