BSP Official on Property Bubbles: Move Along Nothing to See Here

Pressed to comment by the media on the ‘formation’ of a property bubble based on the recent rise of Non-performing loans (NPL) of the thrift banking industry, a BSP official brushed aside such statistical data as a “blip” and readily dismissed concerns over bubbles as non-problematic[1].

NPLs increased to 5.34% as of the end of 2012 compared to 4.97% period in June of last year.

The same BSP official cited that “real demand” and not speculation has been the main force driving the property sector and that current boom has not compromised the banking system’s underwriting standards for “the sake of growth”.

Here is the latest year-on-year bank lending growth for the each month during the first semester of 2013.

The BSP says that 80% of the banking system’s loan portfolio has been extended to production activities, where for the month June, overall banking lending growth slightly receded to 12.2% from 13.5% in May (revised data).

Meanwhile loan growth to the domestic consumers eased slightly to 12.1% from 12.2% over the same period[2].

Since we understand that only 21.5 of every 100 households[3] have access to the banking system, growth in consumer loans can be seen as less of a systemic threat.

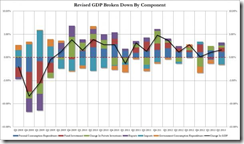

In addition, in contrast to the popular wisdom which sees the Philippines as being driven by consumer or household spending, the reality is that current exemplary performance by the statistical economy has mainly been powered by supply side and government spending bubble dynamics[4].

Yet if household demand have been growing at the range of 4-6%, while the rate of growth of supply side expenditures (particularly real estate and real estate related sectors) have been more than double the household rate, then to suggest that the current boom represents final demand or where there has hardly been any yield chasing going on, signifies as a bizarre or contradictory claim which practically ignores reality or substitutes reality with statistical data mining.

Yet how sustainable is the economic framework where supply side growth continually outpaces the demand side?

The mainstream often confuses statistical analysis as economic reasoning. Statistics without causal theory underpinning them tends to mislead. As the French classical liberal economist[5] Jean Baptiste Say wrote in A Treatise on Political Economy[6],

Hence, there is not an absurd theory, or an extravagant opinion that has not been supported by an appeal to facts; and it is by facts also that public authorities have been so often misled. But a knowledge of facts, without a knowledge of their mutual relations, without being able to show why the one is a cause, and the other a consequence, is really no better than the crude information of an office-clerk, of whom the most intelligent seldom becomes acquainted with more than one particular series, which only enables him to examine a question in a single point of view.

Of course, we understand that officials need to “toe the line” or be a part of the political PR campaign to promote the administration’s agenda.

Despite the declining year on year rate of bank lending growth by the supply side (production activities) and the steady growth of demand side (household), the current pace credit growth expansion remains largely above the previous years.

Nevertheless the declining trend looks portentous.

For June, real estate renting and business services grew by 22.35% which has significantly been down from the peak at 28.53% in January.

The construction industry continues to sizzle with 48.7% growth in June albeit at the low side of the year’s growth. The massive rebound in the construction industry has been a belated effect since construction growth during the past few years has been negligible. For the year, construction growth has been at the 48-56% levels.

Meanwhile, offsetting the decline in the real estate loans has been the sterling growth of the wholesale and retail trade (which have been part of the shopping mall bubble) has been reaccelerating from a low of 10.02% in April to June’s 15.74% (or a 50% jump).

Also lending to Hotel and restaurant (casino bubble) remains brisk at a 19.55% y-o-y which is slightly off the mean growth of 20.385% for the year.

Despite the apparent slowdown, bank lending in support of supply side ‘interest rate-sensitive’ bubble blowing industries continues to overwhelm demand side growth. If such trend will be sustained then the outcome will be anything but pleasant.

Is the Financial Intermediation Sector the Canary in the Coal Mine?

A good example has been the ballooning shopping mall bubble in China. The race to expand shopping malls has led to a massive oversupply, where many developers and landlords resort not only to foregoing rents to attract tenants, but likewise to paying popular mass market based retail firms to have a presence in their malls[7].

In China’s second tier cities, mall vacancy rates are expected to surge to over 30% by next year! If these malls have been mainly financed by debt or leverage, then rising vacancies will extrapolate to mass insolvencies that will pressure China’s formal and informal (shadow) banking system which similarly will have a contractionary spillover effect on the economy.

China’s impending shopping mall bubble bust should serve as a crucial lesson to the Philippines[8].

And interestingly, one critical industry that has significantly contributed to the marginally declining trend of overall loan growth to production activities in the Philippines has been financial intermediation sector.

Coincidental to the bear market strike on the Phisix last May-June, the rate of growth on loans to the financial intermediation sector dramatically shrunk to a still positive but a measly 1.45% in June. In January, this sector grew by a stunning 39.25% y-o-y. In the onset of the financial market stress last May, the rate of growth has slumped by more than half the highs of January to 12.99%.

If a significant segment of the previous loan growth from this sector has been channeled to the domestic financial assets, such as the stock and bond markets, and if pressures on financial markets persist and or if domestic interest rates should rise in response to the ongoing bond market turmoil, then a call on these loans and or margin calls will likely be the response by the lending institutions or creditors.

The implication is that these will compound on the existing strains on the financial markets via the feedback loop between asset prices and collateral values.

Debtors will be required to add collateral or creditors will require liquidation of soured loans. If the liquidations route dominates, then this would put additional downside pressure on financial asset prices. Lower asset prices would extrapolate to diminishing value of collateral which should prompt lending institutions to demand more collateral or for more liquidations.

In addition, what has been seen as a ‘blip’ and uncompromised underwriting standards will eventually extrapolate to a series of tightening of credit standards as asset quality deteriorates and as NPLs rise.

Such debt deflation dynamics ultimately will depend on the scale of exposure of financial intermediation loans on the domestic financial markets, which is something unspecified in BSP data. What is publicly known is that financial intermediation loans account for 9.4% of the overall loans to production activities in June.

While this may seem small, it would be foolhardy to ignore the potential contagion effects on the highly leveraged real estate and allied industries which falling asset markets may spur or trigger.

Bubbles Operate as a Process

Bubbles don’t just appear from nowhere. Bubbles represent a process where people’s incentives are shaped by distortive social policies, which leads to a clustering of errors via discoordination or misallocation of resources. The eventual unwinding of such imbalances also undergoes a reversal process.

For instance the survival of shopping malls ultimately depends on mostly retail based tenants, whom are predominantly small and medium scale enterprises (SME).

The domestic shopping mall industry has been growing rapidly via the industry’s misperception or overestimation of the rate of growth of domestic consumers. They have been misled by the price signals brought about by zero bound rates or easy money policies and from the disinformation disseminated by mainstream media.

Popular wisdom holds that easy money represents a perpetual phenomenon. The reemergence of the bond vigilantes has placed the spotlight on viability of mainstream’s premises.

And like China, there has been a blitz of shopping mall expansion, mostly financed by debt, designed to capture profits from what seems as unlimited pockets by the consumer.

The Philippine consumers, if based on inflation adjusted GDP per capita growth, has been expanding by a top of the line 3.16% in 2006-2010[9]. If we estimate per capita growth for 2011-2013 at 7% (economic growth rate) per annum then per capita levels today would only be at about 3.87%. This would hardly be enough to finance all the double digit supply side spending boom. This is unless the informal economy has been far larger than estimated.

Yet if the profitability of the SME retail sector should come under pressure from a combination of factors: cut throat competition, oversupply, higher cost of capital via rising interest rates, and rising cost of business from non-regulation directly influenced factors such as rising input prices via rents, wages or producers goods and etc.., then loans from ensuing operational losses will most likely reflect on the lenders via impaired loans.

So any sustained amplification of the deterioration of NPLs from clients of thrift banks could signify as one of the possible symptoms of the periphery-to-core process of a bursting bubble.

To disregard them by comparing with the past when credit growth has not reached current levels would signify as imprudent anchoring bias or even apples to oranges comparison.

A Peak in Domestic M3?

The BSP also recently noted of a significant boost in domestic liquidity in June, where on a year on year basis growth ramped up by 20.3% to Php 5.7 trillion, which has risen faster than the 16.4% in May.

The surge in M3 has mostly been due to Net Domestic Assets (NDA) which jumped by 30.5% in June from 28.7% in May. Soaring NDAs, according to the BSP, reflected the sustained growth in bank lending to help finance economic activity[10].

Since 2004, M3[11] has been growing by a Compounded Annual Growth Rate (CAGR) of 11.05%. But this hasn’t been reflecting on the current state of affairs. One would note that M3 zoomed only during the end of 2012. Based on 2011, Philippine M3 CAGR soared by 13.815% from 2011, and from January 2012 until June 2013 CAGR catapulted by 14.53%. So we have a 2-3+% increase in money supply from the current administration.

Where has all these 13-14% money growth been flowing? The most probable answer: property, stock and bond market bubbles. Yes, the 13-14% money growth from sharp increases in bank loans been responsible for, or represents as the trade secret of the current administration’s ‘good governance’ ‘rising tiger’ statistical economy.

Unfortunately the recent declining trend on bank loans spearheaded by the financial intermediation sector will reduce the speed of rate of change of M3 overtime. Such decline may have already been signalled by the domestic stock market.

Similarly, should the rate of growth of bank loans continue to shrivel, then this would also be reflected on the rate of growth of the statistical economy.

The populist glorification of the so-called politically driven economic boom will face reality.

Philippine 10 year Bond: The Odd Man Out?

And speaking of asset bubbles, last week’s actions in ASEAN’s bond markets brought upon a huge surprise.

Yields of the Philippines 10 year bonds[12] has fallen nearly to the pre-Taper market seizure levels (upper left window) even as yields of our bigger and far richer ASEAN neighbors climbed. As of the actions of last week, the Philippines has decoupled from the region!

This implies the following:

One the Philippines doesn’t need a Moody’s upgrade or that the bond markets has been front running or pre-empting a Moody’s upgrade.

Two, current yields demonstrates the prevailing low interest rate environment.

Three, Philippine yields is just about 103 basis points away from the US counterpart as of Friday’s close, which if I am not mistaken accounts for as the narrowest spread between 10 year Philippine Peso and 10 US treasury note ever.

However this also means that the vastly narrowing yield spread will likely work as a disincentive for US based investors who will likely look for bigger spreads as margin of safety.

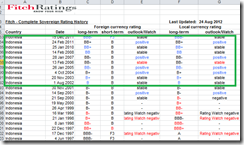

Four, such record low spread or near record low yield means that the Philippines is seen as having lesser interest rate and credit risks relative to her bigger and wealthier neighbor. Said differently, the Philippines despite having a US dollar GDP nominal per capita of only US$ 2,617 (IMF 2012)[13] compared with Indonesia’s US$ 3,910 (IMF 2012), Thailand’s US$5,678 (IMF 2012) and Malaysia’s $10,304 (IMF 2012) has been valued by the markets as having been far more credit worthy or has higher credit standings.

The Philippines at $2,617 per capita seems now at par with Australia US $67,723 (IMF 2012).

Wow this time is different! Or has it?

As of July 25th 5 year senior Credit Default Swaps (CDS)[14] of the Philippine has marginally been higher or exhibits the higher risk profile compared with Malaysia and Thailand (upper right window). It is unclear if the CDS markets have replicated the bond markets over the last few trading days.

But one thing is certain, during the last market seizure emanating from the return of the bond vigilantes in response to Bernanke’s Taper Talk, CDS prices of the four ASEAN majors surged concomitantly (lower window). While CDS prices have fallen from their peaks in June, they have been creeping higher during the last few days ending July 25th. My guess is that they are above the July 25th levels considering the recent actions in the bond-stock and currency markets.

And speaking of currency markets, the Philippine Peso continues to drop along with her regional peers. This reveals of the sharp divergences between actions of the 10 year bond yields and the Peso.

Importantly, stock markets of the three of ASEAN majors appear to be substantially faltering. The decline in the Phisix along with the Peso appears to be departing from the signals emitted by the domestic bond market.

Such huge divergences and the record (US-Phil) spread exhibits of the enormous misperception, misappraisal, maladjusted and deeply mispriced markets.

Given what seem as the odd man out, Philippine 10-year bonds look like a great short opportunity.

The Philippine Government Spending Bubble

Apart from titles to capital goods (stocks and property), another aspect of the risk of bubbles, which the public can’t or refuses to see, has been the government’s spending budget.

The Philippine President has recently submitted to the Congress for approval a proposed Php 2.268 trillion (US $52 billion) budget for 2014 which is reportedly 13.1% higher than this year[15].

While the general public has been debating over who gets what, they hardly realize that the current trend of growth of the Philippine government’s spending is unsustainable and will lead to a debt or currency crisis.

According to the data from National Statistical Coordination Board or NSC[16], over the past 17 years CAGR for revenues has been at 8.07% (green) whereas the CAGR for expenditures has been at 9.1% (red). The Philippine budget has turned into deficit in 1998 and never looked backed.

The CAGR for the budget deficit has been 11.1% over the past 17 years.

If the economy grows at 5-6% while growth trend of deficits remains at the current pace then we will see huge increases in taxes or higher inflation or exploding debt overtime.

The budget gap was almost closed or the elusive balancing of the budget was nearly a reality in 2007-2008. But a crisis exploded, whose epicenter was in the US, which rippled through the globe, and nearly caused a recession in the Philippines.

The effect of the near recession was felt a year later or in 2009, where the deficit swelled as revenues slumped amidst sustained increases in government expenditures.

Interestingly, the pattern where government revenues plummet in the aftermath of every banking crisis[17] affected the Philippines even in the absence of a domestic banking crisis.

Such transmission mechanism has apparently been an offshoot from today’s financial globalization.

Admittedly the incumbent administration has accomplished marginal improvements.

Revenues (CAGR 8.31%) grew more than expenditures (5.305%) in 2010-2012, but such has not been enough to push back deficits to the 1998-2007 levels.

But to consider, we supposedly are in the salad ‘economic boom’ days where budget gaps should narrow. Obviously this hasn’t been the case.

And yet if the current budget will be approved and spent accordingly, then this will signify as a big jump on the expenditure side. Of course, the hope is that these expenditures will transform into future revenues. This seems as wishful thinking. Aside from arguing that public works are unproductive, the public has obviously discounted risks even when the Philippines look vulnerable from both directions or from external (capital flows, remittances, merchandise trade, external debt) and internal (level of domestic debt).

Yes I know, the popular approach has been to use the above as ratio to GDP. But again, I don’t think that the conventional accounting GDP identity represents a useful indicator since I have been pointing out these have been puffed up and manifest on a credit driven asset bubble and unproductive government expenditures which may unravel and easily cause a swift deterioration on what seems solid ratios today.

My understanding of the theory of business ‘boom-bust’ cycles, backed by the history of banking, sovereign and currency crises tells me where and what aspects to monitor. I wouldn’t like to be subjected to a Black Swan event when the latter can be predicted.

Deficits will have to be financed by debt, taxes or inflation.

In terms of debt, the rate of increases in Philippine debt outstanding[18] both from domestic and from foreign lenders over the past 17 years have been at CAGR 9.49% and 9.62% respectively. Total debt has grown 9.59%. The growth rate during the past 17 years, if sustained, enhances sovereign credit risks.

But boom days have cosmetically improved debt levels.

It is true that the current administration has reduced the rate of growth in total debt levels by almost half or 4.84% from 2010-2012, aside from changing the mix of the debt exposure in favor of domestic debt, where domestic debt grew by 8.46% while foreign debt contracted by .523%. Domestic debt now commands nearly 64% share of the total outstanding debt. The shift to tilt the balance of debt outstanding towards domestic debt from foreign debt deftly avoids external debt risks and at the same maximizes the Philippine government’s financial repression policies, through not only the stealth transfer of people’s savings in favor of the government (debtor) but importantly by keeping interest artificially rates low, such reduces the government’s interest expenditures which effectively operates as a covert deficit reduction mechanism.

But these again are boom days which can easily be reversed by a dramatic collapse of revenues and from potential bailout policies—should a crisis emerge from anywhere from the world.

And all it takes is a snap of a finger, from Professors Carmen Reinhart and Kenneth Rogoff[19];

Perhaps more than anything else, failure to recognize the precariousness and fickleness of confidence—especially in cases in which large short term debts need to be rolled over continuously—is the key factor that gives rise to the this-time is different syndrome. Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang!—confidence collapses, lenders, disappear and a crisis hits.

The bang! actually represents a state of unpredictable time, where accumulated imbalances have reached a tipping point that radically overturns the positive perception of the critical mass of creditors against debtors.

[1] Inquirer.net Property ‘bubble’ a remote possibility August 3, 2013

[2] BSP.gov.ph Bank Lending Sustains Growth in June, July 31, 2013

[3] see The Flaws of BSP’s Real Estate Monitoring and Banking Stress Tests May 20, 2013

[4] see Phisix: The Myth of the Consumer ‘Dream’ Economy July 22, 2013

[5] Wikipedia.org Jean-Baptiste Say

[6] Jean Baptiste Say A Treatise on Political Economy, Library of Economics and Liberty

[7] see China’s Shopping Mall Bubble: Free Rents to Attract Tenants, July 2, 2013

[8] see Philippine Economy’s Achilles Heels: Shopping Mall Bubble (Redux), January 13, 2013

[10] BSP Domestic Liquidity Growth Accelerates in June July 31, 2013

[11] Tradingeconomics.com PHILIPPINES MONEY SUPPLY M3

[12] Investing.com Philippines 10-Year Bond Yield

[13] Wikipedia.org List of countries by GDP (nominal) per capita

[14] AsianBondsOnline.org Credit Risk Watch

[15] ABS-CBNNews.com PNoy to submit P2.3T budget for 2014 July 23, 2013

[16] National Statistical Coordination Board, Statistics, Public Finance

[17] Carmen Reinhart and Kenneth Rogoff BANKING CRISES: AN EQUAL OPPORTUNITY MENACE December 2008 NBER Working Papers

[18] National Statistical Coordination Board Lubog na ba tayo sa Utang? May 9, 2012; Bureau of Treasury National Government Outstanding Debt

[19] Carmen Reinhart and Kenneth Rogoff, Preamble: Some Initial Intuitions… This Time is Different Princeton University