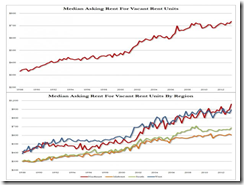

China’s runaway credit financed property bubble will undergo scrutiny from Chinese national government, who will focus on reining debt levels of the local government

China will start a nationwide audit of government debt this week as the new Communist Party leadership investigates the threats to growth and the financial system from a record credit boom.

The State Council, under Premier Li Keqiang, requested the National Audit Office review, the office said in a statement yesterday without elaborating. The cabinet’s July 26 order was “urgent” and the office suspended other projects to work on the review and will send staff to provinces and cities this week, People’s Daily reported yesterday on its website, citing sources it didn’t identify.

The first full audit since an initial review two years ago underscores concern expressed by institutions such as the International Monetary Fund, which this month cited risks to the economy from borrowing by local governments and an expansion of non-traditional sources of credit. The new leadership oversaw a showdown with state-owned lenders last month as the People’s Bank of China engineered a cash squeeze to pressure banks to better manage their operations.

On the surface this looks impressive, but the question is how or on what basis will the national leadership apply controls? Will these be selective? Will the political opposition bear the brunt of such crackdown?

The enormous leveraged exposure by local governments. From the same article:

The first audit of local-government debt found liabilities of 10.7 trillion yuan ($1.8 trillion) at the end of 2010, the National Audit Office said in June 2011…

Ding estimated China has at least 12 trillion yuan of local-government debt. The review may pave the way for future fiscal reforms, including changes to rules on local governments’ roles and responsibilities, Ding said.

I think that this goes beyond merely changing of rules, it is more likely that the problem lies, aside from the PBoC’s inflationary policies, on China’s top down political system and the command economy.

China's centralized political framewok has previously used the statistical economy as a tool to promote the national political agenda. Moreover, the statistical economy has also been used as carrot and stick to manage the political careers of local government officials.

As explained by a paper from Cornell University (Derek Headey, Ravi Kanbur, Xiaobo Zhang) [bold mine]

Modern China has always had centralized merit‐based governance structure. In the planning economy era, the evaluation of cadres was largely based on political performance. However, since the China’s reforms initiated in 1978, political conformity gave way to economic performance and other competence‐related indicators as the new criteria for promotion. The promotion of China cadres’ is now largely based on yardstick competition in several key economic indicators, including economic and fiscal revenue growth rates, and some central mandates, such as family planning (Li and Zhou, 2005, Chapter 12, this volume). These indicators have been written into local leaders’ contracts. This creates tremendous pressure for local government personnel to compete with each other through superior regional performance.

In other words, the massive local government leverage has been a product of the political imperatives of the previous leaderships in generating high statistical economic growth regardless of the costs.

More. The Chinese government will allegedly cap spending…

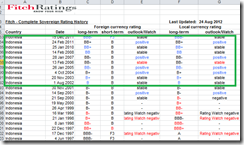

Separately, China’s government has decided to cap the ratio of the fiscal deficit to gross domestic product at 3 percent in a bid to avert a downgrade of China’s credit rating by international rating companies, China Business News reported today, citing an unidentified person familiar with the matter.

So will the recently announced $85 billion railway stimulus be a limited one? This remains to be seen. I suspect that should China's economic slowdown intensify, spending caps may become an open spigot for stimulus. That's because a meltdown of the Chinese economy will likely jeopardize the power structure of the incumbent political system that would put to risks the grip on power by the incumbents.

Again chasing statistical growth at any cost by the local government has been previously powered by huge borrowing.

Again from the same Bloomberg article:

Local-government financing vehicles need to repay a record amount of debt this year, prompting Moody’s Investors Service to warn that Premier Li may set an example by allowing China’s first onshore bond default.

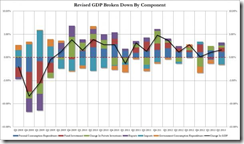

Regional governments set up more than 10,000 LGFVs to fund the construction of roads, sewage plants and subways after they were barred from directly issuing bonds under a 1994 budget law. A 4 trillion yuan stimulus plan during the 2008-09 financial crisis swelled loans to companies, which they have been rolling over or refinancing with new note sales.

LGFVs may hold more than 20 trillion yuan of debt, former Finance Minister Xiang Huaicheng said in April. Refinancing will be a challenge after corporate bond sales slumped to a two-year low in the second quarter and policy makers cracked down on shadow-banking activities that bypass regulatory limits on lending.

The obvious lesson here is that politically driven economic growth engenders massive imbalances. The boom of which are not only artificial and temporary, but eventually backfires.

Whether or not the national government pursues with tenacity the crackdown on local government and on the shadow banks, the above accounts appear as deepening manifestations of the unfolding meaningful slowdown of the real (and not the inflated statistical) Chinese economy, the increasing hissing signs from China’s property bubbles and of the greater uncertainty over political direction and its ramifications.

In the face of a volatile global bond markets, these risks are likely to be amplified.

Interesting times indeed.