The consensus holds that stock markets have been about G-R-O-W-T-H.

Let us see how this applies to Thailand’s case.

From Nikkei Asia: (bold mine)

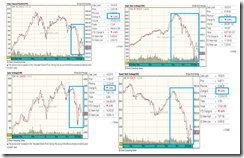

Despite political unrest and other woes, the Stock Exchange of Thailand (SET) in 2014 recorded the highest average daily trading value among ASEAN bourses for a third consecutive year.Trading rallied on the SET and its benchmark index shot up after the military staged a coup d'etat on May 22, bolstering hopes that the economy would revive. However, some analysts believe the market may have overheated…In 2014, average daily trading value was 45.47 billion baht ($1.38 billion), down 9% from the previous year. Although second place Singapore closed in at $1.3 billion, the SET managed to retain its top slot in ASEAN. The benchmark index gained 15% over the year.The country had been in a political deadlock since late 2013 when anti-government protesters took to the streets in Bangkok. The economy shrank in the first quarter of 2014 sending the SET index to an 18-month low.

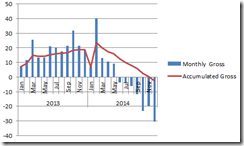

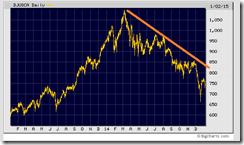

Thailand’s SET has indeed ballooned by 15% in 2014. This would have been much higher except for the December shakeout highlighted by an intraday 9% crash in the middle of that month as shown in the chart from stockcharts.com

Despite recent signs of recovery, the SET appears to remain under pressure.

The article suggest of a cognitive dissonance, a rally based on hope (of an economic recovery) and a denial (Thailand’s statistical economy hardly recovered through the 3Q).

The SET has risen 15% in the face of stagnating economic performance which could have even been negative in real terms.

Since government makes the statistics, so they can show whatever they want.

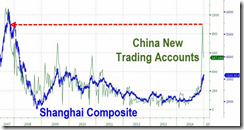

The important question is how has the stock market rally been funded?

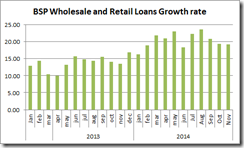

The most likely answer has been by credit.

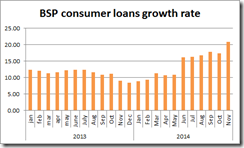

Loans to the private sector soared to a record before the third quarter slowdown. Consumer loans has also bulged to a record last September 2014.

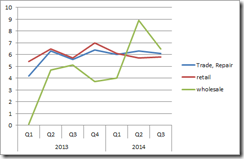

Ironically record consumer loans hasn’t translated to retail spending which on a year on year basis has remained negative in 2014 through October (albeit signs of improvements from the previous rates of deep declines).

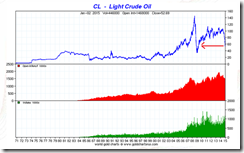

Those issued loans haven’t been circulating to bid up consumer prices either, statistical inflation rate slumped to .6% last December! The oil price collapse may have compounded on this trend.

Yet on a month to month basis, December marks the largest contraction of consumer spending. So even if we go by the September-October data where consumer spending was last reported, the same story can be derived: Thai consumers withheld spending.

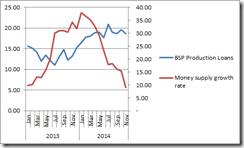

But those record loans has ballooned Thai’s banking system balance sheet and money supply M3. The latter possibly from the 364 billion baht stimulus announced last October.

Yet this coincides with the reports of swelling of non-performing loans.

So where has all these money issued been funneled to?

The most likely answer is on the speculative markets.

Even as the economy stagnates, Thailand’s property markets has sizzled. As of the 3Q 2014 housing y-o-y gains has increased to 3.29% according to Global Property Guide. In nominal terms based 2009 baht, housing prices have been spiraling to the upside (right)!

It looks as if the average citizenry has been borrowing money to speculate on stocks and real estate based on a rationalized “hope” rather than engage in productive investments.

And the increasing use of leverage for speculation has hardly even spilled over to retail consumption.

Such developments seems like deepening signs of a massive accretion of malinvestments where more and more resources have been channeled into unproductive activities. Incipient signs of rising NPLs have been symptoms of these.

And the surge in the US dollar-Thai baht has only been exposing on the vulnerabilities of the system which recently has been vented through strains in the speculative markets.

As one can see from Thai example, it has been liquidity and credit and the subsequent confidence that drives pricing of financial markets rather than real economy.

Take away credit and liquidity, so goes fickle confidence.

And it would seem that the identical twins in the form of chart pattern between the Philippine Phisix and the Thai SET has diverged: temporary or new trend?