There

is a serious credit contraction underway, I think [Yellen] should

acknowledge that. I think she has to look at the capital base being

wiped off the banks in this downdraft and equities: that's not

supposed to be happening right now. They're supposed to be

bulletproof, and oh, by the way, gold at $1,200 an ounce, what

does that tell you? It tells you that in a flight to quality, in

a safe haven, people have more confidence in gold than in bank

deposits or paper money. I think things have gotten out of

control—Robert Michele, JP Morgan Global

CIO & Head, Global Fixed Income, Currency & Commodities Group

In

this issue

Phisix

6,650: Resurgent Gold, Will Mining Sector Lead in 2016? Negative

Yield Spread Hits 1 Month Bill-10 Year Treasuries!

-Global

Stock Markets Dive as Faith in Central Bankers Fade

-Has

Gold’s Resurgence Been About A Developing

Major Dislocation In The Global Monetary System?

-Deepening

Strains in the Global Banking System, Singapore as Epicenter for

Asian Crisis 2.0?

-Phisix

6,650: Rotation from Mainstream to Mining Stocks, Trend for 2016?

-Gold

Miners Lead the Mining Index

-Divergent

Trends Between Mining and Mainstream Stocks, The Absence of Domestic

Commodity Markets

-Yield

Spread of Philippine 10 Year Bonds and 1 Month Bills Turn Negative,

Yikes!

Phisix

6,650: Resurgent Gold, Will Mining Sector Lead in 2016? Negative

Yield Spread Hits 1 Month Bill-10 Year Treasuries

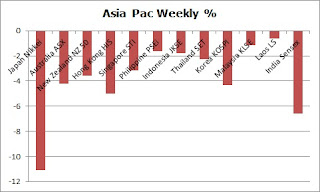

Global

Stock Markets Dive as Faith in Central Bankers Fade

At

the end of January I noted that markets seem to have lost faith in

central bankers1

If

so, in the next transition from fight to flight, then this would mean

that the ensuing cascade should be sharp and fast as central banks

have effectively lost control!

With

equity markets of developed economies in a freefall last week, the

central-bank-losing-control dynamic appears to be gaining momentum.

Despite

Friday’s massive stock market rallies, equity benchmark of Europe

and the US has closed substantially lower. Friday’s sharp rebound

has largely been imputed to the

colossal 12% bounce by oil prices, which news say had been about

rumors of an OPEC deal or possibly, from liquidations

from inverse oil ETF positions or even from both.

Most

of Europe’s bourses have lost 3% and above. Peripheral

Europe, nations which suffered the debt crisis in 2011-12, bled most.

Equity benchmarks of Greece, Portugal, Spain and Italy dived 9.84%.

7.63%, 6.77% and 4.26% respectively. And it’s not just stocks,

benchmark sovereign bonds of these nations came under pressure (or

bond yields has recently spiked.

The

10 year Greek

yield surged to a 7 month high at 11.516%. The Portugal

equivalent soared to an August 2014 high at 3.734%. Italy’s

yield jumped to a two month high at 1.65% and the Spanish

yield increased to a month’s high at 1.739%. If current trends will

be sustained, then have these been seminal signs that Europe’s debt

crisis returned?

Yet

as of Thursday, February 11, the

grizzly bears have claimed the global equity markets.

It’s

interesting to note that Japan’s

Nikkei 225 hemorrhaged by 11.1% from three days of steep losses

during the holiday truncated week.

Stock

markets of China and Vietnam were closed for the week.

Yet

if Hong Kong’s stock market should serve as precursor to the

China’s performance this coming week, then HSI’s heavy 5.02%

losses this week may reflect on bear market forces reasserting

dominance on mainland China’s bourses. That’s unless the

‘national team’ goes to work early to offset the selling

pressures.

Meanwhile,

one

of the latest Asian bellwether to fall into the domain of the

grizzly bears has been the Australian benchmark, the S&P ASX 200.

The S&P ASX 200

crashed 4.24% this week.

On

the other hand, India’s

Sensex dived 6.62% this week even as the government declared a 3Q

(October-December) GDP of 7.3%.

Apparently,

some

quarters in media have expressed doubt on the methodology of how

the Indian government has arrived with its numbers! This week’s

meltdown has also brought the SENSEX to the bear market!

This

is not to say that actions of central banks will have no effects on

the markets. Rather, present dynamics have shown diminishing returns

in terms of boosting risk assets. Or said differently, central bank

magic has been fading. But it won’t stop them from trying.

Central

bankers have been busy this week. Sweden’s Riksbank sent

their policy rates deeper into the negative zone. In her Senate

testimony, Fed Chair Janet Yellen said that since there

“is always some chance of recession in any year” … the Fed

would consider negative

rates: “ In light of the experience of European countries and

others that have gone to negative rates, we're taking a look at them

again, because we would want to be prepared in the event that we

would need (to increase) accommodation”.

In

addition, the Bank of Japan may call an emergency meeting soon for

them “to

undertake additional monetary easing if financial markets remain

turbulent”.

Additionally,

the European central Bank was

reported to be in talks with the Italian government

for the former to buy “bundles

of bad loans as part of its asset-purchase programme and accepting

them as collateral from banks in return for cash”

It’s

truly amazing how central banks have shown even more expressions of

panic with financial markets apparently ignoring their overtures and

or even actions (such as Sweden’s

Riksbank).

But

sentiments abroad depart from that of the Philippines.

Yet

it has truly been a fascination to observe on how the establishment

perceives of the escalating global financial volatilities as having

little impact on the Philippine economy or the financial markets. For

them, it’s all about the incantation of “domestic demand”. As

if domestic demand have permanently been engraved on the economic

stone. As if domestic demand occurs automatically, just like manna

from heaven. As if prospective losses from exports, tourism, BPOs,

OFWs, foreign investments and portfolio outflows would have little or

NO direct and indirect effects on jobs, incomes, earnings,

investments or consumption.

And

if policies of ZIRP and NIRP have been backfiring on economies and

markets of both developed and emerging markets, then why should the

Philippines, which

embraced the same policies in 2009, be immune to such pathology?

Because

media ‘experts’ and authorities say so? Because the Philippines

is immune to the law of economics? Or has it been because the

Philippines, coming off a clean balance sheet prior to 2009, have

represented the one of the few nations to enter the late stage of the

credit cycle?

The

more the misperception the greater the crash

Has

Gold’s Resurgence Been About A Developing

Major Dislocation In The Global Monetary System?

Last

week’s equity meltdown seem to have punctuated a pivotal change in

market dynamics: from Risk OFF to Flight to Safety

As

stock markets bled ($FAW-FTSE ALL World), gold and government bonds

of some developed economies soared.

This

week, yields of US 10

and 30 year

treasuries fell by 10 bps to 1.748% and by 7 bps to 2.6%

respectively. Shown as prices, the 10 year UST soared (lowest window)

On

the other hand, gold (main window) rocketed by 5.49% over the week.

Gold has surged in 4 consecutive weeks to account for a massive

13.19% in gains. Gold’s surge has been accompanied by a magnificent

10.55% runup of the HUI

gold bugs or an index of 15 major gold miners (middle window).

Gold

(and UST) appears to have ‘bottomed’ when the FED

raised rates in mid-December. Both have spiraled higher when the

Bank of Japan announced the NIRP in late January.

In

September 2015 I made this recommendation2

(bold original)

One

should consider hedging against further market volatility or from

more episodes of meltdowns or from a torturous bear market in stocks.

So here’s my recommendation, for Philippine residents I recommend to stay in cash, especially in US dollar. Use any USD-peso reprieve to buy the US dollar or sell the peso.

One can add gold (and or gold based assets) to such hedges. Gold may be down today (which makes it a value buy), but this may be a different story when the “real thing” arrives.

And by “real thing” I mean that if the current Emerging Market-Asian-ASEAN market selloffs morphs into a financial crisis, then the USD-PHP high in September 27, 2004 at 56.45 can easily be taken out.

And growing risks of confiscation from indirect means (inflationism) or from direct means (war on cash via negative nominal rates, wealth taxes, deposit haircuts) should spur a reversal in gold.

I

followed this up last November with3

So

I expect the USD to serve as a lightning rod against stresses that

would surface in response to massive imbalances as an outgrowth of

central bank policies from all over the world. And once the charade

from risks assets have been sloughed off, gold will scintillate.

So

far gold has been affirming on my recommendations

Gold

as a flight to safety hasn’t been always the case. Gold chart from

goldprice.org

Nominal

USD-Gold prices fell when the dot.com

bubble burst in 2000.

Gold

prices plunged during the emergence of the US mortgage crisis or the

Great Financial Crisis (GFC) in 2007-2008.

Gold’s

secular bullmarket began in 2003. That’s when global stocks

bottomed from the dotcom bubble bust. That’s also after the FED

went into a series of rate cuts from 6.5%

in 2001 to 1.75% in 2003.

Gold

also rallied when the FED

and various central banks launched their massive rescue programs

in the face of the GFC from 2008 onwards.

However,

after 11

consecutive (2001-2011) years of annual gains, gold prices peaked

in August 2011.

Gold’s

climax came a month before the FED

announced QE 2.0 (Operation Twist, September 2011) and 6 months

after Eurozone

finance ministers set up a permanent bailout fund, called the

European Stability Mechanism,

plus the string of bailouts from the embattled PIGS, which signified

the core of the

European Debt Crisis.

In

the meantime, 3 years after the imposition of

gargantuan $586 billion stimulus in November 2008 to shield her

economy from the GFC, China’s

GDP began its descending path in 2011.

Following

gold’s 11 years of successive run ups, cyclically speaking, it

would be natural for gold to take a reprieve. So perhaps gold’s 4

year and 5 months old 41.96% downturn signified a cyclical bear

market under a secular bullmarket. If this is true then a bullmarket

for gold should be in the works.

Yet

even as the central banks of US, Europe and Japan and the rest of

emerging markets deployed life support policies, which in particular,

according to Bank of America Merrill Lynch: 637 rate cuts, $12.3tn of

asset purchases by global central banks in the past 8 years,

$8.3tn of global government debt currently yielding 0% or less and

489 million people currently living in countries with official

negative rates policies (i.e. Japan, Eurozone, Switzerland, Sweden,

Denmark)4,

initially economic performances diverged. Today, economic signals

point to a convergence—increasing risk of a global recession.

So

maybe gold smelled of the impotency of central bank policies. Perhaps

too gold’s bear market instead reflected on the spreading of

deflationary forces regardless of central bank actions.

And

possibly with Japan’s adaption of the Negative Interest Rate Policy

(NIRP), gold may have seen this as a reinforcement of a de facto

global central bank policy trend.

Coupled

with growing ban on cash by governments mostly under NIRP, the

likelihood of imposition of myriad capital controls, prospective

bail-ins or deposit haircuts on troubled banks, and or even perhaps

outright protectionism, probably gold senses a massive disruption in

the banking system, and the large scale drying up of global liquidity

as the public gravitate towards cash with gold functioning as an

alternative medium of exchange.

In

other words, could

gold be sensing a brewing or developing major dislocation in the

monetary system?

Deepening

Strains in the Global Banking System, Singapore as Epicenter for

Asian Crisis 2.0?

And

signs of such escalating strains seem to have already surfaced in the

global banking system.

First,

the tightening of “dollar” liquidity, which has created a

feedback loop with economic slowdown, has been a key reason for

deteriorating bank fundamentals.

The

US dollar has been manifesting such dynamic since 2012.

The

Bloomberg US dollar

index or BBDXY (upper window) has risen by 31.5% from the lows of

2012 through last week. Or said differently, the US dollar has risen

against a broad measure of currencies of her key trading partners.

The

BBDXY’s

distribution share as follows: 34.3% euro, 16.2% yen, 12%

Canadian dollar, 9.9% British pound, 8.5% Mexican peso, 5.5%

Australian Dollar, 4.9% Swiss Franc, 3.6% Korean won, 3% China yuan

and 2.2% Singapore dollar

On

the other hand, the JP

Morgan Bloomberg Asian dollar index or the ADXY has fallen by

11.6% since 2012. The bulk of Asian currency losses to the USD have

emerged from the 2H 2014 through today.

The

ADXY’s

basket consists of the following: China yuan 38.16%, Korean won

12.98%, Singapore dollar 11.07%, Hong Kong dollar 9.22%, India rupee

8.75%, Taiwan dollar 6.1%, Thai baht 4.92%, Malaysian ringgit 4.23%,

Indonesian rupiah 2.85% and the Philippine peso 1.65%.

So

rising BBDXY (USD) since 2012 eventually spilled over to as the

weakening of Asian currencies in 2H 2014.

Second,

has been the recent meltdown of global

banking stocks.

Third,

has been the transmission of credit risk. The crash of commodity

prices has spread to emerging market debt, to high yield bonds and

then to bank exposure on vulnerable industries and economies. In

short, the deterioration in credit conditions has spread to many

industries which leaves banks and other financial institutions

vulnerable given years of massive credit expansion.

Fourth,

has been an upside

spiraling of credit default swaps (CDS) of several major European

banks such as Deutsche bank, Credit Suisse and UBS, which means

default risk has been rising.

Even

additional Tier 1 bank capital in Europe’s banking system has now

come under scrutiny.

From

Bloomberg5:

The

volatility and credit spread gyrations seen in the financial space

over the past 24 hours may be the consequence of more than just

investor unease over Deutsche Bank AG’s ability or otherwise to

meet obligations on its riskiest bonds and other debt service costs,

Bloomberg strategist Simon Ballard writes.

Rather

it probably highlights the extent to which investors have chased

yield down the capital structure over the past couple of years and

are now left exposed to possible re-pricing risk.

From

a regulatory perspective, Contingent Convertible Bonds, known as

CoCos or additional Tier 1 securities, were developed to be a

strategic funding tool -- a regulatory capital buffer to prevent

systemic collapse of important financial institutions. Effectively,

CoCos are designed to fail, without bringing down the bank itself in

the process. The key problem in understanding the true risk embedded

in this asset class, though, might be that it has never been tested.

Deutsche Bank, in feeling compelled to reassure investors and

employees that it has the solvency to meet its coupon obligations on

this riskiest debt may have only exacerbated market uncertainty over,

and price reaction in, these assets.

Investor

concerns remain over what the overall market impact might be if a

bank should see the need to suspend a coupon payment on a CoCo

security. Indeed, such a move could make the latest selloff in credit

risk look like a mere correction.

Fifth

and lastly, a sharp widening of credit spreads in the US

and across

the globe, as well as negative

swap spreads in the US and a sharp flattening

of the yield curve in the US and in other developed economies

which raises the risk of a US-Global recession.

This

has simply been the periphery to the core in motion. And the feedback

mechanism from the underlying deterioration in finance has only been

spreading to infect the center of credit transmission, the banking

system.

Of

course it has been interesting to note of the significant

deterioration in the US retail industry: as enumerated by Fox

business contributor Gary Kaltbaum6:

Wal-Mart

is closing 269 stores, including 154 inside the United States, KMart

is closing dozens of stores, JC Penney shutting down almost 100

stores, Macys shutting 36 stores, The Gap closing 175 stores,

Aeropostale closing 84 stores, Finish Line closing 150 stores,

Sears shutting 100s of stores and Massive sales and earnings

misses by Kohls, Bed Bath and Beyond, Best Buy, Ralph Lauren and many

others.

Not

only will the above imply more DEAD

shopping malls in the US,

these should extrapolate to a wider spectrum of credit risk for the

financial system!

The

above should be another wonderful template to what will happen to

the shopping malls bubble in the Philippines.

Nonetheless,

a popular Swiss investor Felix

Zulauf

who

runs Zulauf Asset Management

predicts that Singapore will be the epicenter

for a banking crisis that will spread to the rest of Asia7

"Singapore,

which has attracted a lot of foreign capital over the years because

of its image as a strong-currency state, will be extremely exposed to

the situation in China," Zulauf told Barron's

Roundtable in January.

"Singapore's

banking-sector loans have grown dramatically in the past five or six

years. Singapore is now losing capital, which means the banking

industry is losing deposits."

He

said this would probably cause carry trades to backfire,

triggering heavy losses for those who had borrowed heavily to

buy higher-yielding assets.

"I

expect a banking crisis to develop in Singapore and to spread

eventually to Hong Kong," he said.

So

with multiple hotspots for a potential crisis and the risk of

prospective confiscation by the government of private funds, it’s

no wonder why British bullion dealers reported last week that

investors had been “going

bananas” over physical gold.

Phisix

6,650: Rotation from Mainstream to Mining Stocks, Trend for 2016?

It’s

been a long time since I wrote about the mining stocks.

Well

what a week of surprise!

What

used to be the most unpopular and ignored sector seem to have stolen

the thunder from mainstream stocks.

For

three successive weeks, superb gains have made the once dejected the

mining sector the recent darling of momentum traders.

The

mining sector soared by an amazing 8.55% this week, 9.19% the other

week and 4% two weeks back to lift the index back to a positive 2.4%

this year.

It’s

the only sector with a positive returns year to date.

The

mining sector (black candle) has parted ways or diverged from

mainstream stocks or the PSEi (blue line). It has missed out on the

record boom in May 2013 and in April 2015.

Since

May 2012 through January 2016 or in a grueling 3 year and 9 months,

the sector’s index has sunk by an agonizing 68.5%. The torturous

saga of the mines reveals what a full blown bear market looked like.

Fantastic

gains of the past 4 weeks have rendered the said benchmark to be

quite overbought.

Regardless

of the coming hiatus, or profit taking sessions, the recent actions

perhaps may provide clues to what may become the dominant dynamic for

the year: will there be a rotation from the mainstream to mining

stocks?

Gold

Miners Lead the Mining Index

Of

course, not all mining stocks are the same.

Based

on the mining index, it appears that the best performers had been

gold mining stocks.

For

the week, Lepanto A and B sizzled by a breathtaking 81.32% and 75.88%

respectively!! Philex Mining took second spot up by a phenomenal

25.98%!! Lepanto subsidiary Manila Mining A and B took third spot by

posting an exceptional weekly advance of 18.18% and 16.67%

correspondingly.

These

3 issues accounted for 30.16% share of the mining index as of last

Friday. The biggest weight, coal miner Semirara, which likewise is a

PSEi composite issue, fell 3.17% this week. Atlas Mining, the third

ranked firm in the index, which includes gold as byproduct, was up

3%.

The

rest of the non-gold mining issues were mixed.

Other

non-index gold mining issues Benguet Consolidated, Apex Mining, Omico

Mining and Alsons Consolidated likewise racked up significant gains,

specifically 35%, 24.73%, 17.53% and 8.73% correspondingly.

Only

United Paragon Mining (UPM) underperformed with a measly 2.67%

advance.

So

the sharp gains in the international prices of gold may have been a

pivotal factor in juicing up the speculative fervor of domestic

participants. As noted above, the HUI gold bugs soared by 10.55% over

the week and have been up 47.13% year to date even as gold has only

been up 16.78%

Perhaps

too, some corporate deals may be at work for Lepanto to have fueled

such stark outperformance.

Question

now is: have recent activities signified just another vicious bear

market rally or the birth pangs of a bull market? The answer entirely

depends on the price of gold.

Divergent

Trends Between Mining and Mainstream Stocks, The Absence of Domestic

Commodity Markets

I

do not believe that domestic participants have pumped gold stocks

because they see this as a bid on safehaven assets.

Instead,

they seem to see this as another opportunity to play the stock market

casino.

Both

mining index (black candle) and Phisix (blue line) has conjointly

dropped in the 4Q and simultaneously rebounded from the massive

January selloff.

But

while the recent rally in the Phisix (blue) seem to have stalled, the

mining index picked up speed to show, possibly and hopefully

incipient, signs of divergence. Nonetheless, as of the last quarter,

the correlation of both indices moving in the same direction seems

greater than the last week’s departure. For now.

Divergence

or rotation can only be affirmed when gold mining stocks will move

independently from the mainstream stocks.

The best evidence will emerge when both will move in opposite

directions. This had been the case from 2012 through 2015 when miners

collapsed while the bubble industries blossomed. It should be a

curiosity to see when both trade places. Time will tell.

Gold

miners for me serve as a proxy or titles to claims on physical gold.

That’s because spot and futures commodity markets have been missing

in a country which sees itself as first world. Yes the Philippines

has been the only ASEAN major without a commodity market.

The

establishment thinks that they can leapfrog over the commodity

backdrop of Philippine economy by blowing property, shopping mall and

casino bubbles financed by massive leveraging or credit expansion.

The

reality

is the commodity (agriculture-mining) industry, even when they

constitute a small segment of statistical GDP, employs

close to a third of labor force. Such translates to mountains of

unlocked savings, investment, demand and consumption.

The

absence of commodity markets simply means that productive growth for

the sector has lagged behind by virtue of insufficient investments

and that the sector remains virtually inefficient as prices have

reflected political obstacles than sheer demand and supply.

The

absence of commodity markets can also be tied to the lack of interest

by the industry to hold savings at the banking sector. That’s

because the industry’s financial knowledge and earning potentials

have been limited to merely growing/mining and selling their output

to politically privileged middle men, rather than through bid and ask

in the commodity markets. When farmers and miners learn to directly

trade and hedge their produce, output or products, such will allow

them to hedge or to reduce their risks and amplify their earnings.

Having to increase their level of trade knowledge plus an increase in

earnings will surely prompt them to enroll in banks and tap capital

markets.

But

the BSP would rather go on a publicity campaign on ‘financial

inclusion’ rather than deal with real issues

And

the reason for the nonexistence of the commodity markets has been

politics: there has been too much vested interest rooted in them. The

existence of commodity markets should mean a substantial reduction,

if not an extirpation, of these politically privileged middle men

protected by byzantine regulations and mandates or agricultural

protectionism.

So

the establishment’s lack of desire to establish commodity markets

should translate to local market participants’ little respect for

precious metals. Never mind if the peso’s origins were from mainly

from a silver

standard and a brief period of a gold standard. History has

little or no importance to people blinded by present orientation

predicated on feel good politics.

Nonetheless,

since international prices of gold will serve as the key determinant

of the fate of gold shares and if locals have been oriented to follow

this correlation, regardless of what they think gold, then domestic

gold stocks should resonate with their international peers.

Other

potential factors that influence share price movements of domestic

gold miners will be the operations side of each miners, as well as,

the politics behind the industry and the locality where these mines

operate. But this will be subsidiary to the international price of

gold.

Yield

Spread of Philippine 10 Year Bonds and 1 Month Bills Turn Negative,

Yikes!

For

the establishment, except for stocks and property prices, all other

prices are considered inferior, irrelevant or beyond their definition

of numbers based ‘economics’

Yet

if international media have raised the issue of flattening of the

yield curve abroad as increasing the risk of recession, in the

Philippines, the yield curve has no significance at all.

Last

week was a milestone in terms of yield spread activities.

As

yields of Philippine treasury bills (1,3 and 6 months) spiked, the 10

year equivalent dropped (upper window). The result? The

first ever inversion of the yield

of the 1

month bill at 3.907% and the 10

year benchmark at 3.826%! Or coupon yields of the 1 month bill has become

higher than the 10 month.

The

spread between the 1 month bill and the 7

year at 3.75% has also turned negative as the 1 month and 5

year yield at 3.938% has massively flattened.

Because

yields of 3 and 6 month bills also spiked, the result has been a

massive flattening of the spread relative to the 10 year benchmark.

And

it has not just been the front face of the curve, negative spreads

have returned to the 10 and 3 year, as well as, the belly of the

yield curve the 10-5 year yields.

Not

signs of signs of severe monetary tightening?

Disclosure:

Writer owns several mining stocks.

____

1

See

Phisix

6,700: Ferocious Bear Market Rally Pump; 4Q and 2015 GDP’s

Cosmetic Numbers January 31, 2016

2

See

Phisix

7,050: The Peso in the Face of Crashing Emerging Market and ASEAN

Currencies, September 6, 2015

3

See

Phisix

7,100: Surprise! ICTSI Chief Enrique Razon Warns: Another Financial

Crisis is COMING!!!! SM Plays with Fire! November 9, 2015

4

Bank

of America Merrill Lynch 637

Rate Cuts And $12.3 Trillion In Global QE Later, World Shocked To

Find "Quantitative Failure" Zero Hedge.com February

12, 2016

5

Bloomberg.com

Deutsche

Bank’s Assurance Exposes Tip of CoCo Iceberg: Analysis

February 10, 2016

6

Gary

Kaltbaum Fox News Business Contributor Our

response to the President’s patting himself on the back on 4.9%

unemployment rate! garykaltbaum.com February 7, 2016

7

Australian

Financial Review Forget

about Europe, investor tips Singapore banking crisis February

10, 2016