``Big government reforms, bailouts, stimulus, and “change" in general create negative expectations of the future along with a great deal of uncertainty. This leads to inaction and fear — the preconditions for a crash in the stock market. All it needs now is the appropriate trigger.” Mark Thornton, Unhinged

Except for some currencies such as the Norwegian Krone, British Pound or the Swiss Franc, the US dollar surged against almost every major currency including those in Asia…the Philippine Peso included. (Be reminded this has nothing do with remittances)

Since the forex market is a huge liquid market, with daily turnover of nearly $ 4 trillion dollars, this means there has been an intense wave of ex-US dollar liquidation. And to see such a coordinated move suggests that the global financial system could be faced with renewed dislocations in a disturbing scale. So the likely suspects could be either major bank/s in distress, or a country or some countries could be at a verge of default.

Central an dEastern Europe’s “Sudden Stop”

With no major spike in the major indicators which we monitor, such as the Libor-OIS, TED Spread, EURIBOR 3 month, Hong Kong Hibor, BBA LIBOR 3 months and 3 MO LIBOR - OIS SPREAD, the epicenter of last week’s pressure appears to emanate from the Central and Eastern European (CEE) region.

Regional credit spreads and Credit Default Swap (CDS) prices soared, as credit ratings agency the Moody’s issued a warning last week of the possibility of credit ratings downgrades in the region’s debt amidst a deteriorating global economic environment, See figure 1.

Figure 1: Danske Bank: CEE Under Pressure

Figure 1: Danske Bank: CEE Under PressureAccording to the Danske Bank, ``Credit spreads have had a hard time during the week – especially for banks. The investment grade CDS index, iTraxx Europe, currently trades at 174bp up from 154bp last Friday. The high yield index iTraxx Crossover currently trades at 1085bp up from 1070bp last week. The senior financial index has also widened considerably and now trades at 152bp. As long as sovereign CDS prices are under pressure CDSs on senior bank debt are also likely to suffer as the two are heavily interlinked due to the various state guarantees on bank debt.”

The turbulence affected every financial market in the region; the CEE currencies crumbled, regional bond markets sovereign spreads widened, and regional equity markets tanked see figure 2.

Figure 2: Danske Bank: Emerging Europe currencies slump, Euro bonds

Figure 2: Danske Bank: Emerging Europe currencies slump, Euro bonds All these resemble what is known as the “sudden stop” or capital stampeding out of the region.

Somehow the CEE crisis approximates what had happened in Asia 12 years ago or what was labeled as the 1997 Asian Financial Crisis.

Central and Eastern European Crisis A Shadow of the Asian Financial Crisis?

So what ails the CEE?

As in all bubble cycles, the common denominator have always been unsustainable debt. And unmanageable debt acquired by the banking system and Eastern European households during the boom days had been manifested through burgeoning current account or external deficits. And these deficits had been balanced or offset by a flux in capital flows, mostly bank loans see figure 3.

Figure 3: Emerging Europe Crisis versus the Asian Crisis

The Bank of International Settlements (BIS) makes a comparison between the present developments in Emerging Europe with of Asia 12 years ago.

From the BIS, ``The crisis was preceded by rapid growth in credit to the private sector, with a significant share of loans denominated in foreign currency. East Asian economies also recorded large current account deficits, mainly induced by the private sector. These deficits were financed by strong debt inflows, which reversed sharply following the crisis. A further similarity lies in exchange rate policies. Prior to the crisis, East Asian economies had fixed nominal exchange rates (in their case against the US dollar). Moreover, the economies relied heavily on a single foreign creditor – Japanese banks. Emerging European countries currently show a similar level of dependence on a few European banking system creditors. For example, claims by Austrian-owned banks are equivalent to 20% of annual GDP in the Czech Republic, Hungary and Slovakia, while claims of Swedish-owned banks on the Baltic states are equivalent to 90% of their combined GDP. An adverse shock to one or more of these foreign banks could result in them withdrawing funds from emerging European countries.”

So the emerging similarities seen in both crises have been strong debt inflows, fixed nominal exchange rates and the concentration of source financing.

As the above chart shows, FDIs (red line) and Bank loans/Debt (blue line) composed most of the inflows in Emerging Europe (left window) whereas the Asian crisis bubble (right window) was almost entirely financed by debt from bank loans.

According to BIS, one marked difference for the strong capital flows in Emerging Europe had been due to the “strengthening in GDP growth and policy frameworks due to closer EU integration.” Plainly put, the integration of many of these countries into the Eurozone facilitated capital flows movement in the region, which may have abetted the bubble formation.

Moreover, another important difference was that Asian debt was principally channeled into the corporate sector while the liabilities in Emerging Europe have been foreign currency related.

Like the recent debacle in Iceland, Emerging Europe’s households incurred vast mortgage liabilities through their banking system in unhedged foreign currency contracts (mostly in Euro and Swiss Francs), which was meant to take advantage of low interest rates while neglectfully assuming the currency risk. In short, Emerging European households engaged in the currency arbitrages or otherwise known as the CARRY TRADE.

So when the sharp downturn in economic growth occurred, these capital starved economies failed to attract external capital, hence, the net effect was a drastic adjustment in their currencies which prompted for a capital flight.

Households which took on massive doses of foreign currency liabilities or loans saw their debts balloon as their domestic currency depreciated.

And it is not just in the households, but foreign investors too which incurred substantial exposure through local currency instruments. Morgan Stanley estimates Turkey, Hungary, Poland and Czech having non-resident exposures to equities and bonds at 30%, 18%, 17% and 10%, respectively.

Thus, the sharp gyrations in the currency markets have accentuated the pressures on the underlying foreign currency mismatches in the region’s financial system.

Another source of distinction has been the degree of exposure of the Emerging Europe’s debt to the European banking system. As noted by the BIS above, the Asian crisis further undermined Japan’s banking system, which provided the most of the loans, at the time when its domestic economy had been enduring the first leg of its decade long recession. On the hand, over 90% of the distribution of loans $1.64 trillion loans held by Emerging Europe have been scattered between the European and Swedish banks.

Doom Mongering: Will Eastern Europe Collapse the World?

Nonetheless this has been the key source of pessimism in media, especially by doom mongers whom have alleged that the failure to salvage East Europe will either lead to a worldwide economic catastrophe or to the disintegration of the Euro, as major European economies as Germany and France may opt NOT to bailout the crisis affected union members or union members whose banking system are heavily exposed to Eastern Europe of which may lead to cross defaults and culminate with a collapse in the monetary union.

In addition, they further assert that due to the huge extent of financing requirements, the IMF would deplete its funds and may be compelled to sell its gold hoard in order to raise cash. And to prim their narrative, they’ve made use of the historical parallelism to bolster their views or as possible precedent; the Austrian bank collapse in 1931 triggered a chain reaction which ushered in an economic crisis in Europe during the Great Depression years.

We are no experts in the Euro zone and Emerging Europe markets, but what we understand is that these doomsayers appear to be inherently biased against the Euro (on its very existence, even prior to these crisis), or alternatively, have been staunch defenders of the US dollar as-the-world’s-international-currency-standard, and have used the recent opportunities to promote their agenda.

Moreover, these doom mongers appear to be interventionists who peddle fear to advocate increased government presence and interference, which ironically has been the primary cause of the present predicament.

Be reminded that the fiat paper money system exists on the basis of trust by the public on the issuing government. Conversely, a lost of faith or trust, for whatever reason, may indeed undermine the existence of a monetary framework, such as the US dollar or the Euro. Thus rising gold prices are emblematic of these monetary disorders and we can’t disregard any of these assertions.

Although, for us, the claims of the tragic collapse from the ongoing CEE crisis could be discerned as somewhat superfluous.

One, the argument looks like a fallacy of composition- as defined by wikipedia.org-something is true of the whole from the fact that it is true of some part of the whole (or even of every proper part).

Figure 4: BIS: Foreign Liabilities Varies Across EM Regions

Figure 4: BIS: Foreign Liabilities Varies Across EM Regions

The CEE debt problem has been interpreted as something with homogeneous like dynamics, where the assumption is that every country appears to be suffering from the same degree of difficulties even when the economic structures (leverage, deficits etc.) are different.

They even apply the same logic to the rest of the world including Asia, where, as can be seen in Figure 4, have different scale of foreign liabilities exposure.

Two, because a large part of the Emerging Europe’s banking system is owned by European banks (see Figure 5) some have alleged that European governments have been indiscriminately pressuring their domestic banks with exposures to Eastern Europe to abruptly reduce or pullback their exposure to these countries, such as Greek banks in Balkans. There may be some cases, but a wholesale withdrawal would seem unlikely.

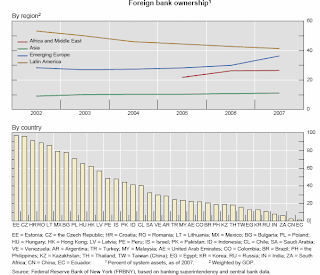

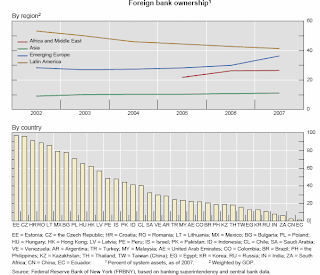

Figure 5 BIS: Foreign Bank Ownership in Emerging Markets

Figure 5 BIS: Foreign Bank Ownership in Emerging MarketsYet according to the BIS, ``a large part of most emerging European banking systems is foreign owned. These banking groups appear to be financially strong currently, as reflected in standard –albeit backward-looking – measures of financial strength such as capital adequacy ratios and profitability. The foreign subsidiaries should have better risk management techniques in place, more geographically dispersed assets and, in principle, good supervision (from the home country on the consolidated entity).” [bold highlight mine]

Three, emerging markets have been reckoned as “more inferior and risk prone” asset class compared to the securitized instruments sold by the US.

As the Europe.view in the Economist magazine aptly remarked, ``Foreign-currency borrowing by east European households was seriously unwise. But it does not compare with the wild selling of sub-prime mortgages in America that turned balance sheets there to toxic waste. It may be necessary to restructure some of these loans, or convert them into local currency (perhaps with statutory intervention). That will hurt bank profits. But it will not mean American-style write-offs. Bank lending to foreign companies based in eastern Europe is still a good business.”

Divergences Even Among Emerging Markets?

While it could be true that some European banks could be heavily levered compared to their US counterparts and has significant exposure to the CEE region- where the latter seem to be encountering an Asian Crisis like unraveling due to outsized external deficits, large internal leverage and foreign currency mismatches in their liabilities- it is unclear that the deterioration in the financial and economic environment would result to an outright disintegration of the Euro monetary union or trigger an October 2008 like contagion across the globe.

The fact that EM stockmarkets have been performing divergently as shown in figure 6, where LATAM (blue), Asia (apple green), CIS (Commonwealth of Independent States-gray) appear to be recovering, while the CEE (red) and MSCI (dark green) index are down, hardly implies of a contagion at work yet.

Moreover, as we earlier noted, credit spreads of major indicators haven’t seen renewed stress and seems to remain placid despite the recent CEE ruckus.

Thus from our standpoint the present strength of the US dollar encapsulates the ongoing Emerging Market phenomenon called the “sudden stop” or capital “flight” (resident capital) or “exodus” (non-resident capital) from the region, which has siphoned off the availability and accessibility of the US dollar in the global financial system which has probably led to the steep rally in the US dollar almost across-the-board.

We believe that 2009 will be a year of divergence as concerted policy induced liquidity measures will likely have dissimilar impact to all nations depending on the economic, financial markets, and political structures aside from the policy responses to the recent crisis and recession.

Even among Emerging Markets such divergences will likely be elaborate.