Harvard economist and professor Carmen Reinhart, who along with co-Harvard peer authored a book chronicling world crises in the bestseller, This Time is Different has recently been interviewed by the Der Spiegel. (bold mine, hat tip zero hedge)

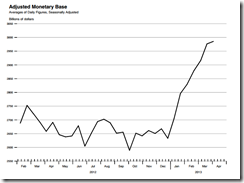

On the real reason for negative interest rates and QEs…

Reinhart: No central bank will admit it is keeping rates low to help governments out of their debt crises. But in fact they are bending over backwards to help governments to finance their deficits. This is nothing new in history. After World War II, there was a long phase in which central banks were subservient to governments. It has only been since the 1970s that they have become politically more independent. The pendulum seems to be swinging back as a result of the financial crisis.

Oops. Financing government deficits has indeed become the norm. This is an essential ingredient to the risks of hyperinflation

On the difference between today and World War II…

Reinhart: No, but after World War II austerity was easier to pursue, because you had a younger population and therefore less entitlements. Furthermore, military expenditure was easier to reduce. So, the build-up in debt we have seen since the crisis is very rare. Usually you get that kind of build-up when there is a war.

Why huge debt has been a burden…

Reinhart: I am not opposing this change, I am just stating it. You have to deal with the debt overhang one way or the other because the high debt levels are an impediment to growth, they paralyze the financial system and the credit process. One way to cope with this is to write off part of the debt.

Why governments resort to plundering of people’s savings by financial repression…

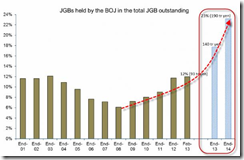

Reinhart: The technical term for this is financial repression. After World War II, all countries that had a big debt overhang relied on financial repression to avoid an explicit default. After the war, governments imposed interest rate ceilings for government bonds. Nowadays they have more sophisticated means..Monetary policy is doing the job. And with high unemployment and low inflation that doesn't even look suspicious. Only when inflation picks up, which is ultimately going to happen, will it become obvious that central banks have become subservient to governments.

Financial repression policies only adds to the debt stock, real austerity is required.

Reinhart: No. Restructuring, inflation und financial repression are not substitutes for austerity. All these measures reduce your existing stock of debt. Unless you do austerity you keep adding to the debt. There is no either-or. You need a combination of both to bring down debt to a sustainable level.

Why we should expect higher inflation…

Reinhart: There are no silver bullets. If central banks try to accommodate and buy debt, there are risks associated with it. Somewhere down the road you are going to wind up with higher inflation. That is a safe bet -- even in Japan …

Again financing deficits heightens risks of hyperinflation.

Surprisingly Ms. Reinhart offers an implied Austrian school solution (except for the higher inflation advice)…

Reinhart: The best way of dealing with a debt overhang is to never get into one. Once you have one, what can you do? You can pray for higher growth, but good luck! Historically it doesn't happen -- you seldom just grow yourself out of debt. You need a combination of austerity, so that you don't add further to the pile of debt, and higher inflation, which is effectively a subtle form of taxation …

Why savers are screwed…

Reinhart: No doubt, pensions are screwed. Governments have a lot of leverage on what kinds of assets pension funds hold. In France, for example, public pension funds have shifted money from shares (on the stock market) to government bonds. Not because their returns are great, but because it is more expedient for the government. Pension funds, domestic banks and insurance companies are the most captive audiences, because governments can just change the rules of the game.

The morality of financial repression…

Reinhart: Let me be a little blunter: A haircut is a transfer from the creditor to the borrower. Who would get hit by a haircut? French banks, German banks, Dutch banks -- banks from the creditor countries. So you can see why this is politically torched. This is why it is not done, it's a redistribution. But ultimately it is going to happen, because the level of debt is too high.

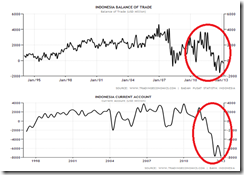

The US will default too but by the inflation route…

Reinhart: Yes, but who are the large holders of government bonds? Foreign central banks. You think the Bank of China is going to be repaid? The US doesn't have to default explicitly. If you have negative real interest rates, the effect on the creditors is the same. That is also a transfer from China, South Korea, Brazil and other creditors to the US.

Why the system will keep continuing until it can’t…

Reinhart: Why do we have such low interest rates? The Federal Reserve Bank is prepared to continue buying record levels of debt as long as the unemployment situation isn't satisfying. And China's central bank will also continue to buy treasuries, because they don't want the renminbi to appreciate.