Easy money also helps the fiscal position of the government. Lower borrowing costs mean lower deficits. In effect, negative real interest rates are indirect debt monetization. Allowing borrowers including the government to get addicted to unsustainably low rates creates enormous solvency risks when rates eventually rise. I believe that the Japanese government has already reached the point where a normalization of rates would create a fiscal crisis. David Einhorn

We are living in interesting times.

Negative Real Interest Rate as Stock Market Driver

In the Philippines, interest rates have considerably been below inflation rates.

Banks like the BPI[1], offers yields anywhere 2-2.75% for 364 days on their regular time deposit account, depending on the size of the account (as of November 15 to 21), whereas statistical Consumer Price Inflation rate has reached 5.2% last October[2].

Most people don’t realize that real money returns for the Peso has been negative or that savers have been losing money in terms of reduced purchasing power.

Curiously, inflation rates are even higher than the yields of domestic government bonds, from 1 to 10 years in maturity. This implies that bondholders of 10 years maturity and below are also getting squeezed from the current negative real interest rate regime (chart from Asian Bonds Online[3]).

Aside, the steep yield curve likewise induces borrow-short lend-long activities or maturity transformation which implies of higher future CPI rates as banks are incentivized to expand lending.

And since the yield curve has been steep even from last year, we are seeing credit activities ramping up.

From the BSP[4], (bold emphasis mine)

Growth in outstanding loans of commercial banks, net of banks’ reverse repurchase (RRP) placements with the BSP, accelerated in September to 21.7 percent from the previous month’s expansion of 19.8 percent. Meanwhile, the growth of bank lending inclusive of RRPs slowed down to 18.9 percent from 24.8 percent in August. Commercial banks’ loans have been growing steadily at double-digit growth rates since January 2011. On a month-on-month seasonally-adjusted basis, commercial banks’ lending in September grew by 1.0 percent for loans net of RRPs, while loans inclusive of RRPs fell by 2.0 percent.

Loans for production activities—which comprised 84.2 percent of commercial banks’ total loan portfolio—grew steadily by 22.9 percent in September from 21.5 percent a month earlier. Growth in consumer loans likewise accelerated to 17.9 percent from 13.4 percent in August, reflecting the rapid growth in lending across all types of household loans.

The expansion in production loans continued to be driven largely by higher lending to electricity, gas and water (which grew by 56.3 percent); manufacturing (24.2 percent); real estate, renting and business services (26.1 percent); wholesale and retail trade (29.8 percent); financial intermediation (32.8 percent); transportation, storage and communication (19.3 percent); and construction (17.6 percent). Moreover, with strong global demand driving growth in the mining and quarrying industry, loans to mining and quarrying more than tripled in September from a year ago, sustaining the three-digit growth rate since May 2011. Meanwhile, contractions were posted in lending to three production sectors, namely, health and social work (-4.9 percent), education (-10.0 percent), and agriculture, hunting and forestry (-3.5 percent).

From a mainstream economic viewpoint this will be seen as a good sign.

Theoretically low interest rate should reflect on the time preferences of individuals, where the preference to consume goods later rather than now (lower time preference) means that there should be an abundance of savings available for investments.

According to Mises.wiki[5]

The act of saving is a means through which man can achieve his ultimate goal, which is bettering his situation. Saving implies giving up some benefits at present - this is the price paid for the attainment of the end sought. The value of the price paid is called cost, and costs are equal to the value of the satisfaction which one must forego to attain the end aimed at.

The return on savings must be in excess of the cost of savings. If the costs are too high - if savings can’t better an individual’s life and well being - then saving will not be undertaken.

Consequently, the return on savings must be above the premium for man to agree to save. A positive time preference (i.e., the existence of a premium) precludes the natural emergence of a zero interest rate. Should a zero interest rate be imposed, this will abort all savings and lead to the destruction of the production structure. The premium of having goods now versus having them in the future is getting smaller with the increase in their stock. This, in turn, means that the required return on savings will be lower. An increase in the pool of funding sets the platform for lower interest rates.

Apart from time preferences, the purchasing power of money and business risk are important elements in the formation of interest. However, their importance is assessed in reference to the fundamental factor, which is time preference.

However as pointed out above a policy induced boom from manipulated interest rates distorts the production structure which will be misdirected towards investments in capital goods (higher stages of production) that leads to a bubble cycle (Austrian Business Cycle Theory—ABCT).

As I wrote last week[6],

Although I am not sure which sector should give the best returns over the short term, I am predisposed towards what Austrian economics calls as the higher order stages of production or the capital goods industries, which are likely the beneficiaries of the business cycle, specifically, mining, property-construction and energy, as well as financials whom are likely to serve as funding intermediaries for these projects.

Interestingly, even the relative performances by different sectors in the PSE seem to coincide or reflect on the distribution of credit growth as noted by the BSP.

For this week, except for Financial-Banking sector, the best gainers have been the mining index, followed by the industrial (mostly weighted on energy and utility companies) and the property sector. Here I am comparing apples to oranges because of the variances of time considerations between the PSE sectoral activities and loan portfolio growth in the real economy.

Yet the outperformance of the mining sector in the PSE can likewise be accounted for in the tripling of loans to the mining and quarrying industry.

Overall, the point is that the accelerating credit growth in capital good industries such as in mining, real estate and construction, power and financial intermediation appears to corroborate the boom bust process.

Another fascinating observation is that negative real interest rates may have altered the composition of trading activities seen during the current cycle in the Philippine Stock Exchange (PSE).

In the 2003-2007 boom cycle, foreign investors had largely been the dominant force in the daily trading activities at the PSE. Today, local participants appear to have wrested that role.

And the ascendancy of local investors seems to have provided resiliency to the Phisix during the recent shakeout.

The implication is that negative real interest rates may have driven many savers to speculate on the stock market to eke out positive real returns.

Yet if holding cash and near term bonds generates negative real returns then where to put one’s resources?

Every investment competes for your money. There will always be a tradeoff for any choices we make. Investments would mean a trade-off in terms of risk-reward and on relative assets.

Market Risk: Debating The Role of the ECB

There is no such thing as a risk free investment as inculcated to us by media, the academe or by mainstream institutions.

The concept of “risk-free” has been impressed upon us to justify the institutional rechanneling of private savings via the banking system into funding pet programs of politicians. And part of the process has been enabled by banking regulations such as the Basel Accord.

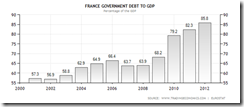

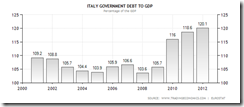

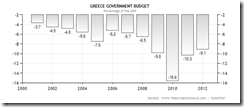

Yet such masquerade is presently being exposed by the markets. The bond spread of Italy and France (relative to the German Bund) has soared to record highs[7] as shown in the above chart (chartoftheday.com).

To add, the cost to insure liabilities of AAA credit rating France is now higher than the Philippines or compared to ASEAN-4[8]. This means that the credit standings applied by the government licensed or accredited credit rating agency cartel does not accurately reflect on the credit risks by developed economies plagued by the unsustainable welfare state.

And because financial markets have been defying whatever the EU governments has been imposing such as credit margin hikes[9] on Italian bonds and ban on short selling of Italian stocks[10], credit rating agencies appear as being pressured to downgrade the AAA credit rating of France[11].

The economics of the marketplace has been reasserting her ascendancy against welfare based politics.

Yet political impasse over the role of the European Central Bank as the “lender of last resort” has proven to be a seething issue that continues to unsettled financial markets.

While some key officials such as German Chancellor Angela Merkel[12], ECB’s Mario Draghi[13] and IMF’s John Lipsky[14] were allegedly against the carte blanche backstop role for the ECB, there has been a growing clarion clamor for the ECB to aggressively support the bond markets from France and from political personalities such as former German Chancellor Gerhard Schroeder[15], Portuguese President Anibal Cavaco Silva[16] and many more.

One popular analyst have even called the ECB’s role as either to “Print or Perish” for the Euro, which resonates with the popular call to inflate. Little do these inflation advocates realize that historical accounts of currency destruction have hardly been about the “deflationary spiral” but more about serial episodes of hyperinflations and or wars[17].

For the ECB to rapidly and intensify inflationism would be to “Print and Perish”.

Nonetheless, print and perish has been the name of the game for global central bankers.

But the supposed political stalemate over the ECB’s role appears as “smoke and mirrors” for me.

That’s because in reality, the ECB along with rest of major Central Banks except the US Federal Reserve has been scaling up their asset purchases as shown by the above chart[18].

Since 2008, major central banks have been ramping up asset purchases which makes today’s developments as unprecedented or entirely unique in modern history. So there hardly can be merit to claims that we are bound for “deflationary spiral” for as long as central banks continue to inundate the world with the liquidity approach to contain what truly are insolvency issues.

The ECB has reportedly an undeclared €20 billion weekly limit of bond purchases[19]. I would conjecture that rules, laws, regulations, policies or self-imposed limits change according to the convenience and the interests of politicians.

And recent reports suggest that European banks have been unloading heaps of sovereign debt issues.

So EU banks have been taking the opportunity to transfer their supposed “risk free” securities to the ECB in order to rehabilitate their balance sheets.

And the desire for the ECB to take on a more aggressive role can be seen through the implied missives from this New York Times article[20],

The dynamic of falling bond prices also undermines the capital position of the banks, since they are among the biggest holders of government bonds in many countries. As those assets plunge in value, banks cut back on lending and hoard capital, increasing the likelihood of a recession.

All these money printing won’t be sucked into a financial black hole, as they will have to flow somewhere.

Yet despite the current turbulence, I think that the current volatility may be ignoring such dynamic.

As a final note, if events in the Eurozone should turn out for the worst, the local and ASEAN economies may not be immune from such disruption, which may affect the region’s stock markets.

As Gerald Hwang of the Matthews Asian Fund writes[21],

Asian fixed income markets can have heavy foreign participation in both bonds and bank loans. The amount of participation from European banks is noteworthy in light of their exposure to European debt and the probability of shrinking balance sheets in the near future. European bank lending into Asia is greater than U.S. bank lending in the region; therefore, weakness in European bank balance sheets may tighten the financing environment for Asia’s borrowers more so than similar weakness in U.S. banks.

While European banks do have material exposure on Asia, I wouldn’t call less than 25% as substantial enough to possibly rock the boat. But again this depends on general market sentiment. Also, any tightening of credit conditions by Euro banks may be used as an opportunity by non-European banks to expand their market share.

Market Risk: US ‘Sequester’ Spending Cuts Will Be a Nonevent

The Philippine Stock Exchange’s Phisix has been up 2.41% on a year-to-date basis and has outperformed the majors and other Emerging Market contemporaries. But it is important to point out that such outperformance has still been dependent on the ebbs and flows of global markets, particularly the US (SPX).

Over the past weeks, we seem to be seeing renewed weakness in Europe (STOX50), China (SSEC) and US S&P 500 (SPX).

So far the stock markets of the Eurozone has, I think, already priced in an economic recession given the current bear market status. The Stoxx50 is still 19% down from the February 2011 high. Yet should the ECB intensify the asset purchases or inflationism we should see European stocks pick up.

Further, I think that US stock markets will likely steer the global markets rather than that of the EU. This means that an ascendant US markets should likely bolster the bullish case of the Phisix and of the ASEAN-4 and vice versa.

Yet another worry being promoted by some of the bears is the brewing gridlock by Congressional super committee over spending cuts that would result to sequester rules or automatic spending cut.

The Wall Street Journal editorial says that such concerns are exaggerated[22],

Under the sequester rules, roughly half of the spending cuts would come from defense and homeland security, and the other half from domestic programs such as roads, education, energy and housing. An automatic cut from every federal agency is far from an ideal way to write a budget, because it sets no priorities and largely exempts the major entitlements like Medicare and Medicaid.

But the sequester does have the virtue of imposing reductions in spending that Congress rarely agrees to on its own. The Congressional Budget Office estimates domestic programs would take a 7.8% cut, while defense programs would get sliced by 10%. Medicare spending, mostly payments to providers, would fall by 2%. This would yield $68 billion in savings in 2013, and more savings in future years by ratcheting down the baseline level of spending.

Given the spending increases of recent years, those cuts are hardly excessive. Domestic programs received a nearly $300 billion windfall under the 2009 stimulus, so a sequester would take back a little more than one-fifth in 2013. Total domestic discretionary spending doubled to $614 billion in 2010 from $298 billion in 2000. Even if there were a 10-year $1.2 trillion "cut," total discretionary spending would still rise by $83 billion by 2021 because those cuts are calculated from inflated "current services" projections.

Essentially, the $1.2 trillion sequester spending cuts will be spread over 10 years, and as mentioned above will be apportioned mostly towards defense, homeland security and domestic programs which hardly tackles on welfare entitlement programs.

The sequester or automatic spending cuts extrapolates to a cut on the rate of growth spending rather than real or actual cuts as shown above[23].

This only means that risks from the supposed political gridlock won’t be anywhere as disastrous as portrayed by political fanatics.

For the US markets, the reaccelerating growth of money supply should filter into and continue to provide support to her stock markets and the economy.

This week, the US economy posted strong growth which apparently surprised the mainstream[24]. Of course we understand this to be inflation boosted growth.

Barring any unforeseen events, I think this momentum should continue.

A Short Note On Commodities

Commodity markets experienced intensified downside volatility last week which many blamed on the Euro crisis.

While the Euro crisis may have aggravated sentiment, my guess is that these have been largely related to the liquidation process being undertaken by the trustee committee handling bankruptcy of MF Global Holdings who incidentally filed papers to set up the required accelerated filing of claims a day before the selloff[25].

Gold oil and copper simultaneously fell the following day.

I earlier noted that this should be expected[26] last week but apparently has been deferred until this week.

And I think that once the proceedings culminate, the upside trend for the commodity markets should resume.

Bottom line: Negative real interest rates and expanding balance sheets of major global central banks will impact asset prices differently. Nevertheless such dynamic will continue to provide support to the Phisix-ASEAN equity markets and the commodity markets.

On the other hand, unless a massive collapse occurs, political developments particularly in the Eurozone should spice up market actions.

So my guess is that the current domestic environment of negative real interest rates should bode well for investors of the PSE.

[1] BPI Expressonline Regular Time Deposit (Peso) November 15 to November 21, 2011

[2] Tradingeconomics.com Philippine Inflation rate

[3] AsianBondsOnline Philippine Government Bond Yields

[4] bsp.gov.ph Bank Lending Growth Expands Further in September, November 11, 2011

[5] Wiki.mises.org Saving and the Interest rate

[6] See Phisix-ASEAN Equities: Awaiting for the Confirmation of the Bullmarket, November 13, 2011

[7] Telegraph.co.uk Spread between French and German bonds hits record, November 9, 2011

[8] See Chart of the Day: France ‘Riskier’ than the Philippines, ASEAN, November 17, 2011

[9] Reuters.com MONEY MARKETS-Italian banks risk becoming dependent on ECB, November 10, 2011

[10] Reuters.com Italy to ban naked short-selling on stocks, November 11, 2011

[11] Guardian.co.uk Debts in France threaten top credit rating, November 15, 2011

[12] Bloomberg.com Merkel Rejects ECB as Crisis Backstop in Clash With France, November 17, 2011

[13] Washington Post, ECB leader Mario Draghi rebuffs calls for greater central bank role, November 19, 2011

[14] CNBC.com IMF’s Lipsky Backs Merkel Over ECB Powers November 18, 2011

[15] Reuters.com German ex-chancellor sees ECB steps in "last resort", November 18, 2011

[16] Bloomberg.com ECB as Lender of Last Resort Will Resolve Debt Crisis for Portugal’s Silva, November 12, 2011

[17] Hewitt Mike The Fate of Paper Money, January 5, 2009 DollarDaze.org

[18] Danske Bank, Bank of Japan on hold, still sees substantial downside risks November 16, 2011

[19] Reuters.com ECB has secret 20 billion euro bond-buying limit: report November 18, 2011

[20] New York Times Europe Fears a Credit Squeeze as Investors Sell Bond Holdings, November 18, 2011

[21] Hwang Gerald Capital Flows: Asia's Quiet Revolution Asia Insight November 2011 Matthews International Capital Management, LLC

[22] Wall Street Journal Editorial The Sequester Option, November 18, 2011

[23] Mitchell Daniel What Matters More to Republicans, Defending Taxpayers or Expanding Government?, November 18, 2011

[24] See Strong Performance of the US Economy Surprises the Mainstream November 19, 2011

[25] See MF Global Holding’s Liquidations and the November 17th Commodity Prices Rout, November 19, 2011

[26] See Client Accounts Transfer from MF Global Holdings may trigger Market Volatility Next Week, November 5, 2011