During the downturning segment of the cycle, the situation is such that credit for investment will be refused. With its supply of credit, the central bank will encounter a rejection of credit-taking by the economy. We have already given two reasons for this. On the one hand, the psychological conditions necessary for the investment of money into durable investments will not be present. There will be general unrest in the economy. On the other hand, the relationship of prices and the general tendency of price development will stand in the way of investment activity. The repudiation of credit will, however, not be general. Even in this stage of the cycle there is a very significant demand for credit, namely the demand by those who are forced to liquidate, to make emergency sales or to cease production due to a lack of capital—a demand for which any credit means at least the momentary avoidance of losses and perhaps even the potential for later improvements. However, satisfying this demand implies delaying the liquidation of the crisis, lengthening and strengthening it. For it is essential to this situation that a significant demand for credit by those who would like to work towards continuing the boom, that is, an “unhealthy” demand for credit, exists along with a significantly reduced demand for new sound investments- Richard Strigl, From Capital and Production (1934)

A local mainstream expert recently argued that for as long as the Euro crisis prevails, the Philippine Phisix won’t likely be able to carve out new highs. His argument has been mostly predicated on the deleveraging process being experienced by major developed economies, momentarily led by the Eurozone.

And given that the correlations of global markets has been intensifying as shown by the chart above[1], which means diversification among global markets have become a less appealing option to scrape for ‘Alpha’ returns, the Phisix will succumb to the same pressures being encountered by her contemporaries, and so it is held.

While part of such observation is true, as I have persistently maintained that an outright decoupling under financial globalization would be highly improbable, divergent outcomes would only become apparent under conditions where the risk of a global recession is low.

And most importantly, aggressive and sustained cumulative policies by global central banks to ease credit through zero bound rates and rampant injections of liquidity via asset purchases could defer the crisis from fully unwinding.

What You See Depends On Where You Stand: Charts

Many local mechanical chartists will see a foreboding road ahead with the bearish head and shoulder pattern looming over the Phisix (blue curves), aside from the extant death cross pattern[2]. Given this pattern searching impulse, these chartists would likely use the bleak events in the Eurozone as confirmation of their personal bias to argue for a pessimistic case.

US markets, as represented by the S&P 500, still trades significantly above the 2010 lows and whose present momentum could lead to an upside breakout above the 1,285 levels which would confirm her interim uptrend.

Moreover, both bellwethers of Europe (E1DOW) and Asia (P1DOW) seem to have bounced off the 2010 critical support levels. This could similarly be construed as either double or triple bottoms—a bullish pattern.

So even from the technical viewpoint, should the US, Europe and Asian equities continue to rebound from current levels then external pressures will imply for a rebound in local stocks more than what the Phisix chart patterns have been signaling.

In short, if global equity markets will retain the trend of high correlations, then external forces will likely influence activities in the local market. This will hold true unless there will be some dominant quirks in the local political economy that could influence the activities in the Philippine Stock Exchange, which thus far seems remote.

What You See Depends On Where You Stand: Liquidity Trap

On the other hand, mainstream economists, who premise their analysis on alleged ‘liquidity trap’, would say that ‘deleveraging’ would translate to a decline in ‘spending’, mainly seen through the credit channel and through consumers, which should translate to lower economic growth and subsequently lower asset prices.

Never mind if little of such assumptions have been proven to be accurately reflected by empirical data.

While US real personal consumption (lower window, red arrows) did fall along with credit conditions in 2008-2009 (upper window), consumer spending has recovered earlier and faster than the credit environment which presently treads at an all-time high.

Furthermore, US equity markets have been mixed year-to-date in spite of the European crisis.

As of Friday’s close, the Dow Industrial was up by 3.8%, the S&P 500 marginally down by 1.06% and the Nasdaq slightly down by .97%. These are hardly signs of deflation.

Moreover, deflationist arguments such as “Given the deflationary pressures that are the natural result of a recession and deleveraging/default, they can print a lot of money without igniting too much inflation[3]” is simply contorted and incorrect.

The excessive focus on the nominal yields of US government’s Treasuries, unemployment data and the CPI index used as basis to declare a supposedly deflationary environment blatantly ignores the composition of the CPI index[4] (which has been heavily weighted to housing), the manipulation of the yield curve via monetary policies and bank regulation, as well as the role of US dollar as the world’s premier reserve currency.

Of course “too much inflation” is a matter of semantics.

Nevertheless, even if US CPI index does not reflect on the actual state, US CPI inflation for October 3.5% has been higher than the 96 year average[5]. This applies to the Eurozone as well, where November’s inflation has been at 3%[6] vastly higher than the 19 year average at 2.24%[7]

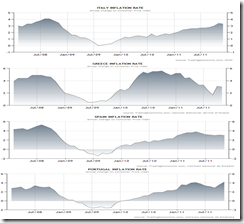

Most importantly NONE of the crisis affected Eurozone crisis nations have shown disinflation. Only Greece’s inflation rate has shown some signs of decline, although the rate of growth has remained positive. Meanwhile Portugal, Spain and Italy’s inflation rate appear to be in an upswing in spite of the current crisis.

While it may be true that money supply has reportedly been contracting in Italy, the recent round of stepped up purchases by the ECB of Italian bonds are likely to offset this.

And given that inflation rates of the Eurozone and the US are above the average, this could be read as “too much inflation” in a relative sense.

No deflation here, move along.

And with gold prices drifting significantly above the $1,700 level and with oil prices at the $ 100 level, further inflationary actions by global central banks will imply for higher inflation figures ahead or that inflation rates will remain sturdily above their averages much to the contrary of the expectations of deflation proponents.

Lastly, the deflation perspective forgets that the deleveraging by the private sector are being substituted or offset by enormous increases in leveraging of major governments via their central banks. Yet all such actions will have consequences which most of them have been ignoring.

Misunderstanding Hyperinflation

Also those in the view that the “US is far from Zimbabwe” again represents deep denial based on the delusion the US can freely operate above or will be immune to the natural forces economics.

And importantly, these denials manifests blatant misunderstanding of the dynamics of inflation or the feedback loop mechanism between government controlled quantity of money and the public’s demand of money, as shaped by price influenced expectations, in the face of policies that leads to hyperinflation.

As a refresher let me quote the great Murray Rothbard[8] on how hyperinflation becomes a reality, (bold emphasis mine, italics original)

When expectations tip decisively over from deflationary, or steady, to inflationary, the economy enters a danger zone. The crucial question is how the government and its monetary authorities are going to react to the new situation. When prices are going up faster than the money supply, the people begin to experience a severe shortage of money, for they now face a shortage of cash balances relative to the much higher price levels. Total cash balances are no longer sufficient to carry transactions at the higher price. The people will then clamor for the government to issue more money to catch up to the higher price. If the government tightens its own belt and stops printing (or otherwise creating) new money, then inflationary expectations will eventually be reversed, and prices will fall once more—thus relieving the money shortage by lowering prices. But if government follows its own inherent inclination to counterfeit and appeases the clamor by printing more money so as to allow the public’s cash balances to “catch up” to prices, then the country is off to the races.

Money and prices will follow each other upward in an ever-accelerating spiral, until finally prices “run away,” doing something like tripling every hour. Chaos ensues, for now the psychology of the public is not merely inflationary, but hyperinflationary, and Phase III’s runaway psychology is as follows: “The value of money is disappearing even as I sit here and contemplate it. I must get rid of money right away, and buy anything, it matters not what, so long as it isn’t money.” A frantic rush ensues to get rid of money at all costs and to buy anything else. In Germany, this was called a “flight into real values.” The demand for money falls precipitously almost to zero, and prices skyrocket upward virtually to infinity. The money collapses in a wild “crack-up boom.”

Episodes of hyperinflation can be seen similar to a hockey stick—serial, gradual and incremental increases of inflation rates for long periods that eventually transitions into a sudden explosion or exponential rates of increases.

The Germany’s Weimar experience[9] exhibits this hockey stick-like transition process from muted inflation towards hyperinflation.

It would further be foolish to assume that hyperinflation signifies as a desired policy outcome. Hyperinflation mostly represents an unintended consequence from repeated and intensifying doses of inflationism. This process eventually results to a critical mass or a tipping point where inflation morphs into hyperinflation. Yet again this will be decided by policymakers who control the money supply.

And stopping hyperinflation, says author of When Money Dies and witness to Weimar Germany’s hyperinflation, Adam Fergusson[10], would require

“the kind of courage that politicians cannot have”

As a caveat, I am not saying that a global hyperinflation is imminent, but hyperinflation could be one of the two possible major extreme outcomes that should NOT be written off.

Again all this would greatly depend on the underlying actions by the global political stewards.

Dollar Swaps, Lehman Comparison and Central Bank Activism

Overtime, a binge of debt defaults should be expected[11], although the political path or approach to such crisis has yet to be determined. And such defaults may be channeled anew through inflation (which risks hyperinflation) or restructuring (repudiation, e.g. Greece 50% haircut[12]) or a mixture of both. All of these aforementioned scenarios would bring about different sets of market outcomes, but assured volatility.

And given the way politicians have been loading up on taxpayer liabilities for the benefit of the bondholders and the banking class, aside from the massive interventions in the economy, growing out of the debt mess economically will be next to impossible.

Yet inflationism seems to be the de facto or preferred path as exhibited by the exhaustive policy efforts to prop up the asset markets.

This week’s joint or coordinated action by 5 major central banks have been targeted to ease credit conditions by lowering of interest rates on dollar swaps and by the creation of bilateral swaps[13]. Such actions has been complimented by China’s lowering of reserve requirements[14]—the first time in 3 years—appears to be symptomatic of major economy’s central banks in a panic mode.

But instead of a panicky market, global equity markets zoomed.

The essence of these swaps would be to facilitate funding flows, in case of a cataclysmic banking run or an abrupt capital flight from the Eurozone.

This week’s EU summit will be critical as they will be dealing with the prospects of treaty changes (that may possibly allow ECB), the proposed fiscal union and the committee’s proposal for Eurobonds[15].

As Professor Gary North incisively writes about the purpose of the swaps[16],

…this was an action preliminary to (1) Angela Merkel's December 2 speech to the German parliament, which is preliminary to (2) the next Eurozone summit, scheduled for the weekend of December 9, which is preliminary to (3) a coordinated violation of the two treaties that created the European Union, which is hoped will (4) pressure the European Central Bank to buy newly created Eurobonds issued illegally by the EU, in order to (5) raise enough euros fast enough to buy Italian government bonds before (6) the Italian government misses interest payments, which may (7) bankrupt the largest French banks, which could (8) trigger a worldwide financial panic.

In short, Bernanke and his peers are in a pre-panic panic.

And failure to reach an agreement may trigger such panic, which is probably why these major central banks led by the US Federal Reserve may have coordinated their actions to institute preventive measures against possible funding stops or a gridlock that may lead to sharp market fluctuations and to ensure accessibility of funds.

And given the state of interdependence of the global banking system, the worsening troubles for the Eurozone would severely hurt US the banking system, an event which the US Federal Reserve may see as urgent which requires their participations.

Writes the Economist[17],

According to data from the Bank for International Settlements, American banks had just $47 billion in exposure to Italian institutions (including the sovereign) as of June. That's a digestable amount. France, on the other hand, has $416 billion in exposure to Italy. That's very bad news for France, but it's also very bad news for America; American banks have a total exposure to France of some $271 billion. Trouble in Italy is manageable, from an American perspective. Trouble in France makes Americans nervous. But that's not where it ends. British banks have a total of $305 billion in total exposure to France. And American exposure to Britain is close to $800 billion.

There are more ties to worry about, of course. If France and Italy get into serious trouble, then German, Swiss, and Dutch banks will also be in very serious trouble, and British and American exposure to those countries is also enormous. And so the full scope of the danger begins to become clear. It was very important for the euro zone to limit trouble to Greece, Ireland, and Portugal. Europe could handle big losses on Greek, Irish, and Portuguese investments, but Italy is too-big-to-fail and, for everyone but the ECB, too-big-to-save. As far as Britain is concerned, trouble in Spain and Italy is worrisome, but problems in France are devastating. And in America, a sinking France is a big headache, but a crash in Germany and Britain is simply gutting.

And by backstopping the Eurozone, the US Federal Reserve will be conducting a global bailout through swaps as another form of quantitative easing most likely on a scale far larger than in 2008.

This chain of prospective bailout, like the footsteps of Germany and France, will likely drag the US deeper into the crisis which would further diminish her status as foreign reserve currency.

The likely difference will be a more liberal US Federal Reserve in terms of lending that could buy the affected parties some time, but would risk heightened inflation.

Nonetheless dealing with the unfolding Euro debt crisis has increasingly become dependent on central banks.

I would further add that comparing today’s dollar swap facility with that of 2008 would seem misleading.

The accounts where the foreign central bank dollar swaps with the US Federal Reserve did not prevent the US equity market from further deterioration in 2008 were true. But one must be reminded that conditions of 2008 has far been different than today.

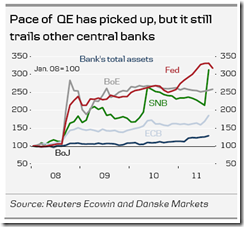

Today has seen an unparalleled scale of the ramping up of major central banks’ balance sheets even prior to the dollar swap interest rate cuts.

The US Federal Reserve opened dollar swap access to specific central banks, namely the ECB and the SNB in March of 2008. The FED gradually expanded the amount involved as the US recession deepened.

However immediately after the Lehman bankruptcy, the US dollar swap facility was expanded to cover more central banks, which came along with increased amout of lending (see chart above from the New York Federal Reserve[18]).

As one would note, the first signs of the current EU crisis has already been manifested in 2008 where the ECB was the largest borrower. As I have been saying, today’s crisis has been a continuation of the 2007-2008 bust phase. This means most of what we see as “recovery” represents artificial boosters from the extensive use of the central bank’s balance sheets to shore up the financial system first and the economy second.

And seen from the actions of the US equity markets, the S&P 500’s trough in February 2009 coincided with the culmination of US dollar swap facility borrowings.

To reiterate, the difference then from today has been global central banks actively revving up on their asset purchases.

In fact, not only seen from asset purchasing perspective, today’s global interest rate environment has been the lowest since 2009[19]. In short, even emerging markets have joined the bandwagon of reflating the system through open market operations[20] which also employs asset purchasing.

At the end of the day, the understanding that the policy of inflationism via activist central banking remains as the dominant path in managing of the unfolding debt crisis is what sets our view apart from the mainstream.

Conclusion: Can the Phisix rise amidst the Euro crisis?

So going back to the original premise, can the Phisix rise amidst the Euro crisis?

Again this will critically depend on the feedback loop mechanism from the prospective political actions of global authorities in response to the unfolding conditions.

If global central bankers will inflate massively, far more than the market’s expectations from the adverse effects of the crisis then the answer should be a conditional “yes”. This week’s EU summit could serve as an implicit license for more asset purchases by the ECB.

And there can be no stronger evidence of the abovestated dynamic than the recent showing of ASEAN bourses.

DESPITE the crisis, the Phisix has been down by only about 5.75% from its August peak.

Yet on a year-to-date basis, the Phisix and the Indonesia’s JCI has been UP by about 2%, while Thailand’s SET and Malaysia’s KLSE has been marginally lower. ASEAN’s performance goes in contrast to the returns of major equity markets, whom are down or negative in the range of 10-25%, except for the United States.

True, past performance may not guarantee future outcome. However, for as long as global central banks remains on an inflationary path in support of the asset markets, then we should see divergent or relative price actions which are likely to benefit the Phisix and ASEAN bourses.

And even more, any hiatus from the perceived worsening of the EU crisis, which will likely be treated with the band-aid approach most likely emanating from massive ECB purchases and possibly from the US Federal Reserve, will likely lead to ASEAN bourses outperforming the region or the world.

This means that contra mechanical chartists and consistently wrong mainstream deflationists, my bet is for the Phisix to breach the August highs perhaps sometime within the first quarter of 2012. Again, all these are conditional or subject to the premise where global central banks will continue to unleash waves and waves of inflationism. Otherwise all bets are off.

[1] US Global Investors Investor Alert - Are Stars Aligned for a Year-End Rally?, December 2, 2011

[2] See Phisix Should Outperform as Global Markets Improve, November 6, 2011

[3] Mauldin John Time to Bring Out the Howitzers December 3, 2011, HoweStreet.com

[4] See US CPI Inflation’s Smoke and Mirror Statistics, May 18, 2011

[5] Tradingeconomics.com United States Inflation Rate

[6] Reuters.com UPDATE 1-Euro zone inflation holds at 3 pct for third month, November 30, 2011

[7] Tradingeconomics.com Euro Area Inflation Rate

[8] Rothbard, Murray N. The Mystery of Banking, 2nd Edition, p.71-72 Mises.org

[9] Nowandfutures.com Germany, during the Weimar Republic & the hyperinflation

[10] See Video: Adam Fergusson: Inflationism is Playing with Fire November 15, 2011

[11] See The Coming Global Government Debt Default Binge, June 20, 2011

[12] See Global Risk Environment: The Transition from Red Light to Yellow Light, October 30, 2011

[13] See Hot: Major Central Banks Coordinate Easing On Dollar Swaps, November 30, 2011

[14] Bloomberg.com China Reserve-Ratio Cut May Signal Slowdown December 1, 2011

[15] Guardian.co.uk Angela Merkel vows to create 'fiscal union' across Eurozone, December 2, 2011

[16] North Gary French Fried Banks, December 2, 2011 Lewrockwell.com

[17] R.A Run, run, run, The Economist, Free Exchange, December 1, 2011

[18] Goldberg Linda S., Kennedy Craig, Miu Jason Central Bank Dollar Swap Lines and Overseas Dollar Funding Costs FRBNY Economic Policy Review / May 2011

[19] See Global Central Banks Ease the Most Since 2009, November 28, 2011

[20] Wikipedia.org Open market operations

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgqn48IMs-Tf-ATJvLThOyakl7RA3gv4btyzByvCmaMNXI5FhIJ7tgHGaVmH5mWCfbEbP4EBxqgT8JmeWeBkW50qe22ps_RpwppU3vnxiHKDogheYRJ9es_abgUvmSGPOeKSoQx/?imgmax=800)