Fund manager Kyle Bass of Hayman Capital interviewed at the CNBC thinks that Japan has reached a critical zone and points to several important factors from the recent BoJ decision. (hat tip zero hedge)

He notes that “Increasing the monetary base by roughly 143 trillion yen is essentially doubling monetary base” which he shares with another expert that represents a “giant experiment” where “doubling monetary base is extremely experimental”

With Japan’s debt accounting for more than 20x tax revenue Japan is already "insolvent". Thus, policymakers have been prompted to “to do something big”

He also adds that Japan is about to “implode under the weight of their debt”. And that BoJ’s recent aggressive stance also included the abandonment of the banknote rule*

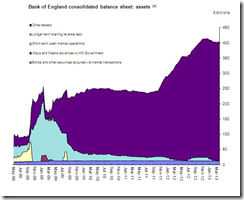

*the Bank Note Rule was a self-imposed rule on the Bank of Japan upon its creation to make sure that the BoJ's balance sheet did not become over-leveraged. Effectively, the rule limits the amount of bonds the BoJ can hold to the amount of currency in circulation. However, by abolishing the rule, the BoJ can effectively lever itself up and buy more bonds. (Nasdaq)

Mr. Bass suggests that the bond markets will now play a crucial role in monitoring Japan’s transition: “what is important is to follow the bond market’s reaction”

He thinks that “central bankers live in a nirvana”, and that eventually “they will lose control of rates”

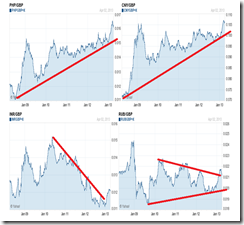

He advises resident Japanese to “spend all the yen you have, you need to go take it out of your country” to save their savings or their purchasing power. And for foreigners to do the yen carry trade by borrowing yen to buy productive assets in other countries

Investors “should not be long yen or not be long Japanese assets” even if equities have responded in Pavlovian fashion to BoJ’s policies.

Mr. Bass also notes that Japan has generally lost trade competitiveness, mostly to South Korea and that her industries been “hollowed out”. Add such predicament to the decline in population and debt rate cross out birth rate and of the coming tax increases.

The forthcoming living tax increase "will pull forward some consumption so nominal gdp move slightly higher" but will be a drag over the long term.

He says that the popular focus on us dollar yen is a myopic view of trade competitiveness. And that mainstream’s expectation of BoJ policies “is not the pancea that everyone hopes that it will be”

Final point he says investing in a world of central banking inflationism has been difficult: “central bankers around the world are creating Potemkin villages, they are very difficult to invest around”

Below is another video inspired from Kyle Bass explaining Japan’s debt trap from Addogram;