A human group transforms itself into a crowd when it suddenly responds to a suggestion rather than to reasoning, to an image rather than an idea, to an affirmation rather than to proof, to the repetition of a phrase rather than to arguments, to prestige rather than to competence.” Jean-François Revel French Journalist and Philosopher

This is one chart which every stock market bulls have either ignored or dismissed as irrelevant.

Yields of 10-year US Treasury Notes skyrocketed by 249 basis points or 9.7% this week to reach a TWO year high of 2.829% as of Friday’s close. This represents 803 basis points above the May 22nd levels at 2.026%, when the perceived “taper” talk by US Federal Reserve chief Ben Bernanke jolted and brought many of global stock markets down on their knees.

While US markets, as embodied by the S&P 500 (SPX), recovered from the early losses to even carve milestone record highs, ASEAN markets (ASEA-FTSE ASEAN 40 ETF) and ASIAN markets ($P1DOW-Dow Jones Asia Pacific) posted unimpressive gains. Such failure to rise along with US stocks has revealed her vulnerability to such transitional phase, see red vertical line.

Considering what I have been calling as the Wile E. Coyete moment or the incompatibility or the unsustainable relationship between rising stock markets and ascendant bond yields (including $100 oil), it seems that signs of such strains has become evident in US stocks.

As I previously wrote[1],

The stock markets operates on a Wile E. Coyote moment. These forces are incompatible and serves as major headwinds to the stock markets. Such relationship eventually will become unglued. Either bond yields and oil prices will have to fall to sustain rising stocks, or stock markets will have to reflect on the new reality brought about by higher interest rates (and oil prices), or that all three will have to adjust accordingly...hopefully in an 'orderly' fashion. Well, the other possibility from 'orderly' is disorderly or instability.

The S&P fell 2.1% this week adding to last week’s loss as yields of 10 year USTs soared (see green circle).

Rising yields affect credit markets anchored on them. This means higher interest rates for many bond or fixed income markets and fixed mortgages[2].

And given a system built on huge debt, viz, $55.3 trillion in total outstanding debt and $179 trillion in credit derivatives, rising interest rates will mean higher cost of debt servicing on $243 trillion of debt related securities[3], thereby putting pressure on profit margins and increasing cost of capital which magnifies credit and counterparty risks. Higher rates also discourage credit based consumption, thereby reducing demand.

In essence, ascendant yields or higher interest rates will expose on the many misallocated capital brought about by the previous easy money policies.

One example is margin debt on stock markets.

The recent record highs reached by the US stock markets have been bolstered by inflationary credit via record levels of net margin debt (New York Stock Exchange).

Should rising yields translate to higher interest rates and where market returns will be insufficient to finance the rising costs of margin credit, then this will lead to calls by brokerage firms on leveraged clients to raise capital or collateral (margin calls[4]) or be faced with forced liquidations.

And intensification of the offloading of securities due to margin calls may become a horrendous reflexive debt liquidation-falling prices feedback loop.

Since 1950s, record margin debt levels tend to peak ahead of the US stock market according to a study by Deutsche Bank as presented by the Zero Hedge[5].

In 2000 and in 2007, the aftermath of record debt levels along with landmark stock market prices has been the dreaded debt-stock market deflation spiral or the stock market bubble bust.

Net margin debt appears to have peaked in April according to the data from New York Stock Exchange[6]. This is about 3 months ahead of the late July highs reached by the S&P 500 echoing the 2007 cycle.

But will this time be different?

Rising Yields Equals Mounting Losses on Global Financial Markets

Rising yields extrapolates to mounting losses on myriad fixed income instruments held by banks, by financial institutions and by governments.

For instance, bond market losses exhibited by rising yields on various US Treasury instruments has led to record outflows in June, which according to Reuters represents the largest since August 2007[7].

The largest UST holder, the Chinese government and her private financial institutions, who supported the UST last May[8], apparently changed their minds. They sold $21.5 billion in June.

Meanwhile the second largest UST holder, the Japanese government and her financial institutions unloaded $20.3 billion signifying a third consecutive month of decline.

Combined selling by China and Japan accounted for 74% of overall net foreign selling.

Total foreign holdings of UST fell by $56.5 billion or by 1% to $5.6 trillion in June where about 71% of the total UST foreign holdings represent official creditors[9]

The Philippines joined the bond market exodus by lowering her UST holding by $1.9 billion to $37.1 billion in July.

However, Japanese investors, mostly from the banking sector, reportedly reversed course and bought $16 billion of US treasuries during the first week of August[10].

Instead of investing locally, as expected from the audacious policy program set by PM Shinzo Abe called Abenomics, the result, so far and as predicted[11], has been the opposite: capital flight. The lower than expected GDP in June also exposes on the continuing reluctance by Japanese investors to invest locally (-.1%)[12].

Politicians and their apologists hardly understand that policy or regime uncertainty and price instability obscures the entrepreneurs’ and of business peoples’ economic calculation process thereby deterring incentives to invest. When uncertainty reigns, especially from increased interventions, people opt to hold cash. And when government debases the currency, people will look to preserve their savings via alternative currencies or assets.

This only shows how the average Japanese investors have been caught between the proverbial devil and the deep blue sea.

It’s not just in UST markets. Losses have spread to cover many bond markets

In the US, bond market losses led to redemptions on bond funds as investors yanked $68 billion in June and $8 billion in July. The Wall Street Journal[13] reports that the June outflow signifies as the first monthly net outflow in two years, according to the Morningstar

Again the actions of the bond vigilantes are being reflected by the reflexive feedback loop between falling prices (higher yields) prompting for liquidations and vice versa.

Rising yields will not only translate to higher cost of capital, which reduces investments, and diminished appetite for speculation, the sustained rate of sharp increases in bond yields accentuate the “the uncertainty factor” in the financial and economic environment. Outsized volatility from today’s mercurial bond markets compounds on the uncertainty factor by spurring a bandwagon effect from the reflexive selling action and in the reluctance by investors to increase exposure on risk assets.

As bond yields continue to rise the losses will spread.

The Impact of Rising UST Yields on Asia

US Treasuries have been also used as key benchmark by many foreign markets. Hence, rapid changes in US bond prices or yields will likewise impact foreign markets.

And as explained last week, substantial improvements in the US twin (fiscal and trade) deficits postulates to the Triffin Paradox. This reserve currency dilemma implies that improved trade and fiscal balance means that there will be lesser US dollars available to the global financial system which has been heavily dependent on the US dollar as bank reserve currency and as medium for trading and settlement.

Such scarcity of the US dollar may undermine trade and the the reserve currency recycling process between the US and her trading partners.

Higher yields and a rise in the US dollar relative to her non-reserve currency major trading partners are likely symptoms from a less liquid or a dollar scarce system

And if rising UST yields have indeed been reflecting on growing scarcity of the quantity of US dollar relative to her non-reserve currency trading partners such as ASEAN, then higher yields would likewise imply pressure on the currencies, and similarly but not contemporaneous, on prices of financial assets.

All four currencies of ASEAN majors are under duress from the bond vigilantes.

The pressure on prices of other financial assets will be a function of accrued internal imbalances that will be amplified by external concerns.

One exception is the Chinese yuan whose currency has yet to be adapted as international currency reserve. The yuan trades at record highs vis-à-vis the US dollar, even as her 10 year yields have been on the rise[14].

In the meantime, fresh reports indicate that despite all the previous regulatory clamps applied by the Chinese government, China’s bubble has been intensifying with new home sales rising in 69 out of 70 cities in July, and with record gains posted by the biggest metropolitan cities[15].

Curiously the report also says that the China’s property markets expect minimal intervention from the Chinese government.

If true then this means that in order for the Chinese economy to register statistical growth, the seemingly desperate Chinese government will further tolerate the inflation of bubbles which has brought public and private debts to already precarious levels.

Rising yields of Chinese 10 year bonds will serve as a natural barrier to the bubble blowing policies by the Chinese government. The sustained rise of interest rates in China may prick China’s simmering property bubble that would lead to a disorderly unwinding that risks a contagion effect on Asia and the world.

Europe’s Bizarre Divergences

Yet, rising UST yields has thus far affected Europe and Asia distinctly.

Bond yields of major European nations[16] as Germany, United Kingdom and France have been on the rise, the former two have resonated with the US counterpart. Yields of German and UK bonds have climbed to a two year high as shown in the upper window [GDBR10:IND Germany red, GUKG10:IND United Kingdom yellow and GFRN10:IND France green].

Paradoxically bonds of the crisis stricken PIGS have shown a stark contrast: declining yields [GGGB10YR:IND Greece green, GBTPGR10:IND Italy red-orange, GSPT10YR:IND Portugal red and GSPG10YR:IND Spain orange.]

I do not subscribe to the idea that such divergence has been a function of the German and French economy having pushed the EU out of a statistical recession last quarter[17]. Instead I think that such deviation has partly been due to the yield chasing by German, UK and French investors on debt of PIGS. But this would seem as a temporary episode.

Such divergences may also be due to furtive manipulation by several European governments given the election season. As this Bloomberg article insinuates[18]:

The bond-market calm that has descended on the euro area in the run-up to next month’s German election masks unresolved conflicts that have frustrated the region’s leaders for more than three years.

Greece needs more debt relief, the International Monetary Fund says; Portugal is struggling to exit its support program; Spanish Prime Minister Mariano Rajoy is battling corruption allegations and calls to resign; France faces unrest as Socialist President Francois Hollande follows through on his promise to cut pension-system losses.

But if the bond vigilantes will continue to trample on the bond markets then eventually such whitewashing will be exposed.

The Fed’s Portfolio Balancing Channel via USTs

In my opening statement I said that every stock market bulls have either ignored or dismissed the activities of the bond vigilantes as irrelevant to stock markets pricing.

It seems that the mainstream hardly realize that USTs have been the object of the Fed’s QE policies. In other words, what the mainstream ignores is actually what monetary officials value.

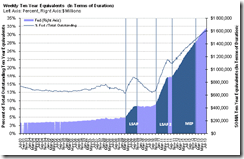

The FED now owns a total of 31.47% of the total outstanding ten year equivalents according to the Zero Hedge[19]. And with the current rate UST accumulation by the FED, or even with a “taper” (marginal reduction in UST buying), eventually what used to be a very liquid asset will become illiquid. This would even heighten the volatility risks of the UST markets.

The FED uses USTs as part of the policy transmission from its “Portfolio Balance Channel” theory which intends to “affect financial conditions by changing the quantity and mix of financial assets held by the public” according to Fed Chairman Bernanke[20]. This will be conducted “so that changes in the net supply of an asset available to investors affect its yield and those of broadly similar asset”

In other words, by influencing yield and duration through the manipulation of the supply side of several asset markets, such policies have been designed to alter or sway the public’s perception of risk and portfolio holdings in accordance to the FED’s views.

Unfortunately the above only shows that markets run in different direction than what has been centrally planned by ivory tower based bureaucrats.

Whether in the US, Europe or Asia, where policymakers have been touting of the perpetuity of accommodative or easy money conditions, markets, as the revealed by bond vigilantes, has been disproving them. Soaring bond yields flies in the face of “do whatever it takes” promises.

Bottom line: Rising UST yields have been affecting global asset markets at a distinct or relative scale.

Rising yields has been a function of a combination of factors such as the growing scarcity of capital or the shrinking pool of real savings at an international level, the unsustainability of inflationary boom, the Triffin Paradox, growing scepticism over central bank and government policies and of the unsustainability of the current growth rate of debt and of the present debt levels (see chart above[21]).

While so far, Asia and other Emerging Markets appear to be the most vulnerable, should bond yields continue to soar, which implies of amplified volatility on the bond markets and eventually interest rate markets, the impact from such lethal one-two punch will spread and intensify.

This makes global risks assets increasingly vulnerable to black swans (low probability-high impact events) accidents.

Caveat emptor.