At least one in four Paris apartments listed by realtor Agence Etoile can’t be sold, even with mortgage rates at record lows, as buyers and sellers fail to agree on price, the company’s director said.“I have some inventory that’s too expensive and sellers don’t want to lower prices,” Christine Perrissel said in an interview. “Buyers are just much more selective.”Across France, an economy that’s stalled for two years, joblessness at a 15-year high, property prices near record highs and new taxes have made households reluctant to borrow to buy homes. While Europe’s debt crisis prompted banks to tighten credit, since the start of this year they’ve offered more attractive terms to lure customers and meet lending targets, after borrowing plunged in 2012.The average home-loan rate fell 0.8 percentage point from a year ago to a record low 3.34 percent in the first two months of the year. Still, new mortgages granted in the 12 months through February slid 27 percent from a year earlier to 98.4 billion euros ($129 billion), according to the Bank of France.New home sales plunged 18 percent in 2012 to 77,900. Existing home sales declined 12 percent to 709,000, with the drop worsening to 22 percent in the year to February. The average housing investment funded with loans represented 3.73 years of the buyer’s income in March, the lowest since January 2010, a study by lender Credit Logement SA and polling firm CSA showsThe data reveal that as rates fall, the market still hasn’t fully shaken off the gloom of 2012 when real estate purchases plunged as banks tightened mortgage lending and after former President Nicolas Sarkozy and his successor Francois Hollande, elected in May, added property taxes to trim the country’s deficit.Hollande, the first Socialist president in France since 1995, has called on those “with the most to show patriotism” in tough times. He’s raised income taxes, those on capital gains from property, as well as wealth and inheritance levies. That prompted Gerard Depardieu, who played Obelix in films about one of France’s most beloved fictional characters, to move to Belgium.“We’ve had a catastrophic start of the year in January and February with the tax squeeze,” said Marc Julien, founder and chief executive officer of Pierre Invest, a broker specializing in new properties for the Paris region, referring to the property taxes.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, April 23, 2013

French Property Sector Takes a Hit from Hollande’s Taxes

Friday, April 05, 2013

Spanish Government’s Ponzi Financing Scheme

Spain’s pension reserve-fund ramped up its holdings of domestic debt last year, profiting from a rally across southern Europe and making it easier for Prime Minister Mariano Rajoy to raid the fund to finance his budget.The so-called Fondo de Reserva de la Seguridad Social in 2012 increased its domestic sovereign debt holdings to 97 percent of its assets from 90 percent at the end of 2011, according to its annual report due to be presented to lawmakers today at 12:30 p.m. in Madrid and obtained by Bloomberg News.The fund purchased about 20 billion euros ($26 billion) of Spanish debt last year, while it sold 4.6 billion euros of French, Dutch and German bonds. More than 70 percent of the purchases took place in the second half of the year, after European Central Bank President Mario Draghi pledged to do “whatever it takes” to defend the euro, boosting Spanish bonds.

Spain’s state-run social security system, also in charge of unemployment benefits, stopped registering surpluses in 2011. Its deficit was 1 percent of GDP last year, contributing to the nation’s total budget gap of 10.2 percent of GDP.A recession is crimping contributions paid by workers and their employers. At the same time spending has increased due to a record jobless rate of 26 percent and a pensions’ bill, which has risen to 9 billion euros a month from 8 billion euros in 2004.While the fund stopped receiving government contributions in 2010, its managers changed rules on July 17 to profit from returns from Spanish securities, according to the document.The maximum amount that can be invested in a given security was increased to 35 percent of the total portfolio from 16 percent. At the same time, the fund raised to 12 percent from 11 percent its maximum share in the Treasury’s total outstanding debt. The Treasury’s debt stock was 634 billion euros in February, according to data on its website.

cash flows from operations are not sufficient to fulfill either the repayment of principle or the interest due on outstanding debts by their cash flows from operations. Such units can sell assets or borrow. Borrowing to pay interest or selling assets to pay interest (and even dividends) on common stock lowers the equity of a unit, even as it increases liabilities and the prior commitment of future incomes. A unit that Ponzi finances lowers the margin of safety that it offers the holders of its debts.

In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance.Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently, units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values.

Wednesday, January 30, 2013

French Labor Minister: France is “Totally Bankrupt”

We can begin 2013 on a more confident note, precisely because significant progress was made during 2012,” Draghi said in a speech in Frankfurt late yesterday. “The darkest clouds over the euro area subsided. Europe’s leaders recognized that monetary union needs to be complemented by a financial union, a fiscal union, a genuine economic union and eventually a deeper political union.”

Senior French politicians have been forced to defend the state of the country’s economy after Labor Minister Michel Sapin set off a storm of controversy by claiming France was “totally bankrupt”.Sapin made the remarks in a radio interview on Jan. 27 after he was asked about Former Prime Minister Francois Fillon comment in September 2007 that France was a “bankrupt state.” Sapin responded, “But it’s a totally bankrupt state,” adding “that’s the reason we have to put deficit- reductions programs in place.”The minister immediately took back the statement, saying he was being “ironic.”

Saturday, January 26, 2013

Tina Turner Renounces US Citizenship: A Tax and Privacy Issue?

Pop legend Tina Turner has announced that she will give up her US citizenship and become a citizen of Switzerland.The most interesting part of this story is that she is renouncing her US citizenship even though she was not required to. Both Switzerland and the US allow dual citizenship.It was her choice to renounce, and that choice has serious costs.Turner, whose net worth likely meets the criteria to be stuck with the so-called US Exit Tax (for those with a net worth of more than $2 million.) This means that upon expatriation, all of her worldwide assets will be taxed as if they were sold at fair market value – a steep price indeed.Other factors must have played a role in her decision to renounce and incur such costs when she was not otherwise forced to.Turner has not explicitly explained why she is renouncing her US citizenship – nor would she be wise to, which would only attract even more scrutiny. She probably weighed the pros and cons of keeping her US passport, which offered her limited benefits and immense liabilities.It probably was not tax related, Switzerland itself is a high tax environment for its citizens.Perhaps an important feature of Switzerland for her is its respect for privacy.Contrast that to the US government's blatant disdain for privacy. Under the pretexts of the various never-ending "wars" (drugs, terrorism, organized crime, tax evasion, etc.) the US government has essentially destroyed privacy and often treats its citizens as if they were prison inmates.

Tuesday, December 11, 2012

Symptoms of Welfare Crisis: French Actor Gérard Depardieu Joins Ballooning Lists of Tax Exiles

French actor Gérard Depardieu has set up legal residence in a Belgian village just over the French border to escape his country's punitive taxes, the local mayor has confirmed.The 63-year-old star has bought an unglamorous-looking former customs official's house in the village of Nechin, a stone's throw from the nearest French town of Roubaix.The corpulent screen icon is the latest rich Frenchman to flee the country ahead of a new tax of 75 per cent on all earnings over one million euros - around 850,000 pounds. Belgium's top rate is 50 per cent.Around a third of the 2,800-strong population of Nechin was already French, the village mayor Daniel Senesael said.

In 2009, 11.2 million French persons received welfare payments, out a total population of 65.3 million. This amounted to $78 billion in payments. Moreover, these 11 million beneficiaries have families (parents, spouses, children); thus, more than 35 million people are actually benefiting directly or indirectly from welfare payments, which is more than 50 percent of the French population.

This seems similar to the recent experience in the United Kingdom, where 2/3 of the rich has recently disappeared.

Since work cannot significantly bring a real improvement in daily life, it is better to stay “poor” and do nothing, which is not rewarding. Assistantship becomes more important than entrepreneurship.

Saturday, November 17, 2012

Southern Europeans Flee to Germany

The influx of Southern Europeans into Germany has gathered pace in recent months, as a growing number of Greeks, Spaniards and Portuguese ventured north to escape deepening recession and growing social tensions.The biggest increase came from Greece. The number of Greeks moving to Germany jumped 78% in the first half of 2012 from a year earlier, Germany's statistics office said.In all, more than 16,000 people moved to Germany from Greece between January and June, an acceleration of a trend that began in 2010 after the Greek crisis began. The number of immigrants to Germany from Spain and Portugal was up by 53% for each country.The trend bodes ill for countries on Europe's southern periphery at a time of worsening economic malaise. Many of those leaving are young professionals with valuable skills. Their departures could have long-term consequences for countries such as Greece and Portugal as they struggle to recover."There are absolutely no jobs here—that's the main reason why people move away," said Charalampos Koutalakis, a politics professor at the University of Athens.

Wednesday, October 10, 2012

Ron Paul: Government Dependency Will End in Chaos

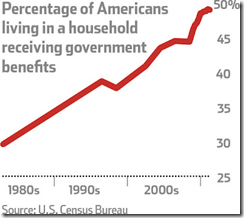

The media insists on characterizing statements about dependency on government handouts as controversial, but in truth such statements are absolutely correct. It's not that nearly half of Americans are dependent on government; it's actually more than half. If one includes not just people on food stamps and welfare, but also seniors on Medicare, Social Security and people employed by the government directly, the number is more like 165 million out of 308 million, which is 53%.Some argue that Social Security and Medicare benefits are a right because people pay into these programs their whole lives, or that we need a government safety net in place for people who fall on hard times. However, this all becomes a moot point when the funds people depend on become worthless due to government default or rampant inflation.This is less an issue of dignity or dependence on government, and more about the deceitfulness of government promises.The Fed recently announced that it plans to keep interest rates near zero and keep buying near worthless assets from banks indefinitely. This enables Congress to spend without having to take deficits or the debt seriously and there is every indication they intend to spend with impunity until the system collapses. There are no brakes on the runaway train. The federal debt ceiling law does nothing to limit spending. The ceiling will have to be raised yet again perhaps before the year is out. What is happening in Greece with austerity measures and riots in the street will happen here within a decade according to some realistic estimates if we do not find some way to fiscally restrain our government.There is little point in a debate about being entitled to healthcare or food or shelter from fellow taxpayers if the whole system has collapsed. And, with the way our politicians have taken over and mismanaged vast amounts of resources, collapse seems almost unavoidable. Yet the number of Americans who have significant dependency on government is dangerously high, and I honestly fear for them.Worse, corporate welfare is also at an all time high with no signs of diminishing. Though it is hard to quantify, Tad Dehaven at Cato has estimated that the government spends nearly twice as much on corporate welfare than on social welfare. Both parties are equally guilty. More and more, the business sector is learning to rely on taxpayer largesse in one form or another. They used to be solely concerned with providing a better product to the consumer at a better price. Now, success on Wall Street depends entirely too much on having the best lobbyists on K Street. If one includes the employees of "private" businesses who depend on government contracts, grants or bailouts, there are even more people dependent on government in some way.

Thursday, September 27, 2012

Video: F.A. Hayek at BBC (Masters of Money)

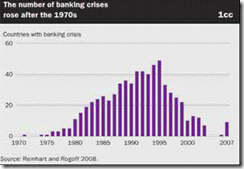

(the number of banking crisis since the Nixon Shock; chart from the World Bank)

Jeffrey Sachs (Count Dooku) said that one of Hayek’s “badly failed” predictions is that of Hayek’s claim that “moving to a social welfare society would eat away at the health of democracy”. Really?

To use the US as example,

Maybe all these has nothing to do with America’s growing police state?

Or perhaps Professor Hayek had been just too early.

Wednesday, September 12, 2012

Ron Paul: US is a Constitutional Republic and Not a Democracy

Congressman Ron Paul reminds Americans that they are supposedly a constitutional Republic and not a democracy (bold emphasis mine)

Democracy is majority rule at the expense of the minority. Our system has certain democratic elements, but the founders never mentioned democracy in the Constitution, the Bill of Rights, or the Declaration of Independence. In fact, our most important protections are decidedly undemocratic. For example, the First Amendment protects free speech. It doesn't – or shouldn't – matter if that speech is abhorrent to 51% or even 99% of the people. Speech is not subject to majority approval. Under our republican form of government, the individual, the smallest of minorities, is protected from the mob.

Sadly, the constitution and its protections are respected less and less as we have quietly allowed our constitutional republic to devolve into a militarist, corporatist social democracy. Laws are broken, quietly changed and ignored when inconvenient to those in power, while others in positions to check and balance do nothing. The protections the founders put in place are more and more just an illusion.

This is why increasing importance is placed on the beliefs and views of the president. The very narrow limitations on government power are clearly laid out in Article 1 Section 8 of the Constitution. Nowhere is there any reference to being able to force Americans to buy health insurance or face a tax/penalty, for example. Yet this power has been claimed by the executive and astonishingly affirmed by Congress and the Supreme Court. Because we are a constitutional republic, the mere popularity of a policy should not matter. If it is in clear violation of the limits of government and the people still want it, a Constitutional amendment is the only appropriate way to proceed. However, rather than going through this arduous process, the Constitution was in effect, ignored and the insurance mandate was allowed anyway.

This demonstrates how there is now a great deal of unhindered flexibility in the Oval Office to impose personal views and preferences on the country, so long as 51% of the people can be convinced to vote a certain way. The other 49% on the other hand have much to be angry about and protest under this system.

We should not tolerate the fact that we have become a nation ruled by men, their whims and the mood of the day, and not laws. It cannot be emphasized enough that we are a republic, not a democracy and, as such, we should insist that the framework of the Constitution be respected and boundaries set by law are not crossed by our leaders. These legal limitations on government assure that other men do not impose their will over the individual, rather, the individual is able to govern himself. When government is restrained, liberty thrives.

Unfortunately, the “increasing importance” that will be “placed on the beliefs and views of the president” or the coming US presidential elections will be determined mostly by the following dynamics:

The jarring charts signifying the “epidemic” of entitlements are from Nicolas Eberstadt of the American Enterprise Institute at the Wall Street Journal

The devolution to “militarist, corporatist, social democracy” is why US fiscal conditions will continue to deteriorate.

Democracy or the rule of men rather than the rule of law self-reinforces on its own destruction.

Thursday, September 06, 2012

Quote of the Day: Fiscal Cliff: The Dangerous Idea of the Permanence of Low Interest Rates

The current national debt is about $16 trillion. This is just the funded portion — the unfunded liabilities of the Treasury, such as Social Security and Medicare, and off-budget items, such as guaranteed mortgages and student loans, loom much larger. Our recent era of unprecedented fiscal irresponsibility means we are throwing an additional $1 trillion or more on the pile every year. The only reason this staggering debt load hasn’t crushed us already is that the Treasury has been able to service it through historically low interest rates (now below 2 percent). These easy terms keep debt-service payments to a relatively manageable $300 billion per year.

On the current trajectory, the national debt likely will hit $20 trillion in a few years. If, by that time, interest rates were to return to 5 percent (a low rate by postwar standards) interest payments on the debt could run around $1 trillion per year. Such a sum would represent almost 40 percent of total current federal revenues and likely would constitute the single largest line item in the federal budget. A balance sheet so constructed would create an immediate fiscal crisis in the United States.

In addition to making the debt service unmanageable, a return to normal rates of interest would depress the kind of low-rate-dependent economic activity that characterizes our current economy. A slowing economy would cut down on tax revenue and trigger increased government spending to beleaguered public sectors. Higher rates on government debt also would push up mortgage rates, thereby putting renewed downward pressure on home prices and perhaps leading to another large wave of foreclosures. (My guess is that losses on government-insured mortgages alone could add several hundred billion dollars more to annual budget deficits.) When all of these factors are taken into account, I think annual deficits could quickly approach, and then exceed, $3 trillion. This would double the amount of debt we need to sell annually.

Currently, foreign creditors buy more than half of all U.S. debt issuance. Most of these purchases are motivated by political reasons that are subject to change. The buyers, who legitimately can be described as “investors,” extend credit to the United States at such generous terms largely because of America’s size, power and perceived economic unassailability. If those perceptions change, 5 percent could quickly become a floor, not a ceiling, for interest rates. Given that America’s balance sheet bears more than a casual resemblance to those of both Spain and Italy, it should not be radical to assume that one day we will be asked to pay the same amount as they do for the money we borrow. The brutal truth is that 6 percent or 7 percent interest rates will force the government to either slash federal spending across the board (including cuts to politically sensitive entitlements), raise middle-class taxes significantly, default on the debt, or hit everyone with the sustained impact of high inflation. Now that’s a real fiscal cliff.

By foolishly borrowing so heavily when interest rates are low, our government is driving us toward this cliff with its eyes firmly glued to the rearview mirror. Most economists downplay debt-servicing concerns with assertions that we have entered a new era of permanently low interest rates. This is a dangerously naive idea.

This is from Peter Schiff at the Washington Times.

My impression is that once a recession becomes a reality, the likely actions by the US government will be to undertake bailouts of the politically favored institutions similar to 2008.

Such rescue efforts will easily bring to fulfillment Mr. Schiff’s $20 trillion debt target in no time.

Eventually the US will default directly (most likely path; read Gary North and Jeffrey Hummel) or attempt to default first indirectly through monetary inflation.

Keynesians, who look to the Great Depression and the Japan lost decade as model, fails to see or are blinded to the fact that today’s problem has not only been a banking based financial crisis but compounded by sovereign debt crisis which has been unprecedented.

The root of the problem hasn't been the lack of aggregate demand but from the sustained consumption of capital which mostly has been burned through serial political rescues, malinvestments from easy money policies and worsened by unsustainable welfare warfare systems.

Thursday, July 26, 2012

The Coming Global Debt Default Binge: Japan’s Pension Fund Sells Japanese Government Bonds (JGB)

The era of Japan’s low interest rates may be at an inflection point.

From San Francisco Chronicle/Bloomberg,

Japan’s public pension fund, the world’s largest, said it has been selling domestic government bonds as the number of people eligible for retirement payments increases.

“Payouts are getting bigger than insurance revenue, so we need to sell Japanese government bonds to raise cash,” said Takahiro Mitani, president of the Government Pension Investment Fund, which oversees 113.6 trillion yen ($1.45 trillion). “To boost returns, we may have to consider investing in new assets beyond conventional ones,” he said in an interview in Tokyo yesterday.

Japan’s population is aging, and baby boomers born in the wake of World War II are beginning to reach 65 and become eligible for pensions. That’s putting GPIF under pressure to sell JGBs to cover the increase in payouts. The fund needs to raise about 8.87 trillion yen this fiscal year, Mitani said in an interview in April. As part of its effort to diversify assets and generate higher returns, GPIF recently started investing in emerging market stocks.

GPIF is historically one of the biggest buyers of Japanese debt and held 71.9 trillion yen, or 63 percent of its assets, in domestic bonds as of March, according to the fund’s financial statement for the 2011 fiscal year. That compares with 13 percent in domestic stocks, 8.7 percent in foreign bonds and 11 percent in overseas equities.

Again the above represents the unintended consequences of the unsustainable welfare state. These could be incipient signs of the liquidation of Japan’s Santa Claus political institutions.

The lack of internal financing (from resident savings) means that Japan’s enormous debts will need to be financed by external (foreign) savings. This also means that Japan will be in tight competition with the Eurozone and the US to attract financing from the world. The nuclear option is that the Bank of Japan (BoJ) will become the financier of last resort.

Neo-Keynesians and Fisherians who claim that the world will undergo prolonged episodes of low interest rates based on historical experiences and from the prospects of deflation, fail to see that this has NOT just been about banking financial crisis, but about the crises of governments manifested through unsustainable debts.

Most of their analysis has been moored to historical banking-financial crisis, e.g Great Depression and Japan’s lost decade, rather than government debt crises.

It is dangerous to read the recent past as roadmap of the future. The above chart from the Economist shows that interest rates of major economies (US Germany Spain and Italy) had their volatile chapters.

When there will be inadequate or scant access to private sector savings, then the chances for a full blown debt crisis becomes a clear and present danger.

Once interest rates rises—out of the lack of financing and or from BoJ’s inflation financing—higher rates would mean higher interest rate payments which is likely to swell the existing debts.

Yet given the Japan's insufficient economic growth from growing political interventionism, surging interest rates will negatively impact both Japan’s banking and financial system as the largest holders of JGBs and Japan’s government—a self-reinforcing spiral.

So the debt crisis, which has already been ravaging the Eurozone, may likely be transmitted to Japan. Unfolding events have been so fluid which means conditions may deteriorate swiftly beyond the public's expectations.

Be careful out there.

Saturday, July 14, 2012

Warren Buffett Sees Rising Municipal Bankruptcies

Obama crony Warren Buffett predicts that municipal bankruptcies will increase

From Bloomberg,

Warren Buffett, the billionaire chairman of Berkshire Hathaway Inc. (BRK/A), said municipal bankruptcies are set to rise as there’s less stigma attached after three California cities opted to seek protection just weeks apart.

The City Council of San Bernardino, California, a community of about 210,000 east of Los Angeles, decided July 10 to seek court protection from its creditors. The move came just weeks after Stockton, a community of 292,000 east of San Francisco, became the biggest U.S. city to enter bankruptcy. Mammoth Lakes, California, also sought the shelter this month.

“The stigma has probably been reduced when you get very sizeable cities like Stockton or San Bernardino to do it,” Buffett, 81, said in an interview today on “In the Loop with Betty Liu” on Bloomberg Television. “The very fact they do it makes it more likely.”

Cities and towns across the U.S. have been strained by rising costs for labor, including pensions and retiree health benefits, while the longest recession since the 1930s crimped sales- and property-tax revenue.

I don’t think “stigma” has anything to do with the real issue of the unsustainable financial and economic conditions of the excessively (welfare and bureaucracy) bloated public sector, driven by Keynesian policies. As per Herb Stein’s Law, if something cannot go on forever, it will stop.

So goes with Munis.

Friday, July 13, 2012

Quote of the Day: The Salad Days of the Keynesian public sector economy are over

The salad days of the Keynesian public sector economy are over, so argues author Patrick Buchanan at the Lewrockwell.com

In the Reagan-Clinton prosperity, officials earned popularity by making commitments that could be met only if the good times lasted forever. They added new beneficiaries to old programs and launched new ones. They hired more bureaucrats, aides, teachers, firemen, cops.

Government's share of the labor force soared to 22.5 million. This is almost three times the number in the public sector when JFK took the oath of office. These employees were guaranteed job security and high salaries, given subsidized health care, and promised early retirement and pensions that the private sector could not match.

The balance between the private and public sectors shifted. As a share of the U.S. population, the number of taxpayers fell, as tax consumers – the beneficiaries of government programs and government employees who run those programs – rose.

The top 1 percent now pays 40 percent of the income tax. The top 10 percent pays 70 percent. The bottom half, scores of millions of workers, pay nothing. They ride free.

This could not go on forever. And when something cannot go on forever it will, by Stein's Law, stop. The Great Recession brought it to a stop. We have come to the end of the line.

U.S. cities depend on property and sales taxes. But property tax revenue has fallen with the collapse of the housing market. Sales tax revenue has fallen as a result of the recession that has kept the consumers out of the malls.

Revenues down, cities and counties face a choice. Raise taxes, or cut payrolls and services. But if taxes rise or workers are laid off and services decline, Americans in our mobile society move across city and state lines, as they are moving from California to Colorado, Nevada and Arizona.

This does not end the crisis, it exacerbates it.

Bankruptcy not only offers cities relief from paying interest to bondholders, it enables mayors to break contracts with public service unions. Since the recession began, 650,000 government workers, almost all city, county or state employees, have lost their jobs. Millions have seen pay and benefits cut.

The salad days of the public sector are over. From San Joaquin Valley to Spain, its numbers have begun to shrink and its benefits to be cut.

A declaration of bankruptcy by a few cities, however, has an impact upon all – for it usually involves a default on debts. This terrifies investors, who then demand a higher rate of interest for the increased risk they take when they buy the new municipal bonds that fund the educational and infrastructure projects of the solvent cities.

Cities and counties have no way out of the vicious cycle. Rising deficits and debts force new tax hikes and new cuts in schools, cops and firemen. Residents see the town going down, and pack and leave.

This further reduces the tax base and further enlarges the deficit.

Then the process begins anew.

This is what is happening in Spain and Greece, which have reached the early 1930s stage of rioting and the rise of radical parties.

Since the New Deal, Keynesianism has been our answer to recession. As the private sector shrinks, the pubic sector expands to fill the void until the private sector returns to health. Only Keynesianism is not working.

Monday, July 09, 2012

The Coming Global Debt Default Binge: Japan’s Government Under Financial Strains

Unwieldy welfare states and bureaucracies are cracking.

Japan’s politicians bicker about maintaining unsustainable public spending even when source of funding has been depleting fast.

From Reuters,

Japan's government could run out of money by the end of October, halting all state spending including salaries, pensions and unemployment benefits, because of a standoff in parliament that has blocked a bill to finance the deficit.

The deficit financing bill, which would allow the government to sell bonds needed to fund almost half of the budget, has languished in parliament as the ruling Democratic Party tussles with opposition parties that can use their control of the upper house to reject legislation.

"Without this bill, the budget will collapse," Finance Minister Jun Azumi said on Friday, pleading for cooperation from the two largest opposition parties.

"It doesn't matter which party is in power. I really hope that we can get a multi-partisan agreement on the deficit bill."

If the bill is not passed, government spending would grind to a halt, the world's third-largest economy would be put in jeopardy and its standing among credit ratings agencies could suffer.

Japan is not the only developed nation that is staring at an imminent fiscal crisis. Greece's debt-strapped government could run out of money within weeks unless it secures a 31.8 billion euro tranche of bailout funds from the European Union.

The U.S. economy is facing $4 trillion worth of expiring tax cuts and automatic government spending reductions at the end of the year, and a standoff in Congress makes the chance of a compromise over the so-called "fiscal cliff" look dim.

chart of Japan’s unsustainable fiscal balances (tradingeconomics.com)

Not to worry, like the US Federal Reserve, the Bank of Japan (BOJ) will most likely come to the rescue.

They are likely to announce more stimulus in supposed aid to the “export” industry.

In reality, these will about saving the banks and financial institutions who constitutes as the major financiers or creditors or owners of Japan’s Government Bonds (JGBs) with some 76% share as of 2009. [chart from Japan Bankers Association]

But the share of ownership by banking and financial institutions of JGBs has even been larger based on 2011 data

From the Wall Street Journal,

Nearly two-thirds of all JGBs are held by just two groups: major Japanese banks with 44%, and insurers with 21%. If either sector starts to sell—or simply stops buying new debt—the market could tumble quickly, since there is little sign that foreign buyers would quickly fill the gap. Foreign investment is just 5.7%, as of end-June figures, less than the share held by Japan's biggest bank, Mitsubishi UFJ Financial Group, which has 6.9%.

So Japanese politicians, like their European and American counterparts, are increasingly caught between the metaphorical devil and the deep blue sea.

Default will either be through inflation or restructuring (bankruptcy).

Thursday, June 14, 2012

Quote of the Day: Welfare Crisis Aggravated by Demographics

Demography is destiny. If so, then the future will be challenging in many countries around the world where fertility rates have dropped below the replacement rate. At the same time, people are living longer. So dependency ratios--the number of retirees divided by the number of earners--are destined to soar.

Why have fertility rates fallen around the world? There are a few plausible explanations. One of them stands out, in my opinion: Socialism may breed infertility! In the past, people relied on their children to support them in their old age. Your children were your old-age insurance policy. Over the past few decades, people have come to depend increasingly on social security provided by their governments. So they are having fewer kids.

That’s fine as long as the ratio of retirees to workers isn't so high that the burden of supporting our senior citizens crushes any incentive to work resulting from excessively high tax rates. The cost of increasingly generous and excessive entitlements has been soaring relative to taxable earned incomes even before dependency ratios are set to rise in many countries. Governments have chosen to borrow to finance social security and other entitlements, to avoid burdening workers with the extremely high tax rates that are necessary to balance entitlement-bloated budgets.

Median ages are highest in advanced economies with large social welfare states. Among the 45 major countries, Japan has the highest median age (44.7), while the Philippines has the lowest (22.2). Advanced economies tend to have higher median ages than emerging ones because they provide more social welfare, which boosts longevity and depresses fertility.

Bond markets may be starting to shut down for countries that have accumulated too much debt. That’s creating a Debt Trap for debt-challenged governments. If they slash their spending and raise their tax rates, economic growth will tend to slow. If tax revenues fall faster than spending, their budget deficits will widen. There has recently been an outcry about the hopelessness of such “austerian” policies that perversely lead to higher, rather than lower, debt-to-GDP ratios.

The demographic reality is that people around the world are living into their 80s and 90s. Some of them believe that they are entitled to retire in their late 50s and early 60s even though they are living longer. Yet, they didn’t have enough children to support them either directly (out-of-pocket) or indirectly (through taxation). Instead, they expect that their governments will support them. So governments have had to borrow more to fund retirement benefits. That debt is mounting fast and will be a great burden for our children. The result can only be described as the Theft of Generations.

That’s from Dr Ed Yardeni at his blog. To “depend increasingly on social security” has not really been about socialism (government ownership of production) but about the welfare state that has played a significant role in driving today’s debt crisis. The Santa Claus principle is being unraveled.

Friday, June 08, 2012

Quote of the Day: Private Arbitration

Enter 21st century technology: there’s a relatively new service called Judge.Me, an online arbitration service whose decisions are legally binding in 146 countries, from Afghanistan to Zimbabwe… and yes, including the US, Canada, and Western Europe.

At just $299, disputes can be settled in a matter of days, and the firm’s case history shows that 96% of all arbitration awards have been honored.

This is the sort of thing that makes me very excited– the private sector displacing the public sector. And there’s going to be a lot more of it coming.

The more insolvent governments become, the more they’re going to be forced to axe all the things they can’t afford. We’re already starting to see this in places from California to England that can no longer hide from their fiscal reality.

With the government monopoly out of the way, the private sector will mop up every service that it can turn a profit on– trash collection, security, fire, prisons, libraries, etc. This forces competition, higher quality service, and lower prices for everyone.

The people who protest against austerity, or think it’s a tragedy when a courthouse closes down due to budget constraints, are really missing the larger point: the sooner this corrupt house of cards collapses, the better off we’ll all be.

Another gem from the maverick Simon Black at the Sovereign Man.

This serves as another example or evidence of how the information age has been transforming our lives and that will lead to decentralization.