Austrian economist and professor Mark Thornton principal exponent of Skyscraper Index Model notes that skyscrapers has had a record of uncanny accuracy in the prediction of many crises which includes today’s Euro crisis.

At the Mises Blog, Professor Thornton writes,

The ECB has once again come to the rescue by cutting interest rates in order to forestall a collapse of the European economy. Also, in a “surprise” move, the Chinese central bank cut interest rates in response to a continuing slow down in economic activity.

When the Skyscraper Index issued a European crisis signal last summer the European stocks markets were riding a wave of optimism and the Euro was worth about a $1.50. Most European stock markets have lost considerable ground along with the value of the Euro. However, we can best visualize the economic trouble from where the skyscraper crisis signal was issued: in the London real estate market. The Shard Skyscraper (which issued the crisis signal by becoming the tallest skyscraper in Western Europe) opened its doors to a badly slumping real estate market. Its owners made the bad mistake of buying out one of its primary lessee at 70 pounds per square foot. Leases are now going for 55 pounds per foot and probably heading lower.

In addition to Europe, there has been a regional crisis signal in China and possible world crisis signals coming from both China and the Middle East.

As for the Middle East, the Burj Khalifa, the world tallest building at 2,717 feet (at the moment), which opened two years ago has now been considered a “distressed property”.

The crash of Dubai’s stock market serves as a harrowing reminder of the bubble bust.

Many of the other grand projects in the Middle East, after having been stricken by the crisis, had also been shelved.

Well, I have been repeatedly saying that the Philippines and ASEAN economies have been undergoing a business or bubble cycle.

And since skyscrapers and business cycles are almost joined to the hip, with skyscrapers as pathological manifestations of financial excesses, then current prestige based property trends could be ominous of a coming crisis with its epicenter in Asia, or even in Southeast Asia.

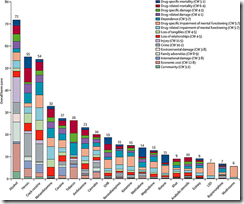

That’s because Asia has been the focal point of where most of the next generation of the world’s tallest buildings will rise.

China and South Korea tops the list, along with Indonesia and Malaysia who will be having their own signature towers.

However, the Middle East will still lay claim to the tiara of having the tallest, with Saudi Arabia’s proposed Kingdom Tower which which will be due for completion this 2018. Eerily, Saudi’s grandiose project seem to coincide with mounting financial pressures on Saudi’s welfare economy.

Some of the proposed tallest buildings in Southeast Asia and Korea (from Business Insider)

Menara Warisan Merdeka

Skyscraper City

Location: Kuala Lumpur, Malaysia

Height: 1,722 feet

The Menara Warisan Merdeka will serve as a residential, office, and hotel building.

The Menera is scheduled to be completed by 2015. When completed, it would be the tallest building in Malaysia, according to The Star.

Signature Tower Jakarta

Skyscraper Center

Location: Jakarta, Indonesia

Height: 2,093 feet

The Signature Tower Jakarta is a 119-floor building (with six floors below ground) that is scheduled to be completed in 2017.

The building will serve as a hotel and an office. If completed, it will be the world's fifth-largest building, according to The Jakarta Post.

Seoul Light DMC Tower

Skyscraper Center

Location: Seoul, South Korea

Height: 2,101 feet

The Seoul Light DMC Tower will be a hotel, residential, and office building.

It's scheduled to be completed in 2017. The building will use wind to power itself, and have interior gardens that act as "lungs" for the building, according to the tower's website.

For the rest of the list, you can see them here

The point is if the Skyscraper Index model’s accurate predictive capabilities should continue, then that time window of 2015-2017 could portend to an Asian Crisis 2.0

The relationship between the Skyscraper and the Austrian Business Cycle as explained by Professor Thornton [bold emphasis mine]

The common pattern in these four historical episodes contains the following features. First, a period of “easy money” leads to a rapid expansion of the economy and a boom in the stock market. In particular, the relatively easy availability of credit fuels a substantial increase in capital expenditures. Capital expenditures flow in the direction of new technologies which in turn creates new industries and transforms some existing industries in terms of their structure and technology. This is when the world’s tallest buildings are begun. At some point thereafter negative information ignites panicky behavior in financial markets and there is a decline in the relative price of fixed capital goods. Finally, unemployment increases, particularly in capital and technology-intensive industries. While this analysis concentrates on the U.S. economy, the impact of these crises was often felt outside the domestic economy.

It would be very easy to dismiss the skyscraper index as a predictor of the business cycle, just as other indicators and indexes have been rightly rejected. However, the skyscraper has many of the characteristic features that play critical roles in various business cycle theories. It is these features that make skyscrapers, especially the construction of the world’s tallest buildings, a salient marker of the twentieth-century’s business cycle; the reoccurring pattern of entrepreneurial error that takes place in the boom phase that is later revealed during the bust phase. In the twentieth century the skyscraper has replaced the factory and railroad, just as the information and service sectors have replaced heavy industry and manufacturing as the dominant sectors of the economy. The skyscraper is the critical nexus of the administration of modern global capitalism and commerce where decisions are made and transmitted throughout the capitalist system and where traders communicate and exchange information and goods, interconnecting with the telecommunications network. Therefore it should not be surprising that the skyscraper is an important manifestation of the twentieth-century business cycle, just as the canals, railroads, and factories were in previous times.