As pointed out in my earlier blog, global central banks are on path to an interest rate easing cycle anew. Asian-ASEAN central bankers will also be joining the bandwagon.

From Bloomberg,

Asian central banks from Thailand to the Philippines may be preparing to cut interest rates in coming weeks as an escalating impact from Europe’s debt crisis prompts economists to scale back growth forecasts for the region.

Thailand will cut its benchmark one-day bond repurchase rate tomorrow, all 16 economists surveyed by Bloomberg News predict. Pakistan’s central bank may add to its previous rate cuts or refrain from raising borrowing costs, a separate survey showed. Two analysts expect the Philippines to cut its key rate on Dec. 1, the first predictions for an easing since August 2009 based on Bloomberg surveys.

Morgan Stanley lowered its Asian economic estimates this week as the region that led the rebound from the 2009 global recession sees export demand impaired by Europe’s sovereign-debt turmoil. Asia’s currencies and stocks have fallen in the past month as investors shun emerging-market assets and the faltering growth outlook prompts companies including Philippine Long Distance Telephone Co. to cut profit forecasts….

The last time Asia went into an interest rate easing spree was during the immediate post Lehman crisis in the last quarter of 2008 until 1st quarter 2011

And to reminisce on what had happened to ASEAN equity markets…. (chart from the World Bank)

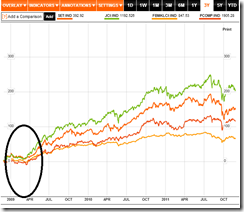

…that cycle stoked the seeds of the boom phase in ASEAN equity markets (chart from Bloomberg).

The Philippine Phisix (red), Malaysia’s KLSE (yellow), Indonesia’s JCI (green) and Thailand’s SET (orange) have all been substantially up (only Malaysia has been up by less than 100%, Indonesia has more than doubled)

While I think that this may spark a similar boom…

…one must be reminded that this cycle will be different. ASEAN’s inflation rate has been substantially elevated compared to 2008 (chart from World Bank). This means that the easing cycle via the interest rate channel will be limited. And that any further easing may fuel the risks of accelerated inflation.

And because of the constrained latitude of interest rate maneuvering, governments will be resorting to other forms of stimulus such as fiscal spending.

From the same Bloomberg article,

Bangko Sentral ng Pilipinas may consider easing its policy rate, Economic Planning Secretary Cayetano Paderanga said after the report. Twelve of the 14 economists surveyed expect the central bank to keep the benchmark at 4.5 percent, with two predicting a cut to 4.25 percent.

President Benigno Aquino unveiled a 72 billion-peso ($1.6 billion) fiscal stimulus package in October, joining neighbors including Malaysia and Indonesia in seeking to protect growth. Bank Indonesia unexpectedly cut rates by half a percentage point to a record low this month to 6 percent.

Fiscal stimulus essentially represents a tradeoff between future growth and current growth, as government spending borrows from future to finance the present.

The goal is to boost Keynesian constructed (spending based) statistics rather than to generate long term jobs as determined by the market.

Think of the irony, if economic growth is generated by government spending why not make spending infinite. Yet spending will have to be financed by taxes (also borrowing) or inflation which leads to either default or hyperinflation and political upheavals.

In reality, government spending will be directed to non-market or political (mostly vote generating, e.g. infrastructure) activities which will signify as 72 billion peso worth of wastage and a 72 billion peso window for corruption.

Thus, the "protection of growth" should be seen in the light of protecting the growth of politicians, allies and cronies rather than the public, as taxpayer money will be diverted into non productive engagements. Also this implies higher taxes ahead which again will increase the burden for investments and competitiveness and more unemployed workers.

So even as the current administration prosecutes the former administration for alleged misconduct, the fiscal spending program signifies a huge room for the same set of malfeasant actions.

Thus, politics is about grabbing credit (to get ratings approval or generate votes) by stepping on someone else’s toes, but at the same time providing opportunities for the same set of inappropriate actions.

And the best way to do this is to divert public’s attention so as to camouflage their actions in the name of "protecting economic growth" and of "anti corruption" measures through public arraignment or trial-by-publicity of political adversaries. In this context, personality based politics in the shadow of welfare-pork barrel politics as explained by Professor Robert Higgs seems fitting.

Nonetheless all those credit creation and spending will have to flow somewhere.

Once the interest rate reductions and the stimulus are activated, the fuse to the next leg of the bubble cycle would have been lit.

Profit from folly.