It would be a mistake to assume that the modern organization of exchange is bound to continue to exist. It carries within itself the germ of its own destruction; the development of the fiduciary medium must necessarily lead to its breakdown. Once common principles for their circulation-credit policy are agreed to by the different credit-issuing banks, or once the multiplicity of credit-issuing banks is replaced by a single world bank, there will no longer be any limit to the issue of fiduciary media.-Ludwig von Mises

The US Federal Reserve’s Quantitative Easing programs will be terminated at the end of this month and some have suggested that this program will be discontinued for good.

I’ll say they’re dead wrong.

Same Old Song

I have heard this music before. In late 2009 going into 2010, as the markets recovered the mainstream blabbered about “exit strategies”.

I called this Bernanke’s poker bluff[1].

Bottom line: Interest Rate Derivatives, Expanding GSE Operations, Economic Ideology Record Debt Issuance, Rollover and Interest Payments, Devaluation as an unofficial policy, Political Influences On Policy Making and the Question Of Having To Conduct Successful Policy Withdrawals all poses as huge factors or incentives that would drive any material changes in the Federal Reserve and or the US government policies.

In knowing the above, I wouldn’t dare call on their bluffs.

In November or 10 months later, Bernanke’s Fed unraveled the QE 2.0[2].

Have any of the above variables changed for the better?

The short answer is NO.

All of the above factors seem in play and some may have turned for the worst.

One, while growth of derivatives (see right window) have slowed they remain sizeable. Importantly growth in interest rate contracts has reached pre-crisis highs.

Reports the Economist[3],

Interest-rate contracts, which make up the bulk of the market, reached $465 trillion in December 2010, exceeding their pre-financial-crisis level. While notional amounts are one measure of market size, the BIS says that gross market values, which measure the cost of replacing all existing contracts, more accurately assess the amounts that are actually at risk. The gross market values fell by 13% in the six months to December 2010, to $24.5 trillion.

So even if growth in gross market values of derivatives has been slightly reduced, an environment of higher interest rates will still risk unsettling the derivatives markets for its sheer size and complexity. That’s the reason why investment guru Mark Mobius currently warned that derivatives may trigger the next financial crisis[4]. For me, derivatives as shown by the sensitivity to interest rates movements represent a symptom rather than the cause.

Second, the average maturity holdings of US treasuries has declined to all time lows, which according to Zero Hedge’s Tyler Durden, just hit 62 months[5] (see left window)

This only means that aside from financing the current fiscal record[6] deficits, the shorter maturities adds to the financial burdens of rolling over of some of these old debts. In short, the US treasury will deal with new debts as well as old ones.

Yet considering that the foreign official sector represents as the only parties (aside from the Fed) that have significant control on the supply holdings of US treasuries to materially influence prices, their recent actions does not indicate continued support to finance of US spending programs.

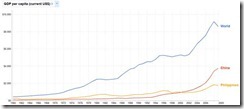

Foreign buying of US treasuries have been on a decline based on yearly change basis and as % of overall ownership (chart from yardeni.com[7]).

Faced with the risk of bond auction failure, the US government will likely try to avert this or get some insurance by having another round of QE.

Proof of this, as I presented last week, exhibits that nearly 100%[8] of US treasury issuance has been presently financed by the US Federal Reserve.

Morgan Stanley’s David Greenlaw estimates FED buying has accounted for 88% during the first quarter of 2011[9]. He also mentions that QE 1 reduced interest rates by 50 basis points on longer maturity securities, according to a Fed study which has on their calculation.

There seems to be a deepening relationship of dependency taking hold. And this certainly is not an auspicious sign.

The private sector as I earlier mentioned have accounted for as a marginal buyer. In addition, new regulations have financially repressed these institutions which compels them to finance (or acquire) government debts to comply with capital adequacy ratios that would meet with the Basel standards[10].

The record debt levels should also mean higher interest rate payments which should place additional burden on the economy.

Thus, the existence of the central bank has been to manipulate rates to benefit the government, aside from the banking sector, which intermediates such financing in behalf of the government.

More Rationalization and Signaling channel

Of course, I have also pointed out that the US housing appears to have regressed to a recession[11]

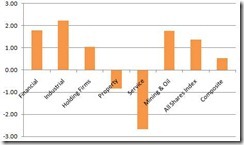

And all these are being vented on the equity prices of banking and financial sector.

As the US property sector staggers, such dynamic impairs or adds pressures to the values of the banking system’s balance sheets. The S&P Bank Index (BIX), the Dow Jones Mortgage Finance Index (DJUSMF), S&P 500 Financials (SPF) and the (XLF) Financial Select Sector have all been rolling over.

To say that NO quantitative easing would be in the pipeline would either mean an apostasy in economic ideology or the recognition of the mistakes from the past policies.

This also means disregarding the trillions thrown to support the banking sector during the last crisis (Neil Barofsky, special inspector general for the Treasury’s Troubled Asset Relief Program says $23.7 trillion[12] or CNN says $11 trillion committed and $3 trillion invested[13])

The fact that the Fed has been obstinately denying the causal linkages between QE and the commodity price increases coupled with patent serial interventions in the commodity marketplace by private regulators (most likely from indirect political pressures applied) via continuous increases in credit margins further suggests that part of the pre-deployment of QE 3.0 has been to condition or rationalize to the public of its necessity[14].

That’s hardly signs of conversion.

Furthermore, political authorities have been addicted to inflationism, which I have argued as signifying economic ideology and path dependency. This seems not only confined to the Fed but likewise to every major governments around the world.

Proof of this is the second round of bailouts being worked out for Greece[15].

And perhaps in anticipation of this cyclical slowdown, China has been in the process of threshing out a new massive bailout scheme[16] for local governments and their banking system, as well as, partially implementing new stimulus measures aimed at boosting the economy with large scale low cost housing projects[17]. Combined, these two grand projects could even surpass in scale, the 2008-9 $586 billion stimulus[18].

Adding to such bailout fad has been Russia and IMF’s rescue of Belarus[19] which appears to be on the brink of hyperinflation[20].

To top it all, the current signs of weakness in the US[21] or in China[22] or in the Eurozone[23] appear to be changing market’s sentiment everywhere.

Like addicts to illegal substance, even a local (Philippine) broadsheet carried a foreign report which appears to be subtly arguing for the rational of QE 3.0[24].

Meanwhile even the commodity marketplace, which has been under duress from the recent spate of interventions, doesn’t seem to be suggesting of the end of QE.

Gold continues to swiftly recover lost ground, while silver appears to be consolidating. The Reuters CRB (CCI[25] is an equal weighted index representing 17 commodities) seems to chime with gold but to a lesser degree. Importantly, natural gas which has been the perpetual laggard among the commodity spectrum seems likewise in an ascendant mode.

Gold Says QE 3.0

Rallying gold prices are not emblematic of desistance of QE, but rather a continuity of currency debasement activities conducted by global governments especially by the country which holds the principal privilege of seignorage—the US dollar.

We are not in a gold standard. While gold has shown incredible improvement in its reception as part of the financial system, where gold has recently been reckoned as collateral eligible[26], it is not money yet. Not yet anyway. We don’t use gold in payment and in settlement transactions.

Having said so, a disinflationary environment from a cessation of QE will lead to its price decline. Since markets operate as information discounting mechanism, then gold prices should not be rallying.

This will even be more pronounced if debt deflation does occur. Gold is unlikely a debt deflation hedge[27] as demand for cash would vastly increase under such conditions. Such dynamic was clearly evident in 2008[28] until the US Federal Reserve began its QE operations.

I’d further add that surging natural gas prices would imply as the deepening of inflation cycle. As I wrote in November 2010[29]

I’d be convinced of the deepening risks of the inflation cycle, when Natural Gas chimes in. So far, this hasn’t been so.

Well, the bull market in natural gas prices could have just begun.

It’s important to point out that many people, as the great Ludwig von Mises said[30],

think that there are higher and more important aims of economic policy than a sound monetary system. They hold that although inflation may be a great evil, yet it is not the greatest evil, and that the state might under certain circumstances find itself in a position where it would do well to oppose greater evils with the lesser evil of inflation. When the defense of the fatherland against enemies, or the rescue of the hungry from starvation is at stake, then, it is said, let the currency go to ruin whatever the cost.

This has also been manifested by the mainstream doctrine, which mistakenly believes that currency devaluation signify as an important tool to solve the economic problems. QEs has, thereby, worked as part of this measure to devalue the US dollar for purported economic ends.

Thus, the current lust for inflation signifies as a severe misunderstanding of the economic phenomenon which the mainstream mistakenly sees politics as a facile means to attain an economic end, from which usually backfires.

One should not also forget that in the US, policymakers are biased towards rising stock markets which for them serves as the trickle down multiplier from the “wealth effect” that works to boost spending and likewise triggers the “animal spirits” of the marketplace.

Thus the US stock markets constitute part of the coverage of the Fed’s policies[31]. To end the QE would extrapolate to the end of the support on the confidence transmission mechanism and to severe what they see as an important wealth effect multiplier.

Bottom line: NONE of the premises I wrote about in 2010, where I accurately predicted QE 2.0, has improved or has been resolved. In some instances they have worsened.

Thus for many reasons, especially applied to the US—the risk of bond auction failure, risk of imploding derivatives from higher interest rates, debt rollover risks and higher interest payments on sovereign liabilities, the implied policy of devaluation, risks of deterioration of the balance sheets of the major banking institutions, dogged refusal to instill fiscal discipline, ideological leanings and the path dependency of central bankers, risks of a downturn in the stock markets, rallying gold prices—all of which are strongly suggestive that there will be QE 3.0, 4.0, 5.0 until the nth.

It would take another monumental catastrophic crisis or a major transformation of people’s belief to embrace sound money and eschew the principle of inflationism for such policies to end.

And this won’t be happening anytime soon.

Lastly never trust government’s words, they always seem mellifluous but are usually laced.

[1] See Poker Bluff: The Exit Strategy Theme For 2010, January 11, 2010

[2] CNN Money QE2: Fed pulls the trigger, November 3, 2010

[3] Economist.com Global OTC derivatives, May 31, 2011

[4] See Will Derivatives Cause the Next Financial Crisis? May 31, 2011

[5] Durden, Tyler Fed Balance Sheet And Monetary Base Update - New Records All Around, Zero Hedge, June 2, 2011

[6] Financial Times, Record US budget deficit projected, January 26, 2011

[7] Yardeni.com, US Government Finance

[8] See How External Forces Influence Activities of the Phisix, May 29, 2011

[9] Greenlaw David Who Will Be the Marginal Buyer of Treasuries Post-QE2?, Morgan Stanley June 2, 2011

[10] See Financial Repression Drives The Bond Markets, May 23, 2011

[11] See How could the Euro be so strong? June 1, 2011

[12] See $23.7 Trillion Worth Of Bailouts?, July 29, 2010

[13] CNNMoney.com CNNMoney.com's bailout tracker

[14] See War on Commodities: Intervention Phase Worsens and Spreads With More Credit Margin Hikes!, May 14, 2011

[15] See Serial Bailouts For Greece (and for PIIGS), June 4, 2011

[16] See China Prepares For Massive Bailout!, June 1, 2011

[17] See China’s Bubble Cycle Deepens with More Grand Inflation Based Projects, June 2, 2011

[18] Wikipedia.org Chinese economic stimulus program

[19] Bloomberg.com Belarus to Receive $3 Billion Russian-Led Loan, Kudrin Says (1), June 4, 2011

[20] See A Crack-up Boom in Belarus, May 26, 2011

[21] Businessinsider.com United States: Brace For The Slowdown, June 1, 2011

[22] Wall Street Journal, China Shares End At 4-Month Low; Slowdown Concerns Dominate, June 2, 2011

[23] Reuters.com GLOBAL ECONOMY-Asia's factories feel the chill as U.S., Europe cool, June 1, 2011

[24] Businessworldonline.com US Federal Reserve mulling third QE?, June 2, 2011

[25] Wikipedia.org Continuous Commodity Index (CCI)

[26] See Two Ways to Interpret Gold’s Acceptance as Collateral to the Global Financial Community, May 27, 2011

[27] See Gold Unlikely A Deflation Hedge, June 28, 2010

[28] See Gold Fundamentals Remain Positive, January 31, 2011

[29] See Oil Markets: Inflation is Dead, Long Live Inflation, November 4, 2010

[30] Mises, Ludwig von Monetary Policy Defined, Part 2 Chapter 13 The Theory of Money and Credit, Mises.org

[31] See The US Stock Markets As Target of US Federal Reserve Policies, May 12, 2011

![clip_image002[1] clip_image002[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhvdqAElBZns0qCTZizg46guGUElAdxX1DKsFpdGppwtSwbU0MYshYolzqkJcy7ThWHD25CXfyVD05Wt1yqO4Yi99xIZUuAluGZlhgo3x6vJ8s_bP4EX1I7FwLLd98JN_p_VFK7/?imgmax=800)

![clip_image004[1] clip_image004[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg0K1WXGSGwJxypbmZ57Y3OBs1ZGUdnwdc_lWtay1UTu-GHwaHSLjqovvRl9F4jfFjSc0gL3C4rr1Momx2_r7kDNqbO2EjG7zwXp0ScQwmnMYauCCTuYfKhj0sdxvk7HNusSrxk/?imgmax=800)