A

lot of what you do see in terms of the profit growth you do have now

is engineering stock

[such as buybacks and global labor arbitrage], …These are the

levers companies have to work with. They're taking advantage of the

fact that there's a lot of opportunities to just continue to engineer

their earnings. –Mike Thompson Chairman of S&P Investment

Advisory Services at the CNBC

In

this issue:

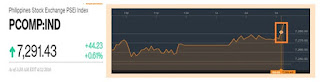

Phisix

7,300: Average EPS Growth for PSEi’s Top 15 Issues Crashed by 30%

in 2015! Some EPS Growth May Be Due to Financial Engineering

-Priceless

Commentaries From Some Annual Reports Demonstrate that the Law of

Economics Work!

-The

Jury is OUT: Average EPS Growth for PSEi’s Top 15 Issues Crashed by

30% in 2015!

-The

Fabulous Eight’s Divergence: Record Highs as EPS Growth

Underperforms!

-Behind

GTCAP’s 32% Eps Growth: Financial Engineering and Creative

Accounting?

-GTCAP’s

Real Estate Woes, Add LTG and Rockwell to the Roster

-GTCAP’s

Stumbling Auto Sales and the Real Growth Story

-Examples

in the PSE of How BSP’s Inflationary Policies Transfer Wealth to

the Elites

-It’s

Not Just Jollibee, McDonalds and Max’s Group Shares JFC’s

Financial Predicaments!

Phisix

7,300: Average EPS Growth for PSEi’s Top 15 Issues Crashed by 30%

in 2015! Some EPS Growth May Be Due to Financial Engineering

Priceless

Commentaries From Some Annual Reports Demonstrate that the Law of

Economics Work!

(italics

added)

Shangri-La

Plaza’s revenue slightly declined by P41.2M mainly due to temporary

close down of certain areas during the year on the Main shopping mall

for renovation. Business was also affected by increased

competition from newly opened shopping centers in the nearby

areas—Shang

Properties 2015 Annual Report1

In

addition, sales attainment during the period was also generally

weaker

than expected due

to increasing competition—Anchor

Land Holdings 2015 Annual Report2

Most

of listed firms released their 2015 annual reports last week.

The

above quotes extracted from the management discussion of the 2015

annual report of the said companies are PRICELESS!

Such

statements essentially reveal that the fundamental laws of economics

work!

In particular, the imbalances from the credit fueled artificial

economic boom, via the race to build supply (malinvestments), have

finally surfaced on the financial results of many companies. And such

formative financial strains have impelled some industry people to

recognize of the emergent existence of oversupply. Albeit, their

perspective comes in the lens of “competition”, which represents

a symptom rather than the cause, as shown in the above excerpts.

Nevertheless,

blissful

ignorance rules!

The dominant perception has been that inferior results of 2015

signify an anomaly. So the intensive competition to build supply

capacity financed by credit inflation continues…

Yet,

will the sustained sprint on capacity expansion improve on eps growth

for 2016? Or will this further aggravate on the present the eps drag?

The

answer will most likely determine the returns of the PSEi at the end

of the year.

The

Jury is OUT: Average EPS Growth for PSEi’s Top 15 Issues Crashed by

30% in 2015!

At

the onset of 2015, the public was made to expect that the earnings of

publicly listed of firms would balloon at the rate of mid-teens. And

such lofty projections had been used to justify a succession of

frenzied pumps for the headline index or the Phisix to reach a

milestone 8,127.48 in April of the same year.

Well

the results are in. Or hope has been transformed into reality with

the release of the eps scorecard for 2015.

And

the grade for consensus forecast: Fail!

For

the top 15 Phisix issues, the average earnings growth (sum of eps

growth rates divided by 15) in 2015 has stumbled to just 6.63% from

9.38% in 2014 (top chart). So instead of a projected 60% jump to an

eps growth of 15%, the average earnings growth skidded by a hefty

30%!

If

applied to the weighted average for the top 15 (the summation of the

products of the market share weight of component issues multiplied by

their respective eps growth rate), eps growth rate collapsed from

10.16% in 2014 to 5.51% in 2015 or a crash of 45.73%.

Back

to the nominal average, a slight a majority or 8 issues posted eps

growth LOWER in 2015 than in 2014, although the number of negative

growth has dwindled by 40% from 5 in 2014 to 3 in 2015.

Eps

numbers more than meets the eye as explained below

Remember

that the top 15 issues accounted for about 80% of the share

weightings of the PSEi basket as of Friday. 80/20 looks very much

like Pareto’s rule at work. I haven’t accounted for the latter

half

So

2015’s eps performance only exposed consensus forecasts as sheer

hyperbole.

And

such blatant misperceptions brought about by excessive optimism had

been revealed by the two market crashes in August 2015 and January

2016, which paradoxically were blamed on external forces!

For

the consensus, valuations don’t ever matter, and the overpriced

securities will become even more overpriced to perpetuity. Yet recent

market crashes say valuations do matter!

Yet

what has changed in 2016?

If

the baseline of 9.4% average eps growth (for the top 15) in 2014 had

been used as springboard for a pump towards PSEi 8,100, then what

would be the foundation for the recent parabolic rally? 2015’s much

lower base of 6.63% eps growth???

Wouldn’t

it be a supreme irony where tanking eps growth should function as

tinder for more frenzied propulsion of the bids on the PSEi???

And

to expand the logic further, should a return to last year’s growth

rates (9.4%), justify even higher

price levels

than when the baseline was at 9.4% and expected growth was at

15-16%???

In

the absence of eps growth, current market actions have only been

puffing up valuation to nosebleed or celestial levels.

Also,

since equity prices have gone in the opposite direction with eps

growth, what happens if those expectations fail again? Won’t this

serve as additional fodder to instability?

As

I raised in January 20153:

Or

has this been about flagrant misappreciation of risks that signifies

as symptoms of financial destabilization in progress?

Perhaps

in a state of denial some may posit, ‘this won’t happen’.

Really? But 2015 is now a fact: eps growth fell with a thud! REDUCED

G-R-O-W-T-H happened! Two crashes in August 2015 and January 2016

were facts too. Crashes were a reality too!

The

vertical ascent or the V-bounce does NOT expunge the cause of the

crash. Rather, soaring stocks on falling eps growth means that the

V-rebound enhanced it!

To

reemphasize, Phisix at 7,300 has been a product of a concentrated

pump on select issues within the spectrum of the top 15 biggest

market caps. And as proof, there are now EIGHT issues, or more than

half of the 15 biggest market caps that have either carved fresh

landmark heights or are within striking distance from historic highs.

Yes

all these have been happening even when eps growth rates in 2015 have

been dropped substantially lower than 2014! In short, bad news IS

good news? Haven’t the incantation been that the Phisix was about

G-R-O-W-T-H???

So

what gives?

The

Fabulous Eight’s Divergence: Record Highs as EPS Growth

Underperforms!

Here

are the eps and price charts of four index issues headed for opposing

directions

EPS

growth rate of the biggest listed firm SM investments have been down

for the past three consecutive years, yet stock prices have partially

broken above the 2013 highs a few weeks back!

Note

that SM’s previous high in occurred in May just as the PSEi reached

7,392.

The

eps growth of Aboitiz Equity Venture has been at the NEGATIVE zone

for three straight years! However, 2015’s decline has ebbed from

the double digit eps growth contraction in 2014 and 2013. Does a

reduced negative number justify fresh record highs????

Ayala

Corp’s eps growth rate tumbled to just 13.61% in 2015 from 45.3% in

2014, 20.55% in 2013 and 20.18% in 2012. Anywhere you look at AC’s

2015 performance, they were substantially less than the previous

years!

So

should lower eps growth rates justify higher price level, and

consequently, overstretched valuations?

Notice

too that Ayala Corp’s record high was in April 2015. As of Friday,

AC share prices are off 4.75% from the 2015 milepost.

Add

to the list of near apogee is Metro Pacific Investments, which stock

has just been an earshot 3.23% away from the May 2013 high.

MPI’s

eps grew by 13.11% in 2015, which is certainly better than 2014’s

9.71%, but still below the 2013 and 2012 rates at 15.83% and 23.08%.

So a growth rate of 13% rationalizes higher price level than when

growth rates were at 15% and 23%?

Without

including the charts, here the other issues with share prices at

record or near record levels

SMPH

also reached its former record level last week. Although the firm’s

2015 eps growth skyrocketed by 48.8% in 2015, this was vastly

inflated from a non-recurring or one-time gain in marketable

securities. Otherwise, eps gains would have been materially lower

given the sinking top line which was mostly from zero growth

(actually .15% increase) in real estate sales (SM

reported negative numbers) but also from a weakening of rental

income despite the introduction of a substantial number of new

inventories in both categories. And parent SM’s eps growth would

have been negative, if such non recurring gains were excluded!

GTCAP

touched its old record high in May of 2015 a few weeks back. The

company reported an incredible 32.41% surge in eps growth. But what

seems isn’t the same as what has been. The surge in eps growth was

considerably a function of the incorporation of financial figures

from a newly acquired real estate company: Property Company of

Friends. The revenues of the new company inflated both the top and

bottom line. Ironically, the newly acquired company posted a huge 35%

drop in sales growth year on year in 2015 while Federal Land posted a

modest 9.9% real estate sales. In short, creative accounting was a

big contributor to the eps upsurge (see below).

Only

JGS have, so far, divulged of a seemingly relatively better eps

health yet. I say “yet” because I haven’t vetted much on the

firm’s FS. But it would look as if a big segment of gains were due

to the petrochem projects that went online in 2015. And such had been

backed by modest contributions from other subsidiaries, even when

topline numbers like CEB and URC has withered.

Curiously,

the growth rate of domestic sales of subsidiary URC plunged

to 10.67% in 2015 from 16.39% in 2014 and 15.47% in 2013 even when

overall sales jumped to 18.05% in 2015. The top line was apparently

boosted by a surge in foreign sales 39.36% mainly due to the

inclusion of a recently acquired company.

Like

GTCAP, creative accounting was instrumental in the inflation of eps.

Additionally and ironically, the immensely inflated top line was

significantly negated by a surge in financing cost which crashed eps

growth to just 5.58% in 2015 from 16.96% in 2014, 24.32% in 2013 and

63.72% in 2012.

For

the eight issue, JFC I

delved on this last week.

Moreover,

financial

engineering and creative accounting have played noteworthy roles in

the eps growth for many companies in 2015. Even more, behind the eps

growth has been the greater surge in debt levels of many companies.

Truly

amazing!

Fascinatingly,

a non PSEi issue but a key member of the bank-financial index,

Security Bank, has virtually gone ballistic or has risen by nearly 90

degrees or close to vertical from the January lows!

Why?

Because of the 2015’s 7.49% eps growth, which has been

substantially lower than the 45.3% growth rate in 2014??? Or has such

been due to Bank of Tokyo-Mitsubishi’s reported

20% acquisition of the said bank?

None

of these has become a reflection of G-R-O-W-T-H but of destabilizing

torrid speculative pumps!

Phisix

7,300: The Predicament of the Fabulous Eight

Understand

that the series of record highs or near record highs for the price

levels of the half of the top 15 biggest market cap have been

achieved even when the PSEi remains off by a substantial 10% from its

headline equivalent in April 2015.

This

is important. The path to April 2015 has been entirely distinct from

today.

Most

of the same big cap issues reached their previous records when the

PSEi was at the RECORD or just a margin away from 8,127. To be

specific; SM, SMPH*, JGS and GTCAP in April, AC in May and JFC in

February 2015.

*SMPH

was the first to break into new records (post April 2015), even when

the PSEi began to falter from its landmark highs. Unfortunately,

there had been four attempts for a breakthrough which all sputtered.

Nonetheless, the fifth attempt was made last week.

In

other words, record 8,127 resonated with an equivalent milepost high

for these issues which backed the PSEi’s feat. Today, these issues

have taken the onus of producing PSEi at ONLY 7,300!

Or

said differently, current prices for these issues have reached or

surpassed their record price levels when the PSEi was at 8,127! This

implies of a substantial

lack of participation

from the rest of the field. Or that the latest bear market has

severely damaged the capacity of the others to participate.

Yet

current actions have consequences.

Unless

a broader base of PSEi issues jump on the bandwagon to share the

burden,

excessive

reliance on the fabulous eight for a renewed push to the 8,000 level

would translate to the stark compounding of extant mispricing,

as shown by their respective PERs (as of April 14): SM 26.98, JGS

31.73, SMPH 34.62, AC 26.22, AEV 19.43, GTCAP 26.66, JFC 44.92 and

MPI 19.32!

Put

differently, the asymmetry in the burden of price actions tilted

towards only the fabulous eight would mean that 8,000 would be a

vastly more difficult target to attain than in 2015. This comes even

with the sustained help of the index managers.

This

week the low volume sessions meant that the weekly gains of 1.02% had

to be accomplished mainly through last minute pumps in April 11,

12

and 15.

Yet

these issues are unlikely bear all the weight for a sustained upside

push. Reason? Excessive valuations will pose as key or structural

hurdle.

And remember, the baseline for 2016 has been a decline

of 2015 eps growth which should serve as headwind

And

since the fabulous eight are unlikely to carry the weight, the risk

is that the lack of broader participation may instead spur these

overbought and overpriced issues to an exhaustion that would prompt

for a volatile (and possibly violent) downside move.

In

short, the V-pump has underwritten the demise of the bulls.

And

like in 2015, failed expectations would have devastating

repercussions.

Will

the monster four year head and shoulder chart pattern of the Phisix

be formed? Will it support the dilemma of the fabulous eight

predicated on its skewed contributions to the Phisix?

A

break of 7,400 may temporarily succeed, but at what cost?

Behind

GTCAP’s 32% Eps Growth: Financial Engineering and Creative

Accounting?

I

have noted of GTCAP’s seeming use of creative accounting/financial

engineering to bloat on their eps.

Although

GTCAP is a holding company, based on 2015’s numbers, 75% share of

its revenues were from automotive sales (Toyota Motor Philippines and

Toyota Cubao), 11 % from power generation Global Business Power

Corporation, 5.6% from real estate (Fed Land and PCFI) and 3.5% from

“equity accounting” or “equity in net income of associates and

jointly controlled entities” (Metropolitan Bank & Trust Company

(“Metrobank” or “MBT’), AXA Philippines, Toyota Manila Bay

Corporation (“TMBC”), and Toyota Financial Services Philippines

Corporation)4

(p 80)

Overall,

GTCAP main business remains skewed towards the automotive industry.

Nonetheless,

last year, for its property business, GTCAP acquired an initial

22.68% stake in affordable (low cost) housing Property Company of

Friends, Inc (PCFI) “for Php7.24 billion, with an option to

increase its direct shareholding to 51% within the next three years”.

With the acquisition and the “attainment of effective control” of

PCPI, “PCFI’s financial statement was consolidated into GT

Capital’s financials effective September 1, 2015”. (p.89)

Thus

explains why GTCAP’s real estate topline ballooned by 54%!

GTCAP’s

consolidated performance numbers departs from its equivalent by

segment.

Take

Federal Land. GTCAP’s main property company posted a mere 10%

growth in revenue mainly from “real estate sales and interest

income on real estate sales which rose by 8% from Php7.0 billion to

Php7.5 billion driven by increased sales recognized from ongoing

high-end and middle market development projects situated in Pasay,

Mandaluyong, Bonifacio Global City, Manila and San Juan” and from

“rent income which grew by 8% from Php769 million to P830 million

owing to annual price escalation”. (p 89)

Moreover,

while real estate sales grew by a mediocre 8% clip in 2015 (given the

large supply expansions), such accounted for a dramatic slowdown

relative to the blistering 28.2% pace in 2014. The decrement in real

estate sales growth apparently filtered into Fed Land’s income

which grew by 10% in 2015 that was sharply down from 2014’s blazing

rate at 18.73%. (lower left window)

As

for newly incorporated PCFI, income dropped 32.7% due to a 33.94%

collapse in real estate sales in 2015 (lower right window)!

Nonetheless,

the PCFI’s inclusion to the GTCAP’s consolidated financial

statement ballooned her real estate top line by 54% which likewise

bolstered the bottomline.

So

poor FS seen via segment performance precipitately morphed into a

stellar consolidated version most likely due to accounting cookery!

GTCAP’s

Real Estate Woes, Add LTG and Rockwell to the Roster

Yes

GTCAP’s decaying real estate performance adds to my roster of real

estate companies encountering seminal difficulties.

Perhaps

we can add two more.

LTG

Group’s real estate sales had sharply been down by 15% in 2015.

(upper window) This followed a 52.1% collapse in real estate sales in

2014. In 2014, LTG declared a “temporary halt in sales activities

to pave the way for the Company’s value optimization plans for its

existing projects” (p 62)5.

LTG was quiet about real estate sales for 2015, instead they focused

mainly on rental income. Nonetheless, LTG has earmarked funds for

property development in Mactan Cebu, Ortigas Pasig and Novaliches

Quezon City/Caloocan City. (p.50)

Meanwhile

Rockwell Land’s real estate (condo) sales decreased 1.18% in 2015.

This was led by the sharp 12% fall in residential condo sales which

the annual report pointed to “the lower completion of The Grove,

Edades, and Alvendia, which were substantially complete already in

2014”6.

Residential sales accounted for 73% of total revenues. Sales of

commercial spaces partly offset the drag on residential sales.

Despite

topline strains, these companies will continue to build, build and

build.

GTCAP’s

Stumbling Auto Sales and the Real Growth Story

Back

to GTCAP. Recall that I

had an issue with the seeming contradictory numbers released by

the cheerleader Chamber

of Automotive Manufacturers of the Philippines (CAMPI) relative to

GTCAP’s Toyota sales reports, where the latter’s announced third

quarter sales numbers showed of a slump in growth

to just 2.31%

even when the former keeps bragging of 25+% growth rates?

Based

on GTCAP’s annual report, automotive sales numbers shows of only

11% increase in peso sales growth in 2015. This accounts for a

collapse

in growth rate when compared to 2014’s raging 46.34%! While fourth

quarter 2015 performance of Toyota’s auto sales recouped to grow at

15.29%, this was down by 58% from 2014’s 4Q growth rate at 37.14%.

As

for the quantity, from GTCAP: “In

2015, TMP exhibited record retail sales of 125,027 units, an 18%

increase from that of previous year. With this feat, TMP earned its

14th Triple Crown award which means Number 1 in passenger car sales,

Number 1 in commercial vehicle sales and Number 1 in overall sales.

Overall market share grew from 36.3% in 2013 to 39.4% in 2014 and

38.9% in 2015.” (p.88)

So

Toyota sales (in units) grew by only 18% in 2015. And given that TMP

holds about 40% market share (rounded off), then this means other car

manufacturers had to deliver 30% to produce 25% growth rate.

And

here is one important thing missed from the GTCAP eps announcement.

Behind

GTCAP’s 32% surge in eps was an even colossal G-R-O-W-T-H story.

Growth in GTCAP’s total debt (short term + long term + bonds

payable) net of the current portion exploded by 67.79% (note 17)!!!

Such growth rate has been more than thrice the 2014 counterpart at

19.19%!

Don’t

you notice? There have been so much accounting profits for these

companies to become so cash deficient. So given the dearth of liquid

resources, companies like these resort to leveraging up at a rate

faster than either sales growth and or profit growth.

Guess

where these business models will eventually end up to?

Examples

in the PSE of How BSP’s Inflationary Policies Transfer Wealth to

the Elites

As

a final note on GTCAP, let us revert back to subsidiary Fed Land’s

income growth.

Apparently,

property

inflation contributed significantly to GTCAP’s top and bottom line,

via the increase in rent income “owing to annual price escalation”.

Or higher rents, due to property bubbles, benefited GTCAP’s FS

while reducing the purchasing power (through lesser disposable

income), as well as, the diminishing housing affordability for

renters.

As

a side note, here is another example of how the money illusion from

central bank’s invisible redistribution policies of subsidizing

property owners. This is an excerpt from the annual report of another

company7:

“Net

other income increased by 1,707.29% or P=163,190,477 this year. Bulk

of the increase came from gain on investment property as property

assets were appraised during the year.

Increase in fair value of investment property amounted to

P=176,725,230 and P=14,243,119 in 2015 and 2014, respectively.”

(italics added)

Money

illusion simply translates to the ephemeral inflation of incomes,

profits, assets and equity values brought about by sustained bank

credit expansion promoted by the BSP through her policies.

Again,

increased rental income or the surge in gains of property assets in

the books of listed firms merely represents the transmission channels

from the BSP’s trickle down (negative real interest rate) policies.

Such monetary policies redistributes wealth in favor of property

companies/landowners/speculators that comes at the expense of the

consumers, renters and future property buyers, as well as, currency

holders.

As

the late free market economist Percy Greaves explained8:

(bold mine)

The

injection of new money into a society adds no new wealth. It

merely redistributes purchasing power, and thus the titles to

existing wealth.

Those who receive some of the new

money can buy more

of the existing goods before prices rise, while others

find prices rising before their incomes do.

So some can thus take what a free market, with an unmanipulated

quantity of money, would allocate to others. Every

increase in the quantity of money therefore helps some at the expense

of others.

Nevertheless,

there is no such thing as a free lunch. And that the present free

lunch experiment by the BSP IS coming to an end.

It’s

Not Just Jollibee, McDonalds and Max’s Group Shares JFC’s

Financial Predicaments!

When

it comes to incipient pressures on sales by major food chains, it

appears that JFC’s conditions have not been isolated.

Looking

at the JFC’s major rival, McDonald’s through GOLDEN

ARCHES DEVELOPMENT CORPORATION (GADC), which is a subsidiary of

Alliance Global Group (AGI), we basically see the same predicament:

increasing pressures on the topline.

Like

Jollibee, McDonalds suffered a huge drop (a near halving at 48.55%)

in sales growth rate from 2014’s 17.34 to 8.92% in 2015.

Like

Jollibee, McDonald’s net profit growth rate suffered a steep

decline, from a positive 1.27% in 2014 to -4.76% in 2015.

Curiously,

McDonalds added 28 stores to its inventory which at the yearend

accrued to 481 nationwide where 53% are company owned while 47% are

franchised. (p.21)

Stunningly,

those additional 6% of stores in 2015 produced unimpressive or

marginal growth.

AGI

reported9:

“Average sales per restaurant increased by 4%, with 3% growth in

sales per company-owned restaurant and 6% for sales per franchised

restaurant. Business extensions provided a growth rate of 15%, with

Drive-thru boosted total revenues by 11%. Value pricing strategy is

adopted in order to drive more guest count and price adjustments are

strategically implemented to mitigate the increase in cost of raw

materials and to maintain the level of product quality. This is

however outspaced by the increases in prices of imported raw

materials and product mix shift and costs of utilities and crew

labor. As a result, net profit contracted slightly 5% year-on-year.

GADC’s results accounted for 15% and 4% of AGI’s consolidated

revenues and net profit, respectively” (p.48)

In

the above, AGI’s annual report tried to explain away the residual

G-R-O-W-T-H, where they focused on the changes in the mix of sales,

without dealing with the huge collapse in topline sales. AGI’s

annual report just painted by the ‘positive’ numbers.

Apparently

too, the falling peso may have increased McDonald’s operating costs

through “increases in prices of imported raw materials”.

Again,

increasing pressures on the topline being transfused into the

bottomline.

And

it has not been just JFC and McDonalds.

Here

is the Max Group on its 2015’s performance (italics mine)10:

Max’s

Group reported consolidated revenues of P10.37 billion for the twelve

months ended 2015 up

6% from P9.74

billion for the twelve months ended 2014. Restaurant sales came

in 6% higher

at P8.59 billion, driven by the opening

of 84 new

stores primarily across winning brands Max’s Restaurant, Pancake

House, Yellow Cab Pizza and Krispy Kreme, which collectively account

for around 83% of total revenues. The Company also discontinued 38

underperforming sites including 10 Le Coeur De France as part of its

on-going rationalization to improve overall store network

profitability. Moreover, Max’s Group added

21 franchised outlets including 7 overseas to

boost its growing franchise portfolio for 2015. As a result,

Commissary sales increased 2% to P1.28 billion from P1.26 billion

while franchise income (franchise and royalty fees) rose 37% to

P497.51 million from P364.15 million for 2014

Max's Group has a network

of 588 outlets including 35 overseas as of December 31, 2015.

Restaurant sales accounted for 83% of total revenues at P8.59 billion

(p40)

Nevertheless

the company “plans to roll out approximately 60-70 stores including

15-20 overseas with minimal churn” (p 42)

But

because of its merger with 20 Max entities (p 30-31), like GTCAP,

what used to be losses suddenly transformed into profits. Max appears

to have used cooking not only for sales but also in its books too.

Yet

even Max’s top line has grown almost at the rate of JFC and

McDonalds (which has been on decline) even when they have

aggressively been opening stores here and abroad. So Max will be

spending a lot for expansion predicated on those topline growth

numbers that appears to be very fragile and susceptible to either a

collapse or a surge in business costs or both. And since the rate of

supply side expansion seems greater than the topline and or

bottomline growth, Max will likely to finance their future projects

through increased leverage. And topline fragility can easily be

transmitted to tarnish on the bottomline and put pressure on existing

liabilities.

Retail

food giants like JFC, McDonalds and Max are major clients of shopping

malls. This means that any further exacerbation of financial strains

on these organizations will eventually affect their expansion plans

or even their existing stores.

They may like Max start to close less productive outlets like Le

Coeur De France.

But

so far, the

existing mindset has been that weakening financials have due to

inadequate supply,

so

the supply side response of more expansion.

Except for the prologue quotes by a few, hardly anyone seem to absorb

the fact weak

demand can be a function of oversupply.

It’s

odd because everyone seem to keep talking about a Philippine consumer

boom. Yet 2015’s performance numbers by key consumer outlets or

food retail giants like JFC, McDonalds and Max have been showing

otherwise.

Updated to add: In my previous discussion of JFC, I forgot to tackle one thing: JFC's soaring debt. Almost everyone is doing the same thing.

______

1

Shang

Properties Inc., Annual

Report 2015 edge.pse.com.ph April 15 2016 (p.16)

2

Anchor

Land Holdings Annual

Report 2015 edge.pse.com.ph April 15 2016 (p 23)

3

See

Phisix:

Draghi’s Bazooka Sends Philippine, Indonesian, Indian and New

Zealand Stocks to Record Highs! January 24, 2016

4

GT

Capital 2015

Annual Report edge.pse.com.ph April 14, 2016

5

LTG

Group 2015

Annual Report edge.pse.com.ph April 15, 2016

6

Rockwell

Land, 2015

Annual Report edge.pse.com.ph April 15, 2016

7

Jolliville

Holdings Corporation 2015

Annual Report edge.pse.com.ph p.19 April 15, 2016

8

Percy

L Greaves

Jr The Theory of

Money August 31, 2012 Mises.org

9

Alliance

Global Group 2015

Annual Report edge.pse.com.ph April 15, 2016