It is important, first, to distinguish between business cycles and ordinary business fluctuations. We live necessarily in a society of continual and unending change, change that can never be precisely charted in advance. People try to forecast and anticipate changes as best they can, but such forecasting can never be reduced to an exact science. Entrepreneurs are in the business of forecasting changes on the market, both for conditions of demand and of supply. The more successful ones make profits pari passus with their accuracy of judgment, while the unsuccessful forecasters fall by the wayside. As a result, the successful entrepreneurs on the free market will be the ones most adept at anticipating future business conditions. Yet, the forecasting can never be perfect, and entrepreneurs will continue to differ in the success of their judgments. If this were not so, no profits or losses would ever be made in business. Murray N. Rothbard

The mainstream view where the turbocharged performance by the Philippine Phisix is largely seen as representative of mainly a domestic affair and accounting for signs of economic “progress” is misguided.

The reality is what we observe as significant advances by the local stock market have instead signified as a global development.

Importantly, these magnificent gains account for as symptoms or illustrative of market’s reactions to easing policies adapted by global central bankers, whom has been promoting a negative real rate environment and has been engaged in massive interventions in the bond markets to provide political support to crisis afflicted governments and the banking system.

The Intensifying Rising Tide Phenomenon

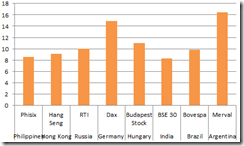

The Phisix ranked an impressive second (based on nominal currency year to date returns) among the world’s top performers[1], last week. Not this time though. Bourses from developed economies to the BRICs to emerging markets and the frontier markets have advanced almost at a frenetic pace.

About 43% of the 72 global benchmarks I monitor posted year-to-date gains of 4% and above. That’s an incredible feat considering we are only 3 weeks into 2012.

Of course, these gains have distinct or individual stories to tell. While most of them seem to be in a recovery mode following last year’s pummelling, only a few bourses has broken into record highs or are within the ambit of previous record highs. The Philippines and slow starting Indonesia seem to fall into the latter two categories.

On the other hand, only about 20% of global equities have posted negative returns where many of them emanate from the MENA Middle East North African region.

While Argentina remains as the market leader on a year-to-date basis, the Philippine Phisix which posted an amazing 2.91% weekly gains this week, has been eclipsed by several major bourses.

Based on year-to-date nominal currency returns, aside from Argentina, the Phisix now trails Germany, Hungary, Brazil, Russia and Hong Kong. India’s BSE 30 is currently neck to neck with the Phisix.

And seen from the region’s performance, over the past 6 months the Philippine Phisix has dramatically displaced Indonesia and Thailand as the region’s trailblazer.

Chart from Bloomberg

It’s important to point out what you see depends on where you stand. Applied to the above, the 6 month perspective changes when we adjust for different time referenced starting points.

On a one year basis (not in chart) the Phisix has slightly surpassed Indonesia, while on a three month basis (not in chart) the Phisix still marginally trails Thailand.

The point is perspectives can be used to advance an observer’s subjective bias rather than to make an objective presentation.

Nevertheless in all three periods, the Phisix has either led the pack or has been slightly behind the leader. As to whether the Phisix can maintain such exemplary performance has yet to be ascertained. And as we have noted in the recent past, the leadership role among the ASEAN-4 bourses has been alternating.

And to give us a clue on what’s been driving the Phisix, we go to the year to date performance of each sector.

The property sector seems to have commanded the lead from last year’s run away leader, the mining sector which now ranks third. The service sector lead by the telecoms has taken the second spot while financials placed fourth.

Except for the service sector, the current rankings seem to fulfill my observations that capital intensive projects (mining, manufacturing, real estate related projects) are likely to benefit from artificially suppressed interest rates, whom will be financed mostly by loans via the banking sector (who will also account for as a beneficiary).

As I previously wrote[2],

Although I am not sure which sector should give the best returns over the short term, I am predisposed towards what Austrian economics calls as the higher order stages of production or the capital goods industries, which are likely the beneficiaries of the business cycle, specifically, mining, property-construction and energy, as well as financials whom are likely to serve as funding intermediaries for these projects.

Of course telecom companies are capital intensive projects too and became subject of an earlier boom bust cycles abroad—the dotcom bubble.

Yet the above dynamics looks like the interlocking and tessellating jigsaw puzzles all falling into their respective places, all of which seem to account for the business cycle.

And for a broader view of which issues from the Phisix basket has contributed much to the recent advances, the top ten largest free float market cap issues ranked according to their respective weights, based on year-to-date as of Friday’s close, can be seen in the above chart (largest to smallest market cap from left to right).

Combined, these issues account for about 61% weighting of the Phisix composite.

So far, the property majors have assumed the leadership role. Ayala Land (ALI) and SM Prime Holdings (SMPH), posted the best gains followed by holding firm Ayala Corporation (AC) and telecom titan PLDT (TEL). These firms have delivered the gist of the gains of the Phisix.

And it is further important to point out that the uptrend in net weekly foreign buying appears to support the case where foreign investors may have likely been loading up or has been providing a boost on these issues.

And as pointed out last week, it would be a mistake to ascribe current market actions as driven solely by corporate fundamentals or by micro factors when, in reality, general market sentiment has been revealing of a rising tide lifting all boats phenomenon.

Advance decline spread (weekly basis; upper window) has materially surged reflecting on broad bullishness of the marketplace. This has largely been due to the breakout of weekly advancing issues (lower window) from the consolidation phase. Given the limited number of issues listed, the ceiling or the maximum upside may have already been attained which means that we should expect rangebound actions but based on the current elevated levels.

What has essentially been happening on a global scene appears to parallel the developments being reflected on the internal market actions in the Philippine Stock Exchange (PSE).

Austrian Business Cycle In Progress

And as I have been reiterating, global central banks have slashing rates in near concert. The Philippines, this week, has joined the bandwagon of promoting policies which represents the euthanasia of the savers via a negative real rate environment[3].

Such policies are designed to stimulate aggregate demand, which have been couched and camouflaged in academic terms, when in reality, have been meant to advance the interests of the banking sector (as intermediaries of savers and borrowers) and the political class.

With nominal interest rates below consumer price inflation (CPI) levels, the public will be incented to shift money from fixed income instruments towards undertaking speculative activities and for entrepreneurs to invest on long range capital intensive projects.

Part of the effects of such policies, would be a boom in the stock market, which has already validated my thesis where negative rates will drive a stock market boom[4] as well as a boom in capital intensive projects such as in the real estate. I have been pointing out that we should expect a boom in the Philippine real estate industry[5].

And most of the funding of the latter’s project will likely be channelled through the banking sector (ergo expanding the latter’s profits).

As an aside, Philippine property sector has been showing signs of a vigorous recovery both in terms of annual price changes in Philippine housing and in luxury 3 bedroom units[6]

Also, at near record low rates, governments will be motivated to increase fiscal spending via more interventionists projects peddled or justified as “infrastructure” or “social” investments, which will be financed through the acquisition of more debts, and which subsequently will be sold and financed by the public through higher taxes or inflation.

Also, suppressed interest rates will impel consumers to spend more using credit cards and other credit programs or mechanism that leads to more consumptive activities.

Combined with higher government spending, and greater appetite for consumers to spend, not only does such activities lead to an overall growth in systemic leverage, thereby increasing fragility and risks, but likewise reduces the incentives for the local economy to produce more and tilts the balance of incentives towards greater consumption activities. Eventually this should unwieldy trade deficits.

Of course, adding to the systemic leverage will include entrepreneurs whom have been lured to invest in capital intensive projects.

Nonetheless, the initial burst of spending and speculation will be seen as a boom (as we are seeing today)

However, the competition for the use and consumption of resources (by government, consumers and entrepreneurs), as well as the misalignment between demand of consumers and investments in the production of capital goods will eventually get exposed through the interest rate channel.

As Professor Steve Horwitz explains[7]

The theory argues that the boom is generated by some exogenous factor that has caused market interest rates to diverge from the natural rate that accurately reflects the time preferences of consumers and producers. That exogenous factor is normally thought to be an excess supply of money, which is normally thought to be the product of bad central bank policy or problematic government regulations on the banking system. Once that bad interest rate signal is in place, intertemporal discoordination will result. The nature of money and the time-ladenness of production mean that we don't see that discoordination at first, as it is masked by the boom. The increased activity at both the higher orders of goods and the consumption level looks like growth until the fact that there is insufficient real savings to support the increased (now "mal") investment at the highest orders makes itself known.

Once interest rates level render many of these capital intensive projects unfeasible, the boom segues into a bust.

Yet countenanced with the prospects of depression, governments and their central banks has greater proclivity to resort to the same measures that has led to such problems—perhaps out of ideology, the interest to preserve the status quo, shared creed or dogma, groupthink, political pressures to apply policies that has immediate impact and path dependent actions—which ultimately becomes unsustainable.

As the great Nobel Prize winner Friedrich von Hayek wrote[8],

And since, if inflation has already lasted for some time, a great many activities will have become dependent on its continuance at a progressive rate, we will have a situation in which, in spite of rising prices, many firms will be making losses, and there may be substantial unemployment. Depression with rising prices is a typical consequence of a mere braking of the increase in the rate of inflation once the economy has become geared to a certain rate of inflation.

We don’t have to look far to identify where the global inflation cycle is being conducted. Since 2008, the balance sheets of major central banks of the world continues to balloon[9]! Inflation is being progressively compounded by through balance sheet inflation in order to keep asset prices afloat and to assure liquidity flows of the global banking sector.

And stepping on the brake by central bankers would extrapolate to a reversal of boom conditions in a disorderly manner.

Widespread Empirical Evidences

Over the past few years we have seen the same cycles being played out even outside the crisis afflicted developed economies, whether in Bangladesh[10], Brazil[11], India[12], Vietnam[13] or China[14].

Every time governments adapt easy money policies, we see booms in the stock market and or in real estate projects. And each time governments tightens the grip on monetary conditions in response to resurgence of consumer price inflation, we see the same weakness or discoodination pressures being reflected on the prices of their respective stock markets.

The great Ludwig von Mises reminds us that imbalances arising from policy intrusions can be reflected on the actions of the stock market[15]

The moderated interest rate is intended to stimulate production and not to cause a stock market boom. However, stock prices increase first of all. At the outset, commodity prices are not caught up in the boom. There are stock exchange booms and stock exchange profits. Yet, the “producer” is dissatisfied. He envies the “speculator” his “easy profit.” Those in power are not willing to accept this situation. They believe that production is being deprived of money which is flowing into the stock market. Besides, it is precisely in the stock market boom that the serious threat of a crisis lies hidden.

Yet it would seem bizarre for the public to bet on the stock market of a slackening economy, but that’s how these things play out, especially when the economy is seen to hit the proverbial wall.

A good example is China, where her stock markets have surged this year when economic figures has been revealing signs of marked deterioration.

Why the surge?

Because market participants have been conditioned or trained to react to signals where policymakers will likely resort to massive measures to reflate of the system, if and when the pace of deterioration reaches alarming levels that risks inciting political upheavals.

And indeed not only do we see a spike in the 3 month rate of change of China’s money supply late last year[16], but there has also been increasing reports, or say speculative expectations of planned stimulus in both financial[17] and fiscal dimensions[18].

While my concerns over a possible bubble implosion in China persist, which prompts me to remain vigilant, I would submit that a massive stimulus program, like her Western counterparts, could buy her time or defer on the day of reckoning.

Moreover rampaging money supply has been permeating into the US economy giving the impression of a ‘broad based recovery’

For instance analyst Ed Yardeni says that the recovery could be broad based[19].

This time, key sectors of the economy haven’t participated in the initial economic rebound, but finally may be on the verge of doing so. The second recovery could take off as the pace of hiring quickens, housing activity finally picks up, auto sales head higher, and state and local governments stop retrenching. If so, then the US would finally enjoy the benefits of a broader-based recovery.

Such appearance of a inflation induced time lag ‘recovery’ has been signalled by the US stocks markets.

Conclusion: Phisix Upside Momentum Should Continue Amidst Interim Corrections

In the face of economic slowdown and the risks of a contagion from the continuing crisis in Europe, global central bankers seems to have tactically implemented a defensive cordon or firewall by massively easing credit conditions partly in coordination with one another. This has led to near record low global interest rates[20] compounded by a surge in liquidity from the various asset purchasing programs being undertaken.

These measures, along with the hiatus in the Euro crisis and the noteworthy inflation induced economic recovery in the US—backed by a surge in money supply growth and recovering credit conditions—have been powering the recent gains of the global stock markets.

The Philippines has undertaken a similar policy route. And considering the still relatively low consumer price inflation, which has yet to trigger political outcry, negative real rates, which have been one of the key factors responsible for the recent monumental and historic breakout of the Phisix, will continue to influence the bullish momentum of the local bellwether, perhaps going into first semester.

But since no trend goes in a straight line, we should expect interim corrections which should serve as windows of opportunities to accumulate.

At the Philippine Stock Exchange, it is important to reiterate that the mining index has been outperforming other sectors in the PSE on a one year alternating interval basis[21]. And since 2011 was yet another stellar year for the sizzling hot sector, and if the alternating trend persists, then there could be another rotation process at work, partly away from the mines and into the broader market as the liquidity driven boom percolates.

But it is not necessary for the mining sector to register losses for a rotation to occur. What we are likely to see is that the variances in the distribution of returns will not likely be as distant as last year.

Since history may not repeat and may not serve as a useful guide in making predictions, and where the public’s recognition of the mining sector seemed to have reached a critical mass only at the current bullmarket cycle which began in 2009, I can’t discount the possibility that the alternating pattern might be rendered irrelevant. So diversifying could probably be the best solution under such scenarios.

Yet if there should be a rotation where gains will be spread out to the other sectors, I think that the best way to diversify would be to use the clues from the Austrian business cycle where capital intensive sectors (most likely property or real estate) and the finance industry could be the major beneficiaries of an inflationary boom (aside from the mines).

Finally, it is worth repeating that there has hardly been any sign of decoupling. As one would observe, local policies have been strongly influenced by policymaking trends in the developed world. We may call this globalization of central banking actions where central bankers not only seem to act in the same manner, but also coordinate or synchronize their activities and extend assistance to one another via swap facilities. And the transmission effect of the other factors of globalization—finance and capital flows, trade, labor and culture—remain as the other major force in shaping market conditions.

And as 2011 has shown, what has made the Phisix and ASEAN markets outperform has been the non-recessionary environment in the US, in spite of the Euro crisis, as well as, the relatively low debt levels compared with her western peers. This relationship is expected to continue through 2012 unless the world deglobalizes or adapts protectionist measures.

[1] See Global Equity Markets: Philippine Phisix Grabs Second Spot January 14, 2012

[2] See Phisix-ASEAN Equities: Awaiting for the Confirmation of the Bullmarket November 13, 2011

[3] See Philippine Government Applies Keynesian Remedies, Boom Bust Cycle Ahead, January 20, 2012

[4] See Investing in the PSE: Will Negative Real Rates Generate Positive Real Returns? November 20, 2011

[5] See The Upcoming Boom In The Philippine Property Sector, September 12, 2010

[6] Global Property Guide Philippine property prices rising again!, December 5, 2011

[7] Horwitz Steve Austrian Cycle Theory is Not a Morality Play, March 3, 2011 CoordinationProblem.org

[8] Hayek Friedrich A. von Can We Still Avoid Inflation? The Austrian Theory of the Trade Cycle, p. 89 Mises.org

[9] Danske Bank A deal for Greece is near, Weekly Focus January 20, 2012

[10] See Bangladesh Stock Market Crash: Evidence of Inflation Driven Markets, January 11, 2011

[11] Moneycontrol.com Brazil cuts interest rates for 4th time to restore growth, January 19, 2012

[12] Wall Street Journal India Adviser: Monetary Tightening Can End as Inflation Is Cooling, December 20, 2011

[13] See Vietnam Stock Market Plunges on Monetary Tightening, May 24, 2011

[14] See Has China’s Bubble Popped? May 29, 2011

[15] Mises, Ludwig von 3. DRIVE FOR TIGHTER CONTROLS, CONTROL OF THE MONEY MARKET p.145 The Causes of the Economic Crisis

[16] Holmes Frank Investor Alert - It May Take a Dragon to Breathe Fire into Markets, January 20, 2012 US Global Investors

[17] Bloomberg.com Chinese Officials Said to Weigh Easing Constraints on Banks, January 19, 2012

[18] China Real Time Report China Eyes Stimulus Targeted at Boosting Consumption, January 20, 2012 Wall Street Journal Blog

[19] Yardeni Ed A Double Recovery? January 17, 2012 Blog.yardeni.com

[20] See Global Central Banks Ease the Most Since 2009 November 28, 2011

[21] See Graphic of the PSE’s Sectoral Performance: Mining Sector and the Rotational Process, July 10, 2011