From Risk OFF suddenly to Risk ON.

Most of global stock markets led by the US went into hyperdrive mode.

Some bulls have come out of their hibernation to aver “you see I told you, forex reserves, floating currency, low NPLs neatly did the trick. And this has been all about ‘irrationality’”. Of course, I will keep pointing out—the so-called financial market ‘irrationality’ represents a two way street, because such involves the base human impulses of both greed and fear. Bluntly put, fear can be irrational as much as greed. However, any idea of a one directional bias for irrationality signifies in and on itself “irrational” logic

A mainstream foreign report even implied that the “short-lived” emerging market woes have passed. I can’t agree to the notion that 7 ½ months of Emerging Market volatility represents a “short” time frame period. Neither can I reconcile how the repeated ON and OFF volatilities over the same period equals the conclusion that EM troubles have passed.

EM guru Franklin Templeton’s Mark Mobius, for instance, flip flopped for the second time in 2 weeks, earlier by noting how EM selloff will “deepen” to this week’s “probably nearing the end of this big rush out of emerging markets.”[1]

Such seeming state of confusion from the mainstream signifies desperation to resurrect the boom days underpinned by cheap money.

Yet has the current rally been really indicative of the end of the EM selloff? Or has this been the proverbial calm before the storm or the maxim “no trend goes in a straight line”? Or a stock market lingo—a dead cat’s bounce?

Nonetheless as I keep pounding on the table, we should expect “sharp volatility in the global financial markets (stocks, bonds, commodities and currencies) in the coming sessions. The volatility may likely be in both directions but with a downside bias”[2]

Acute market volatilities represent a normative character of major inflection points whether bottom or top. Incidentally since the present volatilities has been occurring at record or post-record highs of asset prices particularly for the stock market, then current volatility logically points to a ‘topping’ formation rather than to a ‘bottoming’ formation.

Severe gyrations tend to highlight the terminal phase of a bull market cycle. Again in whether in 1994-1997 or in 2007-2008, denial rallies can be ferocious to the point of expunging all early bear market losses but eventually capitulate to the full bear market cycle[3].

The bottom line is that stock markets operate in cycles and that the best way to play safe is to first understand the cycle and ride on the cyclical tide.

China: Stocks Soar as Default Risks Escalates

Let us examine why global stock markets resumed a risk ON scenario this week.

Take China, the Shanghai Composite celebrated the first week of the year of the wooden horse with a blistering 3.5% run.

Monday’s ramp was allegedly prompted by the extension of subsidies by the Chinese government to automakers[4]. Incidentally one of the beneficiaries of the extended subsidies to automakers has been BYD Co., an automaker with investments from Warren Buffett’s Berkshire Hathaway. More signs that Mr. Buffett once a value investor has transformed into a political entrepreneur.

Moreover, this one week stock market blitzkrieg has partly been an offshoot to the Chinese government’s rescue of a troubled shadow banking wealth management ‘trust’ product worth 3 billion-yuan ($496 million) at the near eve of the New Year’s celebrations[5].

So prior to the New Year, the Chinese government conducted a bailout. After the New Year, the Chinese government extends a subsidy (another bailout?) to a politically privileged sector.

Yet will the two interventions be enough to stabilize China’s markets? Or will the Chinese government have to employ serial bailouts in increasing frequency in order to keep the China’s highly fragile financial markets and economic system from falling apart?

How about reports where six trust firms which has 5 billion ($826.6 million) loan portfolio to a delinquent coal company have been in danger of default[6]? The debt exposure by the six trust firms account for 67% more than the size of the one recently bailed out by the world’s largest China’s state owned bank, the Industrial & Commercial Bank of China Ltd (ICBC).

The Reuters’ report adds that another trust, Jilin Province Trust Co Ltd, with exposure to struggling coal company Shanxi Liansheng Energy Co Ltd have failed to pay off “763 million yuan in maturing high-yield investments it sold to wealthy clients of CCB (China Construction Bank)”.

Ironically this is the same coal company with which the ‘first’ bailed out trust firm has exposure to. Has Jilin Province Trust’s debt payment delinquency been in the hope for a bailout? Will other creditors with exposure to the same coal company follow suit?

So has the pre-New Year bailout of the ICBC sponsored Trust firm exposed to Shanxi Liansheng Energy, opened the Pandora’s box of the moral hazard of dependency on government life support system? Will shadow banks resort to defaults or threats of defaults in order to be bailed out? Should we expect a wave of bailouts? How will the Chinese government pay for all these?

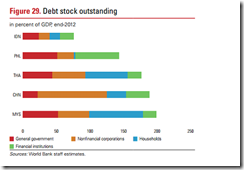

Yes while foreign currency reserves of the Chinese government tabulates to a record high of $3.82 trillion at the close of December 2013, as proportion to shadow banking debt this represents only half of $7.5 trillion based on JP Morgan estimates[7] and one fourth if based on the estimates of the controversial former Fitch’s analyst Charlene Chu[8]

And this is just the shadow banks. Of course not every shadow banks will fail, but the point is how deep will a potential contagion be? This is some dynamic which I think no one has a clue.

Aside from tremors from the shadow banks, private Chinese companies who lack implicit guarantees from the government have either postponed or canceled debt issuance. The Zero hedge reports[9] 9 companies who recently backed down from raising $1 billion worth of debt.

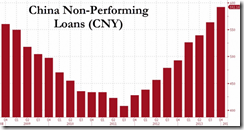

Moreover, Chinese non-performing loans (NPL) have been racing higher for the 9th consecutive quarter to the highest level since the 2008 crisis.

As you can see, the Chinese NPL experience demolishes the false notion that falling NPLs are free passes to bubbles. Credit bubbles implode from their own weight or from rising interest rates or from a reversal of confidence by lenders. In China’s case, rising NPLs are symptoms of the hissing overstretched credit bubble which has been transmitted via higher consumer price inflation and rising interest rates.

The growing risk of debt default, shrinking access to credit and rising NPLs are troubling signs of rapidly deteriorating China’s credit conditions. Yet these are signs of stability?

Even the China’s central bank, the People’s Bank of China, has been cognizant of the growing risks of debt defaults. As quoted by Bloomberg[10]:

China’s central bank signaled that volatility in money-market interest rates will persist and borrowing costs will rise, underscoring the risk of defaults that could weigh on confidence and drag down growth.

“When the valve of liquidity starts to tame and curb excessive credit expansion, money-market rates, or the cost of liquidity, will reflect that,” the People’s Bank of China said in a Feb. 8 report. “The market needs to tolerate reasonable rate changes so that rates can be effective in allocating resources and modifying the behavior of market players.”

Meanwhile China’s banking regulator, the China Banking Regulatory Commission, in the face of rising concerns of defaults has ordered some small financial institutions to “set aside more funds to avoid a cash shortfall” according to another Bloomberg report[11].

As you can clearly see, the Chinese government has been preparing for their financial Yolanda.

Moreover, the Chinese government dramatically infused money into the financial system last January based on the latest PBOC data where the Zero Hedge observed, “this month's broad liquidity creation was the largest monthly amount in China's history!”[12]

China’s infusion of a tsunami of liquidity, where China’s loan creation (left window) totalled $218 billion in January while total social financing (right window) spiked by $425 billion has essentially dwarfed the $75 billion by the US Federal Reserve and the $74 billion by the Bank of Japan.

Why the gush of government sponsored loan creation-total social financing in the face of rising risks of defaults? Has the Chinese government been forced to play the debt musical chairs in the recognition that a stoppage in credit inflation would extrapolate to a Black Swan event[13]?

All these represents newfound stability and a conclusion to the EM sell off? All these are bullish reasons to bid up on stocks? Will ASEAN or the Philippines be immune to a potential debt implosion?

Or have the recent spurt in China’s stocks been signs of communications (public relations/ signalling channel in central bank gobbledygook) management by Chinese government aimed at creating a financial Potenkim Village in order to assuage creditors?

As risk analyst, I’d say good luck to all those who believe that “this time is different”.

US Stocks: Fed’s Janet Yellen Gives Go Signal for More Stock Market Bubble

How about US stocks?

US stocks sprinted for the two successive weeks expunging most if not all of the earlier losses. As of Friday, the S&P 500 knocks at the door of new record highs.

The melt up in US stocks began the previous week when the ECB made a “teaser” to further ease by suspending sterilization in March.

As a side note, this week the enticement for more easing came with a report the ECB has been “seriously considering” negative overnight bank deposit rates[14]. This may have also compounded on the frenzied charge by US-European stock market bulls.

Europe’s stocks have been on a blitz. But ECB’s overture for more easing reveals of the stagnation of Europe’s real economy.

Ironically, European stock markets seem to see heavenly bliss from such negative streak of earnings.

Such parallel universe exhibits why this has hardly been your granddaddy’s stock markets.

Central bank policies have transformed financial markets into a loaded casino (backed by central bank PUT or implicit guarantees) where people mindlessly chase yields with the singular aim of jumping on the stock market bandwagon financed with a deluge of credit money and rationalizing such actions by shouting statistics, regardless of their relevance.

Moreover, the unimpressive US job data whetted on the speculative appetite of the Pavlovian momentum chasing crowd.

Bad news in the real economy has been good news for Wall Street. Why? Because Wall Street expects subsidies provided by the US Federal Reserve to them, via zero bound rates and asset purchases charged to the real economy, to continue.

In terms of present policies, this implies that the Fed’s “tapering” may be truncated.

Bad news in the real economy is good news for Wall Street has been one of this week’s main theme.

Retail sales fell most since June 2012 blamed mostly on the “bad weather”. Revised data showed that retail sales slumped also even in December but at a lesser degree[15]. So this has hardly been about bad weather or that bad weather represents a convenient rationalization for the stock market meltup.

The chart from Businessinsider reveals that core retail sales has been in a downtrend even as retail employment has been rising[16]. Yet how will a sustained fall in retail sales continue to finance retail employment?

Most importantly factory production dropped most since 2009[17] again blamed on the bad weather.

So the unexpected declines in factory output, jobs and retail sales, which not only translates to sluggish economic growth but may even reinforce on each other, have been seen as bullish for stocks by Wall Street.

This reveals how central banking policies have been driving a wedge or a gulf between the Main Street and Wall Street as evidenced by such seeming economic and social schadenfreude, where Wall Street benefit from the sufferings of the real economy. This also means more polarization or partisanship in the political sphere.

Another very significant catalyst for US stock market melt UP has been the debut testimony given by Fed Chairwoman, Ms. Janet Yellen, at the House Financial Services Committee hearing[18].

While Ms. Yellen admits that low interest rate can fuel asset bubbles, she denies that US stocks have been a bubble, where her personal sentiment sent a flurry of bid orders that powered stocks to a frenetic melt up mode.

Ms. Yellen’s admission that low interest rates serves fuel to bubbles…(bold mine)

We recognize that in an environment of low interest rates like we've had in the Unites States now for quite some time, there may be an incentive to reach for yield. We do have the potential to develop asset bubbles or a build up in leverage or rapid credit growth or other threats to financial stability. Especially given that our monetary policy is so accommodative, we are highly focused on trying to identify those threats.

Ms. Yellen’s grants a license to the US stock market bubble…

I think it's fair to say our monetary policy has had an effect of boosting asset prices. We have tried to look carefully at whether or not broad classes of asset prices suggest bubble-like activity. I have not seen that in stocks, generally speaking. Land prices, I would say, suggest a greater degree of overvaluation.

First, admit it and then deny it. Except for land prices, for Ms. Yellen “threats to financial stability” has been anything but relevant to the US. Does Ms. Yellen own a lot of stocks?

As another side note: Contra other central bankers like those from the Philippines, at least Ms Yellen acknowledges that low interest rates “may be an incentive to reach for yield” and thus “have the potential to develop asset bubbles”.

I don’t know which metrics Ms Yellen uses in valuing stocks or measuring credit growth. But the Russell 2000 at 81 price earnings ratio (!!!) as of Friday February 14th close, certainly looks like a bubble from whatever angle.

And that “potential to develop asset bubbles or a build up in leverage or rapid credit growth or other threats to financial stability” has already been present via record net margin debt, and record issuance of various types of bonds e.g. junk bonds, corporate bonds that has been used to finance equity buybacks.

Perhaps the FED may be looking at solely the credit from the banking sector. If so, then such blinders will come at a great cost. Are bonds not financial assets held by US banks?

Yet systemic build up in leverage or rapid credit has been relentless.

The latest financial engineering has been to increasingly use shadow banks via “synthetic” derivatives based on corporate bonds in the face of shrinking liquidity in the bond markets. This novel approach has been meant to hedge on assets or to bet on their performance which according to the Financial Times represents a “dramatic shift in the nature of the corporate bond market”[19].

Moreover equities have increasingly played an important role as collateral for repo trades. From a Bloomberg report[20] “Repurchase agreements, known as repos, backed by equities rose 40 percent during the year ended Jan. 10, according to Federal Reserve data. Rising equity-collateral usage combined with a slide in repos backed by government securities pushed equities share to 9.6 percent of the $1.55 trillion tri-party repo market in January, up from 5.7 percent a year earlier, Fitch said in a report published yesterday.”

This growing moneyness or liquidity yield of equities seem to play right into Mr. George Soros’ reflexivity theory[21] in that “when people are eager to borrow and the banks are willing to lend, the value of the collateral rises in a self-reinforcing manner and vice versa.”

Hence soaring stocks, which leads to increasing values of equity based collateral, feeds on the borrowing appetite of stock market participants. The latter are likely to use proceeds from such borrowing to finance even more equity purchases that would be used to obtain more credit for speculation. Such collateral-lending-price feedback loop mechanism only serves as fodder to a deeper stock market Wile E. Coyote mania.

Manias may persist for as long as return on assets outpaces the cost of servicing debt or upon the sustained confidence of creditors on the capability and willingness of borrowers to fulfil their financial obligations.

If the cost of servicing debt is measured by the actions of the US treasury markets, then we should see how the latter has recently behaved.

Yet the dramatic melt UP in stocks have translated into wild swings in the yields of 10 year UST notes.

Why? Because rising stocks based on intensifying demand for credit tends to push up on yields, while adverse main stream economic data tend to push down yields as economic uncertainty spurs concern over asset selloffs or asset “deflation”.

Yet over the week, yields of 10 year notes climbed 7 bps to 2.75%. This means that the stock market melt UP seem to have bigger influence on the UST markets than the sluggish growth data.

This also means that regardless of what the Fed does (whether they persist on tapering or Untapers) for as long as, or in the condition that the stock market (and real estate) mania persists, yields of USTs are most likely to edge up.

This seems as signs that the US inflationary boom has reached a maturation phase where available resources have not been adequate to finance bubble projects on the pipeline. The entrepreneurial cluster of errors has been based on the misplaced belief of the abundance of savings from artificially lowered interest rates. Such errors are being reflected on rising interest rates and or an up creep of inflation.

Bernanke’s QE 3.0 in September 2012 had only a 3 month impact in the suppression of yields. Since July 2012, yields of USTs trekked higher, but the upside momentum accelerated when Abenomics and the Bernanke’s “taper” was announced in the second quarter of 2013.

This also is one reason why past data can hardly be relied on. That’s because central policies have so vastly distorted the pricing mechanism that has altered the traditional functional relationship of firms, markets and the economy.

What has driven yields of USTs down of late has been a pseudo meltdown in US stocks. While “bad news is good news” may hinder rising yields, strength in economic data will expedite the advance.

As one would note from the above overlapped charts of the yields of 10 year notes (TNX) and the S&P, over the last 9 months, there seems to be new correlation where yields of 10 year USTs decline ahead of the S&P (green rectangle). And the S&P rallies ahead of the bottoming TNX.

And rising UST yields (higher interest rates) amidst rising asset prices fuelled by massive debt expansion only exacerbates on the Wile E. Coyote momentum which eventually will lead to the Wile E. Coyote moment or what Ms. Yellen calls as “threats to financial stability”.

And all the RECORD credit inflation seems to escape the eyes of an econometric technician like Ms. Yellen who seems to think that all these operates in a vacuum.

Unfortunately blindness leads to Black Swans.