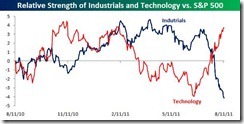

Bespoke Invest shows us some very important developments in the US stock markets during the recent sharp volatility: Technology Sector’s market leadership has been intensifying

Bespoke Invest writes

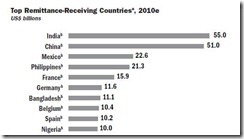

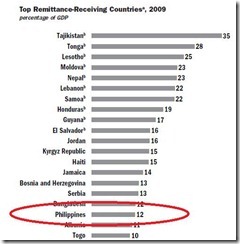

As shown, the Technology sector, which was already the largest sector in the index, has seen the biggest gain in weighting since the bull market peaked. On April 29th, Tech had a weighting of 18.07%. As of now, its weighting is 19.06%. The gain in Tech is even more impressive because the only other sectors that have seen increases in their weightings since the bull market peaked are non-cyclical in nature (Cons. Staples, Utilities, Health Care, Telecom).

Additionally, the technology sector has been outpacing the industrials.

Again from Bespoke Invest

While Industrials have been slumping, the Technology sector has been ramping. Although there have been numerous calls to avoid the sector during this downturn, Tech stocks have been handily outperforming the market. In fact, heading into today, Technology was the least oversold of the ten sectors.

My thoughts

Recent volatility has been proving to be more of a shakeout than a genuine inflection point.

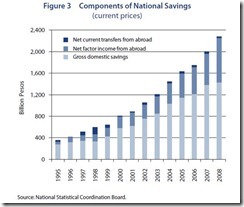

The underlying change of market leadership or divergent actions in the sectoral performances, which reveals of an ongoing rotation towards the technology sector, shows that this has not been a debt deflation driven financial market sell down, as global central bankers have been applying aggressive activists measures.

The gap in the market cap weighting of the technology and other sector has been widening. In the Philippines, the Mining sector has been assuming this role.

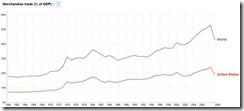

As I have been saying, as the information age deepens, the pie of the technology sector relative to the economy will continue to expand.

Global production process will continue to lengthen or experience enhanced specialization as more technology products and services will be offered and provided to the marketplace. Competition led innovation will be the major driving force for this dynamic.

People hardly notice that the internet search industry is one big example of this ongoing dynamic.

The technology market leadership dynamic will continue to be reflected on prices of technology equities, which should be expected to have a greater share in the US equity market’s sectoral weightings as time goes by.

Essentially, a bet on the information age should translate to a bet on the technology sector.

But as caveat, since policies of central bankers have led to periodic bubble cycles, the capital intensive technology sector could be in a formative bubble cycle process. Although I guess this has yet to reach a maturity phase.

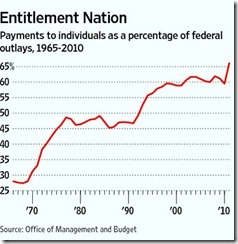

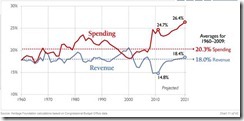

Of course, US treasuries are the ultimate bubble in the US, which I think is in a near maturity or blowoff phase. The global bond bubble applies to many developed economies based on the 20th century designed welfare system.

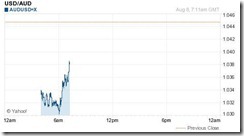

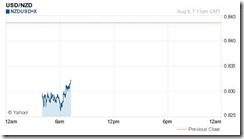

And so goes the US treasury securities and other bond bubbles (EU, Japan), so with the US dollar and the US dollar system.

I’d stick to precious metals and the technology sector.