This chart from an article from the Telegraph reveals the cheapest and the most expensive stocks in the world (based on their own measures):

The Mr Troue said this was useful for markets such as Britain and the US where there is plenty of data available, but for emerging market nations such as China and India, where data is not as widely available, it does not work so well.

2 reasons for 'cheapest'

Some stock markets will be cheap because the countries are in the midst of economic turmoil – this certainly rings true for Greece and Turkey, which both have fragile economies. Highly indebted Greece, in particular, has been trying to get its house in order.

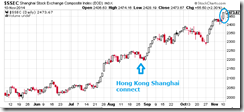

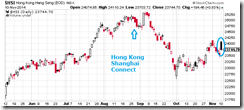

As noted, the reason many are cheap has been because markets have priced heavy debt burdens as an obstacle to fundamentals. China's PBoC and Japan's BoJ for instance hopes to submerge fundamentals with manipulation of the markets via flooding the market with fiat money and by direct interventions.

3 reasons for the 'priciest'

3 reasons for the 'priciest'

The main reason for the lofty valuations is that these stock markets have performed well in recent years. This pulled in other investors and has left these markets substantially overpriced.

I’d have an opposite causal view of the above; “performed well” has been a function of “pulled in other investors” predicated on the mostly fallacious G-R-O-W-T-H story, which has mainly been underpinned by massive debt acquisition.

In short, speculative frenzies financed by cheap money always looks for excuses to justify their actions. Excessive speculations or manias are symptoms of the bandwagon effect—the piggybacking on momentum—which leads to overvaluation.

Simply said when stock market returns exceed growth in fundamentals then price multiple expansions are the logical outcomes. This implies that if growth has really been the story then there won’t be egregious mispricing.

Proof of this can be seen in the pricey ASEAN equity markets: debt accumulation by several major companies has ballooned dramatically for the S&P to recently warn on increasing vulnerability to default. This is what I call as widening adaption of “Ponzi financing”.

So whatever G-R-O-W-T-H seen in corporate (or even macro) fundamentals have mainly been a mirage brought by credit expansion. Take away credit and G-R-O-W-T-H vanishes.

In short, speculative frenzies financed by cheap money always looks for excuses to justify their actions. Excessive speculations or manias are symptoms of the bandwagon effect—the piggybacking on momentum—which leads to overvaluation.

Simply said when stock market returns exceed growth in fundamentals then price multiple expansions are the logical outcomes. This implies that if growth has really been the story then there won’t be egregious mispricing.

Proof of this can be seen in the pricey ASEAN equity markets: debt accumulation by several major companies has ballooned dramatically for the S&P to recently warn on increasing vulnerability to default. This is what I call as widening adaption of “Ponzi financing”.

So whatever G-R-O-W-T-H seen in corporate (or even macro) fundamentals have mainly been a mirage brought by credit expansion. Take away credit and G-R-O-W-T-H vanishes.

The article doesn’t include the Philippine phisix, but if one takes a look at how Indonesia or Thailand has fared along with the Phisix (chart from Bloomberg), the Philippine index has outperformed her peers during the past 5 years. So I’d place the Phisix among the world’s most expensive along with her peers.

Oh by the way, as sign of credit expansion driving fundamentals, Global M&A financed by junk bonds are at record levels.

From the Wall Street Journal (bold mine)

As of last Thursday, junk-rated companies had borrowed $92.5 billion in the high-yield bond markets for acquisitions. That’s up 40% from the year-earlier period and the highest on record for any comparable stretch, according to Dealogic.

US equity boom financed by M&A (but currently has been on a downturn)

M&A-related bond borrowing has accounted for roughly 30% of all new offerings in the U.S. bond market this year, said Marc Warm, head of U.S. high-yield capital markets at Credit Suisse Group AG .He pointed out, however, that such borrowing is down from previous M&A booms. “When we look back at times like 2005, 2006 and 2007, the M&A component of the market was 40% to 50%,” he said. “It was a meaningful difference than where it is today.” M&A activity has begun to slow recently. While global M&A value for the year stood at $2.90 trillion as of Thursday, the highest level since 2007, October’s deal value, at $227.1 billion, was the weakest for October since 2011, according to Dealogic.

Highest level since 2007, doesn't this ring a bell?

Take away credit and G-R-O-W-T-H and its attendant equity BOOM vanishes.

Take away credit and G-R-O-W-T-H and its attendant equity BOOM vanishes.

.png)