A delirious stock-exchange speculation such as the one that went crash in 1929 is a pyramid of that character. Its stones are avarice, mass-delusion and mania; its tokens are bits of printed paper representing fragments and fictions of title to things both real and unreal, including title to profits that have not yet been earned and never will be. All imponderable. An ephemeral, whirling, upside-down pyramid, doomed in its own velocity. Yet it devours credit in an uncontrollable manner, more and more to the very end; credit feeds its velocity- Garet Garett

Portfolio Pumping at the Philippine Stock Exchange

Friday’s session, which marked the last trading day for the month of August, manifested another probable sign of the politicization of Philippine equity market.

95% of Friday’s trading activities saw the sluggish Phisix in the red, albeit modestly. That was until the last few minutes where a spike occurred, as shown by the intraday chart from Bloomberg. Such fantastic comeback accounted for a hefty 1.4% move from bottom to the session’s close.

On social media, market participants occasionally yammer or bellyache about supposed price manipulations on certain issues, but Friday’s action makes them pale by comparison.

Because the event happened on the month end, I earlier noted[1] that the typical rationalization will be that of ‘window dressing’. And perhaps too some may say that last minute flow of new information might have prompted some fund managers with sizeable portfolios to urgently position based on an anticipated boom.

But I see none of the above. From the flow of circumstantial empirical evidences, the last minute juggernaut seems to have been well crafted, through coordinated executions.

For starters, it usually takes a handful of heavyweight blue chip issues to move the Phisix. Of course being that they are blue chips this entails huge amount of money as these issues are the most liquid or frequently the most heavily traded

However, a push based on select heavyweights, while providing a lift to the Phisix, would not be reflected on all sectors.

This is why Friday’s action has been remarkable. As illustrated by the intraday charts from citiseconline.com, the resurgent Phisix was not limited to Phisix component leaders but to the major market caps of ALL the sectors.

Coordinated and synchronized buying has been adeptly executed which targeted heavyweights of every sector.

The systematic buying activities, thus, projected a broad based advance. (table from the Philippine Stock Exchange)

Among the sectoral benchmarks, the service sector, led by PLDT, promptly stood out. PLDT remains as the largest free float market cap constituting 14.62% of the Phisix basket as of Friday’s close. PLDT closed 2.16% on Friday (see red arrow below).

Ironically, there were some major issues that closed in the red such as Ayala Corp and Metrobank.

But again, the well contrived buying operation ensured that their losses had been neutralized by gains on some other heavyweights. For instance, in the holding sector, Ayala Corp’s losses had been offset by the gains of larger market cap Aboitiz Equity Ventures [PSE: AEV] and SM Investments [PSE: SM]. Also in the banking sector, Metrobank’s losses were countered by material gains of Bank of the Philippine Islands [PSE: BPI] and BDO Union Bank [PSE: BDO]

In short, the strategy’s centrepiece was that PLDT ensured the gains of the benchmark, while other blue chips were meant to “paint the town red”.

Peso volume net of special block sales, for the day, accrued to a substantial 6.9 billion pesos (US 165 million).

Since foreign money posted substantial net outflows (Php 1.8 billion; USD 43 m) during the session, this means that the local institution/s, channelled through a variety of leading brokers, were responsible for the synchronized buying spree.

It would seem senseless, if not irrational, for money managers with substantial portfolios to undertake what seems as dicey actions, considering the current risk environment and given the recent correction phase the Phisix has been undergoing.

This also means that the parties involved may not be after pursuing Alpha (investment) returns[2] but intended to garnish the Phisix for whatever non-financial reasons.

Importantly, in the absence of economic incentives, the likelihood is that the hefty risk money used could have been third party money.

If such actions have been limited to a single issue, then this would be known as “marking the close” which under Philippine laws are considered illegal[3]

In the US “marking the close” is defined[4] as “the practice of buying a security at the very end of the trading day at a significantly higher price than the current price of the security”.

Even if these acts has been engineered for so-called “window dressing”, they are reckoned as unethical, if not illegal, through Portfolio Pumping[5]

The illegal act of bidding up the value of a fund's holdings right before the end of a quarter, when the fund's performance is measured. This is done by placing a large number of orders on existing holdings, which drives up the value of the fund.

Nonetheless because “marking the close” is technically hard to prove, the elaborate broad index “management” scheme may have also been designed to elude legal technicalities.

Such “marking the close” manipulation was part of the insider trading charge[6] levelled against crony Dante Tan on the BW Resources scam but whose twin cases were eventually dropped by the Supreme Court[7].

Bottom line is that whatever gains accrued from Friday’s ploy to artificially boost stock prices should be taken as temporary and with a grain of salt. Eventually markets will prevail.

Global Equities on a Correction Mode

Most of the weekly 1.03% gain by the Philippine benchmark, the Phisix, can be traced to Friday’s extraordinary recovery of .91%.

For the week, among major international bellwethers, only the Phisix posted positive results.

The rest of the world seems to be in a correction mode.

However, the emerging market majors, particularly the BRICs, endured the heaviest losses.

What seems even more worrisome is that backed by a string of negative developments, such as Saturday’s post-trading announcement where Chinese manufacturing activities shrank or contracted (and not reduced growth) for the first time in nine months[8], China’s Shanghai index continues to fathom new depths. This may point to greater possibility of a hard landing for China.

Ignoring developments in China would be a reckless proposition. Aside from being the second largest economy in the world, China assumes very important roles in many aspects of global trade. This only means that a sharp unexpected downturn in China may amplify the risks of contagion.

It would also seem foolhardy to become overly optimistic on the sustained narrative by mainstream media that Chinese authorities would eventually come to the rescue. Chinese markets have so far dispelled the torrent of propaganda.

Well, the global equity market downturn seems to have affected even the streaking hot Thailand equity bellwether, the SET. Thailand’s SET sizzled even as the other ASEAN peers fumbled over the past few weeks.

Thailand SET (green) now joins the Phisix (PCOMP, red orange), Indonesia’s JCI (orange) and Malaysia (FBMKLCI, red) in rolling over to what seems as a downside bias.

If the SET should continue to correct, then this goes to prove that the forces of “reversion to the mean” are at work. This should also debunks the anachronistic idea of decoupling.

Risks to Ben Bernanke’s Political Career Points to Fed Action Soon

On the other hand, the cumulative weekly losses by US markets has been apparently been mitigated by a strong Friday close.

Again, the one day rally came amidst promises made by the US Federal Reserve’s Ben Bernanke for more policy stimulus in his Jackson Hole speech.

The Bloomberg gives us a good account on the Pavlovian behavior adapted by the markets[9],

U.S. stocks rallied with commodities and Treasuries as Federal Reserve Chairman Ben S. Bernanke said he wouldn’t rule out more stimulus to lower a jobless rate he described as a “grave concern…

Bernanke’s 24-page speech at the Kansas City Fed’s symposium made the case for further monetary easing and concluded that the central bank’s non-traditional policy tools such as bond purchases have been effective in boosting growth and improving financial conditions. He said that declines in the unemployment rate would continue only if growth picks up above its longer term trend.

Mr. Bernanke’s speech seems to impart subtle political implications.

Mitt Romney, Republican presidential candidate, lately announced that should he win the presidency this November, according to a Bloomberg article[10], “he wouldn’t reappoint Bernanke, raising questions about the succession more than a year before Bernanke’s term expires in January 2014.”

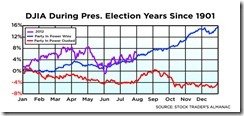

And as noted last week[11], the performance of the US stock market has had a strong correlationship with the outcome of the presidential elections. Strong stocks mostly led to the re-election of the incumbent (chart from yahoo[12]). This again may be due to public’s interpretation of rising markets as signs of economic “progress” even if in reality such artificially tweaked gains were mainly due to bank credit expansions.

This from USA News[13],

InvestTech Research, an investment firm out of Montana, says the stock market is the most reliable indicator of who will win the presidency and has been for more than 100 years.

"The election is a reaction to the stock market. If you see strength in the market, consumer sentiment and confidence among the voters is higher. If you see volatility, you are going to see investors take that out on the incumbent," says Eric Vermulm, an InvestTech Research senior portfolio manager.

Gains of the US stock markets have essentially been built around the slew of policy steroids or from repeated interventions by US Federal Reserve. This essentially postulates to the deepening politicization of US financial (equity) markets.

And as I pointed out in the recent past[14] the New York Federal Reserve even blustered about successfully boosting the US stock markets. Thus, the fate of equity markets seems largely beholden to the Fed’s sustained infusion of steroids.

In the knowledge that the Fed can tweak policies to favor the stock markets, and in the prospects that Mr. Bernanke will be out of work from a Romney presidency, then the most likely guiding incentive for Mr. Bernanke will be to work to retain his tenure by promoting the re-election of President Obama through “stock market friendly” policies in September or October.

Besides Mr. Bernanke seems to have a strong backing from FOMC members, according to the Carl Tannenbaum of Northern Trust[15], “more than half of the current FOMC members would be amenable to additional easing”

I previously said that the Mr. Bernanke may likely wait for the ECB to move first[16]. Now I am more inclined to the scenario or the probability that Fed action this September or in October may become a reality.

Two major variables yet could prevent Mr. Bernanke from doing so; one is a sustained surge in food prices, and the other, would be a more vocal opposition by the public on expanded Fed policies.

All Eyes On Central Bankers

Global equity markets have generally been on a correction mode, a dynamic which is likely to continue, until perhaps central banks lay down their cards.

Only the US markets seem to contradict this. Yet the strength of the US markets has been mainly erected from expectations of further policy easing by the US Federal Reserve.

On the other hand, the ECB may finalize the rescue mechanism within the first half of the month. This in spite of incipient signs of stagflation[17]; elevated inflation, high unemployment and contracting economic growth.

Mounting expectations and deepening dependence from central banking opiate, which has been clashing with the unfolding economic reality, will prompt for more price volatility on both directions. The Bank of America posits that QE 3.0 has been substantially priced in[18].

Eventually stock markets will either reflect on economic reality or that central bankers will have to relent to the market’s expectations. Otherwise fat tail risks may also become a harsh reality.

Market direction now depends on the details of central bank actions.

Mounting Stagflation Risks

Rising commodity prices appear to be factoring in the imminence of such actions. Gold’s recent recovery leads other commodities, Energy ($GKX-S&P GSCI Energy Index) and Industrial metals ($GYX-S&P GSCI Industrial metals) except Agriculture ($GKX-S&P GSCI Agricultural Index) which seems to have presaged the commodity rally.

For emerging markets, sustained high levels of food prices, which incidentally have now become a global phenomenon according to the World Bank, raises the risks of stagflation[19] which will force their respective central banks to tighten.

An environment plagued by stagflation will not be friendly to the stock market in general.

Perhaps China’s procrastination to pursue further aggressive stimulus has been due to the supposed huge disconnect between statistical CPI index and on the ground real food prices[20].

Surging food prices have been prompting many Asians to stockpile.

According to Wall Street Journal[21],

Reduced availability and higher prices are spurring importers to buy more, not less, as a hedge against even higher prices in the future. China, which accounts for more than 60% of the world's soybean imports, is also buying cargoes several months before shipment. Demand there is driven mainly by double-digit annual growth in dairy-product consumption, 5% to 6% growth in poultry consumption and 3% growth in pork consumpion, said Christopher Langholz, the business unit leader at Cargill Investments (China) Ltd.'s animal protein division in Shanghai.

Yet the prospects of Fed and the ECB simultaneously easing in the coming days, weeks or months will likely intensify not only on stagflation risks but the risk of a global food crisis as well.

Incipient stagflation, aside from micro bubble busts, may have been a principal reason why major emerging markets continue to underperform.

Correction Mode: PSE Capital Flows and the Peso US Dollar Trend

For the Philippine equity markets, the ongoing episode of correction has also been evident in the foreign fund flows.

Net foreign flows have begun to turn negative over the past weeks.

And negative foreign fund flows may have been influencing on the decline of the Peso.

According to an IMF paper[22], foreign capital flows dynamic via stock market transactions influence exchange rates more than the bond markets.

when it comes to external capital flows, it is foreign investors’ private information related to the stock market and not the bond market which drives the exchange rate.

This may hold some relevance to the relationship between the Phisix and the Philippine Peso

The correction phase of the Phisix (red candle), partly influenced by increasing net foreign sales, has likewise been manifested through the weakening of the Peso vis-à-vis the US dollar (black candle). The Phisix and the Peso exhibits strong correlations which may partly validate the theory that flows in and out of the stock market influence more the direction of the exchange rates.

So far, the Phisix correction cycle seems largely intact and could intensify

Domestic market technical picture and internal market dynamics, two items I discussed last week, along with capital flows and the trend of the Peso have converged to suggest that the correction phase of the Phisix has unlikely been over.

Add to these the external based dynamics which are likely to be transmitted to the local financial markets and to the real economy.

Don’t get lulled into the mainstream idea that the domestic central bank, the Bangko Sentral ng Pilipinas (BSP), will be able to successfully achieve so-called “inflation targeting” or contain price inflation through macro ‘policy toolkits[23]’ and that the statistical economic growth will remain robust as mainstream economists predict.

Had these policy toolkits “worked” then the world would not be experiencing what has been a lingering and worsening crisis since 2008. Technical gobbledygook has only been meant to project an aura of pretentious superiority in knowledge to justify the existence of unsound political institutions, even if they really don’t work.

Once price inflation accelerates through food and energy channels, which is likely to be accentuated by current easy money policies, and where stagflation becomes a clear and present threat, statistical economic growth, like a bubble, will simply pop. Then, the BSP will be in a state of panic. The public will discover that the emperor has no clothes.

[1] See Phisix: Another Fantastic Last Minute Upward Push August 31, 2012

[2] Wikipedia.org Alpha (investment)

[3] Security and Exchange Commission, CHAPTER VII Prohibitions on Fraud, Manipulation and Insider Trading Securities Regulation Code

[4] USLegal.com Marking the Close Law & Legal Definition

[5] Investopedia.com Definition of 'Portfolio Pumping'

[6] Philstar.com SEC favors random closing time for PSE December 3, 2002

[7] Manila Bulletin SC oks dismissal of Dante Tan charges in BW Resources case August 1, 2010

[8] Bloomberg.com China Manufacturing Unexpectedly Contracts As Orders Drop, September 1, 2012

[9] Bloomberg.com Stocks Rise With Commodities, Treasuries On Stimulus Bets, September 1, 2012

[10] Bloomberg.com Bernanke Makes Case For Further Stimulus To Help Jobless September 1, 2012

[11] See Phisix: The Correction Cycle is in Motion August 27, 2012

[12] Yahoo.com Obama’s Re-Election Odds Are Better Than You Think Says Hirsch, August 15, 2012

[13] USA News Stock Market Picks 90 Percent of Presidential Elections February 24, 2012

[14] See Bernanke Doctrine: New York Fed Boasts of Pushing Up the US Stock Markets, July 14, 2012

[15] Carl R. Tannenbaum The Message from Jackson Hole, Northern Trust Augst 31, 2012

[16] See Phisix: Managing Through Volatile Times August 6, 2012

[17] See Eurozone’s Nascent Signs of Stagflation September 1, 2012

[18] Zero Hedge, Chart Of The Day: With All Of QE3 Priced In, The Only Way Is Down Should Bernanke Disappoint, August 31, 2012

[19] See Stagflation Risk: Food Price Inflation is Worldwide August 31, 2012

[20] Zero Hedge, Big Outflow Trouble In Not So Little China? August 25, 2012

[21] Wall Street Journal Soybean Worries Spur Asian Buying August 29, 2012

[22] Jacob Gyntelberg, Mico Loretan, and Tientip Subhanij Private Information, Capital Flows, and Exchange Rates IMF Working Paper September 2012

[23] Businessonline.com BSP ready to tweak policy August 30, 2012