All

fixed set patterns are incapable of adaptability or pliability. The truth is

outside of all fixed patterns.—Bruce Lee

In this issue

Phisix 7,100: Surprise! ICTSI Chief Enrique

Razon Warns: Another Financial Crisis is COMING!!!! SM Plays with Fire!

-Surprise! ICTSI Chief Enrique Razon

Warns: Another Financial Crisis is COMING!!!!

-SM Group Plays With Fire: SMPH’s Race to

Build Capacity Financed by Debt

-More Playing with Fire: SMIC’s Declining

Earnings Trend as Capacity Expands

-BSP

and Media’s Up is Down,

High is Low, More is Less

-Phisix 7,100: Sluggish Trading

Actions as US Dollar-Asia/Peso Likely Higher on US Jobs Report

Phisix 7,100: Surprise! ICTSI Chief Enrique

Razon Warns: Another Financial Crisis is COMING!!!! SM Plays with Fire!

Surprise! ICTSI Chief Enrique Razon

Warns: Another Financial Crisis is COMING!!!!

Wow, this is

absolutely stunning!

For me, this explosive

revelation by International Container Terminal Services Chairman and President

Enrique Razon’s signifies a thundering breakthrough!

Mr. Razon reverberates

on my theme in this interview with Nikkei Asian Review[1]…

(bold mine)

Q: You have been critical on how monetary

authorities are addressing economic issues through stimulus programs.

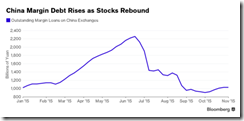

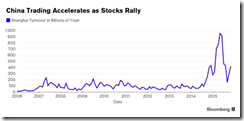

A: I think it's nonsense, and we will pay a big price for this. What

is happening is that asset valuations

are growing. Debt is being taken on in unprecedented scale by everybody in

the last five to six years. The economy is suffering from overcapacity and lack

of demand. So capacity is more than

demand, but people are still

expanding. I think this is a recipe for something not good.

Q: Do you agree with those who say another

crisis is on its way?

A: I think that is for sure. The crisis is getting bigger and bigger because there

is more money. Another Asian crisis is

possible, probably just around the corner with currency devaluation. We

just hope companies are better prepared.

Why breakthrough?

This comment

hasn’t come from an opinion writer or a lowly investor, like me. And they are

not statements from multinational agencies like the Bank

for International Settlements, the IMF or the OECD.

Instead, Mr. Razon, whose wealth emerges out of economic rent

or as per Wikipedia—“benefit received for

non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities”—from

the political

(monopolistic) privilege granted by the government to operate a port company,

represents one of the entrenched

politically connected elites.

Mr. Razon

according to the updated

Forbes November 5 data, has an estimated wealth of $3

billion. He ranks FIFTH in the Philippines wealthiest roster and holds the

291st spot among the world’s wealthiest.

In essence, with

this interview, Mr. Razon seems to have

broken ranks with his colleagues! (more on this below)

And by stating

that “another Asian crisis is possible”, and given that

Asian crisis means a crisis of several nations within region, as exhibited by

the 1997 episode, it shows that he may believe that the Philippines

would be involved. Though he did not make this explicit in the public

discussion with foreign media. (Keeping quiet on local front would be

understandable)

However, notice

that Mr. Razon attempted to deodorize on his premises he propounded on. That

because if another “Asian crisis is possible, probably just

around the corner with currency devaluation”, which has been pillared from “capacity

is more than demand”, that presently is being aggravated by people who “are

still expanding”, then obviously it would be logically incoherent to think and

say that “companies are better prepared”.

Crises exist because people go to the extreme ends

to blindly IGNORE risks while imbibing immeasurable amount of leverage. Or in

general, if people running companies have been prepared, then there won’t be a

crisis at all!

There would not be a massive clustering of entrepreneurial

errors or malinvestments from the brazen misreading of the economic environment.

Since the accumulation of such maladjustments and imbalances are unsustainable,

they lead to an eventual unravelling or a disorderly market clearing process.

And this counterbalancing process would be expressed or ventilated through

recessions, or at worst a crisis.

Debt is a merely a symptom of malinvestments.

And such concentrated scale of misallocation of

resources can only occur through the tampering of money prices through

inflationism (e.g. negative rate policies).

Well, MR. RAZON

should know of what he admonished about. His businesses span the world.

Moreover, this partly

explains ICTSI’s 50% capex cut for 2015. The capex cut

was announced last October that was INTENDED for THIS year.

Yet if he is

serious about his prognostication, then ICTSI and BLOOM’s capital expenditures should be ALL about capital replacement NOW!

CAPEX or capital

expansion should be done at the peak or during the heat of the crisis! Yes, you read me right…EXPAND WHEN

EVERYBODY SELLS or WHEN EVERYBODY ECONOMIZES!

Crises are sources of MAJOR economic opportunities.

It’s where market share can be expanded (as competition ebbs)! And it’s where the

TEN baggers are made!

And crisis

investing was exactly how

the legendary John Templeton built his empire! In the

post-great depression era, Sir Templeton famously leveraged (borrowed money) to

buy 100 shares in 104 companies that had been priced at a USD dollar or LESS!

Mr. Templeton’s bargain hunting included 34 companies in bankruptcy! Sir

Templeton deftly played the law of averages to convert a heap of garbage into a

mountain of gold!

But I am not sure

Mr. Razon’s casino venture has been prepared. Of course, that’s unless if he had

subtlety insured this for himself in means that have not been visible to the

public…yet.

But this could

come at the expense of the other equity holders and creditors, or even domestic

media. Said differently Mr. Razon may be going against the interests of his and

ICTSI/BLOOM’s present business and social network. But that’s unless, again, if

he has commenced to reconcile his recently revamped views with his networks.

This would also

mean going against the political tide of propping up a farcical boom predicated

on “capacity is more than demand” financed by “debt is

being taken on in unprecedented scale by everybody”.

So taking on a

full frontal with the view that a ‘crisis-is-coming’ and ‘another Asian crisis is possible’ could mean

relational or network strains.

And if he has

been preparing for a crisis, considering that he foresees “another Asian crisis is possible”, through “currency devaluation” then

this should mean that much of his personal money (or even

ICTSI’s money) must have shifted or may have likely gravitated, or has been in

the process of transferring, to US dollars or US dollar denominated assets

(T-bills?).

Oddly, last

August, ICTSI

raised USD $450 million. Borrowing US dollar where the

firm’s revenues are mostly in pesos would mean more pesos to service USD

liabilities. And a weak economic environment here and abroad should magnify the

repayment strains.

So getting

exposed with USD liabilities can only be sign of (previous) bullishness or cash

flow predicaments.

Mr. Razon’s change

of heart: Bullish August—then suddenly—bearish October?

If so, ever

wonder why the peso remains weak?

How much more if

the other elites join the bandwagon? (Of course, markets will force them eventually)

Will the USD Peso

break 55?

And where will

the Phisix be headed for under Mr Razon’s scenario? 10,000 or 3,000?

And what will

happen to domestic “capacity is more than demand” and of big companies run by people

who “are still expanding”?

Curiously, Mr.

Razon’s opinion appeared in foreign media and NOT in domestic media.

Will he be

censored here? So far I have seen no extended coverage of this comment.

Will he retract,

or sanitize or downplay or say that he had been misquoted from this radical politically

incorrect perspective? Certain quarters will likely take his dissenting view

with vehemence.

Or will he boldly

pursue “we will pay a big price for this” because “debt is

being taken on in unprecedented scale” which should escalate

on the snowballing sentiment that would hasten the reversal process of this quack

boom?

Mr. Razon’s ICTSI

share prices had been thrashed by an astounding 13.7% this week! Could this

have signified a backlash from his latest ‘politically incorrect’ from his out

of the box views?

Finally, it’s

really fascinating for him to criticize monetary measures in addressing current

conditions where he says as “I think it's nonsense and we

will pay a big price for this”. Basically, he and

his firms had been major beneficiaries from such invisible transfers/subsidies.

In effect, Mr.

Razon seems to have had a surfeit of such subsidies to say enough is enough! He

appears to have recognized of the massive imbalances that arose and accreted from

these which may have begun to affect his interests.

And now he seemed

to have renounced it—a proselytization! Curiously, aside from personal

experience, what other influences could have prompted his tergiversation?

And if my interpretation

is right about his conversion, then kudos to Mr. Razon!

Mr Razon can help

awaken, educate, inspire and lead the public to a crusade to put to an end to such

unscrupulous redistributive practice from central banks. Such policies are the

nucleus of crises. Yes this should include the BSP’s financial repression

policies.

SM Group Plays With Fire: SMPH’s Race to

Build Capacity Financed by Debt

The statement “capacity is more than demand, but people are still expanding” represents

what I call as the race to build supply financed by debt. The outcome from such

carefree activities will not just be excess capacity but tensions in the credit

environment.

There is no

splendid example than to witness SM Group’s SMPH first declare a ‘strong’ 3Q earnings,

then a day after, announce the issuance of Php 15 billion worth of retail bonds to finance “mall expansions and refinance loans of the

company”.

People are

entranced by the surface. They seem to hardly care about what’s under the hood.

For me, there

would be no problem to raise money to “finance mall

expansions”. But it would be a different animal when bonds are raised to “refinance

loans of the company”.

Just what happened to all those supposed “strong earnings”? Just where exactly are those earnings to be

found? Why haven’t the firm been generating enough cash flows enough to cover internal

debt refinancing to prompt them to borrow externally?

Does anyone care?

Of course,

through negative real rates, borrowing from the public means not only the

transfer of resources via claims on SMPH’s future revenues, but likewise the

transfer of various risks from SMPH to creditors predicated on SMPH’s business

undertakings. Or simply said, if SMPH’s ventures fail, savers who lent money to

them take the hit.

Borrowing to

refinance loans are symptoms of neo-Keynesian Hyman

Minsky’s Ponzi finance pathology. For Minsky, insufficient

cash flows generated to pay interest and principal from operations makes a ‘Ponzi’

borrower mainly dependent on sustained appreciation of asset values to

refinance debt. This is aside from debt rollovers to bridge the financing gap.

To be clear, I am

not saying SM Group is into Ponzi Financing, instead I am saying that SM’s current business template appears to be

headed for one. Besides, I am only using the SM Group as representative of

the conventional debt financed ‘capacity is more

than demand’ dynamic. By market cap, SM accounts for

the LARGEST domestic firm at the PSEi, while subsidiary SMPH accounts for the

FIFTH largest (as of Friday). This demonstrates of the scale of resources and

financing involved by the SM Group relative to the formal economy.

I wrote about SMPH’s

booby traps in the 1H, apparently such dynamic has only

been amplified…

The following

excerpts are from SMPH’s 3Q 17Q report published at the PSE[2].

(bold mine)

Rent: SM Prime recorded consolidated revenues from rent of P29.41 billion in 2015, an increase of 11% from P26.44 billion in 2014. The increase in rental revenue was primarily due to the new malls and expansions opened in 2013 and 2014, namely, SM Aura Premier, SM City BF Parañaque, Mega Fashion Hall in SM Megamall, SM City Cauayan, SM Center Angono and SM City Bacolod Expansion, with a total gross floor area of 652,000 square meters. Excluding the new malls and expansions, same-store rental growth is at 7%. Rent from commercial operations also increased due to the opening of SM Cyber West and Five E-Com Center. Also, rentals from hotels and convention centers contributed to the increase due to improvement in average room rates and occupancy rates.Real Estate Sales: SM Prime recorded a 4% increase in real estate sales in 2015 from P15.97 billion to P16.62 billion primarily due to increase in sales take-up and higher construction accomplishments of projects launched in 2010 up to 2013 namely, Jazz, Wind, Green, Breeze, Grace, Shore and Trees Residences accounting for 60% of total revenues from real estate sales. Actual construction of projects usually starts within one year from launch date and revenues are recognized in the books based on percentage of completion.SM Prime’s malls business unit has fifty four shopping malls in the Philippines with 6.8 million square meters of gross floor area and six shopping malls in China with 0.9 million square meters of gross floor area. For the rest of 2015, the malls business unit will open one new mall located in SRP Cebu, as well as expansions of SM City Iloilo and SM City Lipa. SM City Cabanatuan and SM Center Sangandaan were opened in October 2015. By end 2015, the malls business unit will have 55 malls in the Philippines and six in China with an estimated combined gross floor area of 8.3 million square meters. SM Prime currently has twenty seven residential projects in the market, twenty five of which are in Metro Manila and two in Tagaytay. For 2015, SM Prime’s residential unit will launch about 12,000-15,000 units in total in the cities of Taguig, Quezon, Mandaluyong, Las Piñas, Parañaque and Pasay at the Mall of Asia Complex. SM Prime’s Commercial Properties Group has five office buildings with an estimated gross leasable area of 203,000 square meters. Currently, Three E-Com Center is under construction scheduled for opening in 2018.

Let us simplify

by dividing the above disclosure into growth in terms of demand and supply.

Demand side growth: (year to

date) Total rental 11%. Same store rent 7%. Real Estate 4%

Supply side growth:

-Mall (year to

date): 6,148,000+652,000 sqm= 6,800,000 sqm or 10%

-Real Estate:

SMPH’s declared inventory 79,741 units from 2003 (not in the above, but from

SMPH’s presentation). Additional 12K equals 15% or 15k equals 18.8%.

Analysis

Rent: A back of

the envelop calculation tells us that 10%

of new stores delivered ONLY FOUR PERCENT 4% of overall year to date growth!

So whatever happened to the other new

stores or the 6% of inventories? They remain as vacant spaces? So store

occupancy rate must falling even as earnings rise.

Given the huge

surge in property prices as discussed last week, same store rent are most

LIKELY about RENTAL INCREASES more than they are about royalty (overriding)

fees on sales.

And despite the

new store inventories (10% growth), year to date rental growth has fallen marginally

from 11.72% in 2014 to just 11.24% in 2015 (see right).

Again why are growth rates falling when massive

inventories are being added? As Mr. Razon noted, because capacity is (growing) more

than demand?!

The law of diminishing returns as defined by Wikipedia, “the

decrease in the marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, while the

amounts of all other factors of production stay constant”.

Has the law of diminishing returns been plaguing the

main source of revenue of SMPH: shopping mall rentals?

For now it isn’t problem. But later it will be a big

problem, particularly when costs overwhelm sales.

Let us move to real estate.

In an investor presentation, SMPH noted that

since 2003 its real estate segment SMDC produced 79,741 units. So in the past

12 years the firm produced an average of 6,645 units. This means that the

current proposed and launched projects have been more than double the average.

But SMDC’s expansion spree has only been

from 2010 (see left). So it would be better to vet on SMDC’s activities from

2010.

From SMPH’s SMDC data, I estimate that 80%

of unit launched were declared as units sold. That’s could because in 6 years,

there has been only 2 years where unit sold exceeded unit launched. As noted

above, units launched are pre-selling projects, where construction happens a

year after the launch. So sales can take place even when the project is yet to be

constructed.

In 3Q 2015, SMDC posted a sales growth of

just 6.89%. This is substantially lower from last year’s 18.11%. But from a

year to date basis, real estate sales grew by just 4.11% from last year’s

1.11%.

So

real estate sales of SMPH have been slowing (in the 3Q) which somewhat

dovetails the slowdown shown in other real estate companies.

Importantly, condo units inventory (year to

date) shows that based on peso, supply of condo units ballooned by 36.245% even

as sales posted only 4% growth!

So

beneath those rosy numbers seem to be developing mismatches between supply and

demand.

Take note. No matter how one tries to shift

the angles, supply side growth has zoomed disproportionately relative to demand

side growth.

Of course, media regales the public with

reservation sales as they did in 2014 but this has yet to be converted into sales

and importantly cash flows!

You see now why SMPH needs to borrow? The

cost to finance supply expansion has been greater than demand growth (sales)

More proof.

I earlier asked “Just

where exactly are those earnings to be found”?

Well, trade receivables serve as a big part

of that answer

Trade receivables, as defined by SMPH, are

from sale of real estate which “pertains mainly to sale of condominiums and

residential units, at various terms of payment”.

In short, trade receivables are

manifestations of SMPH’s vendor financing

scheme platform. SMPH lends to its real estate customers, say down payment,

which the latter pays in installments or “various terms of payment”.

To be clear, there is no money transfer

from the developer to the buyer, lending comes in the form of staggered

payments or installments on agreed portions of the sale contract (say down payment)

that are internally financed by the company.

So while trade receivables are considered

in accounting as “current assets” or as defined by Investopedia, “the value of

assets that can reasonably expected to be converted into cash within a year”, it

is worth emphasizing that the uncollected or due sales translate to future and

NOT present cash flows. Down payments,

for instance, can extend by more than a year (up to five years).

SMPH’s

earnings are thus tied to the collection of these receivables which means the

company’s profits are mostly ‘accounting profits’. That’s because NO collection means NO realization

of profits.

Yet trade collections are by no means a

guarantee. They could most likely be subject to economic fluctuations.

SMPH’s trade receivables (uncollected

sales) account for nearly a third of

the company’s current assets.

Trade receivables have slightly been down

this year from last year, but this may partly be due to the low rate of sales

growth and partly from the completion of earlier down payments and its

consequent migration to bank financed loans for the balance of the sales

contract, as well as, to full cash payments.

So

given the rate of inventory (condo units) expansion that has been

insufficiently backed by cash collections derived from accounting sales,

naturally a financing gap arises.

Besides, as earlier noted, the rate of supply

side expansion has been growing faster than even top line growth

SMPH’s cash flow statement reveals of its

heavy dependence on bank credit to finance BOTH its sales and the delivery of

its products.

And that

financing gap—particularly from supply side expansion growing faster than top

line sales and from cash collections—signifies what the Php 15 billion retail

bond offering has been about—which officially has been stated as to finance

“mall expansions and refinance loans of the company”.

This

is the essence of SMPH-SMDC’s real estate growth story: an economic model heavily

based on leverage.

The problem with SMPH’s leverage model is that when an

economic downturn takes place, this will likely hit FIRST SMPH’s real estate market

through its potential and existing customers. This will affect not only topline

sales, but then filter and spread into trade receivables (via loan impairments),

cash flow and overall debt, notwithstanding, the excess inventories and those

jobs and supplier-creditor networks attached to them.

In addition, a weak real estate market will compel

companies operating like SMPH to become increasingly dependent on access to

debt in order to finance existing debt—Debt IN Debt OUT—hence the pathway

towards Ponzi financing.

So SMPH-SMDC depends on a trajectory of sales growth

predicated on sustained expansion of credit. Or stated differently, because the

company’s business model relies heavily on credit expansion for its prosperity

and for survival, the company depends on a continued inflationary boom, as

evidenced by the continuing surge in prices of properties, facilitated and

enabled by BSP subsidies.

Moreover, the swelling of trade receivables are

manifestations of the invisible redistribution mechanism of the BSP’s financial

repression policies. Easy money policies have only stoked artificial demand for

properties through credit accommodation, in particular, through vendor

financing. The artificial surge in

demand from mostly a small segment of society has ignited unsustainable

property inflation which has serious economic wide side effects.

Unfortunately, there is no such thing as free lunch

forever.

Thus with little margin for error, SMPH’s current real estate growth model would

be tantamount to playing with fire. And to play with fire, one risks getting

burned.

More Playing with Fire: SMIC’s Declining

Earnings Trend as Capacity Expands

In 2013 SMDC was

merged with SMPH. Here is a guess why the merger took place. SMPH’s shopping

malls has been popularly seen as a cash cow. Perhaps SMDC or the real estate

segment has been seen by the owners as a fragile venture. Through the merger,

the revenues from shopping malls are supposed to hide such fragilities or

subsidize any deficits that would be incurred by SMDC in the event of a

downturn. On the other hand, a boom on the real estate would amplify or

compliment mall revenues. This seemed like a neat strategy. But this strategy

depends on the premise that SMPH’s shopping malls would continue to serve as

cash cows.

Since SMDC

was merged with SMPH in 2013, the real estate

data provided by SMPH has been limited.

Nonetheless 3Q

results from parent SMIC was also announced last week. But the announcement

came without the corresponding 17Q yet. So I will just quote relevant portions

of the disclosure based on media.

First parent SMIC

reported earnings grew by 7% for the first 9 months.

Next the retail

operations: Retail operations under SM Retail, Inc. netted P4.6 billion in the

nine-month period, up 21% year-on-year, on the back of a 6.5% jump in total

sales to P145.3 billion. At end-September 2015, SM Retail had a total of 294

stores, comprising 51 department stores, 41 supermarkets, 43 hypermarkets, 130

Savemore stores and 29 WalterMart stores…[3]

From another

report…The group’s food retail group, SM Markets, expanded in both urban and

rural communities in various parts of Luzon, Visayas and Mindanao. This

unit added 20 new stores, mostly standalone Savemore stores.[4]

I find these reports intriguing due to the

absence of same store sales number in media’s report.

In the 1H, I posted that same store

sales growth (year on year) for SM department stores at 3.7% and

for SM food retailing group 1.2%. In the 1H, SMIC

earnings grew by 10%.

So with income down by 3 percentage points how did same store sales

perform? Why is this important?

Same store sales provide an

insight of consumer spending activities in the lens of the largest retail

chain.

The government says that household

consumption grew by 7.2% and 7.1% in 1Q and

2Q (at current prices) even when the network of the largest retail stores grew

by below half of the stated government numbers. Perhaps competition has eroded

or muted SM’s performance or perhaps government has been overstating consumer

activities, or such might be a combination of both.

Same store sales also provide an

outlook for the prospective earnings growth for the SM’s shopping mall, the

core of SMPH’s revenues and also of the health of SM’s real estate segment

SMIC’s top line growth rate declined to 6.16% in 1H 2015 from 7.17% in 1H

2014 (upper window). This was mostly due to the combination of diminishing

growth rate of retail sales and rents. Real estate has posted insignificant

growth rates.

Yet 2014 and 2015 performance have been halved from 2013 and 2012’s

numbers at 16.14% and 14.18%, respectively.

Overall, SMIC’s growth rate has

been plunging.

Curiously, this comes even as SMIC has aggressively been expanding

capacity. Why have growth been dropping when capacity continues to swell? Why

have all those extra capacity not been adding to the growth rate of SMIC and

her subsidiaries? Law of diminishing returns at work? Or has consumer spending

been falling? Or both?

Ironically, SMIC’s real estate performance hardly reflects on the massive

price inflation from Makati, Ortigas and Rockwell during the same period.

SMIC’s real estate segment provided a major boost only in 2012. The

underperformance of SMIC reveals that so called ‘demand’ that fueled 1H

property price inflation has been only in some areas and hardly applies to all.

Global Property Guide could be right; there could be an ongoing

expansion of ‘ghost cities’ or ghost condos serving the middle class.

A portion of the 1H performance can be seen in the 2Q activities (see

lower window). Since both tell of the same story, then they resonate on the 1Q

performance, except that 2Q top line sales was weaker +4.83% than the 1H

performance. So this means 1Q lifted the average.

SMIC’s 3Q and first 9 months activities from 2012-2014 (no data available

for 2015 yet) shares the same tale; slowing top line revenues mainly from

descending performances in retail and rents. Real estate outperformed only in

3Q 2014.

Moreover, SMIC profits rose 10% in 1H 2015. In 9 months of this year,

profits rose by only 7%. This means that

the profit growth rate for 3Q significantly slumped! And that number could just

be about 1.2%! That’s why I noted that the absence of media’s report on

same store sales for me seems intriguing. Because

they seem to be hiding something unpleasant. Something that would not only

expose on health of the resident consumers as seen in the purview of retail

outfits, but most importantly decompose on the populist myth of the political

fabrication called as the consumer economic growth ‘success’ story.

More, the downhill performance of retail sales suggests that SMPH’s

rental growth 3Q 2015 of 13.7% and for the first 9 months at 11.24%, have considerably

been due to rental increases rather than from royalty fees or consumer spending

growth. So if true, money illusion via property inflation (aside from new mall

spaces) had been a significant contributor to 3Q earnings growth. Hardly a

sound economic model.

Yet if profit growth rate has been headed toward stagnation, then just

how will SMIC and her subsidiaries finance all her aggressive expansions? Part

of this is through bond issuance.

Also what justifies those stock market ridiculous valuations?

I believe that a

lot of companies have embarked on the same business model as SM Group. They

better make sure that they have many channels to access to credit. SM, through

their subsidiary bank BDO, has that privilege.

That’s because

once Mr. Razon would be proven right, many people will pay a big price for their

recklessness. And access to credit will be the premier concern for survival.

As clue to this, a retailer BW

Gaisano dived its IPO offering by a shocking 35%!!!

The Gaisano IPO account hardly signifies a sign of a boom. Rather, it

looks likely a symptom of desperation to gain access to financing! Why??!!

BSP

and Media’s Up is Down, High is Low, More is Less

In the dystopian novel

1984, George Orwell coined the slogan

of “war is peace, freedom is slavery, and ignorance is

strength” to demonstrate of doublespeak

or the corruption of language to control people through their thoughts.

I

was reminded by these when I came through an article where the Bangko Sentral

ng Pilipinas would reportedly “tighten rules” on the banking system’s treasury operations in order to minimize risks. And minimizing risks

will be coursed through new regulations that supposedly will prevent investors

“from transacting in financial products for which they are unsuited[5]”

Astounding! Just

how on earth will the BSP know which financial products are suited or not

suited for individuals???? Does the BSP know every person’s risk tolerance

profile for them to make such a claim???

Instead of treasury

products let us apply such ‘fatal

conceit’ on stocks.

The above

represents the price to cash flow (or a ratio of market price

relative to its cash flows) of the MSCI Philippines (21 component) as

constructed by the fabulous Gavekal team.

Do the above

numbers indicate a buy or a sell for the MSCI Philippines or for specific sectoral

based performance, for me or Juan or Pedro? Does the BSP know? What are the

profit or loss probabilities for a position on them, for me or Juan or Pedro?

How does one apply a position, short term or long term based on the above, for

me or Juan or Pedro?? Does the BSP know? What are the risks for me or Juan or

Pedro, or to the general markets from the above valuations? Does the BSP know?

What do the above

valuations indicate relative to “the proper conduct of client suitability is,

therefore, deemed a crucial part not only of consumer protection but also of

the self-protection of supervised entities against adverse claims”?

How about the

next image? These are related to the price to cash ratio. How? They account for

as the numerator of the ratio. However, the figure exposes on the price fixing

actions by certain groups through “marking the close” which had 3 incidences last

week. Marking the close based

on SEC mandate has been stipulated to be illegitimate. So

how do such manipulative actions serve to protect consumers? What is the BSP’s

role in them?

In the same

article Deputy Governor Nestor A. Espenilla, Jr was quoted as saying new

regulations are needed to minimize risks of mis-selling treasury products, “In

a low-interest environment when there may be great temptation to chase yield,

sellers may be too aggressive and buyers too careless.”

The BSP has

hardly ever bothered to make an official comment on whether current equity

market valuations have been products of the “great temptation to chase yield”.

Although to be fair, the BSP chief did issue implied warnings during two of his

speeches in August 2014 (“complacency and chasing the markets”) and in October 2014 on (“mis-appreciation of risks in certain segments of the market, including the real estate sector and the

stock market”). Yet unless one follows the speeches of the BSP leaders, hardly

anyone would have known since there hardly has been public coverage on this.

Especially not with biased media (or what political analyst and trend

forecaster George Celente contrived as “presstitutes”). For biased media, unless it is

about personality based politics, nothing can ever go wrong with the Philippine

economy.

Media recently broadcasted that some

P 25 billion that have been lost to investment scams. Yet what has the BSP’s role been in them?

In an

environment where money has been politicized and manipulated to become free

(for government and for cronies), has the

BSP not been responsible for creating incentives for people to the fall trap to

the “great temptation to chase yield” in which many become suckers and fall

victim to unscrupulous agents?

Media

also reported that there has been a “rising trend among young people

victimizing the older citizens”. Increasing market stress

also aggravates on the proliferation of financial fraud (Ponzi-pyramiding

schemes) as I noted in 2008. The greater the market stress, the more

vulnerable people are to fraud.

Yet who created

such market boom bust market tensions?

To add, whom have

media and the BSP been kidding when they show of the sudden drop in the growth

rate of consumer NPLs in the face of a slowing economy?

The BSP,

possibly in cahoots with the banks, may be engaged in statistical talisman or

shouting statistics to shoo away financial demons that plagues the banking system’s

balance sheets.

The rate of

consumer lending continues to sizzle, though lower the previous highs, even

when the statistical economy has been materially slowing.

The cooling

formal economy such as in manufacturing and in exports translates to output,

jobs, income and financial losses. So for those who have contracted loans when

everything had been booming, they are likely to be feeling the financial heat

in 2Q, and even right now.

So what those stats above from the BSP seem to tell us have

been that economic conditions hardly has any bearing on credit conditions. Even

when debt is high, a substantially lower GDP translates to the more prompt

payers by debtors!

Up is down. High

is low. More is less.

And while the

second quarter has signified a done deal, and while there have been persistent

and sustained attempts to widen spreads of the yield curve, the above

flattening doesn’t spell good for credit, liquidity and even for NPLs! They can

hide a quarter but eventually those tensions will surface.

Moreover, media

tell us that 3Q GDP should be better than the 1H.

So they cherry

pick on statistics that makes GDP to supposedly look good. Say manufacturing,

despite a negative August data, they will instead cite ‘volume’ which grew by

3.7%. It’s really disconcerting, if not pathetic, to see people brandish

numbers even when official GDP computation of manufacturing is about Gross Value Added or the measure of value of goods and services of a sector in the economy. And yet they call themselves experts.

Apparently, experts at manipulating numbers.

Down is Up. Low

is High. Less is More.

The above

quarterly growth numbers of tax revenue collections seem to be declining in

conjunction with GDP.

Though the

relationship between changes in tax revenues and GDP has not been clear cut, as

taxation represents stringently political activities relative to the GDP which

supposedly measures economic output from a political economic environment,

somehow tax collections may partly reflect on economic conditions.

In three

occasions where growth rate of tax revenues fell for two successive quarters,

GDP either fell as in 2010, or flat lined as in 2013.

So falling

revenues may be a manifestation of a lack of political will to collect taxes,

easing up of tax collection due to political season, and or has been reflecting

on economic conditions-a slowdown.

I know. The

opaque relationship may even be called a null

hypothesis.

Finally, the BSP seems inundated with

contradictions. First, they tell us that they know what is good for the public.

So they lay rules that are supposed to protect us. But then they tell us many

things about them not knowing! That’s when they have agendas to push or when

they are put on the spot.

Agendas to push. In a speech

early this year, the BSP chief lectured media about the knowledge problem or

how to LOOK beyond statistical numbers. As I earlier posted[6]:

Economic

numbers rarely tell the complete story when taken at face value. Therefore, a responsible journalist

who seeks to offer readers a fuller appreciation of the information will examine the figures within a

broader context or against an array of other relevant indicators. Given the

facts on hand, a good reporter will know which leads to chase, and which to set

aside, perhaps for another day, for another story. The objective is to understand what is

happening -- and why -- so

that the facts can be pieced

together into a sensible and useful news report for their publics.

By engaging in

statistical talisman for 2Q consumer loans, such sagacious advice from the BSP

chief is something which the BSP doesn’t want the public to do. Or they want

the public to just take these numbers at face value, even if they defy economic

logic!

Put on the spot. And when

asked about how risks from China’s economy may affect the Philippines, the BSP

chief even used one my favorite—the Chaos Theory—to justify the BSP’s knowledge

problem or ignorance!

In a September

speech[7]:

(bold mine) This reminds me of how “chaos theory” is

often described. As everyone here is aware, CHAOS THEORY is the study of

nonlinear relationships where events that appear logically random are actually

linked. It is said, a butterfly flapping its wings in the Amazon will affect

the time of formation, exact location, and path of a hurricane several weeks

later in North America. This “butterfly effect” is formalized in various fields

like risk management, that’s why this audience knows it, right? It underpins

the very framework of Financial Stability used by the BSP but, in its simplest

form, it is more commonly referred to today as “contagion”….Ladies and

gentlemen, it is clear that there is already some impact on EMEs, including the

Philippines. And the possible

consequences of a hard landing could be significant to many

jurisdictions. There are layers of nonlinear and changing linkages that

make the prediction of full effects an impossible task. But it is

precisely an evolving situation such as that in China which should provide us a

good platform to think about the possible issues that prudential policy may

consider. In your more focused request, you asked me what the impact is on us

of the slowdown of the Chinese economy. My reply -- So far, it’s been on the

whole, benign. We’ve so far managed well but we are not immune should Chinese growth slow more steeply and

financial market volatilities intensify further.

So the BSP thinks

that the “chaos theory” or nonlinear relationships apply ONLY to external

forces and its linkages with the Philippines. They can’t seem to perceive of the

chaos theory applied to the domestic setting particularly from “new regulations

setting “minimum expectations” for supervised financial institutions that sell

securities and similar financial instruments”

Very interesting.

Nevertheless, the

great Austrian economist F.A Hayek has once been again validated.[8]

The curious task of economics is to

demonstrate to men how little they really know about what they imagine they can

design.

To

the naive mind that can conceive of order only as the product of deliberate

arrangement, it may seem absurd that in complex conditions order, and

adaptation to the unknown, can be achieved more effectively by decentralising

decisions, and that a division of authority will actually extend the

possibility of overall order

Phisix 7,100: Sluggish Trading

Actions as US Dollar-Asia/Peso Likely Higher on US Jobs Report

A short note on

the Phisix.

The PSEi was

down .23% on a mixed showing. The headline index was generally up: 19 advancers

versus 11 decliners. All sectoral indices were up except the service sector.

The service

crashed by 6.54% last week, spearheaded by telco issues, PLDT -7.91% and Globe

-5.35% and seconded by port giant ICTSI -13.70%.

But market

breadth was considerably down: in aggregate decliners led advancers by 91.

Three of the 5 days were in favor of the sellers.

Despite the

rangebound trading that has partly been a product of price fixing, fascinatingly

peso daily volume continues to emaciate.

This week’s daily volume (averaged weekly)

at Php 5.479 billion accounted for the second

smallest volume for 2015. The lowest volume for the year was at week ending at

September 11, 2015 where peso volume (averaged weekly) was at P 5.404 billion.

(see left)

Moreover, wobbly

volume has resonated with other trading indicators, such as daily trades and

number of traded issues.

Such frail

volume makes the PSEi once again vulnerable to another selling stampede. The

August 24 meltdown was preceded by a daily volume (average weekly) of Php 5.82

billion, the third lowest for the year!

Interestingly

the USD peso has once again reached its resistance to close at 46.935.

The USD was

mostly up in Asia with the exception of the Indonesian rupiah and Taiwan dollar.

The Indonesian government reportedly announced a sixth economic package for this year.

Malaysia ringgit and the rupiah have diverged last week.

Given that US

October jobs market 271,000 widely beat expectations, this has been perceived

as substantially bolstering the odds for a FED rate hike in December, the USD

peso as with other ASEAN currencies are likely to trade significantly up at the

opening of next week. If sustained through the day, then this should mean a

breakout of the USD Php past the 47 level where the next target could be Php

47.5- 48 zone.

What arouses my

curiosity in the US job report has been that many of the details seem to

contradict other economic data related to the jobs. For instance strong jobs

from retail and wholesale sectors come even as sales performance of the wholesale sector has been fumbling while retail sales (ex

food seems to have plateaued since July). Wholesale inventory to sales ratio

continues to climb and has now been approaching recession levels! Manufacturing

showed ZERO job growth! Yet 54% of the 271K jobs growth came from arbitrary birth-death model. Generally, the US October job data was a story of mostly construction jobs from a property boom.

What can be seen

has been a widely divergent or unbalanced economy which has been tilted balance

towards areas benefiting from zero bound rates—asset boom.

Yet I doubt the

integrity of those numbers. Because the FED was widely criticized for pushing

back rates by incorporating “global

economic and financial developments” the job data looks designed or a set up to

reverse what seems as faux pas that would pave way for the FED to redeem itself

by a reluctant hike in December.

But a December hike will hardly solve the global

dollar problem which mostly emerged out of the accumulation of balance sheet

imbalances or mismatches.

A December hike will only put a squeeze on

highly levered balance sheets of the rest world (specifically Asia and emerging

markets) which should eventually boomerang back to the US.

And even when the US Fed eases (by QE) in

response to a faltering economy (or bursting bubbles), the matching process of

central bank action to fill balance sheet deficits will likely take time. So I expect the USD to serve as a lightning

rod against stresses that would surface in response to massive imbalances as an

outgrowth of central bank policies from all over the world. And once the charade

from risks assets have been sloughed off, gold will scintillate.

[1]

Nikkei

Asian Review ICTSI

chief sees another crisis coming November 5, 2015

[3]

Business World SMIC 9-month profit up 7%, driven by property, retail November 5, 2015

[4]

Inquirer.net Core businesses push SMIC income to hit P19.4B November 5, 2015

[5]

Businessworld BW Rules on financial products fortified November 4, 2015

[6]

See

Phisix

7,800: Record Phisix as the BSP Continues with Deflation Spiel!

March 9, 2015

[7]

Amando M. Tetangco Jr Navigating Thru the Waters of Change...and Butterflies 2015 Annual Joint General Membership Meeting

of ACI, FMAP, IHAP, MART, NASBI and TOAP September 29, 2015, BSP.gov.ph