Last week I wrote[1]:

While so far, Asia and other Emerging Markets appear to be the most vulnerable, should bond yields continue to soar, which implies of amplified volatility on the bond markets and eventually interest rate markets, the impact from such lethal one-two punch will spread and intensify.This makes global risks assets increasingly vulnerable to black swans (low probability-high impact events) accidents.

Bond Vigilantes Mortally Wounds the ASEAN Financial Markets

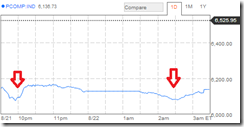

Twice within the last three months the Philippine equity benchmark the Phisix endured a one day 6% meltdown. Contra the consensus expectations, this only underscores my point[2] that last June’s crash wasn’t just out of ‘irrational’ market sentiment, instead this signaled an upcoming radical change in the financial and economic environment.

Unlike populist notions that bear markets have been devoid of “fundamentals”, bear market signals are symptoms of underlying pressures from maladjusted markets and economies or even strains from politics. The former two symptoms are more representative of today’s conventional markets here and abroad, while the political factor was largely behind the 1987 and 1989 bear market cycle.

In a week where trading sessions had been abbreviated by 2 days due to massive monsoon generated floods and by a public holiday, the selling pressures which tormented the region had been ventilated when the Philippine markets opened last Thursday where the Phisix dived by 5.96%.

For the week, the Phisix closed sharply down by 5.59%. The peso too had been bludgeoned by 1.42% to 44.26 US-PHP from last week’s 43.64

And this has not just been a Philippine affair.

Financial markets of major ASEAN nations have been whacked.

Indonesia’s equity benchmark the JCI crashed into bear market territory as the nation’s 10 year bonds and her currency, the rupiah, has equally been smashed.

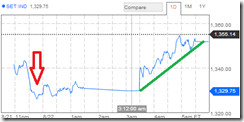

With only less than 2% away, Thailand’s SET is at the verge of joining Indonesia into the bear market as both the currency, the baht and the Thai bonds has been equally under selling pressure.

Thailand has reportedly fallen into a recession during the 2nd quarter of the year[3].

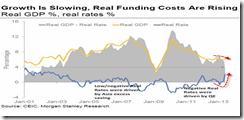

If rising bond yields amplify on Thailand’s slowing economic growth, then this will magnify the fragility of Thailand’s heavily leveraged system which has financed a huge domestic bubble[4], thereby increasing the risks of a regional debt crisis.

A significant share (56%) of Thailand’s external debt has been based on short term debt[5] (as of 2011), the risk of which the Bank of Thailand’s dismissed as “limited” since this has supposedly been related to international trade and foreign asset acquisition[6]. Such bureaucratic presumptuousness in risk assessment has been undergoing a severe test.

Incidentally, Thailand’s external debt, since 2008 through the 1st quarter of 2013[7], has ballooned by about 75% or a compounded annual growth rate (CAGR) of 14.07%. With slowing growth, debt levels will be enlarged as real funding cost increases.

The bond market contagion has even spread to Malaysia who earlier looked resilient. Malaysian bonds and the ringgit have also been under the pressure cooker. The KLCI fell by 3.76% this week, which broke its uptrend.

Mainstream media has been desperately looking to rationalize the current market actions using deteriorating current account, swelling debt and a large exposure by foreigners on Malaysia’s bond markets as factors shaping the current selloff[8]. In reality, what media sees as ‘causes’ are really symptoms of a much deeper force: Malaysia’s credit fueled bubbles[9].

The bond vigilante inflicted contagion appears to be spreading throughout the rest of the ASEAN region.

Incidentally, while the previous market collapse was featured on the headlines, this week’s equivalent has been relegated to the business pages. Why? Has it been because of the wear and tear of defending today’s phony economic boom in the face of unresponsive markets? And second and the other most likely factor have been due to more pressing sensational Pork Barrel scam[10] which has captured the public’s attention. Perhaps a combination of both of these?

If the public only understood how financial repression (negative real rates) works, the pork barrel scam represents just a walk in the park

US Federal Reserve Dilemma: Taper Talk versus Credibility

Various sorts of myths have emerged and have been disseminated in media on the supposed causes of the current meltdown.

A high official of the banking industry was recently quoted by media who blamed the recent market carnage on the US Federal Reserve’s supposed tapering: “It’s not an issue of if. It’s an issue of when[11]”.

The common perception sold by media and the mainstream experts on the public is one of a post hoc fallacy relationship: Fed tapers, foreigners sell market and return to the homeland, thus crashing domestic markets.

There appears to be hardly any attempt to explain the mechanics of such relationship except to imply of the ridiculous idea that foreigners are unthinking entities whom are merely driven by market sentiment and by the perceived FED actions. Thus foreigners are painted as wrong for ignoring “strong macro fundamentals”[12].

But will the FED really voluntarily taper?

I pointed out that when the first bout of market stress emerged from the perceived tapering by FED in May, many central bankers immediately backpedalled.

For instance, the Bank of England’s Mark Carney announced a new forward guidance program meant to contain interest rates. The European Central Bank’s Mario Draghi seconded and reversed his earlier non-committal position by declaring that interest rates will remain at low levels for an “extended period of time[13].

Meanwhile the US Fed Chair Dr. Bernanke’s told the public that low interest rates will remain: “highly accommodative monetary policy for the foreseeable future”.

Barely a week after, in a question and answer forum Dr. Bernanke furthered his dovish tone saying that “If we were to tighten policy, the economy would tank”[14]

The following is from the minutes of the FED’s Open Market Committee’s July 30-31 gathering released last week[15]: (bold mine)

Almost all committee members agreed that a change in the purchase program was not yet appropriate,” and a few said “it might soon be time to slow somewhat the pace of purchases as outlined in that plan”

Does this sound like the Fed’s tapering is an “if and when” issue?

My point is that FED officials have increasingly become more opaque in their statements and have increasingly been throwing data driven targets (unemployment and inflation) or might I suggest obstacles in attempts to move the goal posts on policy actions. Such muddled communications signify as resistance or reluctance to taper.

Let me analogize. Government X declares price control on apples by putting a ceiling on them say Php 10 per apple. But because of a huge demand on apples, apples sales has vanished from the formal sector and instead moved to the informal sector, where prices of rise first to Php 12, then to Php 14… Government X, thus, responds by announcing a crackdown on apple sales. But instead of lowering prices, prices continue to ascend…Php 16, Php 18 then Php 20 per apple. Failing to admit of their failed policies, Government X announces that due to shortages of apples, they will increase price ceiling to Php 15 per apple.

Just replace government X with Venezuela and Argentina, and apples with their respective currencies the bolivar[16] and the Argentine dollar and we see the forex conditions of both countries. The growing gap between black market and official rates has been forcing both governments to adjust official rates higher.

As shown above, governments recalibrate their policies to realign with the markets, rather than the opposite. This has been designed to reduce the negative publicity impact of failed policies which simultaneously has been meant to maintain “credibility”.

The same mechanics applies to the US Federal Reserve and the US bond markets.

The FED in effect manipulates the yield curve specifically using ZIRP[17] (Zero bound Interest Rate Policies) through Fed Fund rates on short term yields, and Quantitative Easing or asset purchasing program through UST of longer maturities to affect long term yields.

As pointed out last week, the FED now holds 31.47% of the total outstanding ten year equivalents. While the FED tries to influence the public’s risk appetite and portfolio holdings in the way they want them via the Portfolio balance theory, the unintended consequence has been to reduce the supply of US treasuries in the system leaving banks with diminished availability of “safe assets” for collateral thereby increasing risks of the banking sector. This is aside from amplifying the risks of a bond selloff as a result of diminished liquidity.

And one thing which the mainstream doesn’t seem to realize is of the guiding philosophical ideology driving the actions of a majority of central bankers, particularly the belief in the “euthanasia of the rentier” or the eradication of the “cumulative oppressive power of the capitalist to exploit the scarcity-value of capital”[18].

In other words, the dogma of interventionism holds that by driving rates to interest rates to zero or by its abolition, mankind will be spared of scarcity.

As the great Austrian economist Ludwig von Mises warned[19]:

Public opinion is prone to see in interest nothing but a merely institutional obstacle to the expansion of production. It does not realize that the discount of future goods as against present goods is a necessary and eternal category of human action and cannot be abolished by bank manipulation. In the eyes of cranks and demagogues, interest is a product of the sinister machinations of rugged exploiters. The age-old disapprobation of interest has been fully revived by modern interventionism. It clings to the dogma that it is one of the foremost duties of good government to lower the rate of interest as far as possible or to abolish it altogether. All present-day governments are fanatically committed to an easy money policy.

So the by-product of the challenge to substitute the law of scarcity with abundance from something for nothing policies has been the unsustainable expansion of debt—part of which is the reason behind bubble cycle dynamics and of today’s rioting bond markets.

More Signs of the Triffin Dilemma

Another important reason for the intensification of the presence of the bond vigilantes has been the Triffin Dilemma[20].

The Paradox is premised on a reserve currency’s conflict of interests between the short term domestic and long term international objectives, such that a nation with the reserve currency enjoys the benefits of consuming more by maintaining deficits (trade and or budget) with foreign trading partners.

On the other hand, the non-reserve partners finance such deficits by recycling (vendor financing) their excess reserves or surpluses with assets of the reserve currency.

With recent improvements in the fiscal and trade deficits of the US, the reduction of deficits extrapolates to lesser availability of US dollars on the global financial system on a relative scale. Thus with reduced supply, the unintended result has been a disorderly response to the unofficial tightening or withdrawal of US dollars in the system.

On the demand side there will also be lesser demand for US treasuries. This has been supported by the massive reduction in foreign buying of UST last June as noted last week. It’s not just on USTs, over the same period, US stocks also suffered outflows, while agency and corporate bonds have been neutral.

This also contravenes the mainstream idea that today’s meltdown has been prompting for a rotation towards US assets[21].

Ironically the Euro and China’s yuan have been firming which may hint that part of the capital migration has been to shift to Euro assets and the inflation of China’s bubbles.

And shown in the above chart[22], the FED will be forced to reduce purchasing even if there will not be an official “tapering” due to decreased US treasury issuance.

Again the unforeseen consequences from the markets may have to force the hands of central bank officials.

And when there is a shortage of US dollars, the predilection of non-reserve trading partners will be to use reserves to finance such void.

As proof of this, central banks of the developing ex-China world have lost $81 billion of international reserves equivalent to 2 per cent of all developing country central bank reserves since early May through July.

Reports the Financial Times[23]:

However, some countries have suffered more precipitous drops. Indonesia has lost 13.6 per cent of its central bank reserves from the end of April until the end of July, Turkey spent 12.7 per cent and Ukraine burnt through almost 10 per cent. India, another country that has seen its currency pummelled in recent months, has shed almost 5.5 per cent of its reserves.

The Gross International Reserves of the Philippines (GIR) appears to be peaking. And if the bond vigilante impelled run on Philippine assets continues, as noted before[24], we may see the same depletion dynamics of the domestic gross international reserves.

The bottom line is that whether the FED tapers or not, bond vigilantes running amok are indications of the widening wedge between policy goals of central banks and market pricing.

Such perceived divergences, or may I say the growing loss of confidence over central actions, accentuate the uncertainties clouding the marketplace. And market uncertainties fertilizes on the reflexive feedback mechanism for more volatility.

Yet if the US markets fall deeper from the current levels or deep enough (say 10-20%) to impact the housing markets and the economy, then expect the FED to expand its QE.

But this will not guarantee a return to a risk ON environment. Yet if yields continue to surge then expect that the same pressures plaguing Asia today to have reached US shores.

Meltdown has been a Regional Dynamic Not Limited to Emerging Markets

Another fashionable media myth has been to portray the current selloffs as entirely an emerging market dynamic brought about by current account deficits.

While it is true the countries with current account deficits have suffered the most damage so far, what has hardly been seen is the growing contagion or the escalatory effects from the revolt of the global bond vigilantes.

Unlike Indonesia, whose deficits have been swiftly widening, the Philippines and Malaysia still maintains current account surpluses. Thailand has a small current account deficit. Yet all four has been under sustained selling pressures.

Meanwhile the first world developed ASEAN neighbor Singapore holds not only a huge current account surplus but likewise massive amounts of international currency reserve (2.13x the Philippines).

If we are to believe the mainstream’s logic, then this makes Singapore’s “strong macro economic” fundamental, which is far far far superior than the Philippines, as supposedly least vulnerable to recent market turbulence.

Lo and behold, Singapore’s financial markets has, like her ASEAN peers, similarly been smacked hard.

Singapore’s equity benchmark, the STI, seem as testing the June lows (above pane). Yields of 10 year Singapore bonds have likewise been soaring (middle pane).

Meanwhile the USD-Singapore dollar has been falling from late 2012 but the losses have been accelerating since May (lower pane).

If Singapore’s markets are being squeezed, then why should her emerging market, less wealthy peers, not be squeezed harder?

For the bond vigilantes to affect Singapore is not something to be ignored and dismissed as nonevent. To do so would mean to court disaster for one’s portfolio.

Should the bond vigilantes persist to haunt Singapore, then this would signify as a warning sign for a possible black swan event to occur in Asia.

And the unpleasant impact from the uprising of the bond vigilantes has also been affecting the yields of 10 year bond markets[25] of the wealthier East Asian neighbors. So far, the impairments has been limited relatively to the just the bond markets. It remains to be seen if these markets will be able to withstand more bond market strains.

The bottom line is that the negative effect from the raging bond market riots have been spreading not only on emerging markets but to wealthier neighbors as well.

Additionally the story of current account deficits as triggers to the current financial market meltdown seems deeply misplaced.

Bond Markets are Interconnected, Philippine Yields will Rise

Another myth broached by local Pollyannaish experts has been that the Philippines supposedly will be shielded by rising bond yields abroad.

The G-7 group[26] basically controls 71% share of the USD 99.5 trillion of the international bond markets as of 2012[27]. Government debt at US 43.7 trillion accounts for 43.9% of the total bond markets.

Excluding Canada, this makes 4 central banks, the US Federal Reserve, the European Central Bank, the Bank of England and the Bank of Japan as dominant policymakers influencing the global the bond and debt security markets.

This also means that actions in bond markets of these economies will affect activities of the rest of the bond and debt markets.

Surging yields of the USTs have not been isolated.

Yields of 10 year bonds of the United Kingdom, Germany and France are nearly at 1-2 year highs. Japan JGBs has been declining from a recent spike. But it is unlikely that this decline will be sustained given both internal weaknesses and external developments.

Yields of Canada’s 10 year bond note also shares the same level of ascent. Only Italy’s bond yields have been significantly off this year’s high. But like Japan, I suspect this wouldn’t last long.

As shown earlier, yields of most of ASEAN, East Asia and South Asia led by India have been climbing at relative different pace and intensity.

The Philippines has been providential enough for bond levels to be little changed. But mounting pressure on the peso and stocks are signs that local bond yields are unsustainable and will rise if the bond market turmoil extends.

Bond yields affect interest rates. As previously explained interest rates affect consumption, saving, and investing patterns, this also means the economy, corporate earnings and political finance will change to reflect on the new realities.

Trade patterns, prices and yields of various securities will also change.

Given that the Philippines has significant external exposure via different channels particularly

-remittances which has been about 10-12% of statistical GDP,

-merchandise trade constituting 46.9% of GDP (2012)[28],

-Gross International Reserves are at $82.9 billion as of July[29] where 84% have been allocated to foreign securities and foreign exchange as of December 2012[30],

-US treasury holdings largely held by the Philippine government at $37.1 as of June 2013[31] and

-external debt based on different currencies mostly the US dollar and Japanese yen (as of December),

This means that changes in global bond yields will also influence all these dynamics. That’s unless the Philippines operates in a vacuum or an imaginary world where prices have been stuck in a stasis.

The bottom line is that changes in global bond markets, especially by the bond markets covering the big 4, will also influence domestic bond markets as well as interest rates.

This Time is Different: Asian Crisis 2.0 is Remote

The biggest myth I have encountered is in the suggestion that the risks of an Asian crisis today is remote for the following reasons: floating exchange rates, foreign reserves, transparency, current account balances, foreign debt, and banking reform[32].

While it is true that Asia is different today than in 1997, the spin to sanitize the risks of a crisis have all been flimsy.

-On floating exchange rate:

Having a floating exchange rate hardly serves a guarantee for a crisis free environment.

While there have supposedly been more accounts of crises under a pegged rate regime, floating rates have not been immune to a crisis. The above chart is based on an IMF study[33] which shows of the share of pegged and floating regimes in the episodes of crises.

Looking at exchange rate is hardly the factor determining the risks of a crisis. Even chief proponent of floating exchange rate, Milton Friedman understood this[34]. (bold mine)

Let me emphasise that there's nothing special about exchange rates. If Australia tries to peg the price of wool - let's say wool is a major product of Australia - and if it sets the price too high, it'll have the same effects as if the exchange rate is set at too high a rate. If it sets it too high, then there will be a surplus of people trying to sell wool and a shortage of people trying to buy wool. If it sets it too low, it'll be the other way around. And the government can maintain the price only if it is willing to accumulate stocks of wool in the one case or to provide wool from inventories in the other. Everything I've just said about wool applies just as well to the Thai baht.

In short, in free markets economic forces determines exchange rate values. Distortions, thus, are a function of government interventions.

-On foreign reserves.

Foreign currency reserves have signified as ramifications of the Triffin dilemma principle operating behind the US dollar standard as noted above. The conditions of foreign reserves should be seen in the context parallel to the conditions of the accrued public and private sector debt. Yet having enormous foreign reserves serves no guarantee against a crisis as in Japan’s case in 1990[35].

Moreover given the highly fragile system where every region has been unduly exposed to huge debt, international bailouts similar to the 1990s will hardly be the same dynamic in case another global crisis erupts.

Developed economies can hardly even wean away from their dependence on central banks.

-On current accounts

Current account deficits have been used as the popular bogeyman for sudden stop triggered crises. But in the case of currency crises, not all have been due to sudden stops: a sudden desistance or slowdown of capital flows to a country as shown above.

A currency crisis may be triggered by bank runs or vice versa[36], or by sovereign debt default either by foreigners (sudden stops) or by residents or by both.

-On the shift to local debt from foreign debt

The idea that shifting from foreign debt to local debt hardly represents a “get out of jail free card” against a crisis.

Let me quote Harvard Professors Carmen Reinhart and Kenneth Rogoff[37]: (bold mine)

This brings us to our central theme—the “this time is different syndrome.” There is a view today that both countries and creditors have learned from their mistakes. Thanks to better-informed macroeconomic policies and more discriminating lending practices, it is argued, the world is not likely to again see a major wave of defaults. Indeed, an often-cited reason these days why “this time it’s different” for the emerging markets is that governments there are relying more on domestic debt financing.

The dynamic duo documented 70 cases of domestic public debt default from 1800-2007 citing that[38]

domestic debt crises typically occur against much worse economic conditions than the average external default. Domestic debt crises do not usually involve external creditors, which may help explain why so many episodes go unnoticed

And what strings up the factors that led to all the debt crises (currency crises, banking crises, sovereign debt defaults and serial defaults) which apparently have been missed out by mainstream commentators?

Again Professors Reinhart and Rogoff[39]

Ahead of banking crises, private debts (external debt, broader private capital inflows, domestic bank debt) also display a repeated cycle of boom and bust—the run-up in debts accelerates as the crisis nears.

The consensus almost always downplays, overlooks or dismisses the role played by debt.

-Finally on transparency and bank reform

Similar to bank stress tests which many have used to determine the supposed strength of the banking system but frustratingly fail in the face of a crisis, the efficacy of so-called transparency and bank reform will only be revealed only after the storm has passed or ex-post.

We will never know how many skeletons were kept in the proverbial closet or as a Chinese war strategy denotes “beat the grass to startle the snake[40]”

Recommendation: Play Defensive

Even some of the mainstream reporting appears to be partially getting it.

This from Reuters[41]:

Having failed to dismantle politically and socially knotty obstacles to growth, Asia has instead relied on low interest rates and massive borrowing to keep its economies expanding, particularly since the 2008/09 global financial crisis that prompted the Fed to start aggressively buying bonds.

The accumulated policies to put in effect the “euthanasia of the rentier” in Asia appear to be facing its unintended comeuppance.

As interest rates rise while economic growth slows, rising real funding cost[42] will increase a litany of risks covering currency risks, interest rate risks, credit risks, counterparty risks, default risks and market risks.

The deepening fragility of Asian financial markets and the economies have been exposed by the two episodes of financial markets meltdown in a span of three months. The fact that the meltdown has contaminated Singapore is by itself a source of alarm.

With major ASEAN equity markets now trading below or near the June lows, every additional incidence of market shocks will lower the public’s confidence levels, leaving the Asian-ASEAN markets increasingly susceptible to even larger downside moves or panics.

Violent swings in both directions by yields alone may be enough to unsettle the bond markets.

Instability will also be represented by the scale and intensity of yield increases of the bond markets. Thus, everything else (recession, crisis or quasi-recovery) will depend on the conditions of the bond markets.

For as long as the global bond market remain unstable, financial markets are likely to remain under selling pressure.

The bond markets are on the way to cleanse the system of its excesses and to correct the grotesque distortions on other financial markets and economies brought to fore by its politicization.

In short, the risk environment has been deteriorating.

Here is a little piece of advice:

-Build cash by reducing some position or lightening up on the market.

-Reduce credit exposure (on anything business or personal) especially on financing covered by floating rates.

-Use higher discounting rates (200-300 basis points at least) in computing for net present values for future projects or investments. Remember to keep a margin of safety especially under the current environment.

-Share this piece of advice with your friends.

-Smile. There will be wonderful opportunities ahead.

[1] See Phisix: Don’t Ignore the Bond Vigilantes August 19, 2013

[2] See Phisix: Don’t Ignore the Bear Market Warnings June 30, 2013

[3] BBC.co.uk Thailand's economy enters recession August 19, 2013

[4] See Thailand’s Credit Bubble January 26, 2013

[5] World Bank Short-term debt (% of total external debt)

[6] Bank of Thailand, Thailand’s Short Term External Debt Assessment May 2012

[7] Tradingeconomics.com THAILAND EXTERNAL DEBT

[8] Real Time Economics Blog Current-Account Figures Key for Malaysia Investors Wall Street Journal August 21, 2013

[9] See Phisix 7,200: Up, up and away! The Illusions of Comfort, May 6, 2013

[10] See Philippine Politics: The Pork Barrel is Dead. Long Live the Pork Barrel August 24, 2013

[11] Inquirer.net Local stock prices, peso fall August 22, 2013

[12] Gulfnews.com Central banker says Philippines to weather US Fed plan August 23, 2013

[13] See Phisix: How Sustainable is the Bernanke Put? July 15, 2013

[14] See Phisix: The Myth of the Consumer ‘Dream’ Economy July 22, 2013

[15] Bloomberg.com FOMC Minutes Show Broad Support for Tapering Timeline August 22, 2013

[16] See Hyperinflation: Venezuela’s Intensifying Stock Market Melt up Amidst a Currency Meltdown June 19, 2013

[17] Federal Reserve of Chicago Monetary Policy at the Zero Lower Bound

[18] John Maynard Keynes Chapter 24. Concluding Notes on the Social Philosophy towards which the General Theory might Lead The General Theory of Employment, Interest and Money Marxists.org

[19] Ludwig von Mises, 8. The Monetary or Circulation Credit Theory of the Trade Cycle XX. INTEREST, CREDIT EXPANSION, AND THE TRADE CYCLE Human Action Mises.org

[20] Wikipedia.org Triffin dilemma

[21] See Asia Slump: Has Capital Been Flowing Back to the US? August 21, 2013

[22] Businessinsider.com The US Treasury Market Has Another Massive Cliff To Worry About In 2013, October 23, 2012

[23] Financial Times Emerging markets central banks’ emergency reserves drop by $81bn August 23, 2013

[24] See How Rising US Treasury Yields May Impact the Phisix July 8, 2013

[25] Tradingeconomics.com GOVERNMENT BOND 10Y - COUNTRIES - LIST

[27] Morgan Stanley Investment Focus The Evolution of the Global Bond Market April 2012

[28] World Bank Merchandise trade (% of GDP)

[29] Bangko Sentral ng Pilipinas End-July 2013 GIR Increases to US$82.9 Billion August 7, 2013

[30] Bangko Sentral ng Pilipinas Annual Report 2012

[31] US Treasury MAJOR FOREIGN HOLDERS OF TREASURY SECURITIES

[32] Real Time Economics, Asia 1997 vs. Asia 2013 August 22, 2013

[33] Andrea Bubula and Inci Otker-Robe Are Pegged and Intermediate Exchange Rate Regimes More Crisis Prone? November 2003

[34] Milton Friedman Professor Milton Friedman Interviewed by Radio Australia 17 July 1998 ABC.net.au

[35] See Phisix: Will Domestic Fundamentals Outweigh External Factors? August 12, 2013

[36] Reuven Glick of Federal Reserve Bank of San Francisco and Michael Hutchison of University of California, Santa Cruz Currency Crises FEDERAL RESERVE BANK OF SAN FRANCISCO September 2011

[37] Carmen M. Reinhart and Kenneth S. Rogoff This Time is Different: A Panoramic View of Eight Centuries of Financial Crises p.53 April 16, 2008

[38] Carmen M. Reinhart and Kenneth S. Rogoff From Financial Crash to Debt Crisis p.1680

[39] Ibid 1687

[40] Wengu.tartarie.com Beat The Grass To Startle The Snake Thirty Six Strategies

[41] Reuters.com As investors mull QE finale, Asia's miracle shows signs of wear August 20, 2013

[42] Zero Hedge Why Asian Markets Are Collapsing In 3 Simple Charts, August 22, 2013