“Keynesians tend to assume that government spending has a big positive effect on economic growth. Others disagree. But if the impact of increasing government spending is large, then the impact of removing it is also. So policy makers better be sure that the boom is around the corner. And all these are just short-run considerations. Here's the real dirty secret of Keynesian policies: They are sure to have a negative effect in the fullness of time.” Kevin Hassett

So how has the global markets affected ASEAN benchmarks and Philippine Phisix during last week’s furor?

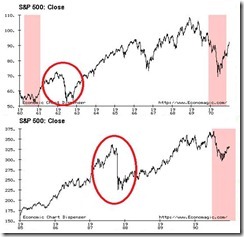

ASEAN’s Gradual Discounting of Global Equity Market Meltdown

Except for Monday and Tuesday, where the bears launched a ‘blitzkrieg’ that has resulted to two day cumulative loss of 6.3%, broken down to 2.3% and 4% respectively, the diminishing marginal (time) value of information has stunningly prompted for an exceptional performance by the Phisix and the ASEAN region.

Astonishingly, the Phisix has managed to shrug off or IGNORE the 6% loss by the US last Thursday and went on to even close marginally higher[1]!

The recovery during the last three sessions of the week accrued to a net loss of 2.61% by the Phisix, still significant but the figures hardly reveal everything.

The actions of the Phisix basically have been identical with most of our neighbors.

Except for Indonesia (JCI) which saw a measly .79% decline for the week and while the Phisix (-2.61%) and the Thailand’s SET (-2.86%) fell by more than the US, the latter two still posted positive returns on a year to date basis, respectively 2.87% and 2.84%. Only Malaysia which fell by 2.67% over the week, has been down by 2.3% on a year to date.

Yet there are some noteworthy developments here and in the region:

1. Again Indonesia, Thailand, and the Philippines remain on the positive territory, despite the global meltdown. Only Malaysia among the ASEAN tag team has been on the negative.

2. Regional volatility appears to be decreasing even as global markets continue to roil.

If such trend should persist then convergence in the performance of ASEAN bourses could deepen or could reflect on higher correlations of emerging Asian equities.

The statistical correlations may seem ambiguous, but from the above charts courtesy of the ADB[2] we can see how least correlated we are with US equities in relative terms.

Among ASEAN bourses only Malaysia has had above half a percent of correlations (left window). Indonesia (.38) has the least correlation followed tightly by the Thailand (.39) and the Philippines (.4).

So well into 2011 the correlations have tightened among ASEAN bourses which have also been reflected on the right window (emerging Asia-emerging Asia correlations, green line). Whereas correlations of emerging Asia with the US has clearly departed or has significantly diminished, where previous correlations .62 in 2009 has recently been only .46.

The implication is that global or US investors who seek to diversify away from high correlations performance with US assets may likely consider Emerging Asia or the ASEAN region as an alternative.

This is why the recent US downgrade is unlikely a net negative for Phisix or the ASEAN region as global diversification play could be a looming reality.

And this could also be why regional policymakers appear to be “bracing” for a possible onslaught of foreign capital flows[3].

3. Domestic participants appear to be learning how to discount events abroad.

In the Phisix, the seeming resiliency from the recent global market rout has primarily been an affair dominated by domestic participants.

Net daily Foreign trade (averaged on a weekly basis) exhibits net outflows last week (left window). Nonetheless, total outflows have yet to reach the May levels, in spite of this week’s dramatic volatility. This has likewise been reflected on the Philippine Peso which was nudged lower (.14%) to close at 42.64 to a US dollar this week.

The share of foreign investors to total trade has spectacularly declined as domestic investors has taken over or dominated (right window) trading activities. Local investors accounted for about 65% of this week’s trade.

I think the current trend of local bullishness can be buttressed by recent empirical evidence. Philippine bank lending in June has reportedly been strongly expanding[4]. Although official statistics say that most of the loan growth has been directed to ‘production activities’ led by power (62.3%) and financial intermediation (31.9%), I would surmise that many of these loans may have been redirected to the Phisix.

The Bangladesh stock market crash should be a noteworthy example to keep in mind where were substantial amount of bank loans had been rechanneled to the stock market. And when the government imposed tightening measures (both monetary and administrative), the Dhaka Stock Index collapsed[5]by about 40% in January of this year. Since, the Dhaka has hardly made a significant headway in recovering.

Nevertheless the Philippines maintains the steepest yield curve in Asia, which should even boost the appetite of banks to lend. This should serve as an impetus for the boom phase of the domestic business cycle which the Phisix seems to be part of the transition.

Importantly, policy rates remain very accommodative with only two marginal increases in the BSP’s policy rates as of June 2011. Meanwhile Indonesia’s rates are at record low (no wonder the outperformance).

Phisix and Market Internal Divergence

3. Market internals despite this week’s drastic swings has not been entirely negative.

Daily traded issues averaged on a weekly basis (left window) seem to validate the remarkable actions by local investors as this sentiment indicator continues to climb.

The advance decline spread computed on a weekly basis reveals of the same developments; lopsided lead by declining issues during the early selloff has partly been offset by the asymmetric difference by the advancing issues during days where the Phisix rebounded.

Proof of this week’s astounding resilience is that the early devastation from global market carnage hasn’t reached the intensity of the 1st quarter storm marked by the Arab Spring-Japan triple whammy calamity selloffs.

In essence, the losses of the Phisix may have overestimated the actual actions in the general market or the Philippine Stock Exchange.

Said differently, the Phisix reflected on foreign outflows (selling of Phisix heavyweights) in contrast to the general market which manifested a much buoyant of local investors, an apparent divergence!

I argued of a potential ASEAN Alpha play at the end of July[6], here is what I wrote,

So it is unclear whether ASEAN and the Phisix would function as an alternative haven, which if such trend continues or deepens, could lead to a ‘decoupling’ dynamic, or will eventually converge with the rest. The latter means that either global equity markets could recover soon—from the aftermath of the Greece (or PIIGS) bailout and the imminent ratification of the raising the US debt ceiling—or that if the declines become sustained or magnified, the ASEAN region eventually tumbles along with them. My bet is on the former.

Therefore, I would caution any interpretation of the current skewness of global equity market actions to imply ‘decoupling’. As I have been saying, the decoupling thesis can only be validated during a crisis.

In the meantime, we can read such divergent signals (between ASEAN and the World) as motions in response to diversified impact from geopolitical turbulence.

For this week, the function of the Phisix (or ASEAN) as alternative haven has been demonstrably true for the domestic participants but unsubstantiated by foreigners fund flows.

My divergence theory seems as gradually being validated by the marketplace!

Again let me remind you, that divergence only thrives in a global scenario that doesn’t signify a real crisis or a recession, most likely from a global liquidity drain. For if the imminence of an overseas recession should emerge, we have yet to see how the local and regional markets would react.

Remember this is no 2008! This time the activist approach by the conventional ‘modern’ central bankers has been paving way for different outcomes on different markets.

Gold as Refuge, Also Played Being Out via Domestic Mining Issues

4. As Gold, the Japanese yen, and the Swiss franc has functioned as the du jour flight to safety assets during the current market distress, we seem to be witnessing the same phenomenon taking hold even in the local equity markets where gold mining issues have taken the center stage!

Whether from year to date (below window) or from last week’s amplified volatility, the market psychology of domestic investors on mining issues have ostensibly turned from the fringe to the mainstream.

One would note that in the sectoral charts above, Tuesday’s carnage only dented the mining sector (violent) which again found footing or used this decline as leverage to recoil higher. All the rest of Phisix (green) sectors, namely bank (blue), Commercial Industrial (grey), Holding (red), Services (light green) and Property (black candle), went in the direction of the mining sector but has been hobbled by the steep losses.

All I can say is that since the Philippines have NO physical markets for gold in terms of spot or futures or even Exchange Traded Funds (ETF), mining issues could have likely served as a proxy or representative asset.

That’s why in the face of the current market inconstancy or turbulence, despite the hefty gains, I would recommend a partial shift of asset exposures to gold mines as hedge. This is not a momentum play but rather a possible flight to safety move as we seem to be seeing here and abroad.

Conclusion

Mimicking the US Federal Reserve, my closing will be a reprise of my statement from last week[7] but with some alterations, enclose by brackets [ ]

The Phisix and the ASEAN-4 bourses have not been unscathed by the brutal global equity market meltdown.

However, excluding Friday’s [Monday and Tuesday’s] emotionally charged fallout and despite the weak performances of developed economy bourses during the week, the Phisix and ASEAN bourses has managed to keep afloat and has even demonstrated significant signs of relative strength, signs that could attract more divergent market activities in a non recessionary setting.

As global policymakers continue to engage in a whack-a-mole approach to the acute problems facing the developed economies’ banking-welfare based government system, the path dependent solution, as demonstrated during this tumultuous week, has been the age old ways of printing money and selective price controls.

The same foreseeable actions can be expected over the coming days, more patchwork with unintended consequences overtime.

And the outcome to the marketplace should be variable as the current conditions reveal.

Lastly, downgrades for Asia and possibly for Europe which may have a short term effect on Asian assets should actually be a plus for the region over the long run. This is not only from the possible diversification move but also from real capital flows.

That is if we adapt relatively sounder money approach and embrace economic freedom.

However if we continue to act in concert with global policy trends then we could expect these downgrades to eventually export boom bust cycles anew to Asia.

[1] See Philippine Phisix: What An Incredible Turnaround! (Global Equity Markets Update), August 11, 2011

[2] Asian Development Bank Asia Capital Markets Monitor August 2011

[3] Bloomberg.com Asia braces for capital flows as currencies rise, gulfnews.com August 9, 2011

[4] BSP.gov.ph Bank Lending Continues to Accelerate in June, August 10, 2011

[5] See Bangladesh Stock Market Crash: Evidence of Inflation Driven Markets, January 11, 2011

[6] See The Phisix-ASEAN Alpha Play, July 31, 2011

[7] See Phisix-ASEAN Outperformance Despite Global Meltdown, August 7, 2011