You can be mostly a marketing firm, or you can be mostly an investment firm. But you cannot serve both masters at the same time. Whatever you give to the one priority, you must take away from the other. The fund industry is a fiduciary business; I recognize that that’s a two-part term. Yes, you are fiduciaries; and yes, you also are businesses that seek to make and maximize profits. And that’s as it should be. In the long run, however, you cannot survive as a business unless you are a fiduciary emphatically first. In the short term, it pays off to be primarily a marketing firm, not an investment firm. But in the long term, that’s no way to build a great business. Today, tomorrow, and forever, the right question to ask yourselves is not “Will this sell?” but rather “Should we be selling this?” —Jason Zweig

In this issue

Phisix 7,700: Deepening Signs of Exhaustion

-Phisix: Tepid Signs of Profit-Taking Yet

-Philippine Bonds Rally as Growth Rate of Banking Loans and Liquidity Measures Plummets

-Falling Inflation? Philippine Student Protestors Disagree!

-Hissing Bubbles: Malaysia’s 1MDB, China’s PBoC Panics Again, Yellen’s Irrational Exuberance

-Shopping Mall Vacancies: An Analogy of Denial

Phisix 7,700: Deepening Signs of Exhaustion

Following NINE consecutive weeks of gains the domestic benchmark finally succumbed to ‘profit-taking’. The Phisix gave back 1.21% over the week, reducing year to data returns to 6.92%.

Phisix: Tepid Signs of Profit-Taking Yet

Of course this profit taking dynamic didn’t come without sustained efforts to prop up or massage the index. A day prior to the first decline, index managers used about 4-5 issues to pump the index at the last minute to ensure a fresh record close at 7,800+.

Even Friday’s follow-up profit taking session had a two company pump from the Industrial sector (right window). Friday’s “marking the close” may have been intended to reduce the headline losses of the domestic equity benchmark (left window). (charts from Colfinancial)

What makes this week’s profit-taking week interesting has been that of the remarkable shift in the market’s leadership and some divergence from within the Phisix basket.

The holding sector essentially bore the brunt of the selling.

Early sharp gains from the property sector offset the losses from the 2 day selling. The opposite direction of the property and holding sectors enabled the former to seize leadership.

And because six of the biggest market cap firms (SM, AC, JGS, AEV, AGI and GTCAP) have been from the holding sector, thus the seeming concentration of losses within the top 15 issues.

And save for a few big losers, the latter 15 didn’t seem to share the sentiment of the leaders yet. The latter halve has 8 issues posting gains relative to 7 decliners.

And paradoxically, the biggest property issues posted substantial gains over the week, which meant, again, a takeover of market leadership and at the same time has reduced the intensity of profit taking activities as seen on the headline numbers.

So last week’s profit taking mode looks half-hearted.

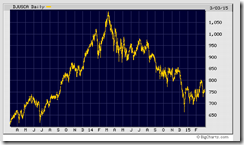

Another interesting development has been that charts of many of the major issues have been exhibiting signs of “exhaustion” from near vertical runs.

In the past, parabolic ramps as revealed by forty five or more degree slopes of the three major issues, namely SM, SMPH and AC had been followed by substantial period of declines.

Property major ALI, on the other hand, appears to be forming a bearish rising wedge pattern. Those wild pumping and pushing seems to have reached their boundaries.

I pointed out last week of the considerable drop in the average peso volume and the average daily trades. Again such points to signs of ‘exhaustion’.

Another market breadth indicator as shown by the advance decline spread has been telling the same story.

Of the 17 trading days prior to Thursday and Friday’s selloff, days where decliners led advancers have dominated by 10 to 6. There was a day which posted a neutral or a zero balance between advancers and decliners.

Now if we include the activities of the last two days, February’s tally would be 12 days where decliners led advances as against 6 in favor of the advancers.

Yet both the charts and market internals tells of the same story, as stated last week, “the bulls have been losing steam”

The overextended push to 7,800 has rendered the Phisix vulnerable to possibly a big correction phase.

It’s a wonder, can the index managers prevent this or defy market forces? Or will they be able to keep the correction stage moderate?

Finally, this week’s tepid profit taking activities hardly changes or dents on the incredibly mispriced securities of the Phisix’s 15 largest companies as revealed by their stratospheric PERs.

What you see in the above are securities priced for perfection with NO margin for errors.

Philippine Bonds Rally as Growth Rate of Banking Loans and Liquidity Measures Plummets

This week’s correction by the Phisix ironically comes with rallies in Philippine bonds and the peso.

Perhaps the bond guys have been reading me so they wanted to prove that everything have been A-OK.

So following last week’s selloff they appear to have embarked on buying activities that has foisted somewhat a reversal of the recent trends.

Yields of short term (3 month and 6 month) bills narrowed steeply while the longer end posted marginal decline in yields. Said different, Philippine bonds rallied with the substance of the rally being at the shorter end.

Nonetheless the result has been to skew the actions of yield curve. While some segment of the yield spread has exhibited signs of modest steepening others remain at status quo.

What makes this even more interesting has been that this week’s rally comes in the light of a sharp downturn in banking system’s loan activities and a further slump in liquidity as measured by the money supply growth rate.

Of the bubble sectors, real estate loans posted slight gains while the manufacturing sector registered a modest increase loan growth, the rest recorded a downturn.

Additionally, monetary liquidity as measured by M3 continues with its freefall. From the BSP[1]: Preliminary data show that domestic liquidity (M3) grew by 7.7 percent year-on-year in January to reach P7.5 trillion. This was slower than the 11.3-percent (revised) expansion recorded in December 2014. On a month-on-month seasonally-adjusted basis, M3 increased by 1.4 percent. Money supply continued to increase due largely to sustained demand for credit. Domestic claims grew by 10.8 percent in January from 17.8 percent (revised) in the previous month as credits to the private sector expanded at a slower pace

Again the revised December data was at 9.6%, thus ballooning the month’s numbers by 17.7%! Like the Banking system loans, the upgrade in December data amplifies the downturn.

It’s just amazing how the BSP makes substantial statistically significant revision.

We’re done with the data, now for the exegesis via the following questions.

Has the effects of the steepened flattening of the yield curve been manifesting itself in domestic credit activities?

What has been the implication of a sustained slowdown by domestic liquidity?

If banking profits have been weighted on loans then what if aggregate loans to the clients of the banking system continues to shrivel? Will profits increase or decrease?

How will a sustained slowdown in monetary liquidity support asset inflation? Will asset inflation be funded from savings or loans from non-banking channel? How will a downshift in asset inflation bolster the non-loan aspects of bank revenues or at least maintain them at current rates?

How about bank clients? Have they accumulated enough cash flow and retained earnings or corporate savings to finance current capital expenditures? Or have they been resorting to nonbanking loans (domestic or foreign bonds, intra corporate loans, private placements, offshore banking and non-banking ‘affiliate’ loans) or equity issuance for financing?

Or have these numbers been suggesting of an ongoing material downshift in investment activities?

How about credit quality? Have current cash flows been sufficient to cover existing levels of debt servicing? Despite the slowdown in loans, current rate of loan growth have still been above 2013 levels. Where has all the freshly issued money—which is supposed to represent new purchasing power to finance ‘aggregate demand’—been flowing? Has new loans been about debt rollovers than capex? If not, what explains the downtrend in liquidity growth? Or why has liquidity been shrinking?

The basic question is how has current G-R-O-W-T-H dynamics been financed? The logic presented here simply has been based on ‘follow the money trail’.

Yet haven’t all these hysteric pumping and pushing of financial assets been about expectations of a single directional trajectory for G-R-O-W-T-H? Yet credit and liquidity activities seem to indicate otherwise. Which has been wrong: the current credit and liquidity dynamics or market expectations?

What about the bond markets? Has last week’s rally been about current credit activities? And or has it been about market expectations that the BSP will cut rates given the backdrop of what the mainstream sees as the growing risk of ‘deflation’ menace here and abroad? Will last week’s actions be sustainable?

Falling Inflation? Philippine Student Protestors Disagree!

Philippine CPI numbers have been falling. This may be true for some food and mostly energy related items. But this has certainly been false in terms of education.

Nonetheless what I oppose against the BSP data has been that education spending accounts for ONLY 3.36% of their inflation basket. 3.36???!!! I may be wrong, but BSP’s methodology seems to give weight on household education spending based on children enrolled in public schools.

And BSP’s data will hardly reflect on reality for the households who send their children to private schools. In my case, direct education spending accounts for over 20% of my budget even if my burden has been partly mitigated due to a very generous sponsor. Although with my eldest daughter graduating (and possibly joining the workforce…I say possibly because she has been considering to take up postgraduate studies) this year, such onus should decline (but may be offset by coming tuition increases). While I may not represent the average, I suspect a wide divergence between reality and statistics.

In short, the street protests exposes on the inaccuracies of government statistics.

Importantly this shows of the relative impact of consumer price inflation to households.

Inflation in consumer prices will all depend on the subjective distribution of spending by individuals or by households. Tuition fee increases negatively affects households, like me, where education accounts for a larger share of the budget. So tuition fee hikes essentially absorb or divert whatever ‘savings’ from diminished pressures on food and energy prices which alternatively means pressure on disposable income. Again with spending transferred to ‘needs’ rather than ‘wants’, such price increases will have pernicious effects on spending on leisure activities or even investments.

And this is where nasty effects of inflation takes hold—in the conflicting dimension of expectations between consumers (demand) and the industry (supply) brought about by relative price distortions from previous monetary policies.

With little or no increase in household income, price increases in the “needs” based goods and services, again, means lesser resources to finance “want” activities, such as shopping, eating out, traveling, sports, or gambling, buying real estate or cars or even investing in stocks or bonds or in real business…

This comes as the bubble industries continue with its frantic race to build capacity in expectations of ‘robust’ household activities. This means that the supply side, whose expectations clashes with real developments at the household level, will be competing intensely over a shrinking peso.

And such competition, which has been prompted by continuing price distortions that has been inflating capacity due to entrepreneurial miscalculations, will lead to losses, excess capacity and eventually credit woes and the grand unveiling of the accumulated imbalances.

Of course another likely negative impact from tuition fee hikes will be more dropouts and diminished enrollments. Yet this will put more pressure on public schools to soak up on this disadvantaged group. Consequently, this means pressures on the taxpayers. With the government edict, the Expanded Government Assistance to Students and Teachers in Private Education, or GASTPE, that forces the subcontracting of public school students to the private school in exchange for a paltry subsidy as I previously discussed, this means more tuition fee hikes overtime and subsequently lesser education for the populace.

So the vicious feedback loop between price pressures—from monetary policies AND political interventions—and its ramifications, the subsequent loss of education (qualitative and quantitative) and political pressure suggests that the current dilemma will only spiral.

Sad to say the imbalances in the education frontier will be also exposed when the bubble busts.

Hissing Bubbles: Malaysia’s 1MDB, China’s PBoC Panics Again, Yellen’s Irrational Exuberance

Another interest development: Asian currencies appear to be diverging. Most Asian currencies rallied strongly this week, this has been led by South Korea’s won 1.27%, the Malaysian ringgit 1.17%, Taiwan dollar .9%, Thai baht .65%, Indian rupee .61% and the Philippine peso .34%.

What makes lots of things so interesting has been that some ASEAN currencies have exhibited turmoil as stock markets soar.

This applies to record Indonesian stocks which apparently like the Phisix, backed off the fresh record highs.

Malaysian stocks , as measured by the FTSE KLSE, which has earlier been under pressure has been up 3.4% year to date. Despite the big rally of the ringgit this week, the rally came in response to last week’s collapse (1.89%). The ringgit currently trades at 2008 levels.

But the above reports was before a fresh exposé that has been out just a few hours back where a well connected tycoon has reportedly masterminded and siphoned out US $700 billion from the company through a joint venture project with Arabian company PetroSaudi.

According to Free Malaysia Today[2] (FMT.com)

The entire joint venture project was conceived, managed and driven through by the Prime Minister’s associate and family friend the party-loving billionaire tycoon, Jho Low,” Sarawak Report said.

Based on a trove of leaked company documents and emails, Sarawak Report said the documents proved that an amount of USD$700 million, supposedly a PetroSaudi loan repayment, “was in fact directed into the Swiss bank account of a company called Good Star, which is controlled by Jho Low”

What makes the coming days interesting will be that of the possible consequences from the coming corruption investigation from the divulged crony deal.

If the financing of the 1MDB will be deferred or ceased entirely, we could possibly see tremors in the credit markets of Malaysia that will be reflected on both the currency and eventually the asset markets. Now the question is, will there be contagion effects through the region?

Additionally, as I pointed out yesterday, China’s property markets seem to have been unraveling faster than the US counterpart that paved way for crisis that culminated with the Lehman bankruptcy in 2008. Although China’s political economy has been distinct from the US, they share one thing, over indebtedness to the extremes.

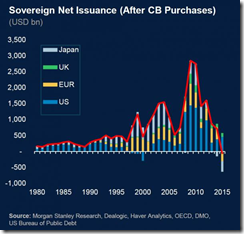

So the US pre-Lehman episode could serve as a potential roadmap for China’s debt problems. And if there will be some resemblance to it, China might fall into a recession by mid 2016. Of course this is just a guess. There are so many complex developments like serial global easing that could either prolong the day of reckoning or even accelerate it.

Last week, the newspaper of China’s central bank warned that the nation has been “dangerously close to slipping into deflation”, the article talks of the “increasing nervousness in policymaking circles as a sputtering economy struggles to pick up speed despite a raft of stimulus steps”[3]

As I have noted two weeks back, the PBoC seems as in a panic mode. The PBoC has been furiously injecting money into the system and announced the easing bank reserve requirements.

Apparently in the dilemma to either protect the yuan or to keep the bubble from imploding, the Chinese government via the People’s Bank of China panicked again to choose the latter

The PBoC cut interest rate again…yesterday.

Let me quote the Wall Street Journal[4]

China’s central bank cut interest rates for the second time in less than four months, in a fresh sign that the country’s leadership is becoming more aggressive in trying to arrest flagging economic growth.

The rate cut by the People’s Bank of China, announced Saturday, came sooner than some analysts and investors had expected and reflects growing worries over the world’s second-largest economy as it struggles with an array of ills: a slumping property market, more money being sent offshore and growing risks of falling prices that, in effect, are pushing up borrowing costs for businesses.

“Deflationary risk and the property market slowdown are two main reasons for the rate cut this time,” said a central bank official in an interview late Saturday.

What previous actions has done has been to spur a debt financed mania in stocks. What the current easing process will do will be to exacerbate the current predicament as debt will continue to balloon from more debt financed debt rollovers and from asset speculation. All these will hit a wall.

China’s central bank is in a panic. The sentiment has been expressed in the unofficial statement. If deflationary risk and the property market slowdown continues to intensify, expect the PBoC to lose credibility that will be vented on the markets.

Remember, according to the Bank for International Settlements[5], China has become by far the largest EME borrower for BIS reporting banks. Outstanding cross-border claims on residents of China totalled $1.1 trillion at end-June 2014

So the PBOC is confronted by two demons: domestic debt and foreign debt. The PBoC has thrown its dice…domestic debt it will be.

And warnings have not been limited to China.

Record stocks in the face of record imbalances at the precipice.

The obverse side of every mania is a crash.

Shopping Mall Vacancies: An Analogy of Denial

Yet shopping malls have become a catechism for many, particularly the participants of the relentless pump and push of asset prices, whereby any criticism has been viewed as impiety thus will be subject to denial or vehemently objected upon without dealing with the basics.

The dilemma has been simple and elementary: what needs to be shown is the balance between the demand and supply side. Said differently, income has to grow faster or at least match the growth rate of credit and supply side.

Let me offer two numbers. Ten and two. If we use the two numbers as relative measurement, you will probably agree with me that ten is larger than two or stated in a reverse lens, two is smaller than ten.

Of course, those numbers have social applications. And such applications will have implications.

Let us apply this to the popular pump and push issues: the shopping mall

Ten… represents the growth rates (at current prices) of the trade industry particularly 9.7% 2013 and 9.1% in 2014. Based on retail trade, 10.8% 2013 and 8.6% 2014. Data from the NSCB.

If you look at the capex plans of major developers and operators expected growth rates have been at least 10% as I pointed out in 2013.

For this discussion, let me grant the oversimplistic popular notion of the “public park model” or traffic equals profits of shopping malls.

Two…represents the growth rate of the Philippine population. Table above from Index Mundi, NSCB data here exhibits the population growth rate.

Because the law of scarcity applies not only to resources but likewise to physical, spatial and time limitations, this means that every second I spend in Mall 1 represents time and effort that will NOT be spent in Mall 2, Mall 3 to Mall nth.

This even applies to stores within the same mall. Every second I spend in store 1 of Mall 1 represents time and effort that will NOT be spent on store 2, store 3 to store nth.

The idea is since people have no supernatural power of omnipresence, there will be opportunity costs. Such opportunity costs will serve as fundamental limits to mall/store traffic.

The above numbers tell us that 2% population growth will mean lesser traffic for the shopping mall industry growing at more than 2%, especially at 5 times the rate of population or 10%.

Or given the above growth rates, the population or traffic density for each mall will grow smaller for every additional mall built.

Here population or traffic density will mean the number of people per mall.

The above table accounts for a mathematical representation of a 5 year population/ traffic density calculated from a population base of 10 million and 10 malls growing at a compounded rate of 10% and 2% respectively (given all things constant—ceteris paribus).

As one would note by year 5, traffic density will fall by 31.45%!

Perhaps domestic malls will have to rely on tourist. But tourists are also subject to opportunity costs. There are many nations competing to have tourists. And tourist can only appear at one place a given time.

International visitor arrivals grew by 11.28% in 2011, 9.07% 2012, 9.56% in 2013 and 3.25% in 2014. If my eyes are telling me correctly, the trend has been in a decline. Besides, tourism has reportedly accounted for only 4.2% of GDP and if to consider indirect contribution 11.3% of the GDP in 2013 according to WTTC. 11.3% is big but 88.7% is bigger. Yet about half of tourism is from domestic tourists.

Don’t forget that every person at the beach or at the mountains will not be at a shopping mall. So shopping malls will need to get shopping mall tourists and not just tourists.

The numbers and the logic above says that tourism will unlikely support traffic density conditions for malls.

The other alternative is to spike the population. However, current trends suggest for a decline in population growth rates to even fertility rates. Again you may use the government’s estimates for this and see the same trends.

Maybe the mall occult should go forth and multiply quickly. And they should do this fast before time runs out and vacancies geometrically expands.

Yet why should the two numbers become irrelevant if we apply them to the bubble industries like the shopping mall? Because people from the industry say so? Because the politicians say so? Because free lunch can last forever and are immune from even basic math?

Bottom line: For as long as the above dynamics as signified by the two numbers remain as the driving force behind the shopping mall economics, the US dead malls and China’s ghost malls will function as an inevitable prototype for the Philippines.

Let me conclude with the allusion that ‘renovations’ has accounted for the current string vacancies as pointed out by a populist crowd in citation of an opinion by an ivory tower expert from one of the bubble industry.

Such quality of response can be analogized by the following:

Here are two senior citizens in a discussion about age.

Senior citizen Pedro: You know, both of us are growing old so…

Senior citizen Juan (interjects and cuts off Pedro): …Me growing old? You must be kidding? You’re wrong. Don’t you see… My hair is still black!

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.bmp)

.bmp)

.png)