Seldom do people think things through foolishly. More often, they do not bother to think things through at all, so that even highly intelligent individuals can reach untenable conclusions because their brainpower means little if it is not deployed and applied—Thomas Sowell

In this issue:

Philippine June 2023 Headline CPI Declined to a 13-Month Low but Core CPI Diverged; the BSP Chief Hints at Rate Cuts

I. BSP Chief Hints at Rate Cuts, Treasury Markets Resist (Long-Term Yields Surged)

II. Don’t Blame the Fed, the Latin America Example

III. "Sticky" Core CPI Deviates from Headline CPI

IV. Credit Driven Food Services and Rent Resulted in the Stickiness of the Core CPI

V. Survey: Inflation Crisis Results in a Poorer Citizenry

VI. Building up the Inflation Bias: The Structural Shift in Bank Lending Towards Consumers: The Core CPI as Symptom

VII. Diminishing Standard of Living: The Role of BSP and Bank Monetization of Public Works

Philippine June 2023 Headline CPI Declined to a 13-Month Low but Core CPI Diverged; the BSP Chief Hints at Rate Cuts

Though the June Headline CPI slipped to a 13-month low, the Core CPI deviated from it, down by a lower degree. Consumer credit has fueled such divergence as the BSP hints at a rate cut.

I. BSP Chief Hints at Rate Cuts, Treasury Markets Resist (Long-Term Yields Surged)

The cat is out of the bag.

Businessworld, July 7: INTEREST RATE CUTS may be on the table this year if inflation falls below 4% by October, the new Bangko Sentral ng Pilipinas (BSP) governor said. BSP Governor Eli M. Remolona told reporters on Wednesday evening the slower-than-expected inflation in June “somewhat” supports an extended pause in interest rate hikes. median estimate in a BusinessWorld poll last week, and at the low end of the BSP’s 5.3-6.1% forecast. June also marked the 15th straight month that inflation exceeded the BSP’s 2-4% target…As to other factors that may prompt a rate cut this year, Mr. Remolona said the BSP would look at economic performance and future policy decisions of the US Federal Reserve. “We’ll do [the cut] one meeting at a time. But in doing it one meeting at a time, we’ll also look forward to what we might do down the road,” he said. “We’re not looking at just one policy rate. We’re looking at a path of the policy rate.”

The BSP signaled its inherent bias for the return of the easy money regime. The anchor of the dovish spiel is a CPI rate of 4% and below.

For them, the June CPI of 5.4% down to a 13-month level justifies the extended pause. This outlook validates our view that the BSP recently held its "victory lap" over inflation.

But guess what?

Figure 1

After the June CPI announcement, treasury traders arduously pushed back on this rhetoric. Instead of bidding up prices (pulling down yields), traders sold down the belly through the long end (yields jumped). (Figure 1, topmost chart)

From a flat and inverted curve, the slope of the Philippine treasury suddenly steepened! (Figure 1, middle graph)

This bearish steepening is "suggestive of rising inflationary expectations."

What's more, while the entire curve traded below the BSP's ON RRP earlier this week, this dynamic almost had a turnaround. Except for T-bills, which remain slightly below, the curve soared above the BSP's official rates of 6.25%. (Figure 1, lowest window)

Treasury markets have indicated HIGHER rates ahead! Awesome!

To be clear, though we called the peak second wave of inflation in March 2023, the recent developments haven't changed our view that the CPI momentum (2nd wave) would be trending lower in the interim.

The thing is, the treasury curve has started to reveal signs of a coming reversal. But it needs further validation.

II. Don’t Blame the Fed, the Latin America Example

Of course, the consensus blames the US Federal Reserve for this, despite ironically asserting that the Philippines can "decouple" from the world!

The embedded assumption is that the US rates are more influential on the Philippine economy than domestic policies.

Perhaps, the mainstream should look at what's happening in several Latin American (Latam) nations, such as Brazil, Mexico, and Chile.

Despite slumping commodity prices, the positive "real" rates from the aggressive central bank rate hikes have bolstered their currencies and stocks (close to All-time highs!).

Brazil's central bank boosted its interest rates from 2% in 2021 to 13.75% in the 2H of 2022, Mexico from 4% in 2Q 2021 to 11.25% in Q1 2023, and Chile from .5% in 3Q 2021 to 11.25% in Q1 2023!

Talk about the mettle to contain inflation!

The CPI rates of Brazil, Mexico, and Chile are at 3.94% (May), 5.06% (June), and 7.6% (June), respectively, which translates to positive differentials of 9.81%, 6.19%, and 3.65%.

Yet one possible factor for the recent boom, Brazil’s soaring agricultural exports have led to record trade surpluses.

As a caveat, this developing Latam boom may signify another "carry trade" boom-bust cycle moored from the credit easing policies of Japan and China and the short USD trade.

Figure 2

And yes, while the BSP's rate has widened its spread above June's CPI rates to .85%, it remains immensely below its Latam emerging market peers. (Figure 2, topmost diagram)

However, even with this meager edge, the BSP is already floating to cut rates! They seem to be in a hurry. Domestic authorities patently feel so entitled to and dependent on free lunches to serenade easy money back into its fold. Further, another reason could be that rising rates escalate the fragility of banks.

III. "Sticky" Core CPI Deviates from Headline CPI

Aljazeera.com, July 5: Annual inflation in the Philippines eased for a fifth straight month in June, supporting expectations the central bank will keep rates unchanged for longer as food and transport cost pressures ease. The consumer price index rose by 5.4 percent in June, the statistics agency said on Wednesday, its slowest pace since April last year. The central bank, however, noted inflation risks remained tilted to the upside due to the potential effects of the El Nino dry weather conditions and wage increases. The Bangko Sentral ng Pilipinas (BSP) said the slower pace of price increases was consistent with its expectation inflation will gradually return to its 2-4 percent target in the fourth quarter barring sudden supply shocks…Core inflation, which strips out volatile food and fuel items, slowed to 7.4 percent from 7.7 percent in May.

The June CPI of 5.4% was lower by 60 bps from May's 6.1%. In contrast, the CORE CPI fell by only 30 bps to 7.4% in June compared with 7.7% a month ago.

Yet, the combined food (and alcoholic beverage) and energy components comprise 46.65% of the BSP-PSA CPI basket, while non-food and non-energy segments have the majority, 53.35% share.

But why does the public fixate on the headline and not the core?

As the Philippine Statistics Authority (PSA) defined the CPI, "It is a major statistical series used for economic analysis and as a monitoring indicator of government economic policy." Further, "CPI components are used as deflators for most personal consumption expenditures (PCE) in the calculation of the gross national product (GNP)."

Again, because food inflation is the most political, it grabs not only the headline but the political thrust to contain it.

As an example, the administration immediately embraced their success of pushing lower food prices with a supply-side "increased production" approach.

After all, a wide swath of the population are voters—one can't keep them hungry and expect their vote.

Therefore, as a number with critical political significance, the embedded motivation for the agency that calculates it—working under the leadership—is to paint a statistical panorama favorable to the administration.

As we have long stated, one of the unstated reasons for changing the base rates (from 2006 to 2012 to 2018) is to deflate the CPI. How would the headline CPI look if based on 2006 or 2012 base rates? How much higher will the CPI be?

While we accede with the mainstream that there has been a slowdown in the rate of increase in goods, this doesn't diminish the corrosion of money's purchasing power.

As a matter of fact, inflation, or the loss of money's capacity to acquire goods or services, is accumulative.

Returning to the issue of the CORE CPI, the quarterly average gives us a better portrayal of its performance.

After peaking in Q1 at 8.3%—a 15-year high—the headline CPI slumped to 6% in Q2 2023.

On the other hand, the core CPI crested in Q1 2023 at 7.7%—a 22-year high—kept at the same level in Q2 2023.

The core barely exceeded the headline CPI except for a few instances. (Figure 2, middle window)

The widest gap, where the core surpassed the headline CPI, was during the trough of the first wave of the 2015 inflation cycle in Q3 2019. (Figure 2, lowest chart)

In a different setting, Q2's spread, in favor of the core, represents the biggest at the climax of the 2nd wave!

This time is different! The four deadliest words of investing.

Put differently, the present "stickiness" of the core CPI is a result of the unique conditions of this period.

To be clear, the chasm between the core and the headline CPI signifies such divergence. It doesn't say it will go against the headline.

IV. Credit Driven Food Services and Rent Resulted in the Stickiness of the Core CPI

Figure 3

Let us look at the major contributors to the core CPI in Q2 2023. (Figure 3, top table)

Outside the transport sector, food services and rent contributed the most. Believe it or not, the transport sector posted a 3.1% contraction from the 23.2% nosedive in personal transport equipment, while passenger transport services zoomed by 11.2%. Yes, transport deflation amidst raging inflation in others!

Despite numerous vacancies, household rent has the largest % share of 12.82% but posted a CPI of 5.6% in June, which contributed .7% to the headline CPI. Based on the BSP data, rent data doesn't include historical numbers.

Meanwhile, food services, which comprised 9.47% of the CPI basket, registered an 8.3% CPI. Food services contributed .8% to the headline CPI in June.

There you have it. People spent a lot dining out, which kept the core CPI "sticky."

Next, what financed this dine-out binge?

We have a clue. The public extensively used credit cards to fund this. (Figure 3, second to the highest window)

The surge in credit cards, which constitutes a primary component of the bank household credit, continues to boom. It was up 29% in May and has been above the 20% growth rate since July 2022.

And it is not just food services; even the other segments of the core CPI, housing and utility, furnishing and miscellaneous goods, have all jibed with credit card-household credit debt. (Figure 3, third to the highest and lowest charts)

Figure 4

A further point is that the downshift in food CPI has coincided with the slowdown in bank salary loans. Though still at an all-time high in pesos, the lower growth rate likely means the lower-income class may have overreached their capacity to borrow. (Figure 4, top and middle windows)

Essentially, household credit (credit card), which is at a record high, has driven the core CPI.

V. Survey: Inflation Crisis Results in a Poorer Citizenry

And almost consistent with the SWS surveys on self-poverty, another poll highlights the struggles of the average citizenry from raging inflation.

Philstar.com July 6: MANILA, Philippines — The bite of painful inflation is shaping how Filipinos are adapting to expensive prices, as many found it difficult to keep up with their financial needs, so says this new survey. The survey revealed 36% of Filipinos found it difficult to make ends meet on their monthly income. The survey was conducted online by local firm Synergy Market Research + Strategic Consultancy alongside YouGov by polling 3,479 adult Filipinos between March 29 and April 5…The same survey also revealed seven out of 10 Filipinos were expecting to slash spending across their households in the next 12 months if inflation does not improve. (bold added)

Of course, diminished purchasing power already translates to a "slash in spending."

If one's income can previously obtain ten goods/services and now get only 9 of them, isn't this a slash in spending?

And from the same premise, without income growth or credit use, how can one decrease spending with the current cash flow unless one would escalate their poverty conditions?

Importantly, this shows that aside from tapping credit to augment their attempt to keep up with their living standards, the average citizenry may be drawing from their pool of savings.

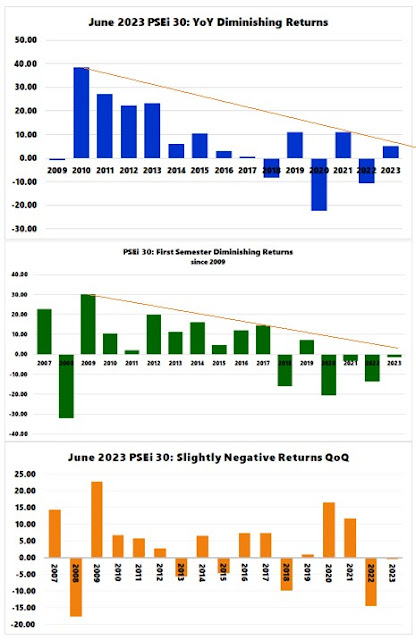

See why the atrophying volume at the PSE?

VI. Building up the Inflation Bias: The Structural Shift in Bank Lending Towards Consumers: The Core CPI as Symptom

Figure 5

A more critical factor, which we will continue to emphasize, has been the structural shift in bank lending slanted toward consumers.

That is, banks are betting heavily on consumer spending while reducing financial access (growth) to the production side. The result is obvious: too much money (consumption) chasing too few goods (production)! (Figure 5, topmost graph)

Last May, household bank credit in pesos eclipsed loans of all industries YoY. Consumer loans via credit card ranked second only to Utility loans. (Figure 5, middle table)

Further proof?

While official statistics say that manufacturing value and output rebounded 7.3% and 8.1% in May, there has been a decline in the take up of bank loans to the industry, which resonated with the PPI.

So how has the industry been financing this growth? Further, declining loans have corresponded with the Producer Price Index PPI, a measurement of change in prices of key commodities produced by the manufacturing sector, indicating a contradiction in the factory data: a slowdown.

However, net sales in value and volume presage this slowdown, with 3.43% and 1.44% growth in May.

Again, the scarcity in production impels imports to fill this demand gap, which translates to extended trade deficits financed by external debt! Debt piling up on debt!

Nonetheless, household bank loans accounted for 10% of total loans last May. Including real estate, the share of household exposure should exceed 20%.

Despite the large segment of the unbanked population, about 45% of adults are involved in informal forms of credit (BSP Financial Inclusion 2021).

And we can only extrapolate that the financing of part of the "informal" credit transactions emanates from the formal sector or banks. Some creditors may have arbitraged this.

In the end, there is no magic in consumer spending. They require financing in three fundamental ways: income or earnings, credit usage, or a drawdown in savings. Economic analysis should focus on how the present inflationary conditions impact these.

Our takeaway is that household credit represents the principal driver of the core CPI, and for as long this remains strong, the core CPI will remain tenaciously "sticky."

Again, this outlook doesn't suggest that it won't go lower, but its decline may be less than the headline CPI as it has been lately. Further, any easing by the BSP would likely combust the core ahead of the headline CPI.

VII. Diminishing Standard of Living: The Role of BSP and Bank Monetization of Public Works

Finally, we shall expand our demand side inflation thesis to cover that aside from bank credit expansion, the BSP assets growth and public sector financing are the other principal factors.

Sadly, the public seems unaware that the BSP's actions don't come for free.

And they're unguided by mainstream experts, who seemingly are burdened by a principal-agent dilemma (conflict of interest), i.e., sell their institutional products or services.

When the BSP rescued the banking system with a historic Php 2.3 trillion in liquidity injections principally through the acquisition of domestic securities, the torrent of liquidity diffused into the economy through a process: first, upon its gradual "reopening," then during the 2022 National Elections and lastly, the public work projects (for example, "build, build and build").

Figure 6

From here, it is no surprise that the BSP's assets (Q1 2023) have correlated with the CPI from 2012 to date, but with a time lag. BSP assets have barely come off even as the BSP has increased rates. It was down by 8% from the October 2021 pinnacle. The latest boost in BSP assets has primarily emanated from their acquisition of domestic securities via net claims on the central government (NCoCG). (Figure 6, topmost chart)

Next, the public works projects financed by the BSP and the banking system have also contributed to liquidity infusions. Through the "Cantillion Effects", these injections benefited specific parties—e.g., government, subcontractors, PPP partners, private affiliates, banking and finance and their clients, and others—involved in these projects that percolated into the economy over time. (Figure 6, second to the highest window)

These interventions distorted the economic process—coordination and allocation—which eventually were expressed in prices.

Government spending doesn't happen in a vacuum. Public spending does not only compete with the private sector for resources and financing, the "crowding out effect" translates to opportunity cost from such redistribution measures that impact the economic process and outcome.

Therefore, it is unsurprising that the BSP's net claims on central government (NCoCG) have resonated with the CPI, even as the banking system's exposure to fiscal activities (NCoCG) continues to expand at ATHs. (Figure 6, second to the lowest and lowest graphs)

To this point, the divergence in the headline and core CPI has not been a matter of statistical definitions.

Instead, it showcases the contortions brought about by the desire to sustain the entitlement privileges of a select few from an easy money regime.

Attributing the spiking CPI to supply-side factors relieves monetary authorities of their responsibilities from the ramifications of their policies. It also gives them leeway to promote further pursue policies that debase the purchasing power of the peso or reduce the standard of living of Philippine residents.

Unfortunately, there is no such thing as free lunch forever.