Here is what I wrote last week[1],

Mounting expectations and deepening dependence from central banking opiate, which has been clashing with the unfolding economic reality, will prompt for more price volatility on both directions. The Bank of America posits that QE 3.0 has been substantially priced in.

Eventually stock markets will either reflect on economic reality or that central bankers will have to relent to the market’s expectations. Otherwise fat tail risks may also become a harsh reality.

The ECB and China’s government eventually relented to the market’s expectations

“Unlimited government bond buying” bazooka program[2] launched by the European Central Bank (ECB), last Thursday, spurred one of the best one-day rally for many global stock markets for the year.

China also announced of a modest infrastructure spending stimulus to the tune of the 1 trillion yuan or US 157 billion[3] last Friday. China’s rescue program seems to have been timed or coordinated with the ECB’s action.

China’s package looks “modest” because the earmarked amount for fiscal spending projects accounts for only a little over a quarter of the $586 billion stimulus implemented in 2008-2009.

Nonetheless the combined stimulus by the ECB and China nudged an astounding reprisal by the browbeaten bulls: the Shanghai index soared by 3.7% on Friday!

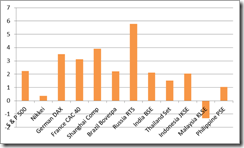

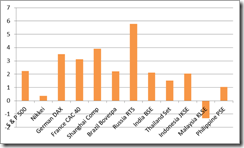

The steroid boosted activities of China’s Shanghai index exhibited the same theme for most of the major equity benchmarks for the week.

The weekly advances concealed the real activities.

Much of the global equity markets were marginally changed when both announcements provoked end of the week spikes. Only Malaysia among the majors lost ground.

Deepening Gulf Between Market Prices and Economic Events

This week’s remarkable rally reveals of two important insights.

ONE. Financial market has been responding to interventions rather than to actions in the real world.

Increasing detachment has characterized the actions in the financial markets relative to real economic activities.

Industrial production in the Eurozone[4] (see left window) have generally been cascading throughout 2012, however European stocks, particularly the German DAX, French CAC, and Italy’s iShares MSCI and Spain’s IBEX has been ascendant since May (see right window).

Year to date, the DAX has been an up by an outstanding 22.31%, the CAC 40 11.37% and Italy’s iShares MSCI 6%. Spain’s Ibex has trimmed losses to only 8%.

Economic performance and stock prices have been going in opposite directions.

Well this has not been limited to the Eurozone.

Divergences can be seen from accounts of declining GDP or economic growth for the G-7, the Eurozone and the US, although the OECD projects that America may defy the global momentum for the rest of the year.

The OECD projection according to the Economist[5],

The global economy has weakened since the spring and the OECD predicts that in the next quarter the GDP of the G7 group of richest countries will grow by just 0.3% (at an annual rate), down from an already anaemic 0.9% in the second quarter. America provides a rare bright spot, but the three biggest economies in the euro zone, Germany, France and Italy, are set to shrink by 1% in Q3, worse even than their 0.3% contraction in Q2. Indeed, figures released on the same day by Eurostat show that GDP growth in the 17 euro-zone countries fell from zero in the first quarter to -0.2% in the second, and from zero to -0.1% in the 27-country European Union.

I don’t share the OECD’s sanguine expectations on the US. The US will, like her global contemporaries, be hobbled by contagion linkages, political bickering and an internal slowdown.

Come to think of it, the OECD expects Germany to fall into a recession by the end of the year[6]. But the German equity benchmark, the DAX, seems to negate all the troubles ahead and seems approaching April 2011 highs. One of them is wrong, so which is which?

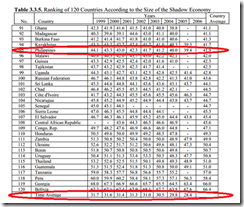

In addition, global trade (light blue line, lower window from the Economist chart) has been drifting in conjunction with global manufacturing activities (Purchasing manager’s index based on new export orders, dark orange line) to the downside. Yet except for the Shanghai index which has been slightly down, aside from Japan’s Nikkei and Malaysia’s KLCI, which has lagged, all other major indices have posted superior double digit year to date returns.

Importantly, the deterioration in global trade and global manufacturing activities has not just been a decline in the trend of growth, instead current data suggests that both indicators have exhibited signs of contraction. About 80% of global manufacturing activities have reportedly been in contraction[7].

So once again stock markets live in a different reality from the economic picture.

We go next to US corporate profits.

Corporate profits seem to have also diverged from the upside price momentum of US major equity prices.

Based on the following profit measures, 1) S&P 500 Earnings Per Share, 2) After-Tax Net Income 3) Pre-Tax Profits by Source, 4) Financial Corporate Profits and 5) Profits from Abroad, Dr Ed Yardeni chief of prominent research firm Yardeni Research, weighs on the profit segment based on an empirical analysis and makes the following conclusions.

In enumerated order, Dr Yardeni[8] says that profits has 1) “lost its upward momentum”, 2) have been “running out of steam”, 3) “have stalled in a zigzag fashion”, 4) “looking especially toppy” and 5) “weakest growth rate since Q3-2009” which implies of “a decline twice as much for overseas profits”.

Mr. Yardeni’s seemingly drab undertone comes prior to Thursday’s ECB-China fueled boom. The point here is that sustained upside price increases for US stocks will push valuations into overpriced territory.

Domestic data hasn’t been that promising too.

Last week’s US jobs data came worse than expected but apparently have been either ignored by the US markets because ECB’s action may have drowned out such negative news or could have been interpreted as the du jour “bad news is good news”.

The job data on the surface showed mediocre signs of improvement. But this came amidst a decline in the labor force. The labor force participation rate (63.5%) dropped to lowest level since May 1979, according to Northern Trust[9] (left window).

Compounding on this, notes the Wall Street Journal Blog[10], is that for June there had been fewer jobs created, manufacturing shed 15,000 jobs which essentially reflected on the ongoing downturn, and fewer people are working.

Many talking heads see this unimpressive and lacklustre economic performance as rationalization for the FED to pursue further easing measures during their FOMC meeting by next week.

From a fundamental standpoint, surging US markets suggest either that 1) moves by central banks (particularly the ECB which will likely be complimented by the FED for political reasons*) will dramatically reverse the dynamics of all of the above concerns, in order for the global equity markets to justify on their current price levels, or 2) the price-fundamental disconnect will only amplify risks for a violent “reversion to the mean”.

* as stated last week, Mr. Bernanke will seek to retain his tenure by propping up the markets to support President Obama’s re-election

The great disconnect is in reality signs of contortions from inflationism.

As the great American economist, philosopher and journalist Henry Hazlitt once wrote[11]

Because inflation leads inevitably to distortions in the interest rate, because during it nobody knows what future prices, costs, or price-cost relations are likely to be, it inevitably distorts and unbalances the structure of production. It gives rise to multitudinous illusions. Because the nominal interest rate, though it rises, does not rise enough, funds are more heavily borrowed than before; uneconomic ventures are encouraged; corporations making high nominal profits invest abnormal sums in expansion of plant. Many regard this, when it is happening, as a happy byproduct of inflation. But when the inflation is over much of this investment is found to have been misdirected—to have been malinvestment, sheer waste. And when the inflation is over, also, there is found to be, because of this previous misdirection of investment, a real and sometimes intense capital shortage.

The second implication from the current rally is that whatever one has conventionally learned from investing has been rendered irrelevant, if not obsolete, by sustained manipulation of prices of financial markets for political reasons.

That political reason has been to effect price controls in the financial markets by burning shorts in order to save the current political order.

Fund manager and Credit Bubble Bulletin (CBB) analyst Doug Noland is spot on with the dynamics behind the current developments[12]

With the financial world fixated on Draghi, Bernanke and endless QE, global markets now wildly diverge from economic fundamentals. Many are content to celebrate, holding firm to the view that financial conditions tend to lead economic activity. Markets discount the future, of course. And, traditionally, an easing of monetary policy would loosen Credit and financial conditions - spurring lending, spending, investing and stronger economic activity.

Importantly, traditional rules and analysis no longer apply. Monetary policy has been locked in super ultra-loose mode now entering an unprecedented fifth year.

This serves as further proof that earnings, economic growth or chart patterns have become subordinate to the actions of central bankers and government authorities in determining stock price movements

ECB’s Actions Enhances Stagflation Risks, Bernanke Next?

Part of the newly announced ECB program includes the replacement of Securities Markets Programme (SMP) with new Outright Monetary Transactions programme (OMT) which is conditional to the EFSF/ESM facility, the ECB also removed the senior status on its purchases and importantly “the easing of collateral rules, namely suspension of the minimum rating threshold for countries with an OMT or an EU-IMF programme. Thus, government bonds (and government guaranteed bonds) no longer face the risk of not becoming eligible collateral (unless countries do not deliver on reforms of course). This should remove an important risk for banks buying government bonds” according to Danske Research[13].

Optimism derived from the tinkering with so called self-made regulations shares the same myopic political idea that edicts have the power to eliminate risks and overpower economic reality.

There are many aspects to deal with covering the ECB’s latest announcement.

These include among the many

-the willingness of crisis stricken nations to sacrifice their sovereignty to the supervising troika (EU, ECB and the IMF) by applying for the EFSF/ESM facility in order for the ECB mechanism to be triggered,

-the political support from the average Germans for the sustained wealth transfer mechanism to the PIGS. Germany’s Constitutional Court will decide on the ESM court case by next week amidst political street protests[14] and

-if these measures will ever work at all.

I think what really matters now will be undeclared objectives by the ECB for such measures. Despite the conditionality to allegedly “sterilize” such interventions, the ECB will have limited means to do so.

First, the ECB will have to sell assets to offset its direct bond purchases. Indirect purchases can also be made through the commercial banking system financed by the ECB.

This means that for the ECB to conduct sterilization, only non-crisis tainted (PIIGS) assets presently held or owned by the ECB will be available for sale, or that the ECB has to shrink its loans to banks collateralized by non-PIGS bonds[15]

Since non PIIGS assets are limited, once used up, the ECB will likely be engaged in unsterilized actions.

Next, if these will be sterilized by fixed term deposits or weekly deposit tenders[16], which function as another form of reserves, the build up of reserves at the ECB will only amplify the debt pyramiding dynamic of the cartelized tripartite political system comprising the banking system, central bank and the government/welfare state through cross financing (banks finance government, the government capitalizes and provides monopoly legal tender status to central banks, central banks backstops the banks and provides financing indirectly to governments through banks (bond buying).

By having to artificially reduce interest rates, governments of the PIIGS will likely defer on making the required reforms and continue with their spending binges, thus, exacerbating the current conditions.

Importantly, the easing of collateral rules may have opened the floodgates for the feedback loop of mechanism of massive debt issuance and ECB buybacks since “banks under the programme”, according to Austrian economist Bob Wenzel who quotes another expert [17], will be able “to use the self-issued government guaranteed debt as collateral”

The point is that the recent price action of commodities seems to have “seen through” the legerdemain over so-called “sterilization”, and have moved significantly up nearly across the board. Such actions appear to be signaling the resurgence of an inflationary boom.

Gold will probably test the 1,800 level by the yearend, oil (WTIC), copper and the broad based commodity benchmark the Reuters CRB (CCI) index have turned materially to the upside.

I hardly believe that this will be the same prolonged Risk ON environment as before. With unlimited or open ended options (US Federal Reserve has already been taking this in consideration), central bankers have been increasingly signaling urgency and desperation.

Yet there are very important differences from today’s implementation of easing programs compared to the past: interventions are being done amidst elevated commodity price levels.

And if commodity price inflation will spillover to the real economy, such euphoria will likely be short term. This will likely be seen first in emerging markets such as the Philippines.

Current environment, for me, seems like very fragile and precarious.

Stocks Under a Stagflationary Environment

As I pointed out in the past, imposing inflationary measures under the current environment heightens the risks of stagflation.

Signs of stagflation have also been transmitted not only to gains in commodity prices but also on global mining stocks.

I would further add that if the US Federal Reserve joins the ECB next week, then the current short term RISK ON momentum may persist, but advances will likely be skewed towards commodities.

Eventually I expect a structural departure between mining and resource with the general trend once the stagflation dynamic becomes entrenched.

Resource companies have the potential to surf the stagflation tide, while others will be restrained by consumer price controls, realignment of economic activities towards consumer staples and higher input costs that will crimp on profits.

Mr. Hazlitt on why the stock market in general faces downside risks during high inflation-stagflation regimes[18].

The causes of these disappointing results have been somewhat complex. Let us recall once more that in any inflation, individual prices and costs never go up at a uniform rate but at widely different relative rates and times. Cost-price relationships become discoordinated. Individual firms find it increasingly difficult to know or guess what their own future costs or future selling prices are going to be, and what will be the ratio between them. During an inflation demand shifts quickly from one product to another. This makes it increasingly difficult to plan production ahead, or to estimate future profit margins. In the later stages of an inflation, wage rates are more certain to go up than individual prices. Even if aggregate profits increase in monetary terms, the range of deviation and dispersion is much greater as between different firms. The investor faces increasing uncertainty. This always tends to lower stock prices.

Because the future of the business is increasingly uncertain, corporations become more reluctant to pay out dividends. If, as in many cases, profits are particularly high in money terms, if inventories and plant and equipment are constantly rising in price, more and more plant managers conclude that the best use of their current profits is to plow them back immediately into expansion of the business. This seems especially the most profitable thing to do in a hyperinflation. It then seems foolish to declare dividends when, by the time the stockholders receive them, they may be worth much less than they were when declared

Bottom line: Bubbles: Illusions of Progress

Financial markets have become materially detached from the unfolding real events. Markets are suggesting not only of recovery, but of a strong upside momentum in terms of economic recovery, whereas present global economic trends have been increasingly portentous of the risks of a global recession. If current diametric positions will remain, such growing divergences may accelerate a buildup on the risks of sharp downside volatility.

Such distortions seem to have become embedded into the market’s psyche. An upside market has now become an entitlement as impressed upon to the public through inflationist policies.

Yet current policies as noted above have been rewarding the bulls while punishing the bears (particularly the shorts). Policies have been designed to wrench economic reality with hope (some call it “hopium” or concatenation of hope and opium or addictive hope) that inflationism will work even if history has shown that it hasn’t.

And not only has such inflationist policies been promoting the “orgy of speculation”, this has been intensely obscuring price signals and economic coordination while giving the public illusion of progress.

As a side note, I recall last week when I presented signs of “portfolio pumping” in the domestic stock exchange, I read a remark somewhere that there should be a congressional investigation on this. Oh puhleez (to borrow Mr. Bob Wenzel’s expression), spare the market from further politicization. It has been bad enough that markets are already being directly and indirectly manipulated and assaulted for political reasons through various policies hardly understood public.

By adding more political interferences, eventually we all get what we deserve real hard.

[1] See Phisix: Why The Correction Cycle Is Not Over Yet September 2, 2012

[2] See ECB’s Mario Draghi Unleashes “Unlimited Bond Buying” Bazooka, Fed’s Ben Bernanke Next? September 7, 2012

[3] See China Joins Stimulus Bandwagon via Massive Infrastructure Spending September 7, 2012

[4] Weekly Focus ECB back as fire fighter and it works, Danske Research, September 7, 2012

[5] Graphic Detail The European effect Economist.com Blog September 6, 2012

[6] Speigel Online OECD Predicts Recession for Largest EU Economy September 6, 2012

[7] See 80% of World Manufacturing Activities Contracting, September 4, 2012

[8] Ed Yardeni Profits Dr. Ed’s Blog September 4, 2012

[9] Asha Bangalore August Employment Data Contain Ample Evidence to Justify QE3, Northern Trust, September 7, 2012

[10] Wall Street Journal Blog Five Key Takeaways From Jobs Report September 7, 2012

[11] Henry Hazlitt The Inflation Crisis, And How To Resolve It, p.125 Mises.org

[12] Doug Noland Diverging Like It's 1929, September 7, 2012 Credit Bubble Bulletin Prudent Bear.com

[13] Danske Research ECB meeting: ECB is now waiting for Spain, September 6, 2012

[14] Reuters.com Hundreds of Germans protest against euro rescue steps September 8, 2012

[15] Lawrence H. White How much dodgy debt will the ECB buy?, September 7, 2012 Freebanking.org

[16] The Tell, Euro gets boost from ECB sterilization speculation Marketwatch.com September 6, 2012

[17] Robert Wenzel The Magic Tricks of Mario Draghi Economic Policy Journal September 8, 2012

[18] Henry Hazlitt op cit p.146